Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Anyone responsible for payment collection knows what a chore it can be. Cheddar Up facilitates the process of collecting payments and their accompanying documents by offering reporting tools and tailored plans that align with a group’s requirements. Cheddar Up’s versatility makes it suitable for numerous groups and nonprofit organizations.

New parents daydream about their child’s future, envisioning all the milestones and ups and downs their child will experience as they grow and mature. And parents will be there by a child’s side through it all, cheering them on to success and lifting them when they fall. It’s part of a parent’s job description.

But few parents have the foresight to anticipate the volume of school and program paperwork — and accompanying fee payments — they’ll encounter along the way.

Nichole Montoya is the Co-Founder and CEO of Cheddar Up, a company that allows groups to request, receive, and track payments and supplemental forms online.

In the early 2010s, Montoya worked in the fintech industry while raising two young children. She said she spent much time writing checks and filling out forms for her children’s various activities. She also invested time in delivering those checks and documents to the organization’s designated point person.

“As a working parent, this was slowing me down,” Montoya said. “And if it was inconvenient for me to fill out a form or write a check for my children, I couldn’t imagine what it was like for the person receiving all these pieces of paper and payments. I never raised my hand to be involved in collecting payments from a group because it was such a pain. Then you’ll have people who won’t commit to making their payments — it’s just cumbersome.”

Montoya said her experiences made her realize there was a gap in the market for collecting payments from individuals belonging to a group. As Montoya began to study the issue further, she said she realized there wasn’t a company offering a way to seamlessly gather the information that often accompanies payments from group members.

“Whenever one of my children needed a check for a school activity, there was also a form requesting some information that went along with it, whether it be requesting my child’s teacher’s name, a listing of any allergies, or a permission slip,” Montoya said. “The ability to collect that information in tandem with a payment is really important.”

Unable to find a satisfactory solution, Montoya determined to build one herself, which led her to co-found Cheddar Up.

Versatility to Suit Various Uses

Montoya said Cheddar Up is suitable for anyone, regardless of their tech fluency. The company’s customers tend to be volunteers. Montoya said volunteer positions have high turnover from one year to the next, which Cheddar Up accommodates by supporting the transfer of management for payment and information acceptance among users.

Initially developed to support payment and information acceptance for school-related activities, Cheddar Up is also useful for fundraisers, group gifts, online sales, and camp registrations.

Montoya said the tool is an excellent fit for PTA leaders who can use it to collect dues, support fundraising initiatives, and sell school spirit items.

“PTA leaders love Cheddar Up because they can use it for so many different projects,” Montoya said. “But our users are not all schools or school-related groups.”

Schools and parent groups supporting school events account for 25% of Cheddar Up’s customers. Nonprofits, religious organizations, and homeowner associations comprise another 25% of the company’s customers. Montoya said the remaining 50% of Cheddar Up’s customers are sports groups, clubs, and small businesses.

Cheddar Up is committed to providing its customers with an easy-to-use and visually appealing platform.

“We want to give our users a pleasant experience,” Montoya explained. “The aesthetic of our platform has always been very important to us. It’s a really simple design — there are no ads. We allow users to customize their platform with a branded banner to make it their own.”

Individuals who submit payments through Cheddar Up don’t need to download an app or create an account with the company. Payers can click the link provided to them by their group’s organizer to submit their payment. Montoya said 75% of payments submitted through Cheddar Up are from mobile phones.

Users have the option to create an account if they’d like to save their payment information for future use.

“Users can create accounts if they wish, but many people prefer the simplicity of paying directly without having to recall another set of login credentials,” Montoya said.

Security Components Keep Payment Information Safe

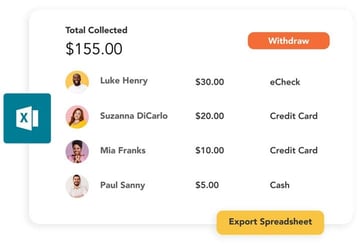

Cheddar Up offers an app allowing users to manage payment collections wherever is most convenient. The company’s online reporting tools help those responsible for collecting payments to track and manage their progress. Users can create custom reports and export data to other programs.

Montoya said information security is essential to Cheddar Up. All of the form-related information sent through Cheddar Up is encrypted.

The company doesn’t access or store any submitted financial information, which a PCI-compliant third-party financial service provider manages. Montoya said Cheddar Up’s fraud management practices also keep accounts secure.

“We have a lot of different tools that we layer on to validate a person’s identity,” Montoya said. “And we have a whole team of people here who focus on data security.”

Customer Feedback Informs Product Enhancements

Cheddar Up offers three plans for customers to choose from. The basic version is free and allows group organizers to collect payments on Cheddar Up’s platform. Montoya said the basic version permits users to create and share unlimited custom payment pages with custom URLs and access payment tracking.

Cheddar Up’s pro plan offers features for customers who need to create an online store. While the basic plan allows users to list up to five items for sale, the pro plan does not cap the number of items users can list. The pro plan also lets users offer discount codes to payers at checkout.

Cheddar Up’s most robust platform is its team plan, intended for users who manage their group’s payments collaboratively. The team plan allows groups to accept recurring payments and offers account-wide reporting that multiple managers can access.

“A lot of users start with the basic plan,” Montoya detailed. “Once they realize how much they love the platform, some users want to access the additional features available through other plans. Our plans are pretty affordable for the type of organizations we work with. Users can also upgrade their plans for a limited time to serve a specific purpose. We like to provide that option.”

Cheddar Up’s customer service team is available to users with questions or challenges that require assistance. The company offers email support and live chat services. Customers who prefer to speak with a Cheddar Up representative can schedule a call with the company.

“We respond to all customer inquiries within 48 hours, but we usually get back to people within a day,” Montoya said. “We’re pretty high touch. That’s something that’s been a differentiator for us.”

Cheddar Up uses customer feedback to build its product road map each year and assess how new features are performing. Montoya said customers regularly provide feedback saying that they are more successful collecting money through Cheddar Up than other methods they’ve tried.

“People really see a dramatic difference in payer participation with us,” Montoya said. “If you make it easy, people are much more likely to contribute.”

![7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year]) 7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Ways-to-Manage-Credit-Card-Debt-When-Interest-Rates-Rise.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Tax Payments ([updated_month_year]) 7 Best Credit Cards for Tax Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-for-Tax-Payments.jpg?width=158&height=120&fit=crop)