Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Did you keep your New Year’s resolutions last year? Or the year before? Or the year before that? Or have your January 1 goals repeatedly fallen by the wayside by March or April? For many people, New Year’s resolutions, though made with the best of intentions, tend not to be fulfilled.

It doesn’t have to be this way. Whether your resolutions feature more savings, less debt, or smarter investments, good habits can help, and so can smart resources. Check out our list of five books, five podcasts, and five websites and apps that will help you get started on your path toward keeping your financial New Year’s resolutions this year.

-

Navigate This Article:

5 Best Books

Whether you prefer hardbacks, paperbacks, ebooks, or audiobooks, reading books about money matters is an excellent way to educate yourself about topics related to your financial New Year’s resolutions. Read multiple books with different ideas and perspectives to figure out which strategies and tips will best meet your needs.

1. “The Total Money Makeover: A Proven Plan for Financial Fitness“

If you’re ready to pay off debt, build your savings, and stop struggling to stretch the pennies in your paycheck from one pay date to the next, this classic book by financial guru Dave Ramsey may be a good choice to read.

The latest edition of this 237-page book features a practical seven-step plan along with more than 50 real-life stories of people who reveal how they used Ramsey’s advice to improve their financial situation.

How does the plan work? “It gets to the heart of your money problems: You.”

2. “The 21-Day Financial Fast: Your Path to Financial Peace and Freedom“

One of four books by personal finance journalist Michelle Singletary, this 256-page volume challenges readers to stop spending on anything that is not essential for three weeks.

The challenge is intended to help you stop overspending, pay off debt, stop worrying about money, prepare for financial setbacks and emergencies, and achieve other important financial goals.

The book’s focus on a time period that’s just 21 days, rather than a full 12 months, lets you ease into your New Year’s resolutions with a specific goal that you can check off as “done” in just 21 days.

3. “One Up On Wall Street: How to Use What You Already Know to Make Money in the Market“

This classic 304-page book about DIY investing by former money manager Peter Lynch aims to help novice investors find hidden value in individual stocks.

Last updated in 2000, the book’s approach and examples may feel a bit dated, but Lynch’s time-tested strategies for investors on the hunt for everyday investment opportunities remain sound.

Finding a few of Lynch’s famed “ten-baggers” — stocks that return 10 times your initial investment — could turn an otherwise average investment portfolio into a long-term out-performer.

The book is a #1 bestseller chockful of investment know-how.

4. “The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness“

The short stories in this 256-page book by investment professional Morgan Housel explore people’s relationship with money and how to make better sense of this important and often highly stressful subject.

Rather than taking a quantitative, numbers-heavy approach to investment strategies, the book approaches money matters from an individual perspective. Housel advises readers to take a balanced approach to financial literacy and their own personal finances.

This book shares 19 short stories highlighting the “strange ways people think about money” and teaches readers how to better comprehend their finances.

5. “Surviving Debt: Expert Advice for Getting Out of Financial Trouble“

Published by the National Consumer Law Center (NCLC), this 296-page book offers detailed advice and guidance for consumers who are struggling with more debt than they can manage.

Topics include how to prioritize debt payments, cope with debt collectors and collection lawsuits, and when to file for bankruptcy protection. Advice about car repossessions, mortgage modifications, and evictions is also included.

The NCLC is a nonprofit organization that works to support consumer justice and economic security for low-income and other disadvantaged people in the U.S.

5 Best Podcasts

Podcasts are a fun and easy way to turn unproductive downtime into a learning opportunity. Listen while you’re commuting, working out, or doing chores that don’t require your full attention. Or schedule a regular time to listen together with your family to build your shared knowledge base and improve your communication about money matters.

1. The Dave Ramsey Show

This popular podcast, which airs live every weekday at 2 PM Eastern Time, features financial guru and author Dave Ramsey and a panel of guest experts who answer listeners’ questions about personal financial matters. Topics cover a range of topics, from saving for retirement and paying off debt to financial infidelity, buying a home, and more.

