Credit card issuers must find consumers with fair credit a challenging bunch. “Fair” credit occupies that murky territory between bad and good, where creditworthiness is somewhat suspect. The issuer’s task is to balance the risk of cardholder default with the need to compete for the overwhelming majority of fair-credit consumers who pay their bills on time.

For some issuers, the answer is to offer modest cash back rewards coupled with high APRs, nuisance fees, limited perks, and/or security deposits. We’ve rounded up the cream of the crop for this review to help you judge how well the credit card companies accomplished their balancing acts.

We’ve divided the reviewed offerings into groups of unsecured, secured, and student credit cards for fair credit. Use them responsibly, and you’ll likely reascend into good-credit territory within a reasonable time.

Unsecured Cash Back Cards For Fair Credit

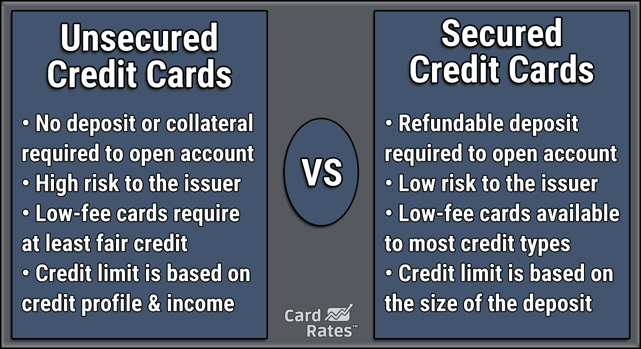

The following cards are for consumers who don’t favor forking over a few hundred dollars of collateral just to get a credit card. That’s fine, but be aware that you will face higher interest rates and fees with these unsecured cards than you would by making a refundable deposit on a secured credit card.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn’t expire for the life of the account. It’s that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

4. Revvi Card

- Earn 1% cash back rewards^^ on payments made to your Revvi Credit Card

- Perfect credit not required

- $300 credit limit (subject to available credit)

- Checking account required

- Opportunity to request credit limit increase after twelve months, fee applies

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair

|

These unsecured cards offer cash back on all eligible purchases that may include limited bonus rewards on select merchant categories. In return, you’ll likely pay an APR of about 30% (or more) if you stretch your payments across multiple billing periods. We advise you to avoid the interest by charging only the amount you can afford to repay each month.

If you have fair credit, your reaction to this collection of credit cards may hinge on your previous credit category. If you clawed your way back up from the bad-credit badlands, you may view these offerings as a justified reward acknowledging your journey toward decent credit.

If you’ve fallen from good credit, you may consider these cards as punishment, justified or not, for unfortunate financial circumstances.

Our take is straightforward: These fair-credit credit cards provide reasonable value, especially if you can avoid interest charges by paying your bill in full each month. And modest cash back is better than none at all.

Secured Cash Back Cards For Fair Credit

Secured cards are easy to get and usually offer better perks than those offered by their unsecured siblings. You may prefer to make a refundable deposit for one of these instead of facing higher, nonrefundable fees on unsecured cards for fair credit.

- No annual or hidden fees, and you can earn unlimited 1.5% cash back on every purchase, every day. See if you’re approved in seconds

- Put down a refundable $200 security deposit to get a $200 initial credit line

- Building your credit? Using a card like this responsibly could help

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

- Earn 1% Cash Back Rewards on payments made to your First Latitude Secured credit card account.

- Past credit issues shouldn’t prevent you from getting a credit card with great benefits & rewards!

- Choose your own fully-refundable credit line – $200 to $2000 – based on your security deposit.

- Build or rebuild your credit!¹

- Accepted wherever Mastercard® is accepted

- Reports to all 3 credit bureaus

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.24% (V)

|

$39.00

|

Poor/Limited/No Credit

|

- Earn unlimited cash back while building credit for the future. Start with a security deposit of $300 to $5,000.

- Earn 5% cash back on your first $2,000 in combined eligible purchases each quarter in two categories you choose, 5% cash back on prepaid air, hotel, and car reservations booked directly in the Rewards Travel Center, 2% back on eligible purchases in your choice of one everyday category (like gas stations and EV charging stations, grocery stores and restaurants), and 1% back on all other eligible purchases.

- Use your card everywhere Visa is accepted. Your secured card works and looks like any other credit card.

- Choose your payment due date and enjoy zero fraud liability for unauthorized transactions.

