In a Nutshell: As our money goes digital so, too, must our budgets. Bringing the tried-and-true method of envelope budgeting into the modern age, Mvelopes helps users build financial awareness and take control of their money. Available online and mobile, the Mvelopes app lets you carry unlimited envelopes in your pocket, allowing you to keep track of your cash flow and see where every dollar belongs. The Mvelopes Learning Center houses hundreds of articles and videos on a variety of important topics, covering everything from paying down debt to planning for retirement. Or get one-on-one support with a personal financial trainer who will be both cheerleader and coach, helping you stick to your budget and deal with any obstacles that come along. //

Once upon a time, before the advent of digital money, every transaction you made involved the transfer of real, tangible currency. As such, making a purchase automatically required an awareness of exactly how much money you were spending — and exactly how much you had left in your wallet.

When expanded upon, the awareness inherent in a dwindling pocketbook can be turned into a very effective personal finance tool: envelope budgeting. A time-tested system, envelope budgeting requires you to assign to each of your expenses its own envelope, then physically portion your income into the envelopes such that all your obligations are met.

As you make purchases over the course of the month, you remove money from the specific envelope assigned to that expense. The constant emptying of funds creates a continual awareness of where you stand, encouraging you to consider each purchase and its impact on your overall budget. With envelope budgeting, areas where you overspend will quickly become clear, like when you realize your grocery envelope is almost empty but you have three weeks left in the month.

“Ultimately, envelope budgeting is so successful for consumers in the offline world because it’s about changing behaviors,” said Christopher Tracy, President of financial technology company, Mvelopes. “It’s about creating discipline for the consumer as they start making these spending decisions and thinking about how they’re going to use every dollar.”

Of course, in the modern swipe-and-go world, the concept of divvying your cash into a bunch of envelopes can seem downright archaic. That’s why the team at Mvelopes developed an online and mobile application designed to help consumers take advantage of envelope budgeting in the new era of digital money.

“Envelope budgeting is extremely effective — but it’s is also very different from how most consumers operate today,” said Christopher. “From our perspective, what we’ve done is really bring that concept into the 21st century and make it more accessible to today’s consumer. Think of that offline concept of a bunch of cash, paper envelopes, and creating those categories with a pen. We now do that with our Mvelopes application.”

Spend Less, Save More & Plan for Tomorrow with the Full-Featured Budgeting Application

Available online as well as for iOS and Android, the Mvelopes app has been used by around 500,000 consumers to take their envelope budgeting on the go. From one convenient app, users can build their budget, create and fill envelopes, and input and assign transactions as they happen, ensuring they always know where their money is — and where it needs to be.

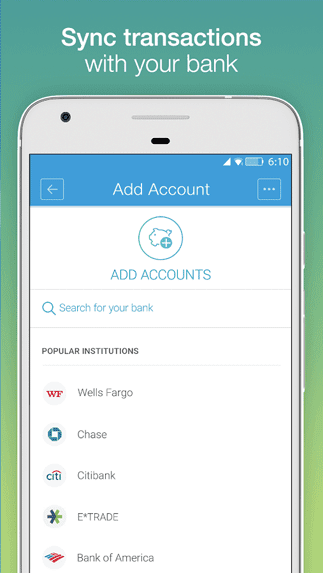

Add accounts to your Mvelopes app from over 15,000 financial institutions.

“The first thing the consumer is going to do is add their financial accounts. And that’s about showing them the big picture, which is important because you need to know where you stand to be able to see where you’re trying to go,” Christopher explained. “The good news is, with Mvelopes, adding your accounts is a really easy process.”

Once they download the app, users can simply select their financial institutions from the over 15,000 supported by Mvelopes. Consumers use their usual online banking information right through the app, then can select the exact accounts to include in their Mvelopes budget.

And you don’t have to worry about your money. All of the information handled by the Mvelopes is read-only, which means no one can move your money through the app, and the data is aggregated in-house to ensure seamless security.

“Security is a really big deal for consumers these days — and it’s an even bigger deal for us here at Mvelopes,” stressed Christopher. “We use, and are held to, the exact same security standards that the top banks, credit card firms, and investment firms use as well. And it’s very important to us that we meet — and exceed — those standards. We also have an additional layer of security at the app level, which requires the user to enter a four-digit pin or biometric fingerprint to gain access to the app.”

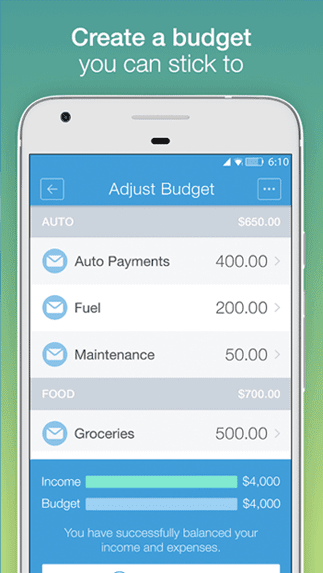

The Mvelopes app is envelope budgeting on-the-go.

After users have input all of their accounts, it’s time to bring out the envelopes and start doling out the dollars. At Mvelopes, this step is called giving your money a purpose, and the team considers it an important part of what makes envelope budgeting so successful.

