Capital One cards for bad and fair credit are a great way to get your foot in the door with one of the biggest card issuers in the world. These cards not only give you access to a revolving credit line, but they’re also a form of dress rehearsal for an eventual upgrade to a more lucrative rewards card.

Since Capital One has one of the most robust credit card portfolios in the business, starting your credit building journey with the Virginia-based bank is a smart move. Not only will you be eligible for future card upgrades with responsible use, but you can work toward regular credit limit increases and other perks you can only find through Capital One credit cards.

Bad Credit | Fair Credit | FAQs

The Best Capital One Card For Bad Credit

Capital One’s lone option for bad credit consumers is the Capital One Platinum Secured Credit Card, and it is one of the best subprime credit cards in the industry. Unlike other cards that match your credit limit to the refundable security deposit you are required to make, your credit score will determine the amount of the security deposit. That means the required deposit amount may only be a fraction of the total credit limit.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

And unlike other secured credit cards, Capital One will regularly monitor your account to see whether you qualify for a higher credit line with no additional deposit necessary. You may also qualify over time for an upgrade to one of the bank’s many unsecured credit card options, in which case Capital One will refund your deposit as a statement credit and transition your account automatically.

Capital One Cards For Fair Credit

Your card options increase once your FICO credit score enters the fair credit territory. The options below are all unsecured credit cards — which means you don’t need to pay a refundable security deposit for approval.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Platinum Credit Card is the bank’s entry-level card for consumers who have average credit or fair credit. While that may not seem exciting on the surface, this card has some great credit-building muscle under the hood.

Capital One reports your balance and payment history to each of the three major credit bureaus, which means you can build credit quickly with responsible behavior. The bank will also regularly monitor your account and increase your credit line — at no extra charge — if you qualify.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

The Capital One QuicksilverOne Cash Rewards Credit Card offers cash back rewards on all your purchases. Depending on how much you spend — and whether you pay your balance in full each month — you can actually make money off this card.

And, like the other cards on this list, your responsible behavior can put you in line for a card upgrade or a higher credit line over time. You’ll also receive free access to the award-winning CreditWise® app that lets you track changes to your credit score.

Can I Get a Capital One Card With Bad Credit?

A bad credit score doesn’t have to be a financial death sentence — especially if you choose the right credit card for bad credit to get you out of credit’s lower depths.

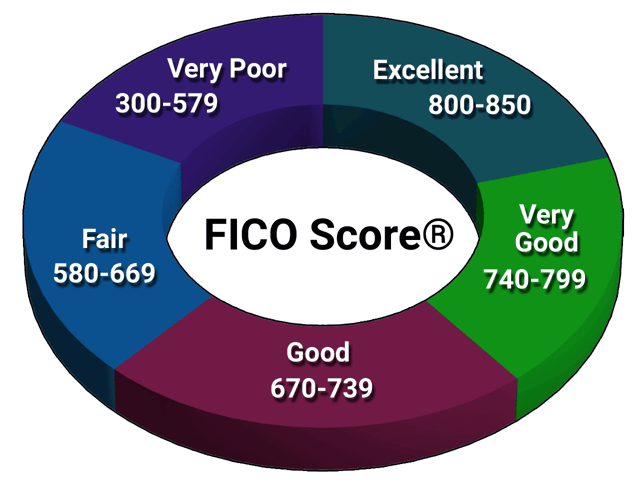

Your FICO credit score can range between 300 and 850. Any score at or below 579 is considered bad credit. If that’s your current standing, your only option may be a secured credit card.

Capital One offers credit cards for all credit scores.

Thankfully, the Capital One Platinum Secured Credit Card is one of the best in the business. Secured cards require a refundable security deposit for approval. The amount of your deposit will typically match the amount of your new card’s spending limit. So an $800 deposit will yield an $800 spending limit.

Capital One issues secured cards differently, though. All new cardholders start with the same credit limit. The amount of your required deposit will depend on your credit score. It’s possible that you may only need to pay a deposit that is a fraction of your card’s spending limit.

