Credit cards have come a long way in the past 20 years. What once was considered a debt trap is now touted as a savvy financial tool that, when used wisely, can help you establish credit, earn valuable rewards, and get something back for the money you’re planning to spend anyway.

However, not all credit cards are created equal, and not all consumers respond to them positively. Here’s a look at 17 credit card studies that shine a light on how these plastic forms of payment affect our personal finances, our personal relationships, and even our families.

1. Cardholders Will Rack Up $140 Billion in Debt in 2020

The year 2020 started off on solid financial footing as Americans made big strides to become debt-free, but this quickly changed course as the pandemic hit.

According to WalletHub’s Credit Card Debt Study, Americans began the year owing more than $1 trillion in credit card debt but were able to quickly change course, posting the biggest first-quarter credit card debt paydown ever at $60 billion.

Although U.S. consumers were on pace for one of the best debt repayment moments, the COVID-19 pandemic turned it into one of the worst. The study now projects that U.S. consumers will rack up more than $140 billion over the rest of 2020, ending the year with a net increase of $80 billion in credit card debt.

2. Credit Card Hardship Programs Come with Downsides

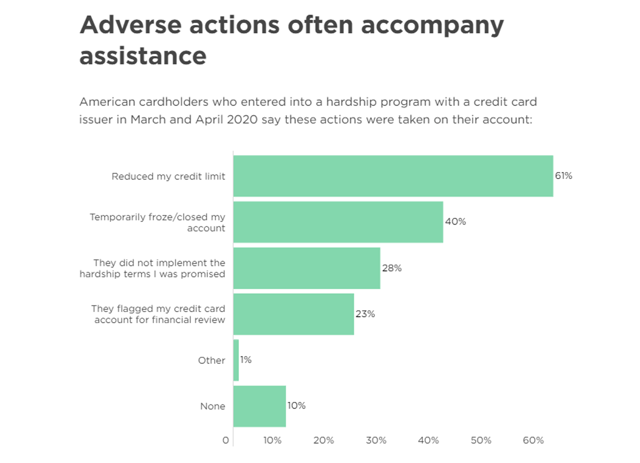

As the coronavirus outbreak wreaks havoc on our health and livelihood, credit card holders are reaching out to companies for assistance. However, these hardship programs come with downsides, often unannounced to the cardholder.

According to the 2020 Consumer Credit Card Report from NerdWallet, approximately 1 in 8 American cardholders reported having entered into a credit card hardship program in March and April 2020. And 9 in 10 of those cardholders said adverse actions were then taken on their accounts, including reduced credit card limits (61%) or temporarily frozen accounts (40%).

Source: Nerdwallet 2020 Consumer Credit Card Report

But don’t let these stats deter you from reaching out to your card issuer when you need assistance.

3. Signup Bonus Offers Tripled Over the Past 10 Years

Credit card companies are offering more to attract new cardmembers, according to a 2018 study by Magnify Money on travel rewards credit card introductory bonus offers. In fact, the report found that introductory bonus offers for travel rewards cards have nearly tripled in the past 10 years.

This research found that the average introductory bonus on a travel rewards credit card in 2018 was 40,556 points, more than double the average 16,050 bonus points in 2008.

Introductory offers aren’t the only thing that’s increased on these cards. The annual fee associated with these cards is also up, proving that consumers are willing to pay more for bigger signup bonuses. In fact, the study found the average annual fee on a card with a bonus offer is $120, up 62% from $74 in 2008.

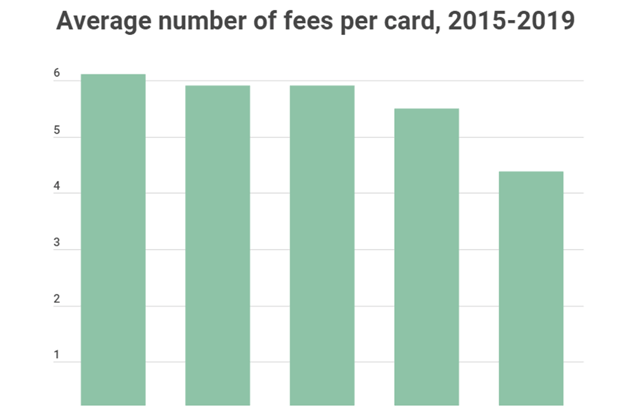

4. More Rewards Lead to Higher Fees

With robust reward programs offered by most major credit card companies these days, opening an account and charging purchases makes sense since you can earn something back for the things you’re buying anyway. However, greater rewards lead to increased fees.

