Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Diversification allows consumers to shield their investment portfolios from market downturns impacting a particular market or asset class. Hedonova provides investors access to alternative investments through one fund. The fund features more than 10 asset classes, including equipment financing, real estate, and music royalties. Interested US parties must be accredited investors to participate in Hedonova’s fund.

Newcomers to the investing world may find it challenging to choose which investment vehicles to purchase. Stocks provide an investor with an ownership stake in a single company. Investors who want to own fractional shares of many companies in one investment vehicle may find mutual funds attractive.

Hedonova offers a fund comprising alternative assets to provide investors with diversification and unique investment opportunities. We spoke with Ameer Esen, Hedonova’s Head of Investor Relations, to learn more about the company’s fund and its approach to democratizing access to international assets.

Esen said the company’s founders are seasoned investors who had encountered roadblocks while seeking to establish international investment opportunities. The founders’ frustrations led them to an epiphany — if they were struggling to establish international investments, then less experienced investors were likely facing similar difficulties.

Esen said Hedonova’s founders initially intended for Hedonova to be a platform by which investors could access an extensive selection of investments. Hedonova’s early users could log in to the platform, set up an account, and choose what to invest in. But, Esen said the company noticed that investors were not making sound investment decisions.

“Investors were not doing any due diligence,” Esen said. “They were just putting their money into whatever choice sounded fancy to them. A lot of users started to reach out to us to tell us they didn’t know what to invest in. They wanted us to provide a service that helped guide them and offered investment advice.”

Esen said Hedonova could not provide its users with investment advice because the company wasn’t permitted to do so by the Securities and Exchange Commission. Hedonova then pivoted its strategy and transitioned from an investment platform to an investment fund.

Overlooked Investments Provide Opportunities

Consumers seeking to invest in the stock market have many resources to turn to when seeking investment advice. Esen said investors who seek alternative investments may find it challenging to locate investment professionals who are knowledgeable and willing to share information with them.

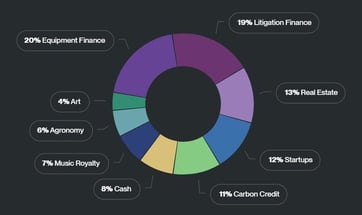

Esen said alternative investments are assets outside of the traditional investment options of cash, bonds, and stocks. Hedonova’s fund exposes investors to various alternative investments, including international real estate, income-generating assets such as music royalties, and startup companies. The company provides investors with information regarding asset classes in its fund.

“When it comes to alternative investments, there aren’t many researchers providing data,” Esen said. “The information investors need often doesn’t exist or is nearly impossible to get.”

Esen said 20% of Hedonova’s fund invests in equipment financing. The company specifically focuses on opportunities surrounding medical equipment. Esen said Hedonova buys expensive medical equipment such as MRI and CT scan machines. The company leases the medical equipment it purchases to hospitals.

Hedonova employs a team of workers to manage its medical equipment. The company’s equipment-managing team works with hospitals to ensure they use the equipment they lease correctly and comply with the terms of the equipment’s manufacturer.

“Ultimately, we own the machines,” Esen said. “All of our equipment is in good condition. If a machine breaks, that’s a loss for us. We have 20 people working in our corporate office and 35 employees who are out on the road managing our assets.”

Hedonova’s fund also invests in real estate. Esen said most of Hedonova’s real estate investment activities focus on international datacenters. Hedonova buys datacenters in India, Indonesia, Malaysia, and Vietnam and leases the centers to tech companies. Esen said datacenters yield reliable returns.

“The leases on our datacenters are long — typically either 15, 20, or 30 years,” Esen said. “We lease them out to cash-rich tech companies, so default rates are low.”

Democratizing Access to International Assets

Litigation financing is the second-largest component of Hedonova’s fund, trailing only equipment financing. Esen said Hedonova lends money to entities interested in suing another party but lacking the funds to pay for their legal fees. Hedonova provides litigants with capital to move forward with their lawsuit.

If a Hedonova-backed party wins a settlement in court, Hedonova keeps 70% of the settlement amount.

“Litigation financing is a billion-dollar asset class growing at a rate of 3% annually,” Esen detailed. “We primarily invest in countries where common law is followed, like Australia and India.”

Hedonova’s fund invests in carbon credits. Esen said companies that pollute the environment must offset some of their pollution by purchasing carbon credits.

