In a Nutshell: For those who love to travel — and do it often — it can pay off to invest in a quality hotel rewards card. Among hotel chains with a branded credit card, we found the Hilton Honors Card from American Express to be a real standout. Boasting a generous rewards structure that returns Points up to 7X for every dollar spent at hotels within the Hilton portfolio, a generous introductory Points offer, access to the latest mobile technology, and no annual fees, the Hilton Honors Card checks off all the boxes. When you combine a superior card with the accessibility that comes with the world’s third-largest hotel chain operating over 5,000 properties in more than 100 countries, you have a real winner. //

Traveling the world in style used to be an extravagance afforded solely to the elite. Staying at the finest resorts in the most beautiful locales around the globe was a privilege few even dreamed of obtaining. Fortunately, thanks to the proliferation of rewards credit cards that earn points on everyday spending, many of us can vacation like the wealthy without reaching the highest tax bracket.

However, not all rewards credit cards are the same, and some are just far better than others — particularly if your goal is to travel more. Here at CardRates, we’re a little obsessed with travel credit cards, and out of the many branded hotel rewards cards currently on the market, we found one with everything we look for in the category: the Hilton Honors Card by American Express.

With so many travel rewards competitors, you may wonder what set the Hilton Honors Card apart for us. Well, for starters, when you talk rewards cards, you have to begin the conversation with the rewards themselves.

The Hilton Worldwide chain has over 5,000 properties across more than 100 countries, and its portfolio includes popular brands like Waldorf Astoria, Conrad, and DoubleTree. For every dollar you spend on your Hilton Honors Card at one of these locations, you’ll earn 7X Points toward Hilton rewards. And that’s not to mention the 5X Points you earn per dollar spent at US restaurants, supermarkets, and gas stations, and the 3X Points you get on all other eligible purchases.

The Hilton Worldwide chain has over 5,000 properties across more than 100 countries, and its portfolio includes popular brands like Waldorf Astoria, Conrad, and DoubleTree. For every dollar you spend on your Hilton Honors Card at one of these locations, you’ll earn 7X Points toward Hilton rewards. And that’s not to mention the 5X Points you earn per dollar spent at US restaurants, supermarkets, and gas stations, and the 3X Points you get on all other eligible purchases.

While Hilton fans will undoubtedly rack up Points quickly for future trips through the generous 7X Points system, the card helps you jumpstart that process with a generous signup bonus, awarding new cardholders 50,000 Points after they make just $1,000 in purchases on the card within the first three months.

Combine this solid earnings system with redemption flexibility, zero annual fees, and access to a helpful mobile app, and the Hilton Honors Card from American Express has a lot to offer wanderlusters of all types.

“At Hilton Honors, we want to be the most customer-centric loyalty program around,” a Hilton spokesperson told us. “This means providing exceptional experiences at every turn, and ensuring our members get more out of their travel — more value, more flexibility, and more personalization.”

Amex and Hilton Combine Forces to Create a Superior Rewards Card

With a reputation for exceptional customer service and superior member perks, American Express is one of the most highly regarded card issuers in the world. Amex members receive a range of useful benefits, like car rental loss and damage insurance, travel accident insurance, entertainment discounts, and access to the 24/7 Amex Global Assist® Hotline. There’s even accidental phone damage coverage that’s included as part of your cardholder benefits if you purchased your phone using your Hilton Honors Amex card.

The combination of American Express member benefits with Hilton’s massive scale and dedication to quality service means that Hilton Honors cardholders can expect to get the most out of their rewards card.

“With instant benefits and new ways of earning and spending Points, the Hilton Honors Card from American Express provides members with the tools needed to make the most of any trip,” a Hilton spokesperson told us. “Cardholders can also redeem their Points for free nights and premium merchandise, as well as to make charitable contributions and gain access to unique events through the Hilton Honors auction platform and through Shop with Points on Amazon.com.”

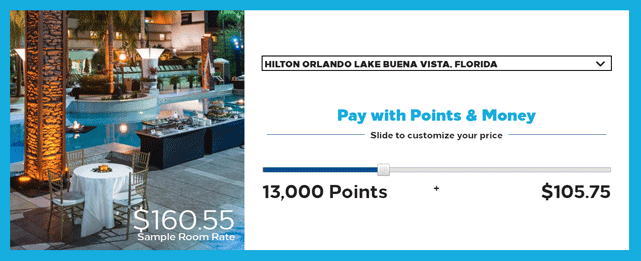

The Hilton Honors Points and Money Slider allows you to combine Points and money to choose your rate.