According to the 2019 Credit Card Fee Survey from CreditCards.com, several card issuers have increased fees recently, making it more expensive to miss a payment, take out a cash advance, and transfer a balance. Not to mention, credit card companies are justifying increased annual fees in exchange for greater rewards.

Source: 2019 Credit Card Fee Survey from CreditCards.com.

For instance, the study points out that the annual fee for the iconic American Express® Green Card went from $95 to $150 while simultaneously introducing improved credit card rewards and benefits.

Other notable fee increases include the average card APR, which now stands at 17.25%, a two-point increase from where it was in 2016. Meanwhile, 74 cards included in the survey are charging up to $39 per missed payment on personal cards.

5. Credit Cards Cause You to Spend 5X More than When Paying with Cash

It’s no surprise that credit cards can lead to impulse purchases and increased spending. But, just how much more are people actually buying when using plastic over money?

The 2016 Diary of Consumer Payment Choice from the Federal Reserve Bank of Boston found that the average value of a cash transaction was just $22 compared with $112 for the average credit card transaction.

When you buy something with a credit card, you aren’t actually paying at the time of the transaction, and it’s less painful to part with virtual money than with physical cash. So a good way to combat impulsive credit card spending is to review your card’s transactions daily because it’s easy to forget how much you’ve charged until your credit card debt becomes overwhelming.

6. Amazon’s Credit Card is the Go-To Choice for Online Shoppers

Amazon is one of the most popular places to shop online and it’s also becoming one of the most popular places to get credit. One in 4 American consumers owns an Amazon Credit Card, according to the State of Online Shopping and Credit Card Usage Habits study from CouponFollow.

According to a study conducted by CouponFollow, 1 in 4 Americans have an Amazon Credit Card.

The study also revealed interesting data about online shopping in general, including that millennials shop the most frequently, spend the most, and are the most likely to have gone into credit card debt while shopping online. About 2 in 5 consumers admit blowing their budgets while online shopping in the past six months.

7. More than 7% of Cardholders Don’t Know How Much They Pay in Annual Fees

Credit card terms and fees can be confusing with all the options available these days. No matter what type of card you get though, it’s important to read the fine print so you know how to maximize rewards and avoid unnecessary fees.

Shockingly, some cardholders pay no attention to their card terms and annual fee. The Points Guy Credit Card Survey found that 7.3% of U.S. adults who have at least one credit card said they don’t know how many cards they have with annual fees of $300 or higher.

Must be nice to spend hundreds of dollars a year on an annual fee and not notice it!

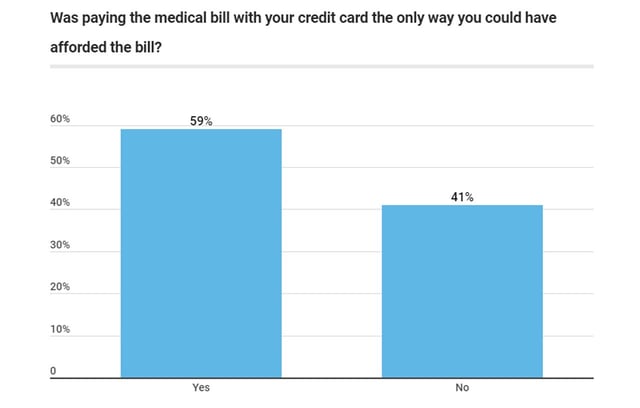

8. 1 in 3 Cardholders Blame Medical Bills for Debt

Credit card debt is often tied to reckless spending decisions and impulse buys, but the reality is that many cardholders find themselves carrying a balance due to a series of unexpected expenses and emergencies for which they just didn’t have enough cash to cover the cost.