“We invest in carbon-removal projects, which consist of factories and plants that essentially act as a big vacuum cleaner to suck the carbon dioxide from the air and bury it underground,” Esen said. “Each credit is the equivalent of removing 1,000 kilograms of carbon dioxide from the environment.”

Hedonova devotes a portion of its fund to investing in music royalties. The company leases music to brokers, who then lease the music to platforms such as Instagram, TikTok, and YouTube. Esen said if a video featuring Hedonova-leased music goes viral, earnings opportunities grow.

US investors must be accredited to participate in Hedonova’s fund. An investor’s initial investment with Hedonova must be at least $10,000.

Hedonova democratizes access to investment opportunities that international borders can restrict. Esen said investors who want to take advantage of emerging markets should consider opportunities in Latin America, Southeast Asia, and the Nordic regions of Europe. Investors seeking to invest in emerging markets may first have to open an international bank account.

“Many US investors can have a difficult time making investments in international markets,” Esen said. “If we have freedom of speech, then we should have freedom to invest.”

Hedonova Positions Itself for Growth

Fund companies often provide investment information to consumers via prospectuses and fact sheets. Esen said preparing information for investors about alternative investments can be challenging due to a lack of standardization in the alternative investment space. Esen said equity markets around the world rely on standard terminology, but the alternative investments arena hasn’t developed generally accepted terms yet.

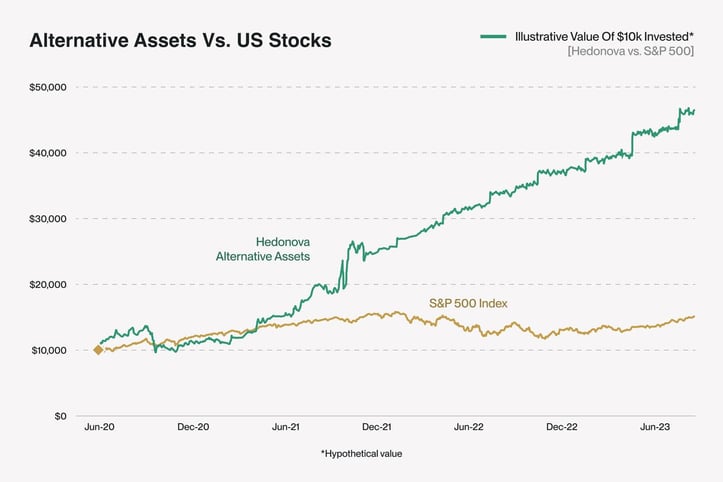

Esen said Hedonova’s fund has performed exceptionally well since its inception.

“The fund has had a 44% annualized return since it started,” Esen said. “The caveat is that in 2021, we had a return of 119% because we had crypto on the books. That skewed the data. If you remove the crypto position completely, the fund would have returned 28%.”

Alternative investments can allow consumers to diversify their portfolios. Still, consumers with only a few thousand dollars to invest should put their money into stocks and government securities, Esen said.

Alternative investments are relatively illiquid. Esen said investors withdrawing money from Hedenova’s fund may not have access to that money in their bank account for up to 30 days.

“Clients who require quicker access to their invested monies should consider other options,” Esen said.

Esen said Hedonova plans to release a short fund to earn increased returns when markets fall.

“The short fund we’re planning to offer is designed to return about 5% to 7% in normal market years when the S&P 500 is rising,” Esen said. “However, in the years the S&P falls, it’s designed to return eight times the amount of the fall. So, if the S&P falls 10%, the fund will return 80%.”

![7 Best Credit Cards for Single Parents ([updated_month_year]) 7 Best Credit Cards for Single Parents ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Single-Parents.jpg?width=158&height=120&fit=crop)

![7 Prepaid Cards With ATM Access ([updated_month_year]) 7 Prepaid Cards With ATM Access ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Prepaid-Cards-With-ATM-Access.jpg?width=158&height=120&fit=crop)

![8 Credit Cards With Lounge Access ([updated_month_year]) 8 Credit Cards With Lounge Access ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Credit-Cards-With-Lounge-Access.jpg?width=158&height=120&fit=crop)

![5 Best Travel Credit Cards With Lounge Access ([updated_month_year]) 5 Best Travel Credit Cards With Lounge Access ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Best-Travel-Credit-Cards-With-Lounge-Access.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Wealth Management ([updated_month_year]) 9 Best Credit Cards For Wealth Management ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Best-Credit-Cards-For-Wealth-Management.jpg?width=158&height=120&fit=crop)