Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: The COVID-19 economic downturn added fresh impetus to the long-standing price appreciation trend in single-family housing. Mortgage rates plummeted, and new demand entered the market. But as the economy overheated in 2022 and the Federal Reserve responded, many markets saw mortgage rates surge and price growth slow. As Chief Economist at CoreLogic, Selma Hepp looks at tax, property, and geospatial data to understand the variables that promote a healthy housing market. Her take suggests no quick fix for the market’s historic lack of inventory but reason for optimism, especially in areas where new construction is taking hold.

The impact of COVID-19 shutdowns on housing is a story of the push and pull of supply and demand in a market of endemic price appreciation.

From her position as Chief Economist at the property intelligence provider CoreLogic, Selma Hepp sees fairly clear sailing ahead for current homeowners but continued problems on the buyer side due to affordability issues and a chronic lack of inventory.

Although the pandemic’s economic buffeting appears on the wane, housing isn’t suddenly emerging into a golden age of new uptake. Instead, Hepp anticipates a return to some form of equilibrium where longer-term structural issues once again come to the fore.

At CoreLogic, a team of more than 5,000 provides data, analytics, and platforms to real estate professionals, financial institutions, insurance carriers, and government agencies.

Dedicated to building healthy housing markets, CoreLogic draws on billions of property ownership records, tax records, and geospatial and visual data to help stakeholders understand risk, anticipate trends, and improve customer efficiencies.

After working in a variety of public and private capacities, Hepp assumed the Chief Economist role in January 2023 after serving on an interim basis since July 2022. She and her team analyze, interpret, and forecast housing and economic trends on behalf of a global customer base.

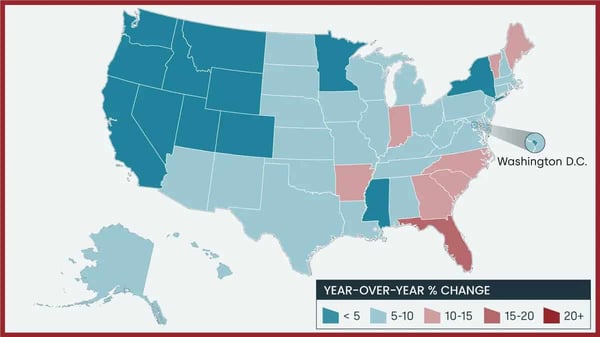

By the time the pandemic asserted itself on the economy, year-over-year home price growth had increased for more than a decade as the housing sector recovered from the trough of the Great Recession. But, Hepp said, COVID sent prices — and inflation — into new territory.

“The momentum really took off in the latter part of 2021 and into 2022,” Hepp said. “But as the Fed started communicating its intent, we started to see things cool off.”

Data Suggests a Soft Landing on Inflation

Pandemic shutdowns exerted pressure on both housing supply and demand. On the supply side, people stopped placing their homes on the market — behavior that exacerbated an already chronic shortage of properties for sale.

On the demand side, millennials in homebuying mode quickly sought to snap up what little housing was available as mortgage rates tumbled. The combination sent prices soaring.

The bigger picture was that prices rose dramatically in the economy as a whole, prompting the Federal Reserve to act against inflation in 2022. As interest rates increased, mortgage rates started a parallel upward trend, from around 3% to 7%. And the demand for housing receded.

“By the end of 2022, we were in a genuine slump — home sales activity declined up to 30-40% depending on the market,” Hepp said. “And some markets that saw particularly strong price growth during the pandemic were down about 10-14% from that peak.”

The affordability crunch brought on by higher mortgage rates wiped out about 30% of purchasing power, impacting buyer confidence. And sellers were less likely to part with properties because many locked in favorable rates as mortgages started climbing.

“We were at our lowest for-sale inventory point historically — no inventory, no buyers, and a market in a standstill,” Hepp said.

The question for the housing sector at the start of 2023 was whether the Fed’s aggressive action against inflation would affect mortgage rates, which appears to be the case. The rate of inflation has slowed, and mortgage rates are easing.

Data suggests the economy will see a soft landing on inflation in 2023 and avoid a prolonged economic slump. Housing market competition indicators have also begun showing improvement.

“With mortgage rates coming down, particularly since mid-December 2022, we can hear the heartbeat coming back in the market,” Hepp said.

New Construction Boosts Growth Potential

We’re not out of the woods yet, particularly considering the market’s systemic flaws. But while 2023 promises challenges, a prolonged recession appears to be a worst-case scenario for the economy, and the mortgage rate reprieve bodes well for housing.