And unlike other secured card offerings, Capital One offers regular credit limit increases for cardholders who qualify. Starting at six months after you open your card, the bank will monitor your account to see whether you meet its standards for a higher credit limit. If you do, it will boost your spending power with no additional deposit required.

Over time, you may also qualify for an upgrade to one of Capital One’s many unsecured credit cards. When that happens, the bank will process the change at no cost to you and refund your security deposit in full.

Despite the required security deposit, your secured credit card will function the same way a credit card does. That means you can use it to make in-store or online purchases, rent a car or a hotel room, pay bills, and have access to a full revolving line of credit.

And whether you upgrade your card or not, you will receive a full refund of your security deposit if you cancel your card with no outstanding debts. If you’re carrying a balance at the time you close your card account, Capital One will subtract that amount from your deposit and refund the rest via a paper check or an electronic funds transfer to your linked bank account.

How Do I apply for a Capital One Credit Card?

Capital One makes it very easy to apply for — or prequalify for — one of its many credit cards through an online application.

You can access the application for the card of your choice through the direct links above or via Capital One’s website. Once there, you can see whether you prequalify for a card using a short online form.

This form will require your basic identifying and financial information — including your name, home address, email address, phone number, Social Security number, and income information. Capital One will use this information to conduct a soft credit pull that will not harm your credit score. This provides the bank access to a modified version of your credit file that gives it a general idea of your ability to qualify if you officially apply for the card.

This entire process typically takes less than five minutes to complete.

You can prequalify and apply for cards directly on Capital One’s website.

If you prequalify, the bank will invite you to apply for the card you’re considering. The official application will still only take a few minutes to complete and can return a near-instant credit decision. Capital One will use any of the three major credit bureaus to conduct a full credit check under your name. This will leave a hard inquiry on your credit report.

If you’re approved, the website page will refresh to reveal your account information and credit limit. Capital One will then print your new credit card and send it to you in the mail. The card typically arrives within seven to 10 business days.

Once you receive your card, you can activate it online or over the phone and immediately begin using your account. You can also download, and sign up for, the Capital One mobile application as soon as the bank approves your application.

Keep in mind that prequalifying does not guarantee that you’ll receive the card when you officially apply. On rare occasions, your full credit check will reveal negative details that were not apparent during the soft credit pull. The bank reserves the right to reject your application even after a prequalifying approval.

If your application is not approved, Capital One will send you an adverse action notice in the mail that details its reasoning for the decision. You should receive this letter within seven to 10 business days.

What Credit Score Do You Need for a Capital One Card?

Like most banks, Capital One does not publicize its minimum credit requirements for approval. But that doesn’t mean that you can’t find a few hints sprinkled around to give you an idea of your ability to qualify.

For example, the Capital One Platinum Secured Credit Card accepts applications from consumers who have bad credit. That means a FICO credit score at or below 579.

The Capital One QuicksilverOne Cash Rewards Credit Card and Capital One Platinum Credit Card both consider applicants who have fair credit, average credit, or limited credit. That typically equates to a FICO score of between 580 and 669.

The cards in this review are generally for credit scores of 669 and below.

Just remember that your credit score is only one facet that the bank considers when viewing your credit card application. Capital One could decide to accept or reject your application regardless of your credit score.

This may happen if you have a good credit score, but too much current debt to afford another credit line. On the other hand, you may have average credit, but a strong recent payment history and little or no debt. In that case, you’d be a good candidate for a credit card.

The bank also looks at the age of any financial mistakes you’ve made. For example, late payments can live on your credit report for seven years. But a late payment that is five years old will have less impact on your credit score than one that is two months old.

To put yourself in a prime position for the desired application approval screen, make sure that any negative items on your credit report are in the distant past. If you have recent negatives, you may want to wait before applying so you can add some positive items to your credit history first.

Before you apply, consider pulling your free annual credit reports from annualcreditreport.com. These reports won’t show your actual credit score but they will show all of the items that make up your credit score. Use these reports to determine the best timing for your application.

You can also attempt to prequalify for a Capital One secured card or unsecured card through the bank’s website. While a prequalification isn’t a guarantee of approval, it will give you peace of mind before you hit the submit button on your official application.

