While not as momentous as selecting which college to attend, your selection among cash back credit cards for students carries some real-world implications. These cards are easy to get and provide a convenient way to build your credit profile. You’ll be grateful you used your card responsibly when you apply later in life for a mortgage or other loans.

Card benefits don’t stop there. A good credit history can help you ingratiate yourself with landlords, employers, utility companies, and others who have access to your credit report. And, let’s face it, cash back on your eligible net purchases is a welcome little boost to your spending power at a time when every dollar counts.

Your cash back can be deposited directly into your checking account, but if you prefer, you can take it as a statement credit, gift card, or check. The benefit of the statement credit approach is that you can set it up to operate automatically each month.

Best Overall | More Cards | FAQs

Best Overall Cash Back Card For Students

There is a lot to like about the Discover it® Student Cash Back card, even beyond its Cashback Match and high cash back percentage on quarterly rotating merchant types up to a purchase limit when activated. Your cash back never expires, and you can redeem your rewards in any amount at any time.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

This card offers several important protective features, such as $0 fraud liability, free security and activity alerts, and immediate account freeze and unfreeze. If you misplace your card, the issuer will ship a replacement Discover credit card overnight for free. And you can pay your bill online or by phone up to midnight of the due date.

More Cash Back Student Cards to Consider

While the Discover it® Student Cash Back card wins our top ranking, each of the following competitors is a worthy alternative with its own unique charms. And after all, there’s no rule limiting you to just one student card. These five will serve you well whether you fit a single one into your wallet or make room for multiple cards.

The Capital One Quicksilver Student Cash Rewards Credit Card is a flat-rate rewards card that means you’ll earn the same rate of cash back on every purchase you make. Although, Capital One tends to offer special promotions that earn you a higher rate of cash back on select purchases, as is the case with its Uber deal running through 11/2024.

This card also offers a small signup bonus when you spend a certain amount within the first three months of card ownership. But try to pay your balance in full each month, as its interest rates are on the high side.

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card for Students offers well-rounded rewards and benefits and is a natural choice to Bank of America customers. You’re well-supported by flexible appointment scheduling, an award-winning Mobile Banking App, and digital wallet compatibility.

This Visa card provides you with account alerts to let you stay on top of your due dates and balances. You also get free FICO scores, a $0 liability guarantee, and automatic blocking of potential fraud when abnormal spending patterns are detected.

The Discover it® Student Chrome is almost identical to its sibling, Discover it® Student Cash Back, differing only in its simpler reward scheme that requires no quarterly activation of rotating merchant categories. You’ll be happy to know that a Discover credit card is accepted at 99% of U.S. merchants that take credit cards.

The card lets you tap to pay at millions of locations, shaving a few seconds off each transaction. If you need assistance, the U.S.-based customer service features real humans available around the clock to answer your questions and help you with problems.

What is a Student Credit Card?

A student credit card works like any other credit card, but with a few extra perks and requirements. To qualify for a student card, you must meet the issuer’s enrollment requirements, which usually amount to at least half-time enrollment in an eligible school.

However, some issuers don’t even need you to prove you’re enrolled in college.

All cards require you to submit information regarding your residency, age, and Social Security number, (except for the Deserve® EDU Mastercard, which was specifically created for students who don’t have a SSN), but they don’t reject applicants just because of low credit scores or limited credit history.

Typically, these cards have modest credit limits and immodest APRs, reflecting the limited credit profiles of young borrowers. Most of these cards stress protective perks like fraud protection and alerts, cellphone insurance, roadside assistance, and other features that a parent will love. Some also offer statement credits for successful referrals, and many come with introductory rewards for new cardmembers.

Should a College Student Get a Credit Card?

We think every college student should be armed with a credit card. To start with, one shouldn’t graduate college without understanding how credit cards work and how to manage them responsibly. This kind of knowledge simply isn’t taught in schools, so it’s up to students to learn about credit cards and many other personal finance topics through direct participation.

Equally important, you will profit by using your college years to establish a credit history that can help you once you graduate. You’ll find that many employers, landlords, and other powerful entities will review your credit reports to better understand how you manage your finances. Having a positive credit profile will open doors that remain closed to others with no credit history or low credit scores.

Things like renting an apartment and buying a car are easier with an established credit history, and responsibly managing a credit card during college can help you achieve that.

