Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Everyone knows that learning by doing is the way to make the lesson stick. But that maxim hasn’t filtered down to youth financial education, which seems frozen in the instructional dark ages of reading articles, watching videos, and answering multiple-choice questions. Stockpile changes that by inviting families to participate in an authentic investing journey, with kids building confidence by making real-world trades under the watchful eye of their parents. Stockpile prepares children to hit the ground running when it’s time to meet financial challenges independently.

Ever play poker with Monopoly money? Sure, it may be entertaining, but it’s much less stressful to bet a million in fake cash than to wager your life away.

The same is true with investing. You can play online games with pretend stocks and have loads of fun, but it’s a different ball game when real money’s on the line.

The problem in our increasingly financially illiterate society is that learning to invest competently and confidently is the key to a sound financial future. Like any other form of learning, it’s best to impart lessons as early as possible, even during childhood. Unfortunately, financial education in schools is a poor substitute for real-world experience.

That’s why more than 1 million parents and children have flocked to Stockpile in the past few years — because Stockpile allows families to learn and invest together using real money. When things go right, children experience the exhilaration of winning. But there’s no bailout when things go wrong, as they sometimes do in the investment world.

Fortunately, although Stockpile encourages families to allow their children to make independent investment decisions, parents must always approve transactions as account custodians. And because Stockpile enables fractional investments, families can start on the platform with as little as $1, in addition to the $4.95 per month membership fee.

That makes Stockpile an ideal learning laboratory capable of transforming children from passive participants in financial services into independent agents able to take charge of their futures as soon as it’s legally possible for them to do so, said Stockpile CEO Victor Wang.

“You don’t get good at basketball by reading about basketball — you’ve got to play,” Wang said. “Study after study shows that traditional classroom financial literacy programs with readings and tests have a negligible impact on financial behavior. The only way to change that is to have kids do things.”

A Learning Environment Where Children Initiate Trades

That’s precisely what they do on Stockpile. The platform requires membership to create and maintain investing accounts. At the end of a free one-month trial, parents pay a $4.95 monthly membership subscription fee. This gets them an individual brokerage account and up to five separate custodial accounts for children.

The individual brokerage account works like any other offered by similar platforms, and individuals without children can sign up and participate on Stockpile. But as custodians of their children’s accounts, parents must manage and approve any requested trade activity their children instigate. That said, children own the stocks they purchase, which is something Wang stresses for its real-world implications.

“There are custodial accounts where parents put in money, but kids don’t see or touch anything and might not even know the account exists,” Wang said. “But when you set up a custodial account on Stockpile, that account belongs to the child. The key thing is we want kids to make the decisions.”

That’s how they learn. Wang said one of the critical things about the experience is that it creates a conversation between parents and children. There must be understanding and appreciation on the part of the parent before the child can initiate a trade.

“Think about piano lessons — if parents are not engaged and motivated to keep their child going, it’s going to die out pretty fast,” Wang said. “Creating that engagement between parents and kids is super-duper critical.”

The environment the platform achieves reminds Wang of his father, who emigrated to the US from Korea with $40 in his pocket. From that humble start, he managed to teach values and raise financially independent children in America.

“We want everybody in America to have that,” Wang said. “The earlier you start, the better.”

Parents Manage Popular Investment Choices

Like many parents, Wang has the opinion that families naturally strive to better themselves from generation to generation. Wang didn’t start investing until he was 30. Stockpile’s mission is partly to encourage generational financial improvement by making early investing part of family tradition.

“It’s tough to get kids in the next generation to learn from your lessons,” Wang said. “The goal is to give the next generation a little bit more awareness of their options early on.”

After arranging accounts, parents and children gain an enhanced brokerage experience. Because new investors tend to gravitate toward the familiar, Stockpile goes the extra mile to provide access to the most popular investment products parents and children will likely respond to. Those include more than 4,000 stocks, American depositary receipts for investing in international firms, and lower-risk exchange-traded funds.