“When you give your money a purpose, you are making sure that you’re thinking about every single dollar,” Christopher described. “You’re asking yourself, ‘What’s the purpose of that dollar? Where does it need to go to meet my goals?'”

As users portion their available funds into each envelope, the app displays the total amount in their envelopes as well as the remaining amount left to be distributed from the initial funds.

As part of the process, the app won’t allow users to move on from this stage until every last penny has an assigned purpose and an envelope to call home. Then, with a balanced budget in hand (or phone, as the case may be), it’s time for users to start taking action.

“In the offline world, we’d be taking the money for our purchases out of each specific envelope as we went. In the digital world, I’m going to assign transactions,” explained Christopher. “And to do that, I go to my inbox where my transactions are listed, and I assign specific transactions as needed. The general premise is, the transaction comes in, I get an alert, I assign that transaction, and then it’s taken from my envelope.”

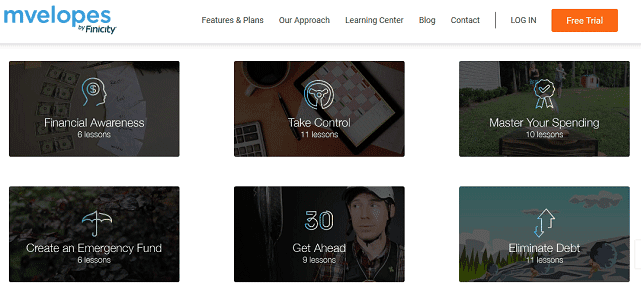

Expand Your Financial Knowledge with 1,000+ Articles & 125+ Videos in the Learning Center

While for some the simple process of maintaining constant awareness of their budget can be all that’s necessary to stay on top of it, others might need a little more help. To offer consumers important tips, advice, and explanations, Mvelopes put together its extensive Learning Center for its Plus and Complete members, which features hundreds of articles and guides covering Mvelopes’ nine-step process.

“Our process starts with creating awareness,” said Christopher. “After that, we want to get some emergency savings in place. Then we attack the debt, learn how to live within our means, and, finally, tackle the long-term solutions. That step includes really looking at what their goals are — whether it’s retirement, saving for education, whatever the case may be — and how they plan to reach them.”

The Mvelopes Learning Center has over 125 videos and 1,000+ articles on a variety of important personal finance topics.

In addition to a wealth of content built around the nine steps, Mvelopes’ Learning Center also has content created to address specific questions and categories. Consumers can find information on particular topics of interest, such as saving for a home, budgeting as a couple, or even how to save money while dating. Mvelopes’ content also comes in a variety of formats, including videos and eBooks — all available from online and within the mobile app.

“We have more than six hours of video instruction, and we just published our 130th video,” Christopher said. “There are short videos, each about three to five minutes, filled with great information to help consumers learn more about specific topics they’re interested in exploring. We also have 12 published eBooks that we share.”

Keep Your Budget on Track with Training (and Cheerleading) from Your Personal Financial Coach

Those consumers who need a little extra encouragement or guidance — or even some (constructive) tough love — to help them stay on track can take advantage of one of Mvelopes’ most distinguishing features: personal financial coaching. Available quarterly to Plus members and monthly for Complete members, coaching pairs each consumer with certified Mvelopes financial trainers for one-on-one development.

“Coaching is very personalized because the needs of each person are different. Some people will say, ‘What I really need is a cheerleader, someone to help with motivation,'” described Christopher. “Other people like the accountability that comes with knowing they’re meeting with their coach later in the month and really wanting to show the progress they’ve made in that time.”

The coaching process begins with an in-depth assessment of your current financial state, and then looks at your future goals. “Over the years, we’ve developed a list of questions that help us understand where the consumer is, where they want to go, and the obstacles they’re facing on the way,” Christopher said. “We determine how the consumer is thinking about money and help them arrange that thinking for the long term.”

After the initial session, Complete members will meet monthly with the same coach, building a relationship over time and dealing with any challenges that come along. During sessions, coaches will offer guidance and support, as well as provide resources to help clients become better informed and make smarter decisions. This may include suggesting relevant articles or videos to study for the next session.

“We try to use the flipped classroom approach. We want clients to do the reading and studying ahead of time, then we can have a discussion the next time we get together,” said Christopher. “Coaches are also looking at your budget, and discussing what you’re struggling with and where you’re seeing success.”

Join the 500K+ Mvelopes Users Boosting Their Savings by an Average $2,400

Although our modern culture seems to be nearly obsessed with the idea that newer is better, some of the most effective tools and processes we use today have been used by our forebearers for generations. When it comes to maintaining healthy finances, the process of envelope budgeting has proven its merits. Even better, with Mvelopes’ app giving the time-tested method a modern makeover, anyone can take advantage of the tried-and-true process to take control of their finances in the 21st century.

“I think the numbers more than speak for themselves. On average, our members increase their savings by over $3,000, and they paid down their debt by almost $15,000 — so a combined value of nearly $18,000 — over a period of two years,” revealed Christopher. “But that’s just the numerical value of what we provide. What tends to be more priceless is the decrease in stress that comes from being more in control of one’s personal finances. I had one woman tell me, ‘Mvelopes was one-tenth the price of a marriage counselor — and 10 times more effective.'”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.