A 2019 poll from CompareCards.com found that 1 in 3 cardholders cite a medical bill as the reason they’re in debt.

Source: CompareCards.com 2019 Poll

Even more startling, however, is that of those who reported paying a medical bill with their credit card, almost 10% owe at least $10,000. Meanwhile, 56% of credit cardholders say they paid a medical bill with a credit card at some point in the past and half admit that they are still in debt because of it.

What’s more, 59% of those who used a credit card to pay off a medical bill said they would not have been able to afford the bill otherwise.

9. College Students Carry an Average of 5 Credit Cards

College is synonymous with being broke, so it’s no shock to learn that students use credit cards to afford basic living expenses. Yet, there are some startling data at just how many credit cards these students carry, increasing their spending temptations.

In fact, the 2019 Majoring in Money survey from Sallie Mae found that college students carry an average of five credit cards, up from an average of three cards in 2016. The median number of cards students have remains two over the same three-year period.

Students reported an average combined monthly balance on those cards of $1,183 over the course of the past year. The credit card balances students reported in 2019 were higher than they were in 2016. In 2019, college students reported an average balance for the most recent month of $1,423 — a 32% increase over the average balance in 2016 of $1,076.

Although these students opened their cards for the right reason, with 58% explaining that they did so to establish credit, the temptation to spend makes it too easy to rack up debt.

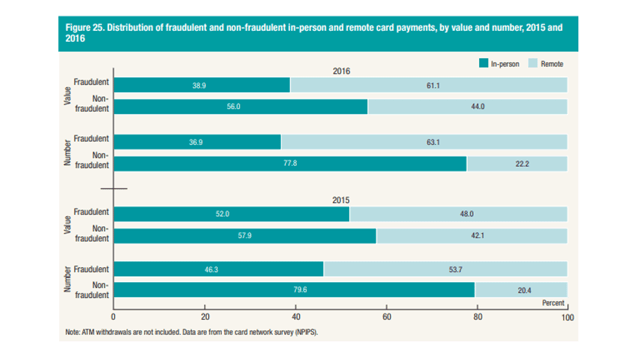

10. Remote Payment Systems Lead to Higher Fraud

As consumer and business payment habits evolve thanks to new technology and other factors, so do the efforts of fraud perpetrators. According to the 2018 Federal Reserve Payments Study, total remote card fraud increased from $3.40 billion in 2015 to $4.57 billion in 2016.

Remote card fraud increased from 2015 to 2016, according to the 2018 Federal Reserve Payments Study.

Although the adoption of chip cards, which are harder to counterfeit, has mitigated fraud at card-present payment systems, it’s clear that remote payment options that use credit card data can be compromised. Thus causing both the financial institution and consumer a lot of headaches and financial distress.

Remaining vigilant and ensuring safe credit card practices such as using secured networks when sharing personal data online, setting up two-step authentication, and keeping a watchful eye on account transactions can help keep fraud at bay.

11. Credit Card Use Influences Purchase Values

Have you ever thought about how you pay for something affects the way you perceive a product’s value — and justifies a purchase? Studies show that credit cards make people less concerned over price, shifting their focus on the product’s features instead.

In fact, a 2012 study by Promothesh Chatterjee and Randall L. Rose found that consumers who used a credit card to make a purchase were often more concerned with an item’s benefits than with its cost.

The reason behind this is likely due to the fact that paying with plastic doesn’t cause the same immediate pain you’d feel when doling out dollar bills for the same purchase. Therefore, you worry less about the price.

In some cases, this can be beneficial, though. Being overly concerned with the price may cause you to make poor purchase decisions and buy cheap items that you constantly have to replace. It’s just as important to make sure that whatever product you end up charging to your card can be paid off in full to avoid racking up interest and going into debt.

