Discover issues the best credit cards with Cashback Match. In fact, it alone within the credit card industry offers this perk across the board.

The Discover Cashback Match provides a powerful competitive advantage for Discover credit cards and deserves serious consideration when applying for a new card.

Discover Cards With Cashback Match

While it’s true that all of the following cards provide new cardmembers with unlimited double cash through its Cashback Match for the first year after account opening, they are no one-trick ponies. Read on to discover (obligatory pun) what these cards offer beyond all that double cash.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card is the flagship of the Discover credit card fleet. After the 0% introductory APR on purchases and balance transfers expires, APRs revert to normal. The card charges a higher interest rate for cash advances but no penalty APR for late payments.

The card’s Freeze it® feature allows you to immediately halt card authorizations for new purchases, cash advances, and balance transfers. Not all activity is frozen, however, including recurring bills, dispute adjustments, account fees, and redemptions. You can thaw the card just as easily via the Discover website or mobile app.

The Discover it® Chrome is designed to protect you against possible fraud by notifying you when a new account appears on your credit report and when anyone pulls your credit. You also get $0 fraud liability protection. If your card is lost or stolen, Discover will ship overnight (upon request) a replacement for free to any U.S. street address.

As with all Discover cards, this one provides a 25-day grace period (23 days for February) between the billing cycle’s statement date and payment due date, in which you will not incur interest on purchases if you pay your entire balance. This grace period is longer than the legal minimum (when offered) of 21 days, eclipsing several of its competitors in this important feature.

One of two Discover cards designed for folks attending post-secondary school, the Discover it® Student Chrome is available to those enrolled at least half time. The card allows you to use your cash back rewards instantly at Amazon.com checkout and while you pay with PayPal.

If campus life distracts you, know that you can pay your bill by phone up to 12 am (ET) of its due date. There is no foreign transaction fee and no fee for exceeding your credit limit. Note that your free credit alerts are based on information obtained from your Experian credit report.

The other Discover entry for undergraduates is the Discover it® Student Cash Back card. It differs from its sibling Discover it® Student chrome card by offering quarterly rotating rewards instead of tiered ones. You can redeem your cash back rewards at any time and in any amount. Keep in mind, the rotating quarterly categories need to be activated, and the bonus cash back is subject to a purchase limit. The rewards never expire, and you will receive your cash back bonus balance if the account closes or is inactive for 18 months.

You can, if you wish, use your cash back to purchase items at Amazon.com or via PayPal. Furthermore, you can choose not to receive your free credit scores — just call 1-800-DISCOVER. As with all Discover cards, this one supports tap-to-pay technology, allowing you to make contactless purchases at millions of merchant locations.

The Discover it® Secured Credit Card is designed for consumers with no credit or with a FICO score not greater than 670. This card has no penalty APR and doesn’t charge a fee for your first late payment. And, as with other Discover cards, you’ll be able to track your credit-building progress with free access to your FICO credit score.

If you were looking forward to earning some interest on your security deposit, you’ll be crushed to learn that Discover pays none.

What is Cashback Match?

Cashback Match is a promotion offered exclusively by Discover. It is available to new cardmembers for the first 12 consecutive billing periods or 365 days (whichever is longer) after opening an account for a Discover cash back card.

Your inclusion in the Cashback Match program is automatic — you need not do anything to participate. There is no limit on how much Discover will match within the promotion period.

How Do I Earn a Cashback Match?

You earn Cashback Match by making purchases with your Discover cash rewards credit card during the one-year promotion period. You’ll receive a matching dollar for every dollar in cash back processed within the promotion period. For example, if you earned $2,000 in cash back during the period, you’ll receive an additional $2,000 after the period ends.

Only new cardmembers are eligible for Cashback Match, and only for the promotion period. Note that you earn cash back rewards when Discover processes them. This may cause some rewards to fall outside the promotion period even if the purchase transaction occurred within the period.

Expect to receive your one-time Cashback Match within two billing cycles of the promotion period’s end. The matching amount will be added to your cash back account. You receive the same match whether or not you redeem cash back within the promotion period.

Cashback Match helps to compensate cardmembers for the lack of a signup welcome bonus. Card issuers use welcome bonus offers to attract new cardmembers.

The $0 annual fee for all Discover credit cards means that your cash back rewards rack up faster. You can track how much Cashback Match you’ve earned so far by visiting the Cashback Summary page.

You will not receive a match for rewards processed after the end of the match period, nor for statement credits, reward transfers from other Discover accounts, or closed accounts.

A great time to get a Discover card is just before a big-ticket purchase. For example, if you are about to buy a home, you may spend many thousands on furnishings, appliances, lighting, etc. in the first year that will add up to a large Cashback Match.

Do All Discover Cards Offer Cashback Match?