What is the Best Capital One Card For Beginners?

If you’re a complete newcomer to credit, the Capital One Platinum Credit Card is your best bet to set a solid financial foundation for yourself.

This card does not have all of the bells and whistles that other cards have, but it does provide a competitive interest rate, no pesky fees, and regular credit bureau reporting that can help you build your credit score faster.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

This card is also a very good entry point into Capital One, which can lead to more lucrative card offers in the future.

When looking for your first credit card, don’t get enamored with the glitzy cash back or points rewards, or promises of rebates for when you make large purchases. The truth is, those perks rarely pay off with first-time credit cards.

For starters, those cards typically have lower credit limits and an annual fee. You have to rack up a substantial amount in charges just to cover the cost of the fee — and that’s if you pay your balance in full and on time each month. If you carry a balance each month and encounter interest rate charges, you’re only digging yourself deeper into a hole.

For example, let’s consider an average starter rewards card with a $300 credit limit, a 1.5% cash back rate, and a $39 annual fee.

While that annual fee may not sound like a large impediment to accessing rewards, you have to consider how much cash back you can earn with this card.

At 1.5%, you would have to charge $2,600 to the card each year — or roughly $217 per month — just to break even. And that’s only if you don’t rack up finance charges. That means you would have to use up most of your available credit and pay it off nearly every month just to recover your annual fee.

That may not be a big deal for some people. For others, it could be a way to build a balance that’s hard to pay off.

You should never go into debt just to accumulate rewards — but there’s certainly a lot of temptation out there to do so. That’s why it may be wise to wait until your second credit card to jump into the rewards game. Use your first credit card to get your feet wet and learn from potential mistakes.

With the Capital One Platinum Credit Card, those mistakes won’t be nearly as costly.

What is the Easiest Capital One Credit Card to Get?

If you only consider its ease of approval, the Capital One Platinum Secured Credit Card is the easiest card in the bank’s portfolio to obtain.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

While some secured credit cards don’t require a credit check for approval, this card requires access to your credit report when you apply. This hard credit check determines the amount of refundable security deposit you must pay to open your account.

That’s what truly sets this card apart from other secured card options. Based on your creditworthiness, your security deposit may not have to match your initial credit limit.

And with responsible usage over time, you can also earn a higher credit limit at no extra charge. When you also consider that you can eventually qualify for an upgrade to an unsecured credit card from Capital One, this is a no-brainer for building credit.

A secured card allows you to grow your credit score by reporting your balance and payment history to each credit bureau that compiles a credit score under your name. With on-time payments and a continuing low balance, you can watch your credit score increase over time.

If a secured card isn’t your thing, the Capital One Platinum Credit Card is a great unsecured card option for credit newcomers.

This card considers applications from consumers who have average credit, fair credit, and limited credit. That rules out those who have bad credit, but offers a valuable financial tool for those who are just starting out and want to begin building their credit.

Remember that you can also attempt to prequalify for any of Capital One’s credit cards without harming your credit score. Just hit the links to the card you’re interested in and fill out the short form to see whether you qualify. This process takes less than five minutes to complete, and you can do it at any time of the day or night.

While prequalifying does not guarantee acceptance once you officially apply, it is typically a good indicator of success.

Which is Better: Capital One Platinum or Quicksilver?

Choosing the better option between the Capital One Platinum Credit Card and the Capital One QuicksilverOne Cash Rewards Credit Card comes down to your spending habits and ability to repay your debt in full each month.

Both cards have a nearly identical interest rate and benefits package for all cardholders. The main difference between the two is that QuicksilverOne charges a small annual fee for access to a flat and unlimited rate of cash back rewards. The Capital One Platinum Credit Card doesn’t offer rewards, but it doesn’t charge an annual fee either.

That rewards-and-fee combo will either make the card worth your while — or make it one to avoid.

You have to pay your entire credit card balance in full each month to truly maximize your rewards earnings with any credit card. Every charge you make has a grace period during which you can pay it off and not incur finance charges.

