In a Nutshell: Behind each important financial decision, risk assessment, and regulatory compliance report, is an extensive mathematical model. And many of those models are developed with MATLAB, the advanced mathematical computing software from MathWorks. By providing a versatile, easy-to-use analysis and modeling environment, MATLAB has become the behind-the-scenes force helping to power everything from pension fund investments and credit scoring to international currency transaction algorithms. As data and technology become increasingly widespread, MathWorks is also helping to bridge the modeling gap between consumers and institutions by putting MATLAB’s modeling power in the hands of consumers and students around the world. //

From an audience’s perspective, few things look so effortless as a well-choreographed stage performance, be it classical ballet, modern musical, or rocking concert. As set pieces, lighting, music, and performers all flow together in practiced harmony, it can almost seem as though it were a natural phenomenon. What isn’t noticed by that same audience is the flurry of activity behind the scenes, as dozens — or even hundreds — of people set about building the illusion of “effortless.”

The concept of the effortless facade is hardly unique to the stage, however. Behind the scenes of every institution, across every industry, is the ensemble of people and tools continuously turning the proverbial cogs. In the financial industry, one of the important tools that keep businesses running smoothly is MATLAB from MathWorks, the mathematical computing software many of us (unknowingly) rely upon every day.

“MATLAB’s footprint can be seen in many of the financial activities that impact consumers,” said Steve Wilcockson, the Industry Manager for Financial Services at MathWorks. “For example, pension fund investments, credit scoring when applying for a mortgage or credit card, the economic policy formulation that determines interest rates and governmental policy, and the algorithms that drive currency transactions when traveling abroad.”

Steve Wilcockson, the Industry Manager for Financial Services at MathWorks.

Beyond finance, MATLAB is used by a variety of industries, including automotive, telecommunications, aerospace, and defense industries. Steve described MATLAB as being like a very advanced calculator, offering comprehensive model development capabilities.

“It is essentially a software environment that lets you rapidly program, develop, and run algorithms and models,” he said. “At its core is the mathematics of matrix algebra, which is a branch of math at the heart of computing. It is a very powerful means of dealing with large in memory, and increasingly out-of-memory data sets in single mathematical operations.”

In the finance industry, MATLAB’s matrix algebra-based modeling is applied behind the scenes in many major institutions, from banks and hedge funds to regulatory agencies and central bank economic policy determination, with the consumer audience rarely aware of its existence.

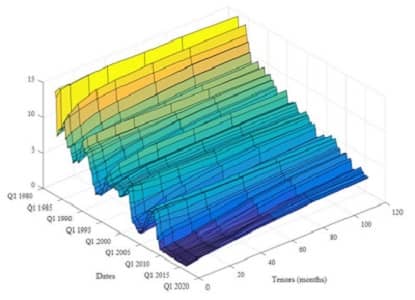

“When it comes to financial modeling, it is used very much in the areas of risk management, portfolio management, trading, insurance, economic forecasting, and so on,” said Steve. “You’ve usually got an element of what you call stochastic calculus (probabilistic or statistical modeling of some description or other; relationships between factors).”

Providing Consistent, Well-Managed Output for Demonstrating Regulatory Compliance

One of the strongest drivers of growth for MathWorks financial tools over the last 10 years has been the growth in regulations. While regulation has long been a factor in the financial industry, the financial crisis of the late 2000s (the US facet of which is often called the Great Recession) caused a flood of new regulations aimed at preventing another catastrophic crash. Today, regulation is part and parcel of everyday life for many financial institutions around the world.

“The role of regulation is very important in terms of driving bank, asset manager, and insurance projects and associated infrastructure change,” Steve explained. “We come across pretty much every regulation. Some of my favorite ones at the moment are the CCAR (Comprehensive Capital Analysis and Review) stress tests and the IFRS 9 regulation — that looks at the consistency of how you account for credit risk on your reported balance sheets.”

MATLAB is used by institutions to perform modeling for regulatory compliance, such as this CCAR stress test model.

Steve also mentioned the Basel III international framework, saying it had some very significant components, including the Fundamental Review of the Trading Book. In addition, he said the Regulation NMS (National Market System) passed by the SEC was of interest, as well as making a note of the EU’s Packaged Retail and Insurance-based Investment Products (PRIIPs), which address transparency around quite complex products when sold to retail.