All but one Discover card comes with Cashback Match. The one exception is the Discover it® Miles card, which offers instead its Mile-for-Mile Match. Except for the fact that the rewards take the form of miles instead of dollars, this card’s match promotion resembles that of the top cashback card, Discover it® Cash Back.

Discover it® Miles lets you earn an unlimited flat rewards rate in miles on all purchases. You can easily redeem the miles for cash (via electronic deposit to your bank account) or use them to pay part of your monthly bill. Alternatively, you can redeem miles as a statement credit to pay for travel purchases made within the previous 180 days.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

A nice feature about your reward miles is that they don’t expire, even if your account closes. You can apply your rewards instantly at Amazon.com and PayPal.

Are Cash Back Credit Cards Really Worth It?

Earning cash back is like getting a discount on every purchase, without the need for a coupon. To evaluate whether this perk is worthwhile, ask yourself a few questions:

- Does the card charge an annual fee? There are plenty of cash back cards that don’t charge an annual fee, making it easy to justify owning them. Cards with annual fees often provide better benefits, but those are only valuable if they make sense for your lifestyle. If you seldom travel, paying an annual fee of $95 or $695 to get free baggage check is not useful to you.

- Will you be tempted to overspend? This can be a problem, especially for your first credit card. It is seductively easy to whip out your card without a moment’s thought and buy something you don’t really need. Do that often enough and you’ll face large credit card balances that you may have trouble repaying. In that case, a cashback credit card may not be worthwhile. In fact, it could contribute to your financial distress and possibly emotional problems.

- Do you do much traveling? For folks who spend a lot of time on airplanes and in hotels, a points or mileage credit card may be more valuable than the cash back variety. The reason is that the points and miles may be worth more than cash back when redeemed for travel. If your travel schedule is extensive, consider a travel rewards card or a co-branded miles card.

- Is your credit score up to snuff? Very few credit cards offer cash back to consumers with bad credit. If your credit score is down in the dumps, you will probably do better getting a secured credit card that you can use to rebuild your credit. To boost your score, pay your bills on time and keep your card balances low.

If your answers are all “no,” then we can’t see anything wrong with owning a cash back credit card. When used responsibly, the card can elevate your lifestyle without much additional cost.

One facet of responsible use is to protect your card (and card information) from theft. Most cards offer $0 liability protection against promptly reported theft, and many include security alerts, such as Social Security number detection on the dark web, the opening of new accounts, and uncharacteristically large spending. Discover cash back cards offer good security features, but so do the cards from several competitors.

It’s not a good idea to apply for many credit cards within a short period (i.e., six months) because each card issuer will do a hard pull of your credit report. Each inquiry can cost you five to 10 points on your FICO score for up to a year and will remain on your report for two. Moderation in all things, people!

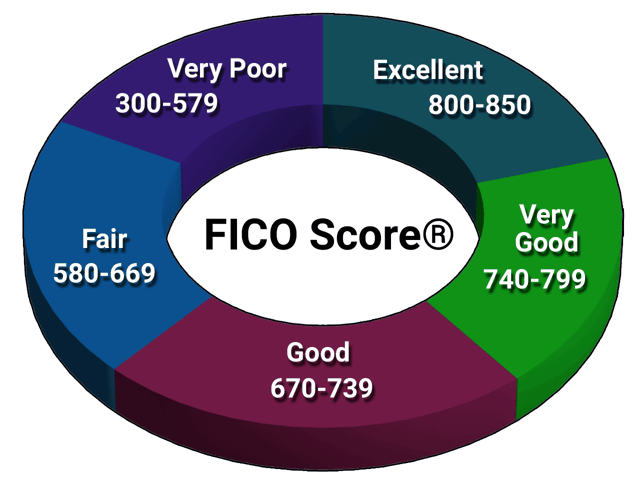

What Credit Score is Needed to Get a Discover Card?

Most of the Discover credit cards, including cash back, miles, and chrome products, are designed for folks with credit scores in the good to excellent category. We define a FICO score of 670 to be at the bottom of this range.

In addition, Discover serves other constituencies:

- Consumers with no credit or a FICO score not exceeding 670: The Discover it® Secured Credit Card is the perfect card for establishing or rebuilding credit. To get the card, you must put down a refundable deposit equal to your initial credit limit. You get the deposit back when you close the account or upgrade to an unsecured card.

- Students: Most students have no credit or thin credit files. Discover offers this group a choice: The Discover it® Student Chrome or the Discover it® Student Cash Back. The only difference between the two cards is the way they reward purchases. The Discover it® Student Chrome offers tiered rewards and is simpler to use. The Discover it® Student Cash Back offers larger rewards but requires activation of the current quarter’s merchant category.

The bottom line: There’s a Discover card available for most credit profiles.

Do Discover Cards Charge an Annual Fee?