It’s important to take advantage of that grace period because your interest rate will always be substantially higher than your rewards rate. Even one month of interest charges can negate several months of cash back rewards earnings.

With the Capital One QuicksilverOne Cash Rewards Credit Card, you must make at least $2,600 in charges on your card each year just to recoup the cost of the annual fee. That comes out to approximately $217 each month in spending. Once you surpass that number, you can actually make money using this card — but again, that only happens if you avoid all finance charges.

And you may be able to surpass that number without maxing out your card, as the Capital One QuicksilverOne Cash Rewards Credit Card has one of the highest potential starting credit limits for consumers with fair credit.

If you’re more of an occasional spender and don’t plan to charge a lot to the card, you’re better served by skipping the annual fee and starting your credit-building journey with the Capital One Platinum Credit Card. This card offers all of the benefits and access you’d want in an unsecured card — only you don’t have to pay for membership.

Both cards are part of Capital One’s popular automatic credit limit increase program. With this free incentive, the bank will continually monitor your account to see whether you qualify for a credit limit increase. If you do, Capital One will boost your credit limit at no extra cost to you.

Either card will also give you access to Capital One’s handy mobile application for tracking your spending and making monthly payments. You’ll also get free access to CreditWise, Capital One’s tool for tracking any changes to your credit rating and creating a plan to get your score to where you want it.

How Much Does Capital One Increase Your Credit Limit After 5 Months?

Capital One only considers new cardholders for a credit limit increase after six months with an account.

There was a time when the bank offered automatic credit limit increases to new cardholders who made their first five payments on time, but this has since been replaced with six-month monitoring. The amount of your increase — if any at all — will depend on several factors:

- Your current balance: If you maintain a large balance on your card, Capital One may decide not to give you access to more credit. A credit limit increase is typically reserved for cardholders who maintain a low — or no — balance.

- Your payment history: You’ll need a spotless record of on-time payments to get access to a higher credit limit. One late payment will totally disqualify you from this perk.

- Your credit score: Even if you kept your balance low and made only on-time payments, you can still fail to qualify for a credit line increase if you had late payments or negative marks on other accounts that made your credit score decrease from where it was when you opened your account.

- Your income: Capital One will require you to provide your current income totals prior to monitoring your account for a credit limit increase. You will only qualify if the bank deems that you can afford the extra potential debt you’d add to your monthly budget.

If you check off all of these boxes, there’s still no way of telling exactly how much of an increase you’ll earn. Many of the Capital One credit cards for fair or limited credit start off with a credit limit of around $200 or $300. With six on-time payments, you could boost that limit to $500 or more.

But this is totally at Capital One’s discretion and isn’t guaranteed.

You can also request a credit limit increase on your own without Capital One’s regular monitoring. While this sometimes results in a successful increase, it likely will not work prior to your six-month anniversary with the card.

Does Capital One Build Your Credit?

Capital One provides all of the tools you need to improve your credit score. With responsible behavior, you can use these tools to improve your credit report over time.

But just having a Capital One credit card will not add points to your credit score. You have to maintain a low balance and make all of your payments on time.

Every month, Capital One reports your balance and payment history to each credit bureau — TransUnion, Equifax, and Experian. The bureaus use this information to help calculate your current credit score.

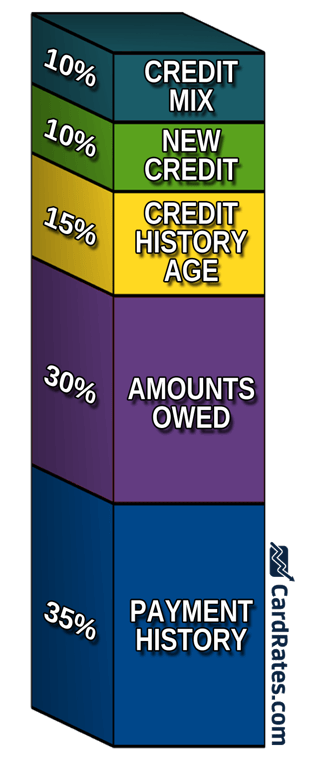

Approximately 30% of your credit score is based on the amount of money you owe. As your total debt increases, your credit score decreases. So, if you allow your Capital One credit card to carry a large balance from month to month, you can expect your credit score to suffer.