- No annual fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.49% Variable

|

$0

|

None/Bad

|

The APRs on these cards aren’t dramatically lower than those on the reviewed unsecured cards. But the average cash back rewards are a bit more generous, and the fees are somewhat lower. Pay on time and your card will likely refund your deposit within a year of account opening.

Student Cash Back Cards For Fair Credit

Student credit cards are the best deal in the industry. You don’t need good credit (or any credit at all) or to pay any annual fees or deposits. The APRs are substantially lower than those that come with the non-student versions, and the cash back rewards are more generous. If you qualify, these cards are something you shouldn’t pass up.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% – 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% – 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it’s misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% – 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% – 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), with 1% on all other purchases

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

To qualify for these cards, you must be a student, but issuer standards differ. For example, these issuers require you to enroll in a two- or four-year college, but only Capital One lets you keep your card if you lose student status. In all cases, you must be at least 18 years old and have enough income to pay your monthly bill.

What Is Fair Credit?

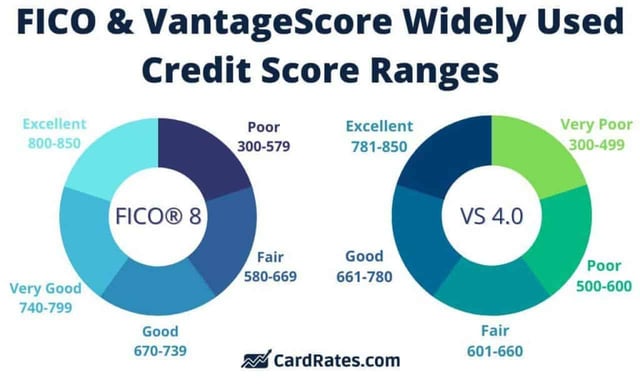

Fair credit refers to a credit score within a specific range, typically between 580 and 669, depending on the credit reporting agency (i.e., FICO or VantageScore). A fair score is below the average credit score but is not necessarily good or bad. It may limit your ability to obtain credit or loans at favorable interest rates.

Lenders and financial institutions use credit scores as a measure of creditworthiness. A fair credit score suggests that a consumer may be a higher-risk borrower than someone with a good or excellent credit score. As a result, individuals with fair credit scores may have to pay higher interest rates on loans or credit cards, or creditors may deny them credit altogether.

You can improve a fair credit score by consistently paying on time, keeping credit card balances in check, and avoiding opening too many new credit accounts simultaneously. When you build credit, you increase your access to loans and credit cards with better terms.

What Is a Cash Back Credit Card?

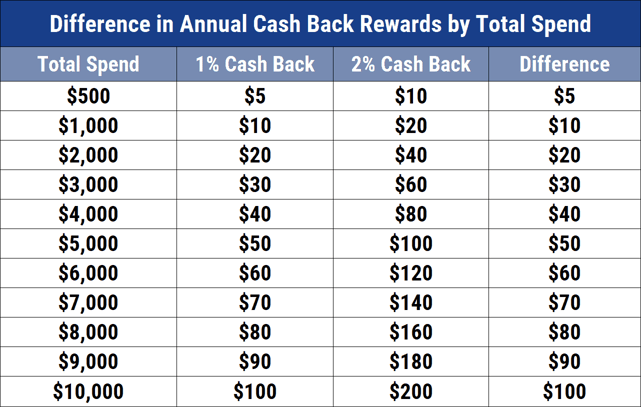

A cash back credit card is a type of credit card that rewards cardholders for their purchases with cash back, typically as a percentage of the amount spent. For example, a cash back credit card may offer 1% cash back on all purchases, which means that for every $100 spent, the cardholder would receive $1 in cash back rewards.

Cash back credit cards can be helpful for consumers who use them regularly to earn rewards for their spending. Some cash back credit cards offer higher cash back rates on specific spending categories, such as groceries, gas, or travel. Others offer a flat cash back rewards rate on all purchases.

Typically, you can redeem cash back rewards as statement credits, direct deposits to a bank account, or as a check. Some cash back credit cards may also offer additional benefits such as travel rewards, purchase protection, and extended warranty coverage.

Cash back credit cards are often best for consumers who pay their credit card balance in full each month. If you carry a balance on your credit card, you’ll pay interest on your purchases, which can offset the value of any cash back rewards you earn.

How Do I Apply For a Cash Back Credit Card?