In the immortal words of John Candy, Matthew Perry, and the other Hollywood giants on Discover’s famous commercials, the answer is a solid “No!” It’s rare to find a card issuer that so resolutely refuses to charge an annual fee for any of its credit cards, so kudos to Discover.

That’s not to say the Discover cards are cost-free — you may have to contend with interest and fees:

- Interest: The variable APRs charged by the unsecured Discover cards range from very low to just above average. The unsecured cards in this review offer a 0% introductory APR for new cardmembers on purchases made within the promotion period. The unsecured cards also offer a 0% or discounted introductory APR for balance transfers.

The APR for cash advances is higher than the top of the range for purchases. This APR kicks in starting on the day after the cash advance — there is no grace period for this kind of transaction. On the plus side, Discover does not impose a penalty APR for late payments. You have at least 25 days (23 in February) following the statement date to avoid interest on purchases by paying your balance in full.

If you do incur interest, the minimum charge is $0.50. As is standard for the industry, Discover’s variable APR is based on the prime rate. If the Federal Reserve pushes the prime rate higher, you will see credit card APRs respond immediately. However, cards generally respond slowly to cuts in the prime rate. Funny, eh?

- Balance transfer fee: Discover cards charge a fee for each balance transfer transaction. Sometimes, the balance transfer fee is reduced during a 0% introductory APR promotion and reverts to a higher amount once the promotion ends. The fee is higher than that of many competitors, up to 5% of each transaction.

- Cash advance fee: You will incur a fee for withdrawing cash from your credit line. This is the greater of a fixed dollar amount or a percentage of the advanced amount.

- Penalty fees: Late payments will not be charged a fee on the first occasion. Subsequent late payments will sting you with a late payment fee.

To its credit, Discover charges no foreign transaction fees, nor any fees for maintenance, credit line increases, overnight card replacement, and all the other fiddly ways some card companies nickel-and-dime us.

Which is Better, Cash Back or Reward Points?

No question elicits more interest at summer parties in the Hamptons than the cash back versus points controversy. Each side has its proponents and detractors.

Cash back has some strong features:

- Everyone loves cash: It’s versatile, accepted everywhere, and makes a wonderful gift.

- Cash back is easy to understand: A dollar in cash back from a cash rewards card is worth, well, one dollar. Other types of rewards have variable values that depend on how they are used. When your account statement says you have a cash back balance of $500, you know immediately what it means. Can you say the same for 500 points or miles?

- It’s easy to redeem: You can have it wired to a bank account, applied as a statement credit, or use it to get a gift card. It’s better to use rewards to get a gift card since you don’t earn rewards when you purchase one with a credit card. You don’t have to use a card issuer’s rewards website to redeem your cash back (although you can if you want to use the cash for shopping).

Points also have fans because:

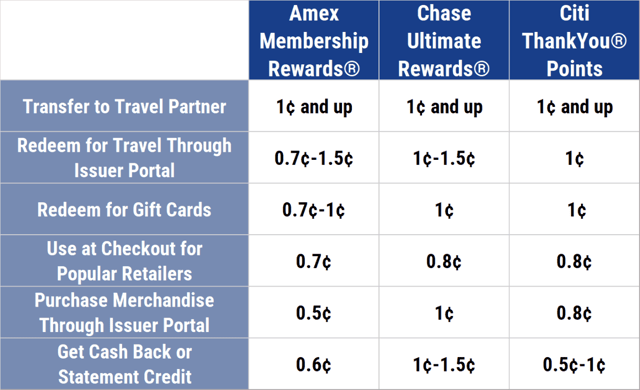

- Points are easily converted: You can convert points to cash, although some cards require minimum amounts to redeem. Many travel cards that reward you with points allow you to convert them to frequent flyer miles of various airline reward programs.

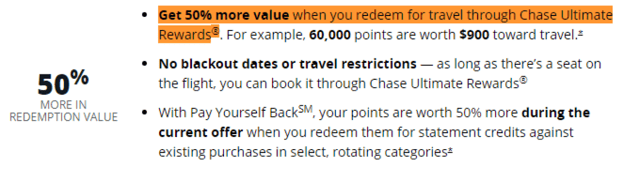

- Points may be worth more than cash: Some cards inflate the value of points redeemed for travel purchased through the card’s reward site. For example, Chase Sapphire Preferred® Card inflates point value by 25% when used for travel purchases at Chase Ultimate Rewards. Many points cards also allow you to shop using points on their reward sites. Often, you get access to special deals and discounts when shopping this way.

To be fair, points can sometimes be worth less than the cash equivalent, depending on how they are used. For example, one points card says that the value of each point can be as low as $.008.

You should be aware that certain cards, like the Chase Freedom Flex℠ and Chase Freedom Unlimited®, appear to be examples of a cashback credit card but actually reward you with points. If you also own a Chase Sapphire card, you can upgrade your Chase Freedom Flex℠ or Unlimited points to the more valuable Sapphire variety.