Approximately 30% of your credit score is based on the amount of money you owe. As your total debt increases, your credit score decreases. So, if you allow your Capital One credit card to carry a large balance from month to month, you can expect your credit score to suffer.

On the other hand, if you pay your balance in full each month, your credit score will improve due to your excellent credit utilization rate.

Your payment history also accounts for 35% of your FICO credit score calculation. On-time payments increase your credit score, a single late payment can deduct as many as 100 points from your total credit score.

Late payments are reported to the credit bureaus as 30 days late, 60 days late, and 90 or more days late. You won’t experience any harm to your credit score until you’re at least 30 days late. If you miss your payment by a few days, you’ll likely encounter a late payment fee, but the error won’t be reported to a credit bureau.

As you may expect, more damage is inflicted on your credit score the longer you go without making a payment. A 90-or-more-days late payment can quickly lead to a charge-off or collections account, which lives on your credit report for seven years.

To avoid these problems, you should contact your lender if you’re having trouble making your monthly payment. In many cases, you can create a plan to get back on track without negative credit reporting.

But if you make your payments on time and keep your balance low, your new Capital One credit card will report nothing but positive data to each credit reporting bureau, which will quickly get you on your way to building a good credit score.

How Often Does Capital One Automatically Increase Your Credit Limit?

Capital One does not guarantee credit limit increases for cardholders, but the bank actively monitors all of its accounts and considers consumers for a higher credit limit starting at six months after card activation.

Once you receive a credit limit increase, the bank will likely not accept another request for a higher credit limit for another six months.

This is all part of the bank’s automatic credit limit increase program that provides active monitoring and spending limit adjustments based on your account history and credit score. To qualify, you must maintain a low account balance, make only on-time payments, and have no other negative credit reporting from other credit cards, loans, or banks.

While automatic monitoring is a convenient way to potentially receive credit limit increases, you can also request a higher credit line through Capital One’s website, call center, or mobile application.

To request a credit limit increase after logging into your card account through the mobile application:

- Click the “Profile” icon on the bottom right of the screen

- Tap the link for “Account Settings and features”

- Tap the “Request Credit Line Increase” link

- Choose the card account you’re requesting an increase on, enter your annual income, employment status, and monthly mortgage/rent payment amount. You can optionally add your monthly spend with credit cards.

- Drag the slider to the right to complete your request.

The mobile app typically processes your request in a matter of seconds. If you receive the credit line increase, the change will take effect immediately.

Through Capital One’s website interface, you can log onto your credit card account and:

- Click the “I want to…” link on the right side of your screen

- Click “Request credit line increase” near the bottom of the box

- Enter your annual income, employment status, occupation, monthly mortgage or rent payment, how much you plan to spend each month on the card, the maximum desired credit line, and the reason why you’re requesting the credit line increase

- Just like through the mobile app, the website will process your request in a matter of seconds and update your credit line if you’re approved.

If you’d rather speak to a human when requesting a credit line increase, you can call the number listed on the back of your Capital One credit card.

You may notice that the website interface asks more questions and goes into more detail about your request. You may be better served using the website or calling customer service if you have a specific credit limit in mind that you’d like. The bank will simply decide how much of an increase — if any — it wants to give you.

There’s currently no limit as to how often you can request a credit limit increase, but Capital One typically won’t consider your request if it has increased your credit line within the last six months.

Does Asking For a Credit Limit Increase Hurt Your Credit Score?

Since you already have a Capital One credit account, the bank will not conduct a full credit check to see whether you qualify for a credit limit increase. This means asking for a credit limit increase will not impact your credit score.

A credit card company may conduct a soft credit pull to look at your account’s payment history, your balance, current income, and regularly occurring monthly bills to see whether you qualify — and can afford — a credit limit increase. This all happens within the bank’s underwriting system and will not involve your credit report.