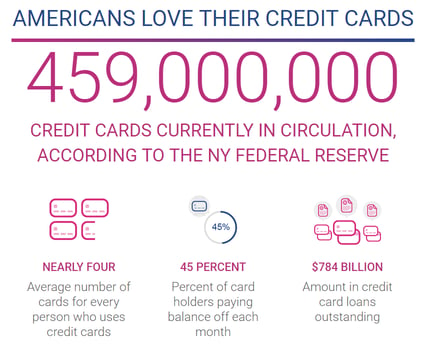

12. Outstanding Credit Card Debt Hovers at $784 Billion

While Americans say they consider their credit cards valuable financial and credit tools, they complain that the process of finding and applying for a new card can be overwhelming. However, this hasn’t stopped people from seeking new cards.

One in 3 respondents to a survey conducted by Edelman Intelligence on behalf of Experian said they were planning to apply for a new credit card within the next six months. The survey also found that American cardholders have a combined $784 billion of outstanding credit card debt, and the average card debt is $2,326.71. The average monthly charge stands at around $780.

13. Credit Scores Are a Key Indicator in a Partner’s Commitment Level

Talking about credit scores may not be the most romantic topic for a first date, but one study suggests that your credit score can predict your compatibility with a potential mate.

According to the 2015 Credit Scores and Committed Relationships study conducted by the Federal Reserve, credit scores play an important role in understanding an individual’s relationship skill and level of commitment. Ultimately, data from this study revealed that a better credit score is positively correlated with the likelihood of forming a committed relationship and its subsequent stability.

A person with a good to excellent credit score exhibits healthy money management skills that will play a crucial role in reaching life goals, according to the study. Consumers with good to excellent credit scores are less likely to make poor financial choices that can lead to anxiety and fiscal distress, issues that often cause couples to split.

The takeaway? Take your credit card payments seriously and pay on time and in full to keep your score in tip-top shape.

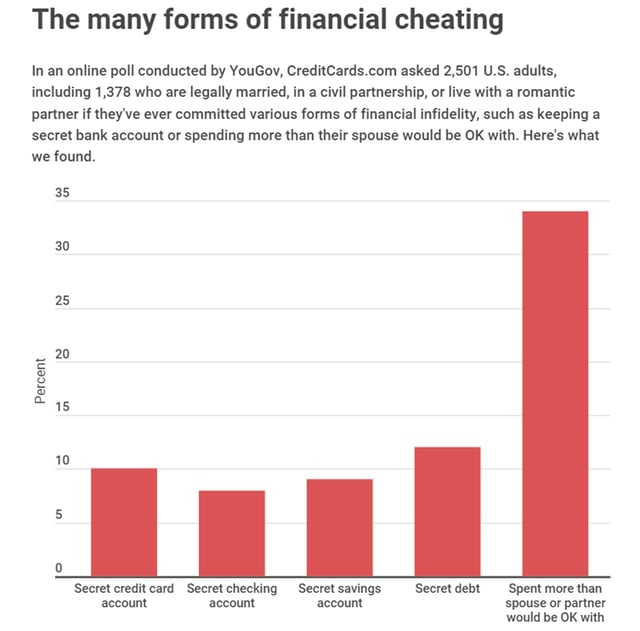

14. 44% of Couples Hide Financial Accounts like Credit Cards

Managing money with a partner can be stressful, especially when you don’t see eye to eye on every expense. For some couples, financial dissonance can lead to keeping secrets about how much one partner is spending or how much they owe — information that can wreak havoc on your relationship. Unfortunately, it’s happening more than many would like to admit.

According to the 2020 Financial Infidelity Poll from CreditCards.com, the percentage of partners who said they lie about money more than doubled when compared with responses in last year’s poll. The latest financial infidelity poll found that 44% of those surveyed admitted to keeping a private financial account hidden from their significant other. Among this group, 10% said they have a secret credit card account, 12% said they have secret debt, and almost 35% said they have spent more than their partner would be okay with.

Source: CreditCards.com Financial Infidelity Poll

Although some of these secrets seem harmless, 27% of survey respondents said that financial infidelity is worse than physical cheating. Regardless of how you rate it, practicing honest communication and getting on the same financial page is crucial for creating a lasting relationship.

