Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Every investment comes with risk, but the complexities of investment decisions deter many from reaping the potential rewards. Others have an affinity for investing but wish to protect a portion of their assets. Save fits both groups by innovating in the FDIC-protected world of deposit accounts. Instead of paying interest on client savings accounts, Save makes portfolio investments on their behalf. FDIC insurance protects the principal while the investments yield significantly higher potential returns than traditional savings accounts.

When was the last time you thought about your savings account? For most people, savings just sit there, earning what they earn in interest. The most ambitious you can get is parking some of your savings in a CD and earning a fraction or two more.

Maintaining an emergency savings fund that pays you a little in return for easy access is wise. But putting too much in savings leaves money on the table.

Investing, on the other hand, promises greater potential returns but poses more risk. Many save for retirement through company-sponsored investment accounts and may put even more aside in individual retirement accounts.

You can do much more, but going it alone in the increasingly complex retail investing world puts surplus funds at risk, and hiring a fiduciary advisor depletes them.

That’s what makes Save such an exciting alternative. Save is for those who feel they should leverage their savings but prefer not to risk their principal.

Save’s Market Savings program carries a one-year term. Users deposit at least $1,000 in an FDIC-insured deposit account. Save’s experienced investing team then invests on your behalf in a portfolio constructed through asset scoring, risk-based weighting, and volatility control.

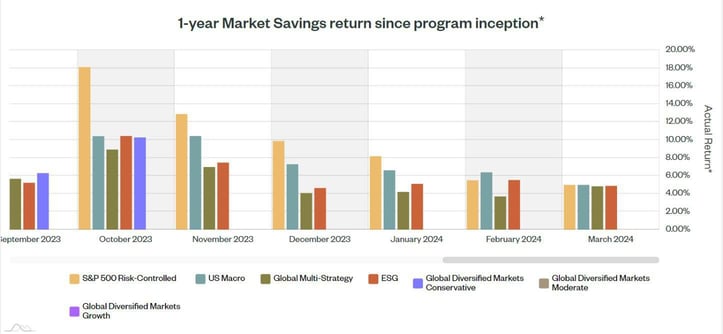

When this article went to press in spring 2024, the average return of all Market Savings customer accounts was 8.17% — significantly more than a high-yield savings product could generate.

“Customers are looking for better ways of getting yield, but they don’t necessarily want to take more risk by entering the equity markets,” said Save Founder and CEO Michael Nelskyla. “Save creates a win-win by generating deposits for banks and higher potential returns for customers.”

A New Combination of Safety and Growth Potential

Most banking customers today don’t realize there was a time in financial history when a savings account was a reasonable investment vehicle. But returns from traditional savings accounts have generally not kept up with inflation for the past 30 years or more.

Macroeconomic and structural factors, increased regulation, and higher banking costs have taken a toll on savings accounts. Yet banks need deposits to invest in economic development.

Save’s team combines experience in insurance, banking, investment banking, fund management, and investment management. Save is an easy-to-use platform that helps mainstream consumers meet their financial goals.

Cash savers and conservative investors comprise Save’s core audience. They’re similar in that they’re both conservative. Both groups find what they’re looking for in a Save Market Savings program but use Save for different purposes.

Savers seek the highest yield for their cash but prefer staying within the FDIC framework. They’re looking for inflation-beating ways to allocate their funds. Save helps by maintaining FDIC insurance to preserve capital from risk while offering more variance in returns.

“They look at us and say, well, this is interesting because if my job is to optimize the yield on my cash, then surely this is a good avenue,” Nelskyla said.

The investor portion of Save’s audience has a fair amount of experience but tends to stick to the conservative end of things and avoid more adventurous vehicles. They may be retirees with an investment advisor and a conservative portfolio or bond holdings.

“That audience looks at our value proposition from the opposite perspective,” Nelskyla said. “They say, now I can get investment exposure, but my capital is safe, so I don’t need to worry about drawdowns.”

Investment Portfolios Fit Multiple Risk Profiles

Save gives tools and means to those two audiences so they can use the platform effectively for their initial investments while not losing money. Save’s investment portfolios offer various risk levels and potential returns based on Save’s customer assessment.

Onboarding combines typical bank strictures with an SEC-advisory component for regulatory purposes. Save is an SEC-regulated advisor, which means it becomes the user’s discretionary advisor with an investment mandate.

Users go through the same process they would go through with a robo advisor or a bank, submitting standard personal information for account registration. The platform then asks critical questions about the user’s investor-risk profile.

“We try to ensure you are not among those requiring an account that gives a guaranteed return because then we know this may not be for you,” Nelskyla said. “That’s a vital separation we do in the onboarding process.”

Save then allocates an investment portfolio based on the user’s investor-risk profile, although the user may override that, if they choose to. Portfolios include the Save Global Multi-Strategy Portfolio, which leverages how financial markets respond to themes and patterns.

The Save US Macro Portfolio focuses on US equities, bond markets, and commodities. The S&P 500 Risk-Controlled Portfolio seeks to maintain stable volatility. The Save ESG Portfolio utilizes environmental, social and governance-focused ETFs where possible.

“The user may tell us our recommendation isn’t what they’re looking for,” Nelskyla said. “Those who prefer the ESG for portfolio, for example, prioritize impact investing and personal preference, and in those cases, we allocate accordingly.”

Advanced Tools to Meet Financial Goals

Save pays rewards for customer referrals and contributes resources to global reforestation. It’s yet more innovation in a market dominated by status-quo savings accounts. Nelskyla said Save innovates in ways that meet and exceed customer expectations elsewhere in financial services.

For example, new investment assets such as crypto have disrupted investing, making it more complex and challenging. Fractionalized access offers cheaper execution when buying equities.

Nelskyla said today’s investment marketplace offers 250,000+ global assets. Mastering the market is challenging for everyone, not just mainstream consumers with little investing experience.

But that innovation has mainly happened outside of the deposit world, Nelskyla said.

“When you look at the playing field for deposits, it’s probably fair to say that nothing of note has happened, we could argue, for 100 years,” he said.

That’s the bigger vision Save taps into — it is building a more meaningful, potentially more lucrative deposit account.

As of spring 2024, Fed rates are coming down, which means equities are likely to rally. Nelskyla said that the current market is the best time to open a Save Market Savings program because rates are relatively high. Investors who come in at this point are protected and positioned to participate in the potential equity rally that may ensue.

It’s also important to note that Save helps banks not just by generating deposits but by generating innovation.

“It’s good timing now,” Nelskyla said. “The biggest issue is you see a lot of innovation everywhere but bank accounts, and in some sense, we’re performing the innovator’s role, servicing and working with banks to help them introduce these accounts.”

![When To Request a Higher Credit Card Limit ([updated_month_year]) When To Request a Higher Credit Card Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/02/when-to-request-a-higher-credit-card-limit.jpg?width=158&height=120&fit=crop)

![First Savings Credit Card: Login, Application & 5 Similar Cards ([updated_month_year]) First Savings Credit Card: Login, Application & 5 Similar Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/02/first-savings-credit-card.jpg?width=158&height=120&fit=crop)