To apply for a cash back credit card, you’ll need to research available offerings and ensure you meet the eligibility requirements. You can apply online, and if the issuer approves your application, expect the card to arrive in a week to 10 days.

These are the steps to apply for a cash back credit card:

- Research available cash back credit cards: Look online at reviews such as this one or speak to your bank or credit union to find the best credit card for your spending habits and credit profile.

- Check eligibility requirements: Review the eligibility requirements for the cash back credit cards you’re interested in to ensure you meet the prerequisites, including minimum credit score.

- Compare offers: Compare the cash back rates, annual fees, and other features of each cash back credit card you’re considering.

- Fill out an application: Once you’ve selected the best credit card for your needs, complete an application online or in person. You’ll need to provide personal information, including your name, address, Social Security number, and employment details.

- Wait for approval: After submitting your application, the credit card issuer will review your application and credit history to determine your eligibility for the cash back credit card. You may receive an approval decision instantly or within a few days.

- Activate your card: If your application is approved, you’ll get your new cash back credit card in the mail. You’ll need to activate your card before you can start using it.

- Start earning cash back rewards: Once you’ve activated your cash back credit card, start using it for purchases to earn cash back rewards. Be sure to pay off your balance in full each month to avoid interest charges and to maximize your cash back rewards.

All the reviewed credit cards should be within reach if you have fair credit. The secured and student cards may have even more lenient conditions, including accepting applicants with very bad credit.

What Credit Score Do I Need to Get a Cash Back Credit Card?

The credit score required to get a cash back credit card can vary depending on the issuer and the specific credit card you’re applying for. But, in general, you’ll need at least a fair credit score, which typically falls within the range of 580 to 669, to qualify. The average credit score hovers just north of 700.

Some cash back credit cards may require a higher credit score, such as a good or excellent credit score, typically within the range of 670 to 850. If you have a lower credit score or no credit history, you may need to apply for a secured card, which requires a deposit as collateral to secure your credit limit. A secured card is an excellent vehicle for rebuilding credit.

In addition to your credit score, the credit card issuer will consider other factors when reviewing your application, such as your income, employment history, and credit utilization.

Even if you have a high enough credit score to qualify for a cash back credit card, your credit limit and cash back rewards may be lower if you have a shorter credit history or a higher debt-to-income ratio. Be sure to read the terms and conditions of the cash back credit card you’re interested in to understand the credit requirements and how the rewards program works.

What Are the Pros and Cons of Cash Back Cards?

On the plus side are the (sometimes significant) rewards for spending, flexible redemptions, credit building, and additional benefits. Minuses include higher interest rates, extra fees, and the temptation to overspend.

Here are more details regarding the most notable advantages and disadvantages of using a cash back credit card.

Pros

- Rewards for spending: Cash back credit cards provide a way to earn rewards for spending money on eligible purchases you would make anyway.

- Flexibility: You can redeem cash back rewards in various ways, including a check, statement credits, or direct deposits to a bank account.

- Potential for significant rewards: Depending on your spending habits, you may be able to earn substantial cash back rewards over time.

- Additional benefits: Some cash back credit cards offer other benefits, such as purchase protection, travel rewards, or extended warranty coverage.

- You can build credit: The credit card will report your payments to at least one credit bureau, enabling you to build or rebuild credit over time.

Cons

- Higher interest rates: Cash back credit cards often have higher interest rates than other types of credit cards. If you carry a balance on your credit card, you may pay more money in interest charges than you earn in cash back rewards.

- Fees: Fair-credit cards usually carry plenty of expenses. Some cash back credit cards charge an annual fee, which offsets the value of any cash back rewards you earn.

- Limited redemption options: Some cash back credit cards restrict how and when you can redeem your rewards.

- The temptation to overspend: The lure of earning cash back rewards can tempt some people to overspend and potentially get into debt.

Whether a cash back credit card is best for you ultimately depends on your financial situation and spending habits. If you use credit cards responsibly and can pay off your balance in full each month, a cash back credit card can be a great way to earn rewards for your spending.

But if you tend to carry a balance on your credit card or are prone to overspending, a cash back credit card may not be your best choice.

How Do Unsecured, Secured, and Student Cash Back Cards Differ?

Cash back unsecured, secured, and student credit cards differ in several ways, including credit requirements, credit limits, rewards rates, and fees. Secured cards are easy to get but require a deposit, and you must attend college to get a student credit card.