2. Suze Orman’s Women and Money Podcast

Money expert Suze Orman dispenses financial advice and answers listeners’ questions in this weekly podcast. Regular features include “Suze School,” in which Orman teaches basic financial lessons, and “Ask Suze Anything,” which opens the floodgates to all sorts of financial topics. Subjects include new rules for retirement accounts, buying a home, understanding investment jargon, how to avoid financial mistakes, and more.

3. BiggerPockets Real Estate and Money podcasts

BiggerPockets offers half a dozen different money-related podcasts, including an award-winning show about investing in real estate that airs every Monday, Wednesday, and Friday. If buying investment property is one of your New Year’s resolutions or longer-term aspirations, this podcast features interviews, news analysis, and “listener coaching calls” to help you get started.

4. Planet Money

At first glance, the “Planet Money” podcast from National Public Radio (NPR) may not seem to be related to personal finance. But that’s not the full picture. This podcast’s aim is to put current trends and news stories into a financial context and “tie any topic back to the economy.” Subjects of interest have included the market for U.S. Treasuries, consumer perception of how healthy the U.S. economy is, job markets and inflation, and the economics of climate change. Lighter subjects, like the economics of cafeteria buffets, are also featured.

5. Your Money, Your Wealth

The weekly “Your Money, Your Wealth” podcast takes a breezy and light approach to serious financial issues that can prove challenging for retirees and people who plan to retire in the near term. Investment strategies, income taxes, retirement income, Social Security benefits, and tax-advantaged retirement accounts are among the topics on the playlist. The hosts Joe Anderson and Alan “Big Al” Clopine are professional financial and investment advisors.

5 Best Websites and Apps

Websites and apps can be another great way to educate yourself about financial topics and help you stay on track with your financial New Year’s resolutions. Better still, these apps don’t require monthly subscription fees. Pay once—or not at all—and you’ll have the app to use for as long as you need it.

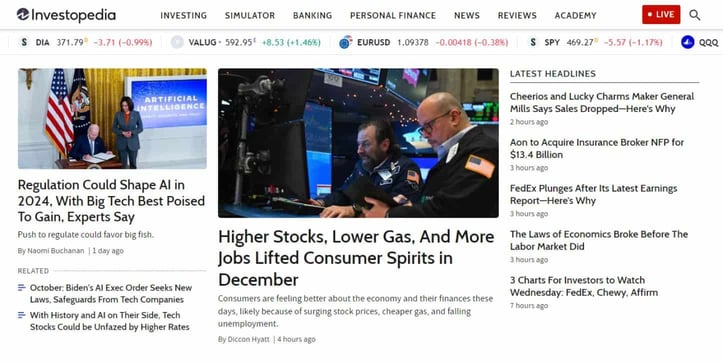

1. Investopedia

The front page of the Investopedia website is filled with news stories and top headlines, but the real gold can be found behind the “Personal Finance” tab, which reveals a wealth of in-depth articles on personal financial subjects. Whether you need to budget for a new baby, figure out how your property taxes are calculated, get an update on student loan interest rates, or understand types of insurable risks, this site is where you’ll find the steps to do it.

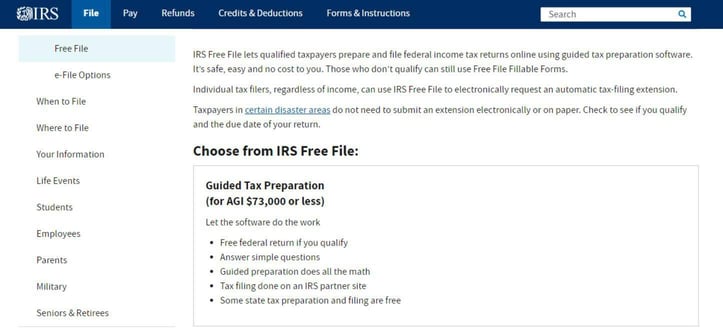

2. Free File

If paying less for tax prep services is one of your New Year’s resolutions, you should check out Free File. This public-private partnership between the IRS and the tax prep industry enables U.S. taxpayers to prepare their own tax returns at no cost. The service may not be a good fit for higher-income taxpayers or those with complicated tax issues, but for those with modest incomes and simple returns, it’s easy to use and, as the name implies, free.

