Is your credit card compromised? When bad things happen to your credit card, you must leap into action in order to contain the fallout. Immediate actions can limit the harm and save you time repairing the damage.

Here are the top three tips to follow when your credit card becomes compromised:

- Have the card deactivated. Note: Remember to destroy your old one (if it’s not lost).

- Check your credit reports and scores. You can do that at TransUnion cheaply.

- Update your payment info for any recurring automatic withdrawals.

Doing these three things will stop additional fraudulent charges, protect your credit and make sure you don’t miss your next automatic payment. Below we explain in depth how to accomplish each step and why each one is important.

Call the Issuer, Check Credit Reports, Update Automatic Payment Info

Don’t worry, all is not lost — taking the time to complete these three actions will ensure your finances will be just fine.

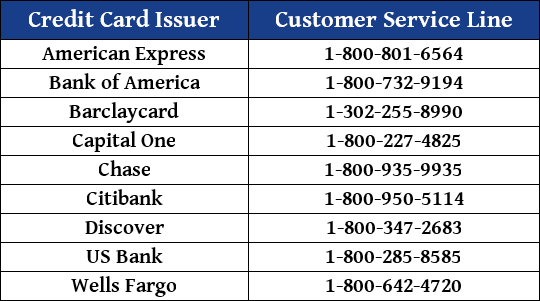

1. Call the Issuer, Have a New Card Issued & Destroy the Old One

The issuer will immediately deactivate the card so no one can use it anymore. You are then not liable for any further use of the card. Your maximum liability is $50 if you report the problem within two business days of learning about it or $500 if you wait up to 60 days. After that, you are responsible for all losses.

The issuer will verify with you all of the latest charges on the card so you won’t have to pay for them. If appropriate, tell your spouse to not use a copy of the card until it’s replaced. Follow up the phone call with an email to the issuer specifying all of the information.

What to Do If You’ve Lost Multiple Cards

If you lost your wallet or purse containing a dozen credit cards, your task is that much harder. You should always keep handy records of all your credit card numbers and the issuers’ phone numbers.

Many card issuers and other firms offer a service to handle the loss of one or more credit cards on your behalf. If you have a habit of losing things, this may be a good option.

In any event, the issuer will send you a new card right away — you might even ask for expedited shipment and receive it overnight. Also, check your homeowners or renters insurance to see if it covers loss from a compromised card.

2. Check Your Credit Reports and Scores

The longer the period between the credit card’s loss and your report of the incident, the more likely someone has used the card for some nefarious reason. The result could be bad information on your credit reports and lowered credit scores. Immediately contact AnnualCreditReport.com and order your three free credit reports.

Check the reports carefully and immediately inform the credit bureaus of any fraudulent transactions stemming from your compromised credit card. Keep in mind that your score is not included. To find your credit score, or if you’ve already claimed your free reports and are not eligible to receive new ones yet, check out these credit report and score providers.

Credit Monitoring Services Offer Added Protection

For added protection and to help prevent this in the future, you can sign up for credit monitoring services. Services such as these alert you whenever a change occurs to your credit report and score.

Try TransUnion Credit Monitoring for 7 days for $1

TransUnion has a good one that you can try for seven days for $1, and each month thereafter is $16.95. You get unlimited access to your TransUnion credit report and score with credit monitoring and up to $1,000,000 in identity theft insurance.

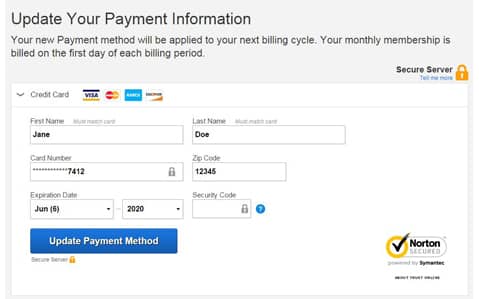

3. Update Payment Info for Any Automatic Withdrawals

Many consumers hook up their credit cards to automatically pay monthly bills, such as rent, utility bills, cable TV, subscriptions, insurance payments or the wine-of-the-month club.

For each of these, go into the merchant’s website and update the credit card with the new number, expiration date and security code. Also, update any software you use that downloads and maintains your credit card transactions.

Final Thoughts

As long as you take these three actions, there’s no need to panic. You should see the money refunded to your account, and a replacement card will arrive in the mail within a few days. Hopefully there isn’t any damage to your credit reports and scores, but if there is, you should have no issues straightening out the problem now that the Consumer Financial Protection Bureau closely monitors how the credit bureaus handle consumer requests.

Maintaining a healthy credit score takes effort. And even when you do everything right, problems can still arise due to fraud or mistakes. Thankfully, these steps can help to get things back in order should problems arise.

Photo credits: AnnualCreditReport.com, Netflix.com

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![Can I Use My Debit Card as a Credit Card? 3 Things to Know ([updated_month_year]) Can I Use My Debit Card as a Credit Card? 3 Things to Know ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/can-i-use-my-debit-card-as-a-credit-card--1.jpg?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)

![What Card is in the Jennifer Garner Credit Card Commercial? ([updated_month_year]) What Card is in the Jennifer Garner Credit Card Commercial? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/jennifer-2.jpg?width=158&height=120&fit=crop)

![7 Options to Get Cashback on a Credit Card ([updated_month_year]) 7 Options to Get Cashback on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Cashback-Credit-Card.png?width=158&height=120&fit=crop)