When you’re traveling abroad, the last thing you probably want to think about is which credit card will work overseas and not charge you extra with each transaction. It’s no secret that some cards are better for traveling than others.

The cards on this list are among some of the best for traveling because they are all Visa/Mastercards that don’t charge any foreign transaction fees. You can also take advantage of other card benefits like travel insurance and reward points to make the most of your spending while you’re traveling the world.

Best Overall | Travel Insurance | Lounge Access | No Annual Fee | Business | Student | Fair Credit | Bad Credit | FAQs

Best Overall Card To Use Abroad

The Capital One Venture Rewards Credit Card is hands down the best travel rewards credit card to use abroad due to its mileage rewards and travel insurance benefits. As a new cardholder, you can earn a one-time bonus miles reward when you meet the spending threshold and continue to earn unlimited miles with every purchase.

Rewards can be redeemed for any travel purchase, including hotels, airline tickets, vacation rental, and car services.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

When you use this card to book your travel, you can also benefit from its travel insurance benefits while you’re abroad. You’ll receive automatic insurance coverage for accidental death or dismemberment. Also, if your luggage is lost or stolen during your trip, Capital One will reimburse you with a travel credit up to $3,000 so long as you book your airline ticket with your Capital One Venture Rewards Credit Card.

If you’re renting a car, you can also receive additional insurance coverage for damage caused by collision or even theft of your vehicle. While some situations may not occur when you travel, it’s reassuring to know that you have some protection against the unexpected by using the Capital One Venture Rewards Credit Card for your overseas spending.

Best Card To Use Abroad With Travel Insurance

The Chase Sapphire Preferred® Card offers a generous sign-on bonus that you can use to book travel, but this card also has industry-leading travel insurance benefits as well.

If you run into any issues during your trip, you can call the Benefits Administrator to receive legal and medical referrals and other emergency assistance. You’ll also be able to receive a few reimbursements for eligible travel purchases made with your card.

If your trip is canceled or cut short due to sickness, severe weather, or other covered issues, you could be reimbursed with a travel credit of up to $10,000 per person or $20,000 per trip for your prepaid travel expenses. This includes expenses like hotels, passenger fares, tours, and more.

Trip delays are inconvenient but also common. So if your trip gets delayed by more than 12 hours or the delay suddenly requires an overnight stay and you used your Chase Sapphire Preferred® Card to book it, you could receive a reimbursement of up to $500 per ticket. Another travel reimbursement you could receive is if your baggage is delayed for over six hours. Chase will provide you with $100 per day for up to five days.

If you’re renting a car abroad, you can save money by charging the rental fee to this card to obtain primary collision insurance. This will provide you with reimbursement up to the actual cash value of the vehicle in the event of theft or a collision.

Best Card To Use Abroad With Lounge Access

With the Chase Sapphire Reserve®, you’ll receive an automatic annual statement credit that you can use for travel. If you spend a lot of time flying, you’ll also enjoy the airport lounge access benefits that come with this card.

Gain access to over 1,000 VIP lounges located in more than 500 cities worldwide once you enroll in Priority Pass Select. Airport lounge access can make all the difference during a long layover or a night spent at the airport waiting for your flight.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

You won’t have to pay an additional fee to activate a Priority Pass membership for yourself and an authorized user (authorized users of the card incur an annual fee, however). For additional guests, your card will be charged a small fee so they can enjoy the VIP airport lounge while traveling with you.

You can also stay in luxury during your trip abroad by using your card to book a stay at one of the hand-selected top hotels and resorts that offer benefits like complimentary room upgrades, early check-in and late-checkout, as well as free WiFi.

Best Card To Use Abroad With No Annual Fee

The Bank of America® Travel Rewards credit card may not offer the highest cash back bonuses or points per dollar, but it makes up for it by not charging users an annual fee. If you love to travel with rewards cards but struggle to keep up with all your different card fees, consider using this card to balance everything out.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

While some cards seem worth the annual fee, it’s another tedious thing that you will need to keep up with — especially if you have multiple credit cards. A more manageable approach is to keep some credit cards with justifiable fees and others with no annual fee to balance things out.

With the Bank of America® Travel Rewards credit card, you can enjoy a low introductory APR for your first few billing cycles, and you can redeem your travel rewards for extra costs like baggage fees and restaurant meals including takeout.