The bottom line is that the value of points differs among different issuers, cards, and types of redemptions. It is up to you to research the point values of a card before applying for it. In some cases, you may do better with a similar card that pays rewards in cash back rather than points.

How Can I Maximize My Card’s Cash Back?

In 2017, Bankrate found that 31% of surveyed cardholders weren’t redeeming their earned credit card rewards. CardRates.com finds that statistic sad, as we are all about getting you the most value from your credit cards. The following describes a few ways to do that.

1. Be Choosey

Choosing the best cards for your wallet should start with the basics. Unless you need costly perks, look for a card with no annual fee. Cards charge this fee only when they can get away with it, largely through higher credit card rewards and more generous benefits. If you don’t travel much, you probably don’t need benefits like luggage insurance or access to airport lounges, so why pay an annual fee to get them?

Other fees can also be decisive when choosing your next credit card. If you travel internationally, you want a card that doesn’t charge a fee for foreign transactions. Avoid cards with nuisance fees for account maintenance or enrollment.

APR ranges among credit cards commonly vary between approximately 10% and 36%. The APR you’ll pay depends on several factors, probably led by your credit score. Some cards specify a single APR, but others provide you a range that will resolve only after you apply.

Some basic comparison shopping can help you identify the cards that are the least costly to own. Our summaries of and links to the cards we review should give you the information you need to choose the best card for your purposes and lifestyle.

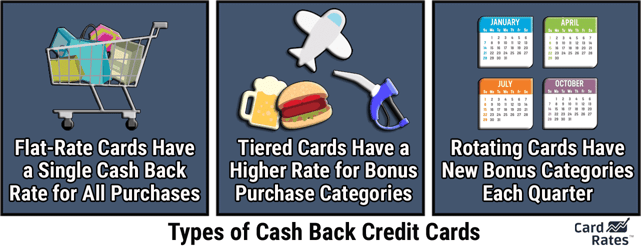

Cash back rewards come in many flavors. Some cards offer a flat cash back rate on all eligible purchases. These cards make it easy to earn cash back because just about all purchases qualify.

All merchant categories earn you the same rate of rewards without favoring any particular merchant types and without any limits on the rewards you can earn. The cost of this simplicity is that these cards seldom provide a cash back rewards rate beyond 1.5% to 2%, which is less than that offered by other card types.

For example, the Citi Double Cash® Card pays an unlimited 2% flat rate cash reward — 1% at the time of purchase and 1% when you make a payment. We’re not aware of any other flat-rate card that beats the rate from the Citi Double Cash® Card.

To enhance your cash back rate, consider a tiered card or one that offers quarterly rotating rewards. Tiered cards offer at least two different cash back rates, including a catch-all (almost always 1%) on everyday purchases that don’t belong to the favored tiers.

The Blue Cash Preferred® Card from American Express has one of the highest reward rates among tiered cards. You get signup bonus cash with the Blue Cash Preferred® Card as well as a 0% introductory APR on purchases. The Blue Cash card waives the first-year annual fee, but you must have good credit to qualify.

The other reward structure involves quarterly rotating merchant types that offer the top rewards (often 5% or more), subject to you activating the new category each quarter. Typically, the amount you can earn at the higher rate is limited, for example, $1,500 per quarter.

The trick to maximizing your cash back is to choose a card that pays elevated rewards on merchant types that you frequently use. For example, a card that pays 5% on travel purchases is a good candidate for tiered rewards if you travel throughout the year. With the quarterly reward scheme, you’d only benefit from elevated travel rewards if you booked your trip during the quarter that features this merchant category.

Rotating quarterly rewards can make sense if you tend to shop in most or all of the featured merchant types. Most credit cards use broadly popular merchant types, such as grocery stores and gas stations. You can use the card’s reward calendar to evaluate whether the rewards are a good match for your spending patterns.

Let’s work out an example. Card A offers 1.5% unlimited cash back on all purchases. Card B offers 3% on $1,500/quarter of grocery shopping, 1% on all other purchases. You spend $4,000 a quarter at grocery stores.

Card A: $4,000 x 1.5% = $60 cash back for the quarter.

Card B: $1,500 x 3% + $2,500 x 1% = $70 cash back for the quarter.

Card B wins this example. But if you spend $6,000 per quarter on groceries, the results would be:

Card A: $6,000 x 1.5% = $90 cash back for the quarter.

Card B: $1,500 x 3% + $4,500 x 1% = $90 cash back for the quarter.

It’s a tie! If you spend more than $6,000 per quarter, the flat rate cash reward will win. Here’s how it works out if you spend $8,000 per quarter to grocery shop for your big family:

Card A: $8,000 x 1.5% = $120 cash back for the quarter.