Many college students live on a shoestring budget, making the ability to charge an eligible purchase and get a cash advance from the card a valuable convenience from time to time. Because student cards usually set tight credit limits, there is little potential to plunge yourself into crippling credit card debt — that’s the job of your student loans.

All things being equal, you can save a little money by limiting your selection to cards that charge no annual fee or foreign transaction fee.

How Do I Apply For a Student Credit Card?

The application process is straightforward, but it’s what you do before applying that deserves the most attention. By that, we mean the effort you expend identifying the best card for your personal situation.

Here are some important things to look at while sizing up a student credit card:

- Annual percentage rate (APR): This is the interest rate you’ll be charged on balances you don’t pay in full by the due date. Student card APRs generally range between 13% and 26%, but exceptions exist. For one thing, a cash advance usually carries a higher APR that is applied immediately and continues until the advance is repaid.

- Grace period: All the cards in this review provide a grace period, which is the interval between the payment cycle end date (or statement date) and the payment due date in which no interest is charged on new eligible net purchases. If a grace period exists, then it must be at least 21 days by law, although many cards offer up to 25 days. Longer grace periods are better since they give you more time to come up with the money to pay your balance.

- Penalties: Some cards are more punitive than others when your payment is late, your check bounces, or you charge more than your credit limit. Penalties can include fees as well as a penalty APR that replaces your original card APR. The Discover it® Student Cash Back card is the most enlightened in this regard, charging no penalty APR and forgiving the fee for your first late payment.

- Cash back rewards: Your lifestyle should influence the type of cash back rewards you’ll earn. Some cards offer a flat rate, albeit a relatively low one, on every eligible purchase. That’s good if you spread your money around to all sorts of merchants. Other cards offer higher tiers of rewards for specified merchant types, sometimes rotating the merchant category every three months and requiring you to activate the category to reap the higher rewards. If you aren’t particularly well-organized, you may not appreciate the quarterly rotating rewards that you continually forget to activate. Also, watch for limits on your card’s rewards. Many cards offer higher rewards on only a limited amount spent on qualifying purchases. The remainder of your purchases earn the rate for everyday purchases, usually 1%. Cards advertise unlimited rewards whenever they can, so if you don’t see that word, limits probably exist that reduce the cash back potential of the card.

- Introductory offers: To entice new students to apply, most cards offer introductory deals such as a welcome bonus and interest-free periods. A welcome bonus (also called a sign up bonus) lets you earn a set cash reward by spending a specified amount on purchases during the first three months after opening the account. A 0% introductory APR lets you carry an unpaid purchase balance for free during the reward period, which typically runs from six to 18 months after opening a new account. If you get a Discover card, you’ll collect the Cashback Match on the cash rewards you earn during the first year of card ownership. This applies only to new cardmembers for cash back rewards processed during the first year of ownership.

Once you choose the card you want, you can fill out the application online by providing your basic identifying and income information. The application shouldn’t take more than five minutes, and the approval decision will happen within seconds of hitting the submit button.

Which Student Card Gives the Most Cash Back?

When judging cash back rewards, be mindful of the limits on the higher reward tiers. Those limits apply to the types of qualifying merchants and to the amount of money spent on purchases at the qualifying merchants each quarter. Everyday purchases earn the default cash back rate, which is typically 1%.

The Discover it® Student Cash Back wins this contest. All cash back earned is doubled for new cardmembers during the first year after opening the account. The 5% top tier reward applies to the first $1,500 in quarterly purchases at rotating merchant categories, and only when you activate the category.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

Even after the Cashback Match expires, we can make the case that this Discover card still offers the highest cash back rate. Its stablemate, the Discover it® Student Chrome, offers 2% cash back on selected merchants up to the $1,000 quarterly limit. Cashback Match turns this into a 4% reward for the first year only — not as good as the card’s sibling.

The Bank of America® Customized Cash Rewards credit card for Students may give the Discover it® Student Cash Back a run for its money after the Cashback Match period ends. The Bank of America card offers 3% cash back on your choice of merchant category and 2% at wholesale clubs and grocery stores, subject to a quarterly $2,500 combined limit on qualifying purchases.

We ran the math, and if you spent up to the quarterly limit on the top tier of each card, you ended up in a numeric tie. However, we’d wager that some of your spending with the Bank of America card would be at the 2% rate rather than the top 3%, giving a small win to the Discover card.

Trailing the pack is the Deserve® EDU Mastercard, earning just 1% cash back.