Best Business Card To Use Abroad

If you have a business and travel throughout the year, the Ink Business Preferred® Credit Card by Chase is a must. While you can earn a sizable signup bonus to help you book travel with points, you’ll also receive a lot of helpful travel benefits that could come in handy while you’re abroad.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

This card comes with trip cancellation/interruption insurance benefits so you can be reimbursed up to $5,000 per person and $10,000 per trip for your prepaid, nonrefundable travel expenses if your trip gets canceled or cut short. If you’re renting a car during your trip for business purposes, you could also receive primary auto collision insurance coverage and reimbursement up to the actual cash value of the vehicle in the event of theft or collision damage.

Roadside dispatch is also available if you find that you need a tow, jump-start, lockout service, or tire change while traveling abroad. Roadside service fees will be charged to your card.

Best Card To Use Abroad With Fair Credit

Even if you have fair credit, you can still benefit from using a rewards card when traveling abroad. Capital One QuicksilverOne Cash Rewards Credit Card is a cash back rewards card with a low annual fee and no foreign transaction fees, but you won’t get the travel insurance benefits or rental car roadside assistance that other cards offer.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

However, if you’d prefer to use a card on your trip instead of converting your cash, you can still spend safely with this card and earn cash back at the same time. Cash back rewards are unlimited and apply to every purchase you make. You’ll also receive free ATM locating services so you can avoid paying costly ATM fees no matter where you are.

If your card is lost or stolen, you can receive an emergency replacement card quickly and will not be responsible for unauthorized charges made due to Capital One’s $0 Fraud Liability protection.

Best Card To Use Abroad With Bad Credit

Secured cards provide a great opportunity to rebuild your credit. The Capital One Platinum Secured Credit Card is the best option if you have bad credit but are still not looking to pay foreign transaction fees when traveling abroad.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

As with all secured credit cards, you’ll fund your credit limit by making a deposit but the deposit is also refundable with this card so you can get it back. As you make on-time payments, your deposit may be returned to you as a statement credit.

You will also receive emergency card replacement and ATM locating services to help you save money on ATM fees if you need to make a cash withdrawal.

What is the Best Credit Card to Use for International Travel?

When you’re traveling internationally, the last thing you probably want to think about are issues like the airport losing your luggage, your trip getting delayed, or determining how you will protect, spend, and keep up with your money. Luckily, some of the best credit cards to use abroad can help alleviate some of those concerns.

Our top picks for the best card to use for international travel is tied between the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card. With both cards, you can earn a generous signup bonus and continue to earn bonus points for your spending. Both cards come with an annual fee, but it could be worth paying this fee if you are using the card to stack up rewards and traveling even just a few times per year.

The Capital One Venture Rewards Credit Card is more flexible in terms of where you can transfer your rewards for travel. Capital One partners with more than 10 travel loyalty programs to give you more options when you book and plan travel. Plus, you’ll get rental car insurance coverage, travel protection if your trip gets canceled, and 24-hour travel assistant services if your card gets lost or stolen.

If you lose cash while you’re abroad, there’s no getting it back. But if you lose your Capital One Venture Rewards Credit Card, you can get an emergency replacement card ASAP as well as a cash advance.

With the Chase Sapphire Preferred® Card, you’ll earn extra points per dollar spent on dining out, travel, and grocery store purchases. This allows you the opportunity to earn more points during your trip that can be redeemed for future travel. If you are a member of a frequent travel program, you can transfer your points to over a dozen travel partners with this card.

The travel insurance benefits are also some of the best we’ve seen — allowing you to receive up to $20,000 in reimbursements for a canceled or delayed trip. If your flight gets delayed and you have to stay overnight, you’ll get up to $500 to cover food and lodging expenses.

Instead of having to spend extra money on travel insurance when you book a trip abroad, you can save money by booking your stay with any of the cards from this list that offer built-in travel insurance benefits when you book your accommodations.

How Do I Know If My Card Charges Foreign Transaction Fees?

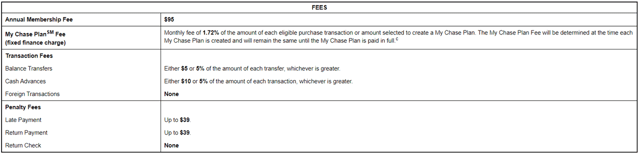

The best way to find out whether your card charges foreign transaction fees is to check your credit card agreement. Don’t wait until you’re abroad and start seeing a ton of extra charges show up on your credit card statement.

