In a Nutshell: Smart cards may soon become the easiest way to pay, so we took a close look to see what Plastc will be offering when it arrives in April. What we found delighted us—hands down, the key to Plastc is superior security. With multiple proactive security features, advanced technology, and durable design all outclassing the competition, Plastc offers consumers and merchants alike confidence that the best time to get on board with Plastc is now.//

Update: Plastc, Inc. is exploring options to file Chapter 7 Bankruptcy and will cease operations on April 20, 2017.

As the smart card market begins to take off, keep an eye on Plastc—it may very well skyrocket. Smart cards keep all your payment card information in one card-sized device, and Plastc is perhaps the most sophisticated of the options. Equipped with current—and even future—payment technologies promising universal retailer acceptance, incredibly intelligent security features, and the capacity to store all the information of up to twenty cards at a time (including not just credit and debit cards, but gift, loyalty, membership, and key cards as well), Plastc Card and its accompanying app, Plastc Wallet, are poised to fly by the competition.

Plastc Co-Founder and CEO, Ryan Marquis

We spoke with Plastc co-founder and CEO, Ryan Marquis, to find out what makes this full-featured smart card a smart choice for credit card holders. In a (super important) word: Security.

“Security, credibility, and semantic values of a traditional card are really the key things that we spent a lot of time developing,” said Marquis, denoting the innovative team’s forethought to consumer concerns. “There are a lot of security features built into Plastc that make it more secure than a traditional card.”

Plastc’s Card-Level Security Features Are Second to None

New payment technologies like smart cards are enticing for consumers who seek streamlined convenience, but the very real threat of credit card fraud may feel too risky. Plastc assures users, “When you pay with Plastc, you pay with confidence.”

While competitors like Swyp, Stratos, and Coin range in appearance from vaguely resembling a credit card to looking like an unidentifiable gadget, consumers and retailers alike will appreciate that Plastc offers the confidence of familiarity. Plastc Card bears what Marquis refers to as the semantic values of a traditional card: a 16-digit card number, an expiration date, the user’s name, the credit card type logo, and the issuing bank’s logo.

Plastc Card offers consumers and retailers confidence.

“Those are values that other competitors in our space, unfortunately, are not displaying,” Marquis said. “We really put a lot of time into making sure that we could display all the values that a card needs to have, not only to give the consumers confidence, but also to give the retailers that are accepting the card confidence that it’s not a cloning device or a card that’s duplicated under card transactions.”

Card Access Made Safe—and Easy

Card access is the next step in Plastc’s multi-faceted security arsenal, but the Plastc team was careful not to make accessing your own card a hassle. If your Plastc Card is in proximity to your smartphone, the built-in Bluetooth will allow the two devices to communicate so that the card will be unlocked and ready for you to use.

If your Plastc Card is out of proximity to your phone, don’t worry—the phone isn’t required to use the card. Instead, the card will display a PIN-code lock on its E-ink touchscreen; once you enter your 4-digit PIN, you can use your Plastc Card the way you would any other card.

Lock Mode Keeps Your Card Safe When It’s Out of Sight

“A lot of cards actually get stolen in merchant locations—where you sit down at a restaurant, you put your card in the little folder, and they walk away. You have no idea what they’re doing with your card when they’re away from you. For online theft, it’s very easy—as long as you have the 16-digit card number, the expiration date, and the CVV number, you can pretty much make any transaction you would like on the web,” Marquis said.

Plastc Card’s Lock Screen keeps your information hidden when the card is out of your sight.

To make Plastc Card impervious to this common threat, the technologists at Plastc built in a security feature called Lock Mode. Once you select which credit card you want to pay with, you can hit Lock Mode before handing it over, and it will mask 12 digits on the card, revealing only the last four digits of the card number and the expiration date; the CVV number will not appear at all. When Plastc is out of your sight, you’ll still have peace of mind.

Plastc’s Photo ID Provides Added Verification

Not only can Plastc Card hide your information when you need it to, it can also change its display to show every detail that appears on the back of a traditional card, providing merchants the information they need to determine that the card belongs to you.

Merchants can see all pertinent details on the card as soon as they swipe it through their POS machine.

When a merchant swipes your Plastc Card through the POS machine, the display changes to show not only the usual back values—CVV number, the bank’s 800-number for support, and your signature—but also an image of you that you can upload for added authentication. This additional security feature means that merchants don’t have to rely on just a signature—they can actually see the face of the person who loaded the credit card onto the device.

Plastc Also Includes Superior Security Features for its Users

Besides making Plastc Card itself the most secure smart card on the market, the Plastc team also took measures to ensure that the onboarding of users was airtight. In other words, unless they’re your cards, they aren’t going on your Plastc Card.

Marquis told us, “There are other competitors out there where it’s literally a cloning device because the onboarding of the user is not verified by a third-party agency, and the ability to add credit cards of other users is very easy. And we’re taking that very seriously as far as verifying a user.”

“On our platform, unless the user is verified, they will not be able to even add a credit or debit card to their account—they will only be able to use the gift card or loyalty card section of our application. Verification of that user is critical to our platform,” he said.

Plastc requires multiple identity checks before setting up an account to keep consumers secure.

In order to get set up with a Plastc account, you’ll have your identity verified through third-party checks. The last four digits of your social security number, or your driver’s license and passport, have to match those of the user who created the Plastc account.

Onboarding card data is similarly secure. All new card data entered into Plastc must match the verified information of the Plastc account.

Plastc will verify users against the OFAC (Office of Foreign Assets Control) database and the KYC (Know Your Customer) database, ensuring that users are who they say they are. Then, of course, all the confirmed data has to match the card data that a user is importing.

“As far as security goes,” Marquis said, “I think that’s a really key thing that we’re building in that’s different than other people in this space.”

The Plastc Wallet App Goes Well Beyond Just Holding Cards

The Plastc Wallet app goes well beyond just storing and managing your cards.

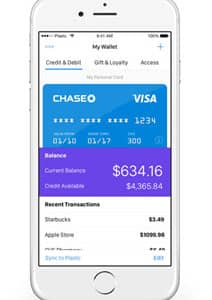

An essential component of Plastc is Plastc Wallet, the free app that goes well beyond just storing and managing an unlimited number of cards.

“One of the really exciting features is a complete PFM solution—a personal finance management solution,” Marquis said, likening it to Mint, which makes it easy for consumers to manage their bank accounts, credit accounts, and transactions in one place.

Plastc Wallet’s PFM tool allows users to add their banking credentials so that they can view all their balances and transactional histories in the single app, obviating the need for multiple apps from various institutions.

Plastc Wallet is compatible with Android and iOS devices, supports multiple languages, and, as with all things Plastc, contains multiple security layers. Featuring proactive (as opposed to reactive) security, Plastc Wallet requires both your Plastc PIN and your facial authentication before accessing the app.

Plastc Offers Unbeatable Value

With several smart cards vying to get into consumers’ wallets, most introductory prices are hovering around a competitive $99; Plastc is unabashedly the priciest of the pack at $155. You get what you pay for, and when it comes to Plastc, you’re paying for superior value, from design to functionality to security.

“We are the most expensive one out there, and we’re fine being the most expensive product,” Marquis said. “We offer more payment technologies than anyone else, and the experience, we feel, is much better than anyone else that has come out in this space yet.”

Plastc Offers More Payment Technologies

Plastc features four payment technologies, not only guaranteeing universal merchant acceptance, but also ensuring consumers won’t have to buy another card when a new technology emerges, as they’d likely have to do with other smart cards.

- Barcode

- Rewriteable magnetic stripe

- Rewriteable EMV Chip and Pin—now required of U.S. retailers

- Rewriteable NFC wireless payments—contactless technology expected to eclipse others in coming years

Plastc’s True Touchscreen Tops the Rest

Unique to Plastc Card is the E-ink touchscreen display and the technology built around it. Measuring 3.1 inches with 312 x 74 pixels, the Plastc touchscreen is a flexible bi-stable display with a touch sensor. This advanced mechanism increases the cost of Plastc Card’s production, but the payoffs to consumers are notable. “We’re the only card on the market with a true touchscreen and a screen that is that large,” Marquis said.

Wireless Charging Gives Plastc Longevity

Plastc also stands out from other smart cards with its wireless charging. When competitor cards run out of battery power, consumers will have to purchase a new card; not so with Plastc.

Plastc’s value is increased by unique features such as wireless charging.

Said Marquis, “Ours is coming with a Qi wireless charging mat, and consumers will be able to recharge their device wirelessly—it’s not going to force consumers to go buy an additional card.”

Plastc Card Quality is Built to Last

How well a smart card holds up is a major consumer concern—if it’s the only card in your wallet, you need to know it can take plenty of regular use. The team at Plastc shares that concern.

“We’ve seen the quality of other competitors’ cards in the marketplace, and after a few weeks of use, they look like they’ve been through a washing machine a few times,” Marquis said. “I’m very confident to say we’re using one of the best manufacturers in the world for cards, and our quality as far as the thickness and the coating that we’re using are going to be superior to anything else in the marketplace.”

The Best Time for a Plastc Subscription is Now

Plastc is accepting pre-orders right now, and they’re offering a solid deal: $155 includes a lifetime subscription.

“Anyone that’s pre-ordered the card will never have to pay that $50 a year—they’re going to be grandfathered in for a lifetime subscription,” Marquis reiterated.

Plastc is accepting pre-orders through April 29, 2016.

Full details of what features the subscription will include have not been released yet, but Marquis said that the PFM solution will be one of them; an insurance policy similar to AppleCare may also be included to give consumers peace of mind should they lose or break their Plastc Card.

But one thing is evident already—for those heading into the future of payment technology with Plastc Card, credit card security will be a concern of the past.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best EMV Chip Credit Cards with Security ([updated_month_year]) 8 Best EMV Chip Credit Cards with Security ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/emv-card-art.jpg?width=158&height=120&fit=crop)

![8 Credit Cards With No Security Deposit ([updated_month_year]) 8 Credit Cards With No Security Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/10/Credit-Cards-With-No-Security-Deposit-Required.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)