While we think the amount of cash back is an important parameter by which to judge a credit card, you shouldn’t let it blind you to the other benefits each card offers. You may be swayed by perks like cellphone protection, introductory promotions, or the low fee structure a card may offer.

If all this gives you a headache, you could just stick with CardRates’ rankings and choose our top-rated card. We did the hard work so you don’t have to.

Can a College Student Get a Credit Card With No Job?

It’s not impossible for a student to get a credit card without a job. The key is to have either a verifiable source of outside income (like a grant or trust), a fat bank account, or a cosigner.

The CARD Act of 2009 is partially responsible for the income requirement. For one thing, the Act raised the minimum age of card ownership (without a cosigner) from 18 to 21. The Act makes an exception for those who are younger than 21 who have verifiable income.

The writers of the Act took the point of view that, absent income or a cosigner, folks under 21 may simply rack up credit card debt with no way to repay it. Many college students probably take the view that attending classes and getting passing grades is their job, but alas, the CARD Act doesn’t budge on the issue.

Recruiting a cosigner is the easiest way for a student to circumvent the Act’s restrictions since the cosigner guarantees that payments will be made on time. A typical card issuer won’t hesitate to come after cosigners when the cardmember misses a payment. Cosigners are likely to respond since their credit scores are as vulnerable as the cardmember’s from missed payments.

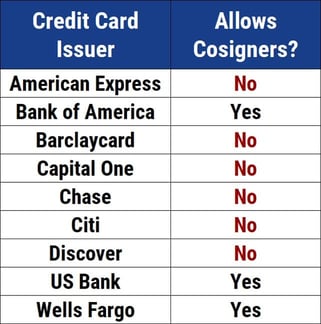

Unfortunately, not every credit card company allows cosigners, as summarized in the accompanying table.

If you wish to depend on a cosigner, the Bank of America® Customized Cash Rewards credit card for Students may be your best bet — the remaining cards don’t allow cosigners.

Another way around the income requirement is to have enough money in your bank account to reassure card issuers that you can pay your bill. For many college students, this is, alas, not a reasonable expectation.

Most colleges offer some kind of employment opportunities to students, such as work-study programs. We can’t make the argument that students should get jobs so they can obtain credit cards, but if you’re going to be working anyway, a credit card is within your grasp.

How Many Student Credit Cards Should I Have?

Americans love credit cards to the tune of four cards owned by the average citizen. However, we doubt this average applies to college students, who usually have limited credit history and income. Having just one card may be good enough to meet the needs of many college students.

A 2019 Sallie Mae study sheds light on student credit card usage. It found that 57% of college students had at least one credit card, and the highest percentage of students (19%) had a single credit card. Yet the study also found that the median number of cards held by enrolled students was two.

There may be a couple of reasons for students to own multiple cards:

- They may feel that the credit limit on a single card is too low.

- They want to maximize the complementary rewards offered by multiple cards.

Arrayed against these pros are several cons:

- Holding multiple cards won’t build your credit any faster than a single card. You build credit by paying your bills on time, regardless of the number of credit cards you own.

- It can be dangerous to have too many credit cards if you lack the discipline to control your spending.

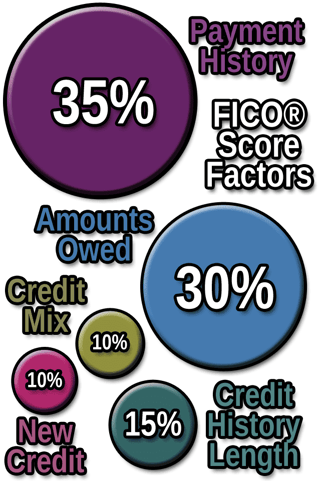

- You can build your credit better by having a wide credit mix (i.e., several different forms of credit) than having multiple credit cards. Credit mix accounts for 10% of your FICO score.

- It’s harder to manage multiple credit cards, as they each have their own payment due dates. If you forget to pay one, your credit score could suffer.

College is a place to experience many new things, but credit overuse need not be one of them. Navigating through four years of college with just a single credit card is a major victory, and there is plenty of time to load up on new cards after you graduate.

What is the Average Credit Limit For a College Student?

Some interesting factoids from the Sallie Mae study dance around the credit limit question without answering it directly. In 2019:

- The average credit card balance among all students was $1,183. This was the average balance over the most recent 12-month period.

- 20% of students chose their first credit card based on the credit limit.