Card B: $1,500 x 3% + $6,500 x 1% = $110 cash back for the quarter.

The break-even spending amount in this example is $6,000, meaning you’d have to spend more than that amount per quarter on groceries to favor Card A over Card B. The better card for you depends on your spending patterns.

But wait — consider Card C, which pays 5% cash back on grocery purchases up to the quarterly purchase limit of $1,500. The break-even quarterly spending rises to $12,000 from Card B’s $6,000. Any spending amount below the break-even point favors Card C.

Card A: $12,000 x 1.5% = $180 cash back for the quarter.

Card C: $1,500 x 5% + $10,500 x 1% = $180 cash back for the quarter.

In the real world, Card C is the better bet unless you shop for a platoon of sumo wrestlers.

We suggest you work out some cash back examples when you compare cards. For example, what would happen to the above results if the quarterly limit was set to $1,000 instead of $1,500? Or if Card C paid a top rate of 4% instead of 5%? Suppose Card A paid a flat cash back rate of 2% instead of 1.5%?

Credit card companies game out these variables as part of their campaign to win your business, so it all boils down to the specifics of each offer.

The analysis gets even more complicated if you choose a card that pays quarterly rotating rewards. At best, you’d earn the limited high reward rate on grocery shopping for only one quarter a year, and 1% on all other everyday purchases. You’d have to extend your calculations to compare your spending for the other three merchant categories that rotate during the year.

I may be going out on a limb here, but I’d guess that most consumers skip this little exercise when choosing a cash back card. But in a way, that’s OK if you decide to own multiple cards…

2. Own Multiple Cards

Rather than identifying the one card that best fits your spending habits, consider getting several cards that pay a top cash back rate on a range of merchant types.

For example, you may decide to get three different tiered-reward cash back cards that pay a top rate of 5% on three different merchant categories (for example, grocery stores, gas stations, and travel). You’d simply use the appropriate card for each purchase to maximize your rewards.

You may even luck out and find suitable credit cards that offer high rewards for purchases at multiple (non-rotating) merchant categories, thereby reducing the need for multiple cards. Among the Discover cards in this review, the two chrome cards and the secured card fit the bill, as they pay higher rewards for purchases at gas stations and restaurants.

This may be an optimal solution, but it’s not perfect.

For one thing, you may have to make multiple card payments each month. If you are not well-organized, you may miss a payment and find yourself paying late fees and perhaps a high penalty APR. That would probably send your cash back strategy limping back to the locker room.

Although you could, theoretically, reduce the number of monthly payments by doing balance transfers to a card with a 0% intro APR promotion, you’d be stuck with the transfer fees (typically 3% per transfer). And the amount of work to repeatedly transfer balances would greatly surpass the effort required to make timely payments.

Another potential problem with a multi-card strategy stems from the terms and conditions each card imposes upon cardholders. Accounting for different fee structures, APRs, and reward schemes can complicate your campaign to extract maximum rewards from your cards.

Nonetheless, you can reduce the complexity and still increase your cash back by favoring tiered-reward cards with no annual fee and setting up auto-pay for your full balance each month, thereby avoiding late fees and interest charges. You also need to remember which card to use with which merchant type (Hint: Use a magic marker to discreetly add a reminder on each card).

Alternatively, you may need just a single card — one with quarterly rotating merchant categories — if the following are true:

- You know in advance the merchant categories and their rotation schedule.

- You spend at least the capped amount each quarter on the current category.

- You remember to activate each quarterly category and to pay your bill on time.

With a little planning, you could arrange your purchases to match the rotation schedule.

For example, you could stock up on long-term staples from your supermarket when the merchant category becomes grocery stores. Or wait to buy that new audio system until the right quarterly merchant cycles around. However, I’m not sure how you’d stock up for categories like gasoline purchases or restaurant dining — write us with your ideas.

3. Use Your Signup Bonus

Many card companies (excluding Discover) offer signup bonuses to new cardmembers. Typically, you earn a set amount of cash back, points, or miles by spending the required amount on purchases during the promotion period (usually extending three months from account opening). Note that you can usually get a bigger signup bonus from a business credit card.

Getting a consumer or business credit card with a signup bonus makes a lot of sense if you are planning to purchase one or more big-ticket items in the next three months. Depending on your planned shopping, you can select among cards with a variety of bonus amounts and spending requirements.

Getting a consumer or business credit card with a signup bonus makes a lot of sense if you are planning to purchase one or more big-ticket items in the next three months. Depending on your planned shopping, you can select among cards with a variety of bonus amounts and spending requirements.

Discover takes a different approach by offering Cashback Match for the first year after opening the account. If you’re about to pay for a wedding or a world cruise, you’ll benefit from the unlimited nature of the Discover Cashback Match as opposed to the limited rewards available from a signup bonus.