15. Survey Says 17% of School-Aged Kids Carry Credit Cards

As our world moves toward a cashless society, it seems more families are giving their kids credit cards to cover day to day expenses. In fact, the 2019 Parents, Kids, and Money Survey from T. Rowe Price found that children as young as 8 through 14 are using credit cards more than their counterparts were just seven years ago.

In fact, credit card use has skyrocketed among school-aged children, growing from 4% in 2012 to 17% in 2019. Of these credit card clad kids, a whopping 41% are responsible for paying off their balance while the other 59% lean on mom and dad to foot the bill.

Adding a child as an authorized user may seem like a risky move, but parents can use it to teach their kids good money management skills while monitoring their spending.

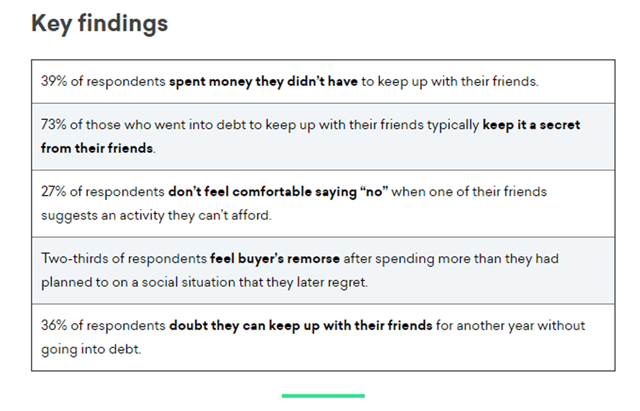

16. FOMO to Blame for 40% of Millennials Go into Debt

From expensive vacations to dining out to partying on the weekends, FOMO often causes consumers to overspend and can lead many people into credit card debt.

Peer pressure and social media also contribute to this trend. The biggest culprits of giving into FOMO spending are millennials who are already laden with debt.

According to this 2018 Credit Karma survey, 40% of millennials surveyed said they have spent money they didn’t have and went into debt to keep up with friends; 73% of those surveyed said they had kept their spending and debt a secret from others. Perhaps the most interesting information pulled from this study are the reasons for giving into FOMO in the first place.

For instance, 36% of respondents say they spend money they don’t have because they’re afraid they won’t be included in a future activity if they don’t while 27% said they don’t want to feel like an outsider, 26% said they don’t want to lose friends and 23% said they don’t want to be judged.

17. Credit Card Debt is How 61% of Couples Can Afford Their Wedding

Getting married is supposed to be a blissful event, but the rising cost of tying the knot is turning this once-in-a-lifetime experience from joyous to stressful. Considering the average cost of a wedding in the U.S. reached a whopping $33,391, according to TheKnot.com, it’s no surprise that many fret over their budgets before the big day. Unfortunately, many turn to credit cards to afford their perfect wedding.

According to the 2018 Wedding Costs Survey from Student Loan Hero, 74% of couples surveyed said they planned to go into debt for their weddings, and, of those soon-to-be newlyweds, 61% planned to use credit cards to pay for many of the common expenses.

Setting a budget is key to avoid overspending. But keep in mind that taking on debt to pay for your wedding can keep you from reaching other financial milestones with your spouse. Scrutinize each potential expense to determine whether going into debt for this big day is worth it and consider other ways you could use that money together instead.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![Can I Use My Debit Card as a Credit Card? 3 Things to Know ([updated_month_year]) Can I Use My Debit Card as a Credit Card? 3 Things to Know ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/can-i-use-my-debit-card-as-a-credit-card--1.jpg?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)

![What Card is in the Jennifer Garner Credit Card Commercial? ([updated_month_year]) What Card is in the Jennifer Garner Credit Card Commercial? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/jennifer-2.jpg?width=158&height=120&fit=crop)

![Kohl’s Card vs. Target Card: Which Is Better? ([updated_month_year]) Kohl’s Card vs. Target Card: Which Is Better? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/vs2.png?width=158&height=120&fit=crop)

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)