Log into your account online and pull up the card terms and fee list so you can confirm whether the card has a foreign transaction fee. Usually, there is a section that lists the balance transfer fees, late payment fees, and other charges you will incur. Pay close attention to whether your card has a foreign transaction fee.

Find your card’s pricing and terms information online to see whether the card charges foreign transaction fees.

You can also go to the credit card provider’s website to look for this information. Our card reviews are also a great way to conduct a quick search.

Make sure you spend a few minutes doing thorough research and confirming what your credit card issuer considers a foreign transaction to be. Some credit cards may consider any purchase outside of the U.S. as a foreign transaction while others may allow nearby countries like Mexico and Canada to be an exception.

If your card does charge a foreign transaction fee, you can always consider applying for a new credit card with no foreign transaction fees to use when traveling abroad instead. If you travel out of the country and plan to use a credit card, it’s worth it to keep a card in your wallet that won’t charge you any foreign transaction fees.

How Do I Avoid Foreign Transaction Fees On My Card?

The best way to avoid a foreign currency transaction fee on your travel credit card is to use a card that doesn’t charge any. There are plenty of options (as outlined above in this article) to choose from if you’re looking for a credit card that doesn’t charge foreign transaction fees.

Capital One’s credit cards never charge any foreign transaction fees, for example. Narrow down your list of wants and needs in terms of a good credit card for you and see which cards have low or no fees and top tier rewards benefits.

If you are considering a credit card that has great benefits but also charges a foreign transaction fee, you can also choose to only use it in your home country and with domestic merchants. When you travel to another country, be sure to bring another credit card that doesn’t charge foreign transaction fees to help you save money.

While the typical 2% to 3% fee you may be charged is often less than what some banks and currency exchanges may charge to convert your cash while you’re abroad, it’s still money you don’t have to spend by choosing to use a credit card that doesn’t charge foreign transaction fees when you travel out of the country.

Do Foreign Transaction Fees Count Toward Your Credit Card Rewards?

Unfortunately, credit card fees don’t apply to your rewards balance. This means that while you may earn points or cash back for a purchase abroad, the foreign transaction fee will not be included in the total spending amount.

Foreign transaction fees do not count toward your total purchase amount and will therefore not earn you rewards. This is generally true for all credit card fees.

So, if you spend $100 at dinner and your foreign transaction fee is 3%, you’ll automatically pay $3 while you could possibly earn rewards on your restaurant purchase depending on the type of card you have. The surcharge will often show up on your statement as a fee and not as a purchase.

When you think about it, foreign transaction fees can also eat into your credit card rewards benefits and make them less useful. If you’re earning 1% to 3% cash back but are also paying a 3% transaction fee, this could easily cancel out any rewards you’re earning. That said, there is really no good reason to use a card with foreign transaction fees when you’re traveling abroad.

The best way to protect your credit card rewards when using your card abroad or with foreign merchants is to get a credit card that doesn’t have foreign transaction fees.

Should I Choose a Travel Card With an Annual Fee?

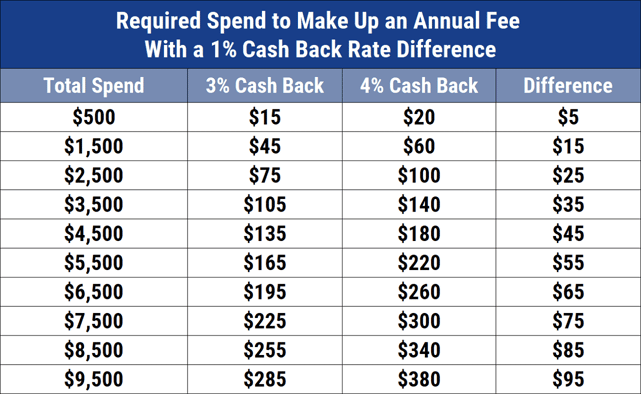

Some credit cards charge an annual fee that is billed automatically and shows up on your balance statement. A typical credit card annual fee amount can range from $39 to hundreds of dollars. You can check to see whether a card charges an annual fee by reviewing the Rates and Fees section, which is usually available on the credit card’s information page.

One of the best ways to determine whether an annual fee is worth it is to consider the monetary value of the card benefit. Most cards with annual fees offer a wide variety of benefits and rewards, including airline miles, higher cash back rates, low intro APR rates, and more.

So if you’re paying a $95 annual fee for one credit card, for example, you’ll want to see how your rewards add up.

Will you earn points that can be used to buy merchandise or book a flight or hotel stay that exceeds the value of that $95 fee? Does the card offer travel insurance, free credit monitoring, or cellphone insurance? These are all benefits that could add up if you had to pay for them on your own.