The only way a credit limit increase will affect your credit score is if you’re approved for a higher spending limit. The new limit will be reported to the bureaus within one month, which should improve your credit utilization rate and, consequently, your credit score.

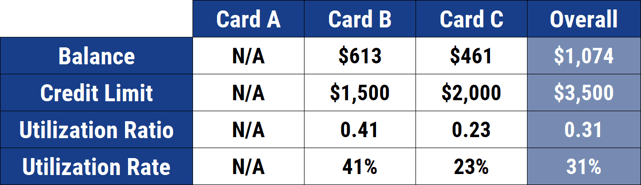

You can calculate your credit utilization rate by dividing your current credit card balance by your total spending limit. For example, a card with a $1,000 spending limit and $500 balance has a 50% credit utilization rate. In short, you’re using 50% of your available credit.

A general rule of thumb is that lenders don’t like to see applications from cardholders who have a credit utilization rate of over 30%. The higher your ratio, the less you have leftover to cover new debts. A high utilization ratio could result in denial of new credit or a credit limit increase.

An example of credit utilization across three card accounts.

This is why a bank such as Capital One will ask for your income and monthly mortgage or rent payments when processing a credit line increase request. By factoring in your debts — and the income you have to repay those debts — it can get a better idea of your ability to take on increased debt.

What Fees Does Capital Charge?

Each card in the Capital One portfolio has its own unique fees. For example, you may find two cards that both charge an annual fee, but the fee amounts are different.

Be sure to look at the rates and disclosures documentation before officially applying for any credit card so you know what fees are charged by the card. But, in the meantime, here is a list of common credit card fees:

- Annual fee: This is a charge that is posted to your account automatically on or around your account anniversary. It is most commonly found on subprime credit cards and on cards that offer high rewards rates.

- Balance transfer fee: Without 0% intro APR balance transfer offers, you can expect to pay no balance transfer fees at the transfer APR.

- Foreign transaction fee: Some cards will charge a foreign transaction fee if you conduct a transaction in a foreign currency. This fee typically equals a percentage of the transaction total and covers the cost of converting the currency.

- Late payment fee: Just about every credit card will charge a late payment fee if you submit your payment after the due date. Some cards may also impose a penalty APR that increases your interest rate after a late payment.

- Cash advance fee: This fee occurs when you withdraw cash from your card account at an ATM machine or bank teller’s window like you would with a debit card — also known as a cash advance. The fee is typically a set amount that varies by card type. A cash advance also has a higher interest rate than a regular purchase and no grace period — which means you start accruing interest charges as soon as you have cash in hand.

- Returned payment fee: If you submit a payment that isn’t approved by your bank — often because of insufficient funds in your checking account — you can expect this fee.

While these fees aren’t standard on all card accounts — and the fee amounts will vary by card type and card issuer — you should expect that you’ll incur some sort of fee for many of these occurrences.

Does Capital One Approve You Instantly?

Capital One makes near-instant credit decisions for most of the consumers who apply online. Once you submit your application, Capital One uses automated underwriting software to process your request and updates your application screen with a decision in 30 seconds or less.

If you’re approved, the bank will provide your account details, including your new card’s credit limit. You can then download and sign up for an online account through Capital One’s mobile application. Capital One will then print and mail your new card, which should arrive within seven to 10 business days.

If you’re not approved, the bank must send you an adverse action notice within seven to 10 business days that outlines its reasons for rejecting your application.

At times, the automated underwriting process may flag your application and require someone to manually review it. This could happen if your stated address doesn’t match the address on your credit report or if the bank sees irregularities in your application.

This isn’t always a negative thing. In many cases, the bank may request supporting documentation that a manual underwriter will view to make a credit decision within a few days.

Does Paying Your Balance In Full Build Your Credit Score?

Maintaining a low credit balance is a key component in turning poor credit into excellent credit. Your card issuer likes it when you make on-time payments in full because that gives the company more money to lend out.

Also, when you maintain a $0 card balance after paying your balance in full each month, you’ll maintain an excellent credit utilization rate that will reflect well on your monthly credit score updates.