In addition, Cashback Match works for the whole year, not just three months. That makes the timing of purchases less critical. Also, having a full year to make big-ticket purchases makes it easier to work around your credit limit by paying your full balance between purchases.

Bear in mind that you can get a second Discover card as long as you own the first one for at least a year. For example, you may start with the Discover it® Cash Back and then get the Discover it® Miles after a year passes. That’s two full years of rewards matching without a penny spent on annual fees.

4. Use Your Perks

A credit card with great perks can save you money on many things. Since part of the money you save may come from cashback bonus rewards, using your perks makes your cash back go further.

Here is a sampling of the money-saving perks available from cash back cards:

- Extended warranties: Eligible purchased items get additional warranty protection at no charge.

- No foreign transaction fees: Never pay a foreign transaction fee when you make a purchase abroad.

- Travel accident insurance: Automatic insurance at no extra charge for a covered loss while traveling when you use the credit card to purchase your fare.

- Trip cancellation insurance: Protects you from forfeiting your fare when you have to cancel or reschedule a trip.

- Shopping: Many credit card issuers have online shopping sites that offer money-saving deals, exclusive offers, and/or automatic coupons.

- Concierge service: This service is complimentary and can help you make arrangements for traveling, entertainment, and dining, often with special money-saving deals and rebates.

- Fraud protection: Most cards offer $0 fraud liability protection against unauthorized charges when your card is lost or stolen.

- Baggage insurance: Provides compensation when your baggage is lost, damaged, or delayed.

- Free baggage check: You can check one or two bags for free at participating airlines.

- Global Entry or TSA Precheck reimbursement: You can be reimbursed for the application fee, usually up to $100

- Car rental insurance: Free collision damage waiver means you don’t have to pay for it.

- Airport lounges: Some cards offer free or discount access to airport lounges around the world.

This is only a partial compendium of the most popular benefits. Check a card’s accompanying details to see which, if any, are included.

What Should I Do With My Cash Back?

Figuring out what to do with your cash back is a good problem to have. Naturally, you can spend it any way you want. You can spend it as you earn it or save it up for a big purchase.

But we’d like to suggest a boring, yet important way to use your cash back: Improve your financial health.

Your cash back rewards can help you increase your financial security in several ways. While not as appealing as a shopping trip to the local mall, these ideas can have lasting benefits that will be worth much more over the long term:

- Pay down debt: Consider using your cash back to pay off any credit card and/or loan balances. As you decrease your debt, your credit score and access to loans should increase. With a better score, you may qualify for lower interest rates on new credit cards and loans.

- Start an emergency fund: Use the cash back to start or augment a rainy-day fund. Ideally, you want the fund to be large enough to pay for at least six months of expenses if your income suddenly terminates. The more you put aside, the less you’ll have to borrow when an emergency occurs.

- Contribute to your retirement: In 2021, you can contribute the lesser of work income and $6,000 ($7,000 if you are 50 or older) to a traditional and/or Roth IRA. If you are self-employed, you can contribute up to $58,000 ($64,5000 if you are 50 or older) of your earned income to a one-participant 401(k) plan. Contributions to traditional retirement accounts are tax-deductible, whereas withdrawals from Roth accounts are free (if you follow the rules). Cash back is not earned income, so you must have enough income from work to cover your contributions. If you are enrolled in a company 401k plan, consider increasing your automatic contributions by the average amount of cash back you earn each month. Speak to your financial advisor before depositing money into your retirement accounts, as the rules for maximum contributions and deductibility can get a little complicated.

- Buy insurance: Make sure your household is covered by adequate life insurance. You can get a low-cost term insurance policy for as little as $9/month. You may want to consider a cash-value life insurance policy that builds up tax-deferred value over time.

- Get energy-efficient: You can save on your utility bills by replacing old kitchen and laundry appliances with new, energy-efficient products with the Energy Star label save money and protect the environment. Also, consider some home upgrades, like additional insulation and thermal windows.

- Join a health club: You can get an annual membership for as little as $49 from the least expensive clubs, though higher prices will get you fancier digs. A healthy body is not only its own reward, but it could keep you from developing heart disease, diabetes, and other expensive couch-potato illnesses.

- Contribute to a 529 plan: Parents can help their kids pay for a college education by setting up and contributing to a 529 education plan. Money donated to a qualified plan grows tax-deferred, or tax-free if used for eligible expenses. Many states allow you to deduct your contributions to an in-state 529 plan. The Securities and Exchange Commission provides a comprehensive introduction that can help you choose the right 529 plan.

These are but a few ways to put your cashback bonus rewards to work. Individuals have many different priorities, so ultimately the choice is deeply personal. Whether you save, invest, or spend your cash back, take the time to identify the credit cards that mesh best with your lifestyle.

How Often Should I Redeem Cash Back?