“PRIIPs is Europe-centered, specifying how customers receive information about fairly complicated products,” Steve described. “This includes structured products, or elements that may have a degree of unpredictability underneath that may not be due to the market. It’s a good regulation, driving at consistent reporting by firms who are selling this stuff to retail customers — who, of course, are also attracted by the potentially higher returns such products can offer, but need to be cognizant of the risks.”

Adding complexity to the veritable sea of regulations through which companies must navigate is that many of the regulations are overseen by disparate organizations.

“There are a lot of regulations out there, and they are often maintained and supervised by very different geographical, political, and financial entities,” said Steve. “In the States, you have the Federal Reserve, the FCC, and the SEC all active, as well as lots of very diverse players in Europe — we have the Basel Committee, we have the Bank of England Prudential Regulation Authority, we have the SSM (Single Supervisory Mechanism).”

Each regulatory agency is setting its own, distinct regulations that also often require a degree of common modeling or analysis. Each one geared toward that body’s particular geographical regions, of course.

“One of our clients, a department in a large international bank, tells us that they have to manage 100+ regulator-facing models serving multiple regulations on a regular basis, applied across different regional jurisdictions,” Steve said. “One problem they face is having to provide country-specific risk reports, so it’s quite hard, for international banks, in particular, to deal with this complex web of regulation.”

A way to manage these problems faced by these large banks, according to Steve, is a capability to ensure the analysts are working with consistent and well-managed models — and data — that can service all compliance regimes, ideally from a coordinated, scalable, and suitably transparent regulatory model stack.

While companies have access to a range of potential solutions, seemingly inexpensive solutions, such as spreadsheets or a platform based on a bottom-up programming language like C++, can be inefficient and sometimes prone to error. At the other end of the spectrum, established platform solutions can range in cost, often millions of dollars per year.

Part of MATLAB’s popularity lies in its role as both an effective, and affordable, solution. “MATLAB is something in between,” said Steve. “Where a lot of the functions are built and prepared for you, but you can incorporate or aggregate them to something that suits your particular need. In this regulatory case, a series of accessible, efficient, and transparent models that can access different data, and offer output in appropriate forms for the multiple internal and external regulatory stakeholders.”

Enabling Faster Risk Analysis & Automated Reporting

Where MATLAB truly shines in finance, alongside its diverse modeling capabilities, is in automated reporting — as a good portion of everything from regulatory compliance to everyday credit risk analysis is, essentially, reporting,

“Analysts spend a lot of time reporting — on their data and modeled data,” Steve explained. “Things like risk metrics are modeled, such as the probability of default or the probability of debt recovery, for example, in credit risk situations. They’re modeled statistically, through simulation, or through economic projection methods, or, perhaps, predictive machine learning methods.”

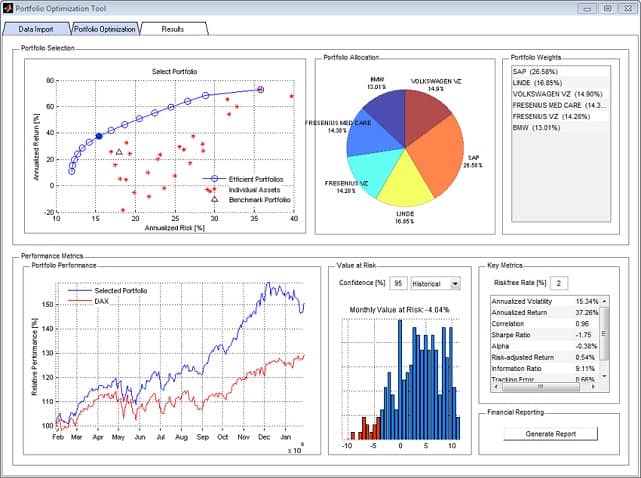

An example of a portfolio optimization application built using MATLAB that enables the comparison of a portfolio and reporting of key metrics.

While Steve notes many other modeling platforms exist in the space, he said a key element in providing a risk solution is consistent reporting of model outputs based on nuanced geographical — or point in time — modeled data. For example, the sensitivity of a BBB-rated mortgage portfolio to the likelihood of an increase in defaults, based on a given risk factor.