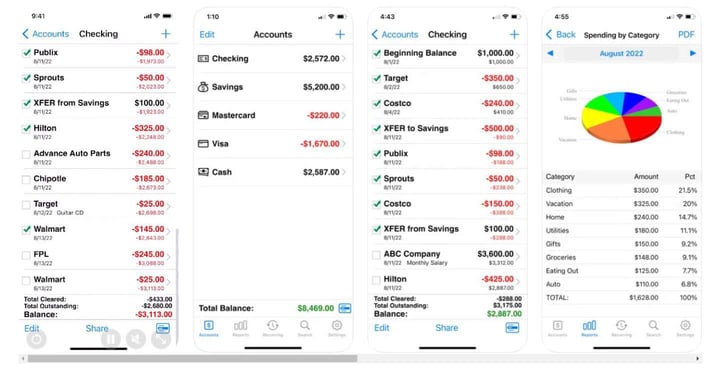

3. Accounts Checkbook

The Accounts Checkbook app, now available in version 3 for the iPhone and iPad, allows you to keep track of your checkbook register on your mobile device. Enter your cash withdrawals, bill payments, checks written, banking fees, interest earned, and deposits in real-time. And you’ll always know exactly how much you have available, even if some of the transactions haven’t yet cleared through your bank. The app is available for a one-time purchase with no monthly subscription or advertising.

4. Debit & Credit

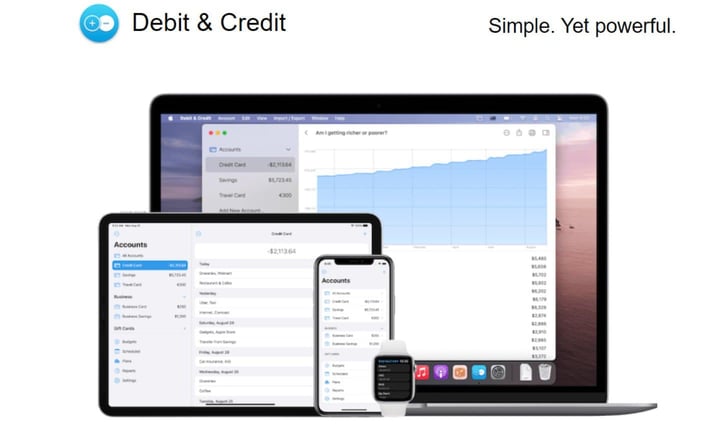

The Debit & Credit app, available for the iPhone or Macbook, lets you keep track of your income and expenses separately from your checkbook register. Use this app to create budgets, generate spending reports, track credit card charges, build savings, and more. If you’re a gig worker or have a side hustle, this app can also be handy to track your income and expenses for tax time.

4. Your Bank’s App

Whether your bank is a national corporation or a local credit union, its mobile banking app is probably one of the most useful apps you can install on your mobile device. This type of app typically allows you to schedule bill payments, make deposits, monitor your balances, and make person-to-person payments with the recipient’s email address. Use the app to avoid late-payment fees and overdrafts, boost your interest income, and spend less on checks, envelopes, and postage stamps.

Start the New Year on the Right Financial Footing

A recent Forbes Health/OnePoll survey found that better physical fitness was the top New Year’s resolution for 2024. Number two, according to survey respondents, was improving their finances. Those two topped all the others, including losing weight, eating healthier, learning a new skill, making more time for hobbies, and traveling more.

The numbers don’t lie. But making resolutions isn’t difficult. It’s keeping them. With these resources to help, staying on track with your financial resolutions for the next 12 months should be easier than ever.

![What is a Charge Card? Definition + 3 Top Cards ([updated_month_year]) What is a Charge Card? Definition + 3 Top Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/what-is-a-charge-card--1.png?width=158&height=120&fit=crop)

![How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year]) How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/04/complete-guide-to-balance-transfers.jpg?width=158&height=120&fit=crop)

![6 Top Cards: Credit Score Needed for Wells Fargo ([updated_month_year]) 6 Top Cards: Credit Score Needed for Wells Fargo ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-2.jpg?width=158&height=120&fit=crop)