You also want to consider how much you spend each year relative to the rewards rate. See the chart below for an example of how much more you’d be required to spend to make up just 1% of cash back.

Some credit cards opt to waive the annual fee the first year, which is great if you are looking to earn a bigger signup bonus. You can always choose to keep a mix of travel cards with annual fees and a few without annual fees to balance things out.

If you’re looking for a travel card with no annual fee, we highly recommend the Bank of America® Travel Rewards credit card. Discover doesn’t charge an annual fee with any of its credit cards either, but you may find a Visa or Mastercard to be more widely accepted than a Discover card when traveling to different destinations.

Is it Best to Use Credit Abroad?

There are several reasons why you may want to use a credit card abroad. Credit cards are easy to carry when traveling and simplify the process of spending money.

You don’t have to worry about converting your U.S. dollars or counting change. All your transactions are tracked so you can review them later and you’ll have more options for purchase protection as well.

If you lose your credit card or it gets stolen during your trip, it will be much easier to recover than if you were to lose cash. You may have the option of freezing your card and also protecting yourself from any unauthorized purchases. If you use a card that has no foreign transaction fees, you can save money on the overseas spending you do abroad.

The only caveat would be to avoid going overboard with your spending while overseas. Traveling can be expensive and using a credit card won’t lower the costs of food, transportation, activities, and related expenses during your trip.

Create a reasonable budget that you can stick to before you go on your trip and review your finances and transactions at least once during a short trip and a few times per week during a longer trip. You’ll still want to monitor your credit card account so make sure no unauthorized purchases have been made, it’s easier to manage everything in the same place.

Credit is safer in the event your card is lost or stolen, but cash can help you stick to a budget and is generally accepted everywhere.

Finally, do a little research on where you’re going and how merchants there handle money. Are you traveling to a more remote area or will you be visiting smaller merchants who may only accept local currency? Remember, merchants must choose to pay the necessary fees to accept credit card payments, and in some areas, stores and restaurants may not want to incur the added costs.

If you’ll be staying at an international resort in a heavy tourist area, it can make sense to use credit abroad. However, depending on your itinerary, you may want to bring a little cash with you just in case you run into a situation where you can’t use a credit card or would prefer to tip someone for their service.

Does Mastercard Charge a Fee for International Transactions?

Mastercard usually charges a 1% fee for foreign transactions. This fee gets added to what the credit card company or card issuing bank charges to make up the total foreign transaction fee.

If you start using a credit card with no foreign transaction fees, it means that the card’s issuer is choosing to cover the international transaction fee for you instead. This is an added perk that many different credit cards offer.

How Much Does Visa Charge for International Transactions?

Similar to Mastercard, Visa typically charges a 1% fee on foreign transactions. This may be covered by your card issuer or used to make up the foreign transaction fee for your card.

A 1% fee doesn’t seem like much, but it adds up as you spend more money with a Visa card internationally. With so many options available in terms of cards that will waive this international fee, you don’t have to get stuck paying an extra surcharge when you spend money abroad if you don’t want to.

Why Was I Charged a Foreign Transaction Fee?

A foreign transaction fee can be charged to your card when you make a purchase that requires funds to be passed through a foreign bank (not based in the U.S.). The average foreign transaction fee ranges from 1% to 3% of the purchase price, and this fee often includes two charges.

One part of the charge is from the credit card network (Visa, Mastercard, etc.) while the other comes from the card issuer (Chase, Citi, etc.).

This fee is meant to help your bank and the payment processor convert your funds to a different type of currency. Instead of having to convert your dollars on your own when you’re in another country, you can do this automatically just by using your credit card.

However, the credit card issuer and company often want to make some money from this service to recoup their costs so they charge you a fee for foreign transactions.

What is the Difference Between a Foreign Transaction Fee and a Conversion Fee?

Currency conversion fees are not the same as foreign transaction fees. A currency conversion fee may be included in a foreign transaction fee, but the two are not one and the same. A currency conversion fee is charged by a merchant to help convert the foreign currency into dollars.

Currency conversion fees can vary and add to your out-of-pocket fees. Mastercard has an online calculator to help you estimate currency conversion fees based on your card and bank.

As an example, say you’re visiting an ATM in another country, and you wish to withdraw funds. This is where a currency conversion fee can come into play so the cash can be properly processed.

