In a Nutshell: Between Credit Talk and its General Lounge forum offerings, Creditnet.com has been a conduit for financial communication between individuals with credit concerns since 1995. With peak membership following the financial crisis in the mid-to-late-2000s, Creditnet.com’s forum has seen nearly 500,000 posts to about 70,000 threads. People turn to the forums for help with uncomfortable financial topics they may be too embarrassed to discuss with friends or family. //

The financial crisis following the burst of the 2007 housing bubble forced nearly 4 million people into foreclosure. Leading up to this market collapse, loosened lending standards allowed homeowners to borrow against the inflating value of their home to pay off other debts or increase their discretionary spending.

By 2008, people who didn’t usually have any problem paying their bills on time or managing their money were drowning in what seemed to be insurmountable debt — and their typically healthy credit scores took a turn for the worse.

The forum on Creditnet.com has been a useful resource on the web since 1995, but the amount of visitors and questions in the forum spiked around the time people were thrust into the worst financial experience of their life — the aftermath of this crisis.

“All of a sudden people who had never had problems with credit before were dealing with foreclosures, short sales, car repossessions,” said Joshua Heckathorn, an expert author and moderator for Creditnet.com’s blog and forum. “Everyone was having problems with their finances.”

To date, the forum has answered thousands of pages of questions with hundreds of replies and is still one of the most popular credit forums on the internet.

Creditnet.com Forum Offers Access to Relatable Peer Advice

While the popularity of the forum experienced an extreme uptick in use during the global recession from 2008 to 2012, it has always aimed to provide a safe space for people to openly ask difficult financial questions.

Joshua Heckathorn is an expert author and moderator for the forums on Creditnet.com.

“Most of the people answering questions on the forum have been helped by the forum in the past, so they’re now giving back to the community we’ve built there,” explained Joshua.

There are about 27,000 registered members that participate in the community forum, from “Newbie” account holders to “Senior Members,” and experts like Joshua.

Difficult subject matters, like credit issues and juggling debt, can be uncomfortable for most people to discuss, but the forum allows you to sign up as an anonymous member (although you do need to use a valid email address, no other personal information is required).

“People are really afraid to talk about the credit problems they’re having with family or friends,” said Joshua. “Everyone acts like everything is fine, but I always tell people that if they’re afraid to talk about it in person, there’s always safe places online, like our forum.”

Forums are Free to View for Members and Guests

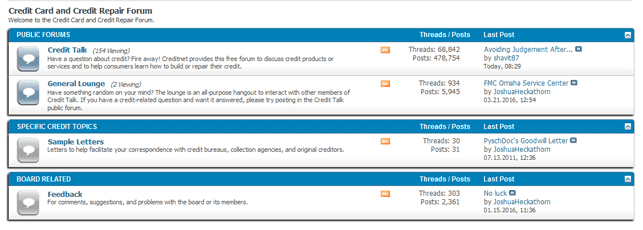

Currently, the Creditnet.com forum has two main groupings for posts — Credit Talk and the General Lounge. Credit Talk has the most activity out of the two forum topics, and hosts questions about credit products and services. The General Lounge section is for discussions that are not necessarily credit related.

Even without signing up, you can browse all the questions and answers within the forum, but to ask a question yourself you must become a free member. However, the membership does include other perks such as access to a library of sample letters to use for creditor correspondence and the ability to privately message other members if they also have messaging enabled.

As the original and longest-running online credit community, the Creditnet.com forum boasts nearly 70,000 individual threads housing almost 500,000 unique posts.

Both members and guests have full access to view all posts in the Creditnet.com forums.

Some of the most popular concerns and advice in the forum are now centered on credit cards, collections, fraud, and business finances.

Financial Resources on Creditnet.com — Forum, Blog, Guides

If you don’t see your question answered in the forum and you’re not sure who else to reach out to, the “Ask an Expert” function on Creditnet.com sends your question directly to experts like Joshua who will answer them within 24 hours.

Creditnet.com also offers additional educational resources like its CreditCents blog and digital learning center.

On CreditCents, visitors can become well versed on lofty financial topics in easy-to-read blog posts that often include helpful infographics for more visual learners. The blog tackles subjects such as how to provide a positive financial education for your children and answers questions like “Can Your Social Media Posts Affect Your Credit Score?” from experts in the field of finance.

Meanwhile the learning center has guides and Frequently Asked Questions segments on topics like credit cards, credit repair, and more. The learning center also has a Credit in the News section for breaking financial news topics.

However, the forum remains one of the most unique aspects of the site due to its high traffic and usage. In fact, a trend Joshua has seen emerging within the forum recently as the housing market progresses in making a recovery, is questions about mortgages and general market trends. If Creditnet.com sees more activity on this topic, Joshua said they will likely split it off to make a new forum thread in addition to Credit Talk and the General Lounge.

Creditnet.com is a Healthy Community for Learning

Joshua is proud of the help the forum has provided members and visitors over the years.

Whether answering a user’s question on student loan deferment and improper reporting or a question on what to expect during foreclosures and bankruptcies, Creditnet.com’s forum has been a go-to source for questions on all things credit and finance for more than 20 years.

Reading through the forums and the blog posts, visitors to Creditnet.com can expect to be treated respectfully and to have their questions answered within a timely manner.

With a committed following of helpful users on the forum, the community at Creditnet.com is open to assisting anyone who may find themselves in need of credit advice.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![“Best Credit Card for Me” Quiz: 3 Simple Questions ([updated_month_year]) “Best Credit Card for Me” Quiz: 3 Simple Questions ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/quiz.png?width=158&height=120&fit=crop)