The considerations for cash back redemption differ from those for points and miles. They include timing considerations as well as the costs imposed by different strategies.

Cash Back vs. Points vs. Miles

As we pointed out earlier, cash back has explicit value — a dollar is a dollar. We can’t make the same statement for travel card points and miles, whose value depends on how you use them.

For example, virtually all points and miles cards allow you to redeem your rewards for cash, and the rate of exchange is clearly defined in the card’s terms and conditions. In most cases, you’ll receive $1 for every 100 points or miles you convert. However, the value of points and miles can vary if you redeem them for something other than cash.

Travel credit cards allow you to redeem your miles or points for airline tickets and related purchases. The value of your rewards depends on whether you make purchases using the cash value of point/miles rewards versus transferring the rewards to an airline’s frequent flyers program.

There are four types of points/miles — non-transferable, transferable, combination, and frequent flyer miles:

- Non-transferable: These are points or miles that are not associated with any one airline. You can’t transfer these rewards directly to an airline loyalty program. Rather, you cash these rewards to buy travel purchases ahead of time or use them to pay for prior travel purchases via a statement credit.The Discover it® Miles card is a good example of non-transferrable reward miles. The cash value of Discover miles is $0.01 per mile, which you can use to pay for travel purchases. Some points cards, such as Chase Sapphire Preferred® Card, actually enhance the value of your points rewards by 25% when you use them to purchase travel through the Chase Ultimate Rewards site.

- Transferable: These are mile or point rewards that can be transferred from the credit card to the loyalty programs of partner airlines. The rewards are not associated with any one frequent flyer program. The value of these rewards depends on:

The transfer ratio: Often, the transfer ratio is 1:1 — one frequent flyer mile for one card point/mile. But there is no reason a different ratio can’t be used, if not currently, then sometime in the future. Credit cards always reserve the right to change their reward programs without notice.

The frequent flyer reward schedule: Each airline specifies how many miles you need for a free ticket, depending on the destination, date of travel, time of day, travel class, and other factors. For example, your upcoming flight on one carrier may require 20,000 miles, whereas another demands 35,000 miles for a similar flight. Given the vagaries of the transfer ratio and reward schedule, it can be almost impossible to figure out the value of transferred points. What’s more, these parameters can change over time, revaluing the points higher or lower.

- Combination: This option combines transferable and non-transferable rewards. The value of point or mile rewards from a combination-type card can vary considerably depending on how you choose to redeem your rewards. You have the option of using the cash value of your points or miles to purchase travel, or you can transfer your rewards directly to an airline or hotel rewards program. For example, Chase Sapphire Reserve® enhances the cash value of points by 50% when used to purchase travel via the Chase Ultimate Reward website. But unlike the Chase Sapphire Preferred® Card card, the Reserve card also allows you to transfer points directly on a 1:1 basis to leading airline and hotel loyalty programs rather than using their cash value for purchases. Another example is the Capital One Venture Rewards Credit Card, which gives you the option to purchase travel with miles or to transfer your miles to more than 10 travel loyalty programs.

- Frequent flyer miles: Many miles cards are co-branded with a partner airline, and the miles in your account are the regular ones for the airline’s (or affiliate’s) frequent flyer program. Since no transferring is required, the value of the miles depends solely on the airline’s reward schedule.

Bear in mind that the miles earned from these cards are only usable on the co-branded airline and its affiliates. They are therefore less flexible than other types of mile/point rewards.

Implications of Redemption Options

How do your redemption options affect when you should redeem your rewards?

To start with, cash back cards are neutral in this regard.

You can keep your cash back rewards on the card as long as the account remains open. Depending on the card, you may forfeit your rewards when you close the account or the credit card issuer — for example, Discover — will send you your remaining rewards if the account closes. The value of the reward will never change since it is denominated in dollars.

Credit cards that reward you with points or miles are a little more complex. If the rewards are denominated in the frequent flyer miles of the co-branded partner or affiliate airline, then you must wait to redeem the miles until you’ve accumulated enough of them to pay for the ticket you want.

Conversely, when you redeem non-transferable miles/points, you are using their cash value to buy airline tickets. Sometimes, there is no need to postpone redemption because the cash value of the miles/points is fixed.

With some cards, the cash value of the miles/points is enhanced when used to purchase travel. When that’s the case, you must wait to redeem your rewards until you have enough for your intended purchase, or you’ll lose the value enhancement.

Cards like the Chase Sapphire Reserve® provide 50% more value for points redeemed in certain categories.

However, immediately transferring the miles/points also carries risks. For example, if you transfer the rewards to a particular airline’s loyalty program well before you plan to book your travel, the value of those miles may change for the worse. Or the value of a competitor’s airline miles may improve in the interim. Had you waited, you may have decided to transfer your card rewards to a different frequent flyer program.

Of course, the biggest risk is that the airline holding your frequent flyer miles will go bankrupt, leaving you high and dry. Whether this is more or less likely than the credit card company going belly up is a matter of conjecture.

The bottom line is that there are fewer reasons to delay redeeming cash back rewards than for points or miles. Nonetheless, unless there is a specific reason to keep your cash back in your card account, prudence suggests you get it out as soon as you earn it.

Lazy Cash at Risk

The reasons why, all things being equal, you’d rather redeem your cash back right away include:

- The money is uninsured: The cash back accumulating in your card account is not FDIC-insured. We aren’t predicting the sudden demise of any credit card company, but wouldn’t you rather have your money sitting safely in an insured bank or credit union account?

- The money isn’t working: The universe will fizzle out to an empty void before you’d collect one cent of interest on your accumulated cash back rewards. Granted, interest rates are punk right now. But it’s your money and you deserve to collect interest, even if it’s a pittance. We have it on good authority that Christmas Clubs are still a thing. While more popular in your grandparents’ day, these holiday club accounts let you stash away small periodic deposits so you have money to spend at the next yuletide. Just remember that your money will be tied up until November 1, but that can be a helpful reinforcement to your own self-discipline.

For those with a little more appetite for risk, consider the advent of products like Schwab Stock SlicesTM that allow you to invest in fractional shares of stock for as little as $5, even when the stock price is higher. If you earn $25 in cash back this month, you could buy slices in up to five different stocks, commission-free. By the way, if you’d like some free help analyzing which slices to buy, check out our review of Last10k.com. The company makes it easy to understand the public filings of corporations by boiling them down into digestible morsels.

Stock slices aren’t the only asset that allows you to invest small amounts of redeemed cash back. Mythic Markets offers fractional shares of rare pop culture collectibles, such as classic comic books or Magic: The Gathering game cards. It’s an interesting way to diversify your portfolio.

Another way to put your cash back to work is to pay down debt. For example, you could take that $25 in cash back and add it to your next mortgage payment, where it will reduce your principal. Doesn’t sound like much, but if you do it every month, you may cut months or years off your mortgage term.

Finally, we would be remiss to omit mention of those lottery tickets you’ve been buying every week for the past 30 years. If you limit your purchases to your monthly cash back, perhaps you’ll feel a tad less frustrated when Powerball fails to deliver. We don’t advocate gambling per se, but hey, the money goes to education, right?

- Hurry up and wait: Redeeming your cash back could take as long as a week or two before you can get your mitts on the money. If you ask for the money to be sent to you in the mail, there is a slight chance that it will be delayed, lost, or stolen. On those occasions when you’d like to have cash in hand, you may be thankful you redeemed your cash back as soon as it became available.

- Get a tax deduction: As we discussed earlier, you can contribute your cash back to your traditional IRA and get a tax deduction, as long as you have enough earned income to cover the contribution.

In sum, the only reason to postpone cash back redemption is when you plan to use the money for special shopping deals and discounts available exclusively through the card. When this is the case, you may want to accumulate your card’s cash back rewards until you have enough to take advantage of a shopping deal.

Compare Discover Cards With Cashback Match

Our review of the best credit cards with Cashback Match highlights the unique and valuable Cashback Match feature common to all cash back Discover cards. Similarly, the Discover it® Miles card offers a Mile-for-Mile Match. Doubling the value of the rewards that new cardmembers can earn during the first year of credit card ownership is an attractive perk, especially if you anticipate some heavy purchasing in the next 12 months.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Options to Get Cashback on a Credit Card ([updated_month_year]) 7 Options to Get Cashback on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Cashback-Credit-Card.png?width=158&height=120&fit=crop)

![6 Best Credit Cards for PPC & Google Adwords ([updated_month_year]) 6 Best Credit Cards for PPC & Google Adwords ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/PPC-Credit-Cards.png?width=158&height=120&fit=crop)

![13 Best Rewards Credit Cards ([updated_month_year]) 13 Best Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/06/Top-13-Best-Rewards-Credit-Card-by-Category1.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for Gas Stations ([updated_month_year]) 8 Best Credit Cards for Gas Stations ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/gascards.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for Groceries ([updated_month_year]) 8 Best Credit Cards for Groceries ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/Best-Credit-Card-for-Groceries1.png?width=158&height=120&fit=crop)

![7+ Best “2% Cash Back” Credit Cards ([updated_month_year]) 7+ Best “2% Cash Back” Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/2-percent.png?width=158&height=120&fit=crop)

![13 Best Credit Cards for Rewards ([updated_month_year]) 13 Best Credit Cards for Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/rewards.png?width=158&height=120&fit=crop)

![8 Best Money-Back Credit Cards ([updated_month_year]) 8 Best Money-Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/best-money-back-credit-cards-feat.png?width=158&height=120&fit=crop)