A currency conversion fee is assessed by a merchant or bank to convert currency, whereas a foreign transaction fee is charged by credit card companies and usually includes the currency conversion fee.

You may encounter this fee if you need to withdraw a cash advance from a credit card. The money must first be converted to your home currency for you to be able to withdraw it.

Or perhaps you’re in a souvenir shop in a foreign country and wish to see how much your transaction costs in U.S. dollars. If you’re paying with your credit card and aren’t too familiar with the currency conversion rate there, it only makes sense to see what you’d be spending in dollars, right?

Well, the merchant may ask you if you’d like them to do a Dynamic Currency Conversion — or DCC — which will give them the authorization to charge the currency conversion fee. To avoid the dynamic currency conversion fee, you can decline it when a merchant asks if you find it unnecessary.

Do Foreign Transaction Fees Apply To Online Purchases?

Yes, a foreign transaction fee can apply to online purchases if you are using a foreign merchant. If you are shopping online and the vendor is processing your payment through a foreign bank or with foreign currency, your credit card may charge you a fee.

Thanks to the internet, we can make purchases from various types of websites and merchants. Some of these may not be U.S.-based, so you’ll want to double-check before placing a transaction. You could also be charged a foreign transaction fee if you’re sending money online to someone who is outside of the country.

For example, if you have a business credit card and use it to pay vendors overseas, you could be charged a foreign transaction fee, even if you haven’t even physically left the country.

To avoid this, use a credit card that doesn’t charge a foreign transaction fee and pay close attention to online purchases that could be processed by a foreign bank. You don’t have to completely avoid these purchases if you find them safe and necessary, but being aware is key.

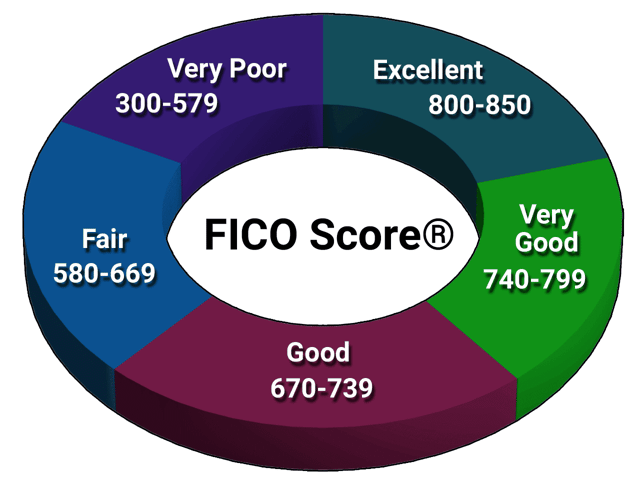

What Are the Credit Score Requirements For a Travel Credit Card?

Credit score requirements will be different for each card. However, most travel credit cards are rewards cards that tend to be offered to consumers with good or excellent credit. Travel rewards cards have exceptional benefits, so a higher credit score is often required.

According to FICO, a good credit score is considered anything between 670 to 739 while a very good credit score is considered 740 to 799. A score of above 800 is considered excellent. You can check your credit online before applying for a travel credit card.

A good or excellent credit score is generally required to obtain a travel rewards card.

If you already have other credit cards, you may have free access to your credit score or FICO score online. If not, you can always use sites like Credit Karma, Credit Sesame, or Discover Scorecard to access your credit score for free.

To improve your credit score, pay close attention to your payment history and make sure you’re paying your bills on time. This includes credit card bills, student loan payments, your car loan, and other debt payments. Also, keeping your overall credit utilization low can be helpful. The general rule of thumb is to keep your credit utilization below 30%.

This means, if you have a credit card with a $3,000 limit, you should not have a balance of more than $900 when your monthly statement cycle closes. If you’re looking to use a card during an upcoming trip and have bad credit, you may do well with a secured credit card with no foreign transaction fees.

Also, check out some of our best credit cards to help you build your credit.

Can I Get a Prepaid Travel Card for International Use?

Prepaid cards can be an alternative to credit cards when you’re traveling internationally. With a prepaid card, you make a cash deposit that allows you to use the card to pay for your transactions. This isn’t a standard credit card, so you don’t need your credit report checked to apply.

A prepaid card also isn’t a debit card because it’s not linked to your checking account. This may be a benefit especially if you want to avoid overspending and sending your account into overdraft while you’re abroad. Using a prepaid card keeps your overseas travel expenses separate from your bank account funds that are tied to your debit card.