While you should aim for a $0 balance with your credit card accounts, be sure to use your cards from time to time. Some card issuers will cancel your credit card if it remains inactive for a prolonged period of time. This can lower your total available credit — also lowering your credit utilization and credit score.

To make sure your card doesn’t go inactive, charge a small purchase to it every few months and pay off the charge as soon as it posts to your account.

As long as you periodically use your credit card, the card issuer will not cancel your account due to inactivity.

Can I Upgrade My Capital One Platinum Credit Card to Quicksilver?

A major perk of starting your credit building — or rebuilding — journey with Capital One is that you could eventually qualify for card upgrades to more robust cards in the bank’s portfolio.

A good example of this is if you were to move from the entry-level Capital One Platinum Credit Card to the Capital One QuicksilverOne Cash Rewards Credit Card.

Upgrading to the Capital One Quicksilver Cash Rewards Credit Card is possible when you’ve exhibited creditworthy behaviors and are in good standing with the bank.

You may qualify for this upgrade after you prove your responsibility and creditworthiness with your current Capital One card. In most cases, the card issuer will not consider an upgrade — also known as a product change — request until you’ve had your account for at least six months. To request an upgrade, call the number on the back of your card and speak to a customer representative about the card you’re interested in getting.

If you’re approved, Capital One will process the change immediately and send your new card in the mail.

Is it Bad to Apply for Two Credit Cards at Once?

There’s no rule or law that states how many credit cards you can have in your wallet. As a result, you can apply for more than one credit card account at a time. But before you do, consider the implications of submitting several applications in quick succession.

Capital One, for example, only allows you to have two if its branded cards in your name at a time. If you attempt to apply for a third — even if you have excellent credit — you will not qualify.

The Chase 5/24 rule states that the bank will not consider your application for new credit if you have five or more new bank card accounts (credit or charge cards) opened within the last 24 months.

Submitting several credit applications at once also increases the number of hard inquiries you have on your credit report. Inquiries live on your credit profile for two years and can lower your credit score if you have more than three.

Which Credit Card Will Approve Me With No Credit?

If you’re just starting out and want to establish your credit history, your best bet is to look at credit cards designed for no credit history. You can choose to apply for a secured or unsecured credit card in this category, and either will help you develop your first credit score.

Just keep in mind that these cards may charge higher-than-average fees because the bank cannot properly gauge the risk it’s taking on by extending credit to someone who has no credit history.

Once you’ve proven your creditworthiness, you can attempt to upgrade your card through the same card issuer or apply for a new card with a different bank that offers better rates and rewards.

Compare Capital One Cards for Bad & Fair Credit Online

Capital One is one of America’s largest credit card issuers for many reasons. Not only does the credit card company provide secure and reliable lines of credit, but it’s also one of the largest auto lenders in the country.

Whether you have made previous financial mistakes or want to build your credit score for the first time, you can’t go wrong with Capital One cards for bad and fair credit. With both secured card and unsecured card offerings, Capital One can provide an option for just about any consumer.

Just make sure you keep your balance low and always submit your payments before their due date. Capital One reports account data to each of the major credit reporting bureaus. That means you’ll build credit and be on your way toward upgrading to an even better Capital One card with robust cash rewards or travel rewards and a higher spending limit.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Easiest Approval Cards For Fair & Bad Credit ([updated_month_year]) 8 Easiest Approval Cards For Fair & Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Easiest-Approval-Cards-For-Fair-Bad-Credit.jpg?width=158&height=120&fit=crop)

![Capital One® Cards For Fair Credit in [current_year] Capital One® Cards For Fair Credit in [current_year]](https://www.cardrates.com/images/uploads/2020/09/shutterstock_124031281.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![6 Credit Cards for Students with Fair Credit ([updated_month_year]) 6 Credit Cards for Students with Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Credit-Cards-for-Students-with-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year]) 7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1092414950-1.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: Instant Approval ([updated_month_year]) 7 Credit Cards for Fair Credit: Instant Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Credit-Cards-For-Fair-Credit-With-Instant-Approval.jpg?width=158&height=120&fit=crop)