- 29% of students obtained multiple credit cards to increase their total credit limit, which ranked behind (in descending order) improving their credit history, earning different rewards, and serving different purposes.

More to the point, our friends at Money Geek reported that, as of 2019, 80% of students have a credit limit of $1,000 or less.

The Discover it® Student Cash Back and Discover it® Student Chrome cards have a minimum credit limit of $500.

Forum comments peg the minimum credit limit for the Bank of America® Customized Cash Rewards credit card for Students at $500, with at least one increase likely within six months for cardholders who make on-time payments.

According to the Deserve® EDU Mastercard, its maximum credit limit is $5,000, but it makes no mention of a minimum limit.

Should I Close My Student Credit Card After Graduation?

In general, closing your student credit card account after graduation is not recommended, because it could hurt your credit score in at least two ways:

- You’ll interrupt the age of your credit history, which accounts for 15% of your FICO score. The fine folks at FICO like to see long and successful credit relationships, lasting seven years or longer.

- You may increase your credit utilization ratio, which is your credit card balance divided by your total credit available. By eliminating some of your available credit, your CUR will rise and hurt your credit score. In fact, 30% of your score is determined by your amounts owed as measured by your CUR.

A better solution is to have your card reclassified after graduation. In many cases, the credit card company will do this automatically when you can no longer prove undergraduate status. Reclassification will not disrupt your credit history nor increase your CUR.

When your card is reclassified, your account moves to the issuer’s most similar traditional credit card. Note that your benefits, rewards, and credit limit may change as a result, and you will have to authorize the move.

Of course, you are not locked into the same card issuer after you graduate. For example, the Chase Freedom Flex℠ and Chase Freedom Unlimited® are quite popular, even if you didn’t own a Chase Freedom® Student card as an undergraduate.

Are There Drawbacks to Using a Student Credit Card?

The drawbacks associated with student credit cards stem from their misuse. If you use your card responsibly, make your payments on time, and stay below your credit limit, your credit card should be viewed as a useful everyday tool to manage your finances.

Let’s take a look at some possible drawbacks and how to avoid them:

- Dependence on credit: You use credit whenever you charge a purchase. This is a convenience, and hopefully will in no way resemble other types of dependencies (like crack cocaine or Ben & Jerry’s). You can avoid overreliance on credit by paying your bill in full each month. This way, you’ll avoid interest charges and your account balance won’t get the chance to balloon out of control.

- Overspending: Notwithstanding the previous paragraph, some folks have trouble controlling their spending, in which case a credit card becomes a codependent in a possibly serious problem. The solution is to trade in your credit card for a prepaid debit card, which allows you to spend only the money you already have. It’s funny how different it feels to spend “real” money instead of credit.

- High interest rates: Typically, student credit cards have high APRs, mainly because the issuers have little evidence of your creditworthiness. That makes these cards an expensive way to borrow. Avoid this problem by repaying your balance in full each month.

- Damaging your future: If you have sloppy financial habits, such as missing your payment due dates, you could end up with derogatory comments on your credit reports. Not only will these hurt your ability to obtain credit in the future, but they may also damage your prospects for getting a job or renting an apartment. Employers, landlords, and other power brokers can access your credit reports, a chilling prospect if you leave school with a tarnished credit history.

Inevitably, some percentage of students will misuse or abuse their credit cards, out of ignorance or worse. If you’ve read this far into our article, chances are you don’t fall into this group. If you take your credit card as seriously as your organic chemistry final, you’re likely to experience your card as a positive part of undergraduate life.

What is the Fastest Way to Build Credit?

Nothing is faster than getting a credit card to build, or rebuild, your credit. A student credit card is perfect in this regard since you don’t need a credit history or good score to get one.

Payment history is the largest credit score factor.

To let your credit card help you improve your credit score, you must actually use it. That means charging at least a few purchases every month.

While it may seem like a great idea to carry a balance, the fact is it’s best to pay your balances in full each month.

If you can’t always pay off your balances, be sure to always meet your minimum payment requirements and to keep your total balance fairly low — don’t let your CUR exceed 30%. You should start to see your credit score rise within six to 12 months. You may also be granted a higher credit limit after five or six months of consecutive on-time payments.

You can usually give your credit score a small boost by incorporating your utility payments into your credit reporting. Services like Experian Boost can help you with this, and it’s free.

Many consumers who don’t happen to be students also need to build their credit. In that vