Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

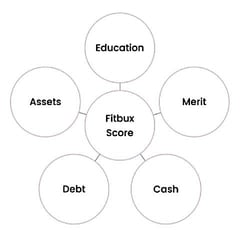

In a Nutshell: Young professionals planning their financial futures face complex challenges, including creating a plan that takes into account their unique history, present status, personality, and goals. Putting the puzzle pieces together through an expensive family office — a privately held company that handles investment management and wealth management for a wealthy family — is possible, but that alternative is unrealistic for most people. FitBUX makes personalized financial planning accessible through a sophisticated algorithm that distills budgets, assets, debt, characteristics, and behavior into a single number: the FitBUX Score. With live coaching on demand, FitBUX tracks thousands of data points to create a basis for building and comparing strategies and maximizing your financial future.

As Joseph Reinke transitioned from a sports obsession in his youth to a financial career, he wasn’t particularly impressed with the state of the financial services industry. He learned how disconnected various financial services were from each other and how difficult it was for the public to understand their financial status and prospects.

The wealthiest individuals had the resources to create family offices that handled their investment and wealth management. But most young professionals interested in building a nest egg struggled to balance information and viewpoints from different providers that didn’t understand each other, much less how to help their clients reach a unified view of their financial status and achieve their goals.

He met with an alarming number of folks approaching retirement age who had been paying financial planners for decades yet were nowhere near able to quit working. It turned out that the 30-page PDFs produced by conventional financial planners weren’t very effective at converting recommendations into actions.

Fortunately, Reinke grew up in Silicon Valley with a tech obsession rivaling his love of sports. He began experimenting with algorithms to tie financial services to behavioral and psychological data to produce a single data point to help people understand their current status and the implications of any financial actions.

The result is FitBUX. Through a single data point known as the FitBUX Score, young professionals can understand where they are financially and what they need to do to get where they want to go. Coupled with live financial coaching, FitBUX helps people match their unique status and needs to an effective action plan.

“You build a profile and schedule a coaching session,” Reinke said. “What typically takes a financial planner 40 hours a year to do, we can do far more affordably in less than 30 minutes.”

Profiles Capture Behavioral Components

Because the FitBUX Score is the crux of the approach, getting up and running with FitBUX naturally requires as much dedication and self-awareness as the user can muster.

Before creating a profile on FitBUX, users should be ready to submit educational, background, and current financial information to the platform. In addition to taking measurables such as financial assets and debt into account, FitBUX incorporates behavioral analytics gleaned from Reinke’s years of research and the user’s human capital: the education, skills, experiences, and behavior that make a person who they are.

The idea is to arrive at personalized, actionable recommendations versus by-the-book strategies designed to apply to everyone. Generic recommendations usually aren’t practical because they aren’t relatable to a person’s life history and current circumstances.

“We ask users if they run marathons or played sports in college,” Reinke said. “Human capital data helps us predict what the person is actually going to do in a financial plan.”

The FitBUX team intends to automate some of the manual data entry required in the platform’s current iteration. After creating a profile, FitBUX directs the user to the program’s other highlight: consulting with a dedicated financial professional for one-on-one financial coaching.

FitBUX coaches help users complete their profile and introduce them to the platform’s dashboard interface. Ongoing free coaching is always available.

There’s no call center associated with FitBIX, so users consult with the same coach they started with. Coaching insights help users become expertly prepared to leverage FitBUX’s many features to the best advantage.

“Our surveys show that when it comes to making major financial decisions, even the younger demographic we mainly appeal to still wants to have some type of human touch they can trust,” Reinke said. “We offer a blended experience depending on changing life events and goals.”

Betterment Partnership Enables Investment Management

Because investment management is hugely significant in financial planning, FitBUX partners with the leading digital investment, retirement, and cash management provider Betterment to integrate it into the platform.

An innovation built in response to user demand, FitBUX’s Hybrid Investment Robo-Advisor uses Betterment’s account opening and compliance technology. Users deploy the technology to invest their IRAs, 401k/403b rollovers, taxable accounts, SEP IRAs, and other investment vehicles.

The cost-efficient partnership enables FitBUX users to customize their investments based on risk tolerance and automatically update them in response to changing life events. Always-on access to a dedicated FitBUX coach ensures users make moves with confidence.

“We don’t use Betterment’s portfolios — I design all of our portfolios,” Reinke said. “But it’s fantastic — users can open an account in less than 2 minutes.”

FitBUX verifies account information within 24 business hours. Users then receive a confirmation email from Betterment confirming the new account is ready for action.

The result is a personalized investment strategy that holistically considers human capital, current investments, cash flow, debt, and behavior to produce unique insights into the level of risk users currently prefer and what they may tolerate in the future.

The FitBUX Score quantifies that risk, with profile updates inducing corresponding score changes. In addition to efficiently onboarding new accounts, Betterment handles ongoing maintenance such as rebalancing.

FitBUX’s Betterment partnership ensures minimal costs associated with integrating investing into the platform. While most companies charge at least 1% of accounts under management, FitBUX’s decision to partner with Betterment on investments means it charges only 0.5% — less than half the going rate.

“It’s a perfect partnership for a company like us that wants users to be able to open up accounts quickly and have somewhere to go,” Reinke said.

Save Money, Reduce Uncertainty, and Reach Your Goals

Additional integrations, including direct banking partnerships, are on the horizon as potential enhancements. FitBUX continually upgrades the user experience through interface enhancements, with UI/UX improvements, including data-entry automation, on the docket for the summer or fall of 2024.

FitBUX doesn’t forget user categories such as student loan recipients, which was an original focus. The platform includes a student loan repayment checklist, a planner, a help center, and refinance technology and services. Reinke’s concern for students overburdened with loans was a prime motivator in creating FitBUX.

“That’s the number one problem young consumers face right now,” Reinke said. “We help people ensure they’re doing everything right and work with nine refinance partners to help them choose what type of student loan repayment plan they should go on.”

The FitBUX team also optimizes the platform to work with homebuyers and those seeking credit card consolidation opportunities.

Users may consult FitBIX coaches and access approved lending partners to obtain a mortgage. Calculators and optimization technology help potential homeowners determine how much they can afford.

FitBUX draws on about a dozen credit consolidation providers to help users find the right fit. Again, tools and technology mesh with the human element to put financially struggling users in the best position to take positive steps forward.

Although young professionals are the platform’s target audience, it doesn’t exclude college students from that description. Many college students embark on life after graduation already saddled with debilitating student loans and credit card debt.

Meanwhile, Reinke and FitBUX encourage a growing user community to exchange tips and tricks for success. Reinke, an author of more than 200 articles, hosts a podcast. FitBUX manages a blog and YouTube channel and produced a Financial Freedom webinar. Users gather in industry-specific communities and participate in student loan and financial planning workshops. Reinke and the FitBUX team help users achieve their goals so they can devote more of their lives to living.

“Money is such a big stressor in people’s lives,” Reinke said. “If you focus on one thing at a time in the short run instead of trying to do five things at once, you will simplify your life.”

![5 Wise Ways to Use Credit When Planning a Wedding ([updated_month_year]) 5 Wise Ways to Use Credit When Planning a Wedding ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/wise-ways-to-use-credit-when-planning-a-wedding-feat.jpg?width=158&height=120&fit=crop)