A prepaid card works similarly to a gift card that you can load funds onto through electronic transfers. With a prepaid card, specifically, you can set up direct deposit from your paychecks to fund the card. While most prepaid cards don’t offer credit card benefits like cash back or points, some prepaid cards actually do.

The PayPal Prepaid Mastercard® allows you to move money from your PayPal account to fund your prepaid card. This card also allows you to earn cash back for your purchases and can be used anywhere debit Mastercards are accepted — including in other countries.

NetSpend is another popular prepaid card that can be used in place of an international credit card. The NetSpend® Visa® Prepaid Card has no ATM withdrawal limits and allows international transactions as well as account-to-account transfers and additional loads.

The process of getting a prepaid travel card for international use is similar to applying for a credit card or bank account. You can often apply online once you find a card you’re interested in and submit your basic information.

You may also need to include your income and employer information, but there are no credit check or credit score requirements. You’ll also need to determine how you will fund your card, whether through direct deposit from your paycheck, online transfers from an external bank account, mobile check, or wire transfer.

The one downside of using prepaid cards, especially when traveling, is that you may incur extra fees if you’re not careful. Some of these fees include:

- Loading your card (NetSpend typically charges $2 to $3.95 when you wish to purchase a reload pack)

- Withdrawal fee (for out of network ATMs)

- Monthly service fee

- Foreign transaction fee

Unfortunately, most prepaid cards don’t waive the foreign transaction fee. Be sure to carefully weigh the pros and cons before considering a prepaid travel card for international use.

Which Issuers Are Most Widely Accepted Worldwide?

The most widely accepted card issuers are the two you probably hear about most — Visa and Mastercard. If a merchant accepts credit cards, odds are they will take a Visa or Mastercard.

According to Statista, over 800 million Visa cards were used worldwide in 2020, with over 340 million being used in the U.S. during that time. Visa can be used in more than 200 countries and territories.

Mastercard is actually accepted in more locations and among more merchants than Visa. Mastercard operates hundreds of corporate offices worldwide and is available in more than 210 countries and territories.

In terms of the most commonly used international credit card company or bank, this can’t be narrowed down to just one card. Capital One does not have foreign transaction fees so their credit cards are often widely used internationally. However, you can choose from a wide variety of credit card options that don’t have foreign transaction fees.

As you’re planning a trip abroad, you may want to research your location and see how common credit cards are there. Plan your itinerary with this in mind if you want to use a card that doesn’t charge a foreign transaction fee. In most cases, you should be fine so long as the merchant accepts Visa or Mastercard.

Compare the Best Credit Cards To Use Abroad

Using a Mastercard or Visa credit card with no foreign transaction fees can save you a lot of money when you’re traveling abroad. The good news is that many rewards credit cards have no transaction fees and offer other useful benefits that you can use while traveling.

Not only can you earn points and cash back for your spending out of the country, but your money will also be protected more closely than if you had cash and your trip may be eligible for insurance. It’s well worth it to compare some of the best credit cards to use abroad to see which one will work for your needs and preferences.

Book accommodations with your credit card and plan out your spending with ease knowing that you won’t pay extra unnecessary fees on transactions made while you’re abroad.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Study Abroad Credit Cards for Students ([updated_month_year]) 9 Best Study Abroad Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/Best-Study-Abroad-Credit-Cards.jpg?width=158&height=120&fit=crop)

![11 Best Prepaid Cards to Use Abroad ([updated_month_year]) 11 Best Prepaid Cards to Use Abroad ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/06/Best-Prepaid-Cards-Abroad.jpg?width=158&height=120&fit=crop)

![5 Travel Credit Cards For Bad Credit ([updated_month_year]) 5 Travel Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Travel-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Hotel Rewards Credit Cards ([updated_month_year]) 7 Best Hotel Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/01/hotels.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for International Travel ([updated_month_year]) 12 Best Credit Cards for International Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/credit-cards-for-international-travel-feat.jpg?width=158&height=120&fit=crop)

![8 Best Travel Credit Cards for Students ([updated_month_year]) 8 Best Travel Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Best-Travel-Credit-Cards-for-Students-1.jpg?width=158&height=120&fit=crop)

![7 Best Vacation Credit Cards ([updated_month_year]) 7 Best Vacation Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/vacation.png?width=158&height=120&fit=crop)

![8 Best Credit Cards to Use in Europe ([updated_month_year]) 8 Best Credit Cards to Use in Europe ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/europe.png?width=158&height=120&fit=crop)