Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: The credit union movement took hold in America during the Great Depression with a cooperative service model dedicated to reinvesting profits. The movement’s mission of financial inclusion led to its global spread. The World Council of Credit Unions advocates for stronger credit unions everywhere with a strategy of digitalization and sustainability. Its work in front of international standard-setting bodies helps create a level yet flexible playing field for credit unions.

Unlike any other industry in financial services, credit unions are part of a cooperative movement dedicated to something broader than financial success. Missions of shared ownership, financial inclusion, and reinvesting profits in communities accompany credit unions wherever they spread globally.

Nearly 90,000 credit unions in 118 countries help improve the lives and communities of 393 million members.

The World Council of Credit Unions (WOCCU) is essential for ensuring all credit unions have the best possible opportunity to advance the credit union mission. WOCCU’s work in international advocacy, development, and education helps bank the unbanked, energize underserved communities, and foster a more equitable and sustainable global society.

Those goals are possible because credit unions are democratically controlled by their members to advance their common cause. Every member receives a vote regardless of their amount of savings or shares. The most critical success benchmark is membership growth, which means extending the benefits of lower-cost products and services to more people.

Financial inclusion is a natural outgrowth, said WOCCU’s President and CEO Elissa McCarter LaBorde. Community service is always a strategic component of the mission because membership is rooted in community, occupation, or place of work, and the best way to grow membership is to expand opportunity.

“Putting profits in the hands of members and using them to reinvest in better services and things that communities need are hallmarks of our mission of inclusion,” LaBorde said.

The problem is that this means different things at different times and places. A host of international standards-setting bodies, including the United Nations and various financial regulators, is responsible for creating common ground for all. WOCCU works for flexibility to ensure credit unions everywhere have their best chance at success.

The Value of the Cooperative Model

The credit union model was a mid-19th century German innovation built on ideals of self-help and social responsibility. Many arose in urban areas, but a model for smaller rural economies also took root.

That idea for small rural cooperatives emerged in the US in 1909 in New Hampshire, and The Federal Credit Union Act was enacted in 1934 as small-town farmers and merchants struggled with the economic and social dislocation of the Great Depression. The US Credit Union National Association founded WOCCU more than 50 years ago to represent and champion the credit union mission worldwide. Members in more than 70 countries contribute to WOCCU today.

Advocacy with international standard setters is WOCCU’s primary mission. Organizations affecting credit union operation include the Basel Committee, the primary global standard-setter for banks. Other groups address money laundering and terrorist financing, develop accounting and sustainability disclosure standards, recommend international financial policies, and enhance deposit insurance effectiveness.

There’s a danger that national regulators, which have limited discretion to deviate from international standards, may not consider credit unions. Most regulation is intended to address the needs of internationally active banks and tends not to acknowledge credit unions’ cooperative structure. But inappropriate regulation can undermine the very structure that makes credit unions inherently less risky and less in need of the rules in the first place.

“The cooperative model is a bit undervalued and underfunded because it runs counter to some of the abuses we see in banks,” LaBorde said. “Our job is to promote the visibility of our business model and ensure that regulators understand the value of credit unions as part of the financial system.”

It’s essential because the cooperative approach has the potential to grow communities more equitably, LaBorde argues.

“We drive solutions that address all barriers to financial inclusion in all underserved communities,” she said.

More Equitable and Resilient Communities

Digital inclusion is a global financial problem. Up to 1.2 billion people live and work outside the banking system. LaBorde estimates another 1.5 billion lack access to the full array of modern financial services.

Meanwhile, a third of Americans live under the poverty line, struggling to stretch their monthly paycheck for quality of life.

Credit unions are sustainable and can thrive in small towns, villages, and rural areas where banks typically don’t go because it’s not profitable for them. Ironically, even though most of the population lives outside major urban centers in many countries, governments tend to discourage megacities because of the migration and infrastructure problems they cause.

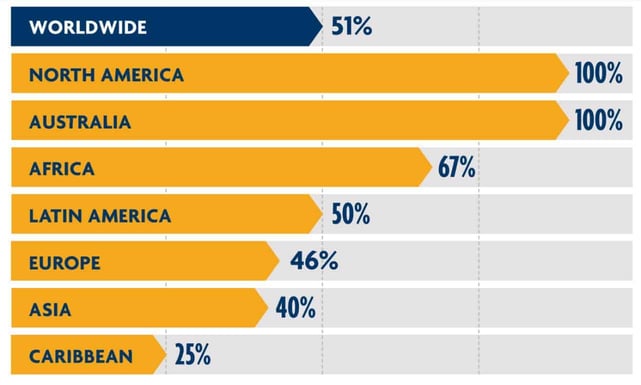

global disparities in payment system access.

That means a very high penetration rate for cooperatives in many developing countries. Kenya is an example. Thirty percent of Kenyans are members of cooperatives known as SACCOs — or Savings and Credit Cooperative Organizations. Ensuring that success can occur elsewhere is one of WOCCU’s core tenants.

“We look to expand financial inclusion and address underbanked populations by promoting regulatory frameworks that aren’t overly burdensome,” LaBorde said. “A lot of what we do is advocate for proportionality and regulations that don’t inhibit the ability of small banks and credit unions to serve members well.”

While banks tend to come and go in response to the vagaries of profitability and the economy, credit unions are in it for the long haul — particularly significant in nations with high economic flux.

“It’s an opportunity for credit unions to grow their business because banks will pull back in the middle of a crisis, whereas credit unions will lean in because it’s what their members need,” LaBorde said. “That’s one of the strongest arguments for us as an organization.”

Building a Sustainable Credit Union Movement

Today, for example, WOCCU supports Ukrainian credit unions that serve farmers tilling the land and addressing food insecurity issues in a time of war. Turkish cooperatives are responding to members in the aftermath of the earthquake. Wherever migration, refugee issues, and economic disruptions are a factor, credit unions can serve as long-term partners during a crisis and beyond as communities rebuild and grow.

“Part of that is an opportunity for us because credit unions are sustainable organizations that have always looked at social impact and environment as part of their mission,” LaBorde said.

WOCCU produces an annual statistical report to measure progress toward its goals and deepen its understanding of the opportunities and barriers cooperative financial institutions face worldwide. The 2021 version of the report found only about half of all credit union national systems have direct access to digital payments, including credit and debit cards.

That’s partly a regulatory issue, but it’s also a technology and access issue. And it’s a huge market opportunity for technology companies. WOCCU works with fintech partners and others to surface those opportunities and drive access.

There’s much for the US to learn. India, for example, has leapfrogged legacy systems through a universal payments interface with digital ID to address issues of equitable access to financial services on a massive scale.

Another significant issue is sustainability based on environmental, social, and governance (ESG) policy. WOCCU highlights credit unions in places like Australia, Canada, and Brazil that are way ahead of the US in developing products to address climate resilience at a household level.

“We’re the most advanced country with the highest levels of poverty and inequity, and that’s just not acceptable,” LaBorde said. “We feel responsible and passionate about the opportunity to correct some of the things we haven’t got right because there’s so much talent and money in this country to rethink how we offer financial services.”

![Global Entry vs. TSA PreCheck vs. CLEAR: Credit Card Benefit Comparison ([updated_month_year]) Global Entry vs. TSA PreCheck vs. CLEAR: Credit Card Benefit Comparison ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Global-Entry-vs.-TSA-PreCheck-vs.-Clear.jpg?width=158&height=120&fit=crop)

![15 of the World’s Most Exclusive Credit Cards ([updated_month_year]) 15 of the World’s Most Exclusive Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/exclusive-cards.png?width=158&height=120&fit=crop)