Job losses haven’t translated into an increasing unemployment rate because workers are still reorienting themselves in the job market post-COVID. And in housing, new construction has the potential — at least in some markets — to overcome stasis among sellers.

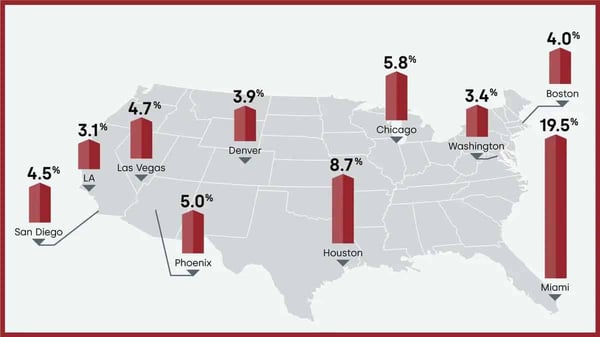

“In states and metropolitan areas where we’re seeing new construction, that’s where we continue to see some movement in the housing market because there is inventory,” Hepp said.

Lack of inventory has emerged as a chronic issue in housing for several reasons. One is that local regulations limit what builders can build. From zoning restrictions that control townhome, condo, and apartment construction to parking minimums that reduce the available land for homes, builders find the odds stacked against them.

Another reason for the chronic lack of inventory is a “not-in-my-backyard” community mentality. Residents worried about the impact of new development on their property values have the power to make their desires felt, and they usually do.

These limitations tend to be more cultural than economic in origin, but they contribute nonetheless to general declines in homeownership rates and ongoing racial and generational housing disparities.

That said, those realities don’t always discourage builders and agents from fighting the good fight. Hepp said buyers tend to be receptive to incentives such as price adjustments and interest rate buydowns.

“So it does seem as if there’s more movement, or more activity at least, in markets where there’s new construction and the possibility of making a deal,” she said. “But in places such as the West Coast, where you have no inventory and no new construction, there’s no deal to be made.”

CoreLogic: Data Analytics for Housing Stakeholders

Where housing goes next is subject to the imprecisions and vagaries of consumer decision-making. Stakeholders interested in all aspects of the market turn to CoreLogic to get the most precise sense of the zeitgeist.

CoreLogic solutions help real estate professionals from the enterprise to the individual level forecast trends and interpret the housing market’s direction.

In the mortgage finance industry, CoreLogic streamlines borrower and origination workflows, optimizes servicing and appraisals, and helps with tax preparation.

And in insurance, CoreLogic brings efficiencies to underwriting and risk assessment, claims management, and hazard intelligence.

Among the copious reports, blogs, case studies, and whitepapers housed on the CoreLogic website, Hepp’s office produces a blog and participates in corporate-wide podcast and video production.

The Office of the Chief Economist also produces flagship CoreLogic monthly reports, including the Home Price Index (HPI), the Loan Performance Index (LPI), the Single-Family Rent Index (SFRI), and the S&P Case-Shiller Index (CSI).

CoreLogic reports cover the gamut of property data from cost, price, and equity analyses to insights regarding loan performance, mortgage fraud, property tax delinquency, and the single-family rental market.

One subject of particular relevance as of early 2023 is homeowner equity — CoreLogic is one of a few data providers in that area. Despite its negative consequences, the massive pandemic housing price increase of 2020-21 is insulating the current market from a potential foreclosure crisis.

“If push comes to shove and homeowners lose their jobs, they can sell at a profit and not go into foreclosure,” Hepp said.

Another significant finding for 2023 is investor involvement in real estate. As housing demand vanished during the 2022 interest rate increases, investors continued to purchase at the same rate they had been buying in 2021.

“There are a few markets out there — Phoenix, Las Vegas, Atlanta, Dallas, and Charlotte — that are really concentrated in investor activity,” Hepp said. “I don’t have an answer, but how that will play out in terms of rents and home prices will be interesting.”

![11 Best Credit Cards With Price Protection ([updated_month_year]) 11 Best Credit Cards With Price Protection ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Credit-Cards-with-Price-Protection-Feat.jpg?width=158&height=120&fit=crop)

![21 Startling Credit Card Data Breach Statistics ([current_year]) 21 Startling Credit Card Data Breach Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Credit-Card-Data-Breach-Statistics.jpg?width=158&height=120&fit=crop)