Among them are stalwarts like Google, Apple, and Tesla that will likely appeal to younger investors. The platform houses every stock on the Standard and Poor 500 index, and the team reviews every stock to ensure conformity to reasonable standards of risk and volatility.

Parents can request to add a stock, but products like penny stocks aren’t candidates for inclusion on the platform. Nor are leveraged products that rely on borrowed money.

Stockpile provides access to crypto investing through a partnership with Bakkt. Crypto, of course, is a somewhat controversial investment class, especially given the recent events surrounding the bankruptcy of the FTX exchange.

However, parental custodians always decide which opportunities to provide on Stockpile. The idea is to grant parents maximum authority over the experience they provide their children.

“We want to empower parents to be the heroes and instill in their kids their own personal values and ideals for how to manage money and invest,” Wang said.

Bridging Gaps and Building Money Independence

The result is decidedly unlike a poker game in that Stockpile aims for a mutual learning experience where families gain competency together. Interestingly, Stockpile research has found that children prefer to get their financial education from their parents rather than through social media, friends, or teachers.

Unfortunately, Stockpile also found that many parents hesitate to bring up money matters with their children.

“Amazingly, our research showed that parents would rather talk about death and religion than money,” Wang said. “People are still very uncomfortable talking about finances in our society.”

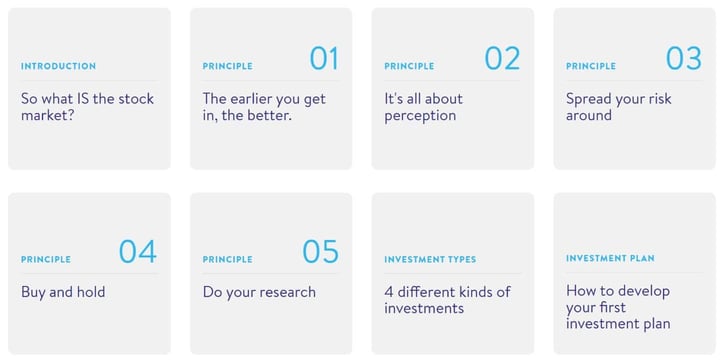

Stockpile fixes that by providing ample resources to get up and running with investing, including a beginner’s guide and a comprehensive advice and answer portal. This FAO portal introduces parent custodians to the platform, walks them through account setup, and explains linking bank accounts, transferring funds, trading, and dividends.

The platform even provides gift cards to enable parents, relatives, and friends to grant young people the opportunity to invest through Stockpile on birthdays or other special occasions.

Wang suggests some commonsense strategies for parents to interact with their kids most effectively regarding their new responsibilities on Stockpile. For example, Stockpile’s behavioral science research suggests that the best time to converse with children about money is during or after dinner rather than before or after school.

The process can be highly enlightening and inspiring. Wang said his two boys participate on the platform with maximum authority over trades.

“You want to make sure you’re creating an opportunity to have an active dialog,” Wang said. “The rule in our house is we never say no; we just ask why.”

One boy decided to invest in Nike during the pandemic because his teachers complained about putting on weight at home, and he theorized a demand for athletic gear once things returned to normal. The other recently decided to hold on to his Tesla shares during a recent period when the stock was declining despite all his friends on the platform selling theirs.

“There’s nothing I can have them read that’s going to better the experience of deciding what to buy or hold on to,” Wang said. “Them being in charge gives them agency and responsibility.”

![Mission Lane Credit Card Preapproval ([updated_month_year]) Mission Lane Credit Card Preapproval ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Mission-Lane-Credit-Card-Preapproval.jpg?width=158&height=120&fit=crop)

![15 of the World’s Most Exclusive Credit Cards ([updated_month_year]) 15 of the World’s Most Exclusive Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/exclusive-cards.png?width=158&height=120&fit=crop)

![9 Best Credit Cards For Wealth Management ([updated_month_year]) 9 Best Credit Cards For Wealth Management ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Best-Credit-Cards-For-Wealth-Management.jpg?width=158&height=120&fit=crop)