“Being able to model risk and present that in a comprehensive way is a fundamental challenge institutions have,” said Steve. “I think our differentiator here, why we’re a good fit, is, not only are many key models available off the shelf — and they’re fast to run and execute — but you can build models in a structured way and store point-in-time (and place) structures to facilitate reproducible analysis, essential if you are scrutinizing someone else’s model.”

The reproducibility of analyses and reports is helpful for both internal and external model governance. Reports need to convey that the model is useful, correct, and transparent to regulators and validators alike. And one of MATLAB’s key advantages is that reports can be generated automatically, saving analysts time, as well as making it easier to validate data by those down the line — “Internal Model Review” teams, for example, and, potentially, supervisors.

“MATLAB can package or reference data and model components to support generated reports,” Steve described. “From when I’ve calculated the model, through to when people have internally validated it, through to my regulator, whoever that is — Canadian regulator, EU regulator, etc. — it’s consistent. They can take what I’ve submitted to them and reproduce those analyses in such a way that we can have a meaningful conversation about my model and the specific data I have used in it.”

Closing the Modeling Gap Between Consumers & Institutions with MATLAB

One of the things the team at MathWorks has been witness to over the last few decades is the rapid evolution of financial modeling. Leaps and bounds in both data and technology have caused significant changes in the way many institutions operate; changes so significant, in fact, that even the average consumer will have noticed some of them.

“The big things consumers see are more services being sold to them, faster decisions on credit, robo-advisors that allow them to make significant investment decisions by pressing the “enter” key,” said Steve. “They can day trade much more easily than they could 10 or 15 years ago.”

What’s more, consumers are not only gaining better access to the tools and data used by large institutions, but they’re also becoming significantly more capable of making use of them. Where you once had to be wealthy, technically able, and resource-rich to perform risk analysis on your financial decisions, these techniques are no longer limited to well-funded banks and hedge funds.

“The average consumers are seeing a changing world — a rapidly changing world — that they can interact and engage with in a way that I don’t think was available to previous generations,” continued Steve. “There’s been a process of democratization in technology, I think. Good data is available to anyone and everyone now.”

And MathWorks is one of the companies closing the modeling gap between consumers and institutions. Anyone with a reasonable knowledge of mathematics and an interest in code can learn to use MATLAB to perform their own analyses.

Any consumer with an interest in modeling can download a copy of MATLAB to gain access to the same tools available to major institutions.

“They can buy a home use license of MATLAB, giving them access to the same capabilities available to large institutions,” said Steve. “A wide range of off-the-shelf models, well documented and with plenty of examples. If they have an aptitude for math and code, they can watch many tutorials, use chat rooms, and attend workshops where they can learn some of the basics.”

In addition, MATLAB is used across 5,000 universities around the world. MATLAB has become the standard in a variety of technical courses, including mathematics, physics, engineering, and programming. “Education is a passion of MathWorks’s founders, who talk to universities on a regular basis,” Steve said. “That extends to home and maker communities too, for example, through the MathWorks Internet of Things platform, ThingSpeak.”

MathWorks is Changing How We Make Financial Decisions

Behind the scenes of every complex system is a whole host of people, processes, and products that make everything possible. This includes everyone from the performers to the porters, and dozens of people in between, diligently working to make an elaborate production appear flawless to the untrained eye.

In the ever-evolving and infinitely convoluted world of international finances and regulation, one of the behind-the-scenes heroes helping to keep everything on track is MATLAB — and its diligent makers at MathWorks.

“What makes MATLAB so much more effective than other methods of modeling is taking its core element of matrix algebra,” said Steve, “and getting it where it’s needed — in robo-advisor platforms, in scrutinized risk reporting processes — and helping people collaborate in models and data across and within organizations.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![15 of the World’s Most Exclusive Credit Cards ([updated_month_year]) 15 of the World’s Most Exclusive Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/exclusive-cards.png?width=158&height=120&fit=crop)

![21 Startling Credit Card Data Breach Statistics ([current_year]) 21 Startling Credit Card Data Breach Statistics ([current_year])](https://www.cardrates.com/images/uploads/2023/10/Credit-Card-Data-Breach-Statistics.jpg?width=158&height=120&fit=crop)