Here’s a breakdown of how these types of cash back credit cards differ:

- Unsecured cash back credit cards: These are traditional credit cards that do not require collateral. They typically have higher credit requirements and offer higher credit limits and rewards rates than secured or student cash back cards. Unsecured cards may charge an annual, balance transfer, or foreign transaction fee.

- Secured cash back credit cards: A secured card requires a cash deposit as collateral to secure the credit limit. Secured credit cards are typically easier to qualify for than unsecured ones, making them a good option for people with limited credit history or bad credit. But secured cards usually have lower credit limits than unsecured ones. They may also charge annual fees, application fees, or other fees.

- Student cash back credit cards: These cards are specifically for students interested in building credit. Student credit cards typically have lower credit limits and rewards rates than unsecured cards. They may also offer special student perks, such as a higher rewards rate for spending on textbooks or school supplies, or a 0% APR on eligible purchases for at least six months following account opening. Many student cash back cards do not charge an annual fee. Invariably, student credit cards report to at least one credit bureau, a necessity for building credit.

When choosing a cash back credit card, consider your credit score, spending habits, and financial goals to determine which card type is right for you.

What Credit Limit Should I Expect From a Cash Back Card For Fair Credit?

The credit limit you can expect from a cash back credit card for fair credit can vary depending on the card issuer and your creditworthiness. Credit limits may range from $500 to $2,000, generally lower than those for credit cards for people with good or excellent credit scores.

Some card issuers may offer a broader range of credit limits depending on your income, employment status, and credit history. Remember that the credit limit you receive may also depend on the specific cash back credit card you apply for, as well as the reward program details and other features the card offers.

If you receive approval for a fair-credit cash back card with a low credit limit, you can begin rebuilding credit over time by making timely payments, keeping your credit utilization ratio low, and maintaining a positive credit history.

You can also request a credit limit increase from the card issuer after several months (typically six or more) of responsible credit card use.

How Does Cash Back Compare to Miles and Points Rewards?

Cash back, miles, and points are all types of credit card rewards programs, but they differ in how you earn and redeem your rewards. Cash back is the most flexible, whereas points and miles are best for consumers who travel.

Here’s a summary of how cash back compares to miles and points rewards:

- Cash back rewards: You earn cash back rewards as a percentage of your spending. The cards typically credit your account as a statement credit, direct deposit, or check. Cash back rewards are often the most straightforward because you need not worry about blackout dates or redemption restrictions. You can use cash back rewards to offset your credit card balance, making these cards a good choice for those who want to save money on their everyday purchases.

- Miles rewards: Miles rewards accrue according to how much you spend on your credit card. You can redeem miles for flights or other travel-related expenses. Miles rewards are associated with airline or travel credit cards. They are a good choice for people who travel frequently and want to save money on flights, hotels, or rental cars. Miles rewards may come with restrictions such as blackout dates or limited availability, so it’s essential to read the terms and conditions carefully before signing up.

- Points rewards: Points rewards are for a wide variety of rewards such as merchandise, gift cards, or travel. You can earn points rewards with general travel credit cards or branded credit cards, including hotel or airline credit cards. Points rewards often have more flexible redemption options other than miles but may require more effort to find the best redemption value.

Cash back rewards may be the best choice if you’re looking for simplicity and flexibility. If you’re a frequent traveler, miles or points rewards may be more valuable. Issuers may limit a cardholder with fair credit to point and mile rewards.

Don’t Let Fair Credit Keep You From Cash Back

If our review shows anything, it’s that a fair credit score does not impede owning a cash back credit card. You have many choices in three card categories: unsecured, secured, and student. Used responsibly, a fair-credit card can be your stepping stone to a higher credit score, better credit cards, and cheaper loans.

The flip side is this: Late payments and high unpaid balances will damage your credit even further and may compromise your future access to credit.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year]) 7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/fair-credit-limits-art.jpg?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![9 Unsecured Credit Cards For Fair Credit ([updated_month_year]) 9 Unsecured Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_617054912.jpg?width=158&height=120&fit=crop)

![7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year]) 7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1092414950-1.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: Instant Approval ([updated_month_year]) 7 Credit Cards for Fair Credit: Instant Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Credit-Cards-For-Fair-Credit-With-Instant-Approval.jpg?width=158&height=120&fit=crop)

![8 Best Gas Credit Cards For Fair Credit ([updated_month_year]) 8 Best Gas Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Gas-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)