When you consider the high rate of rewards earned by cardholders, the Hilton Honors card is already providing a great value. But sometimes you just don’t have enough Points to redeem for your next getaway — so Hilton came up with a solution.

In the words of the Hilton spokesperson, “By using our Points and Money slider, introduced this year, members can now use nearly any combination of Points and money to book a standard or premium room. While the amount of Points required to redeem standard room rewards varies by hotel, room, booking, and stay date, the number of Points required for a reward stay starts as low as 5,000 Points per night.”

Unlock More Perks with the Hilton Honors Mobile App

The Hilton Honors mobile app is another way you can make the most of your Hilton Honors Card. Using the versatile app, you can unlock even more benefits and rewards, such as choosing the perfect room in your favorite hotel and exploring it virtually from wherever you are when you book. Hilton knows the last thing you want to do when you get to one of its hotels is wait in line to check in, so the app allows for digital check-in and checkout, with a receipt for charges available in the app.

With the Hilton Honors app, your smartphone or tablet is your key to extra benefits, but it’s also the key to your room. Using the Digital Key within the Hilton Honors app allows you to securely access your room without worrying about carrying around a plastic key card. Your device can even be used to order room service for a truly indulgent experience.

As an added incentive to go digital, when you book a stay with the app in 2017, you’ll get an extra 500 Points on top of what you would have already earned in Hilton Honors rewards.

If those perks aren’t enough reason to download the app, try these on for size: your app can hail Uber rides and provide recommendations for trending hotspots in the area you’re staying. You’ll also get notifications about special offers and events, as well as exclusive promotions only available to members.

Hilton Honors Card from American Express: The Perfect Travel Companion

When you combine access to Hilton’s extensive portfolio of properties around the world with an unprecedentedly generous rewards structure, you end up with what just might be the perfect plastic travel companion.

On top of getting 7X rewards for staying at a luxurious Hilton property, you’ll also be covered for car rental loss and damage insurance. This can be a huge benefit if you’re in an unfamiliar place, and the worst happens. And let’s not forget insurance for lost baggage and access to a global assistance hotline that’s available around the clock.

The value you get with any hotel or travel rewards card depends a lot on how much you tend to travel and spend. For those who devote much of their income to traveling, the Hilton Honors Card especially pays off. However, even for those who travel just once or twice a year, this is a card that still provides great benefits.

Because the Hilton Honors Amex Card has no annual fee, all of the Points you earn are a direct benefit. By spending the relatively reasonable $1,000 amount needed in the first three months to earn the 50,000 bonus Points, you can quickly reward yourself with a luxurious vacation. Earn additional Points by using your card throughout the year, and those bonus Points could add up to significant travel incentives that will have you globetrotting like never before.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Visa vs. Mastercard vs. Discover vs. Amex: Who Wins? ([updated_month_year]) Visa vs. Mastercard vs. Discover vs. Amex: Who Wins? ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/vs.png?width=158&height=120&fit=crop)

![Capital One Venture vs. Venture X: Which Wins? ([updated_month_year]) Capital One Venture vs. Venture X: Which Wins? ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Capital-One-Venture-vs-Venture-X-1.jpg?width=158&height=120&fit=crop)

![How to Get a Black Card – American Express® Requirements ([updated_month_year]) How to Get a Black Card – American Express® Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/03/How-to-Get-a-Black-Card-2--1.jpg?width=158&height=120&fit=crop)

![7 Best American Express Card Alternatives ([updated_month_year]) 7 Best American Express Card Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/amexalt.png?width=158&height=120&fit=crop)

![7 Best Hotel Rewards Credit Cards ([updated_month_year]) 7 Best Hotel Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/01/hotels.png?width=158&height=120&fit=crop)

![7 Best Credit Cards for Free Hotel Stays ([updated_month_year]) 7 Best Credit Cards for Free Hotel Stays ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-Free-Hotel-Stays-Feat.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt in American Households ([current_year]) Average Credit Card Debt in American Households ([current_year])](https://www.cardrates.com/images/uploads/2018/01/avgdebt.png?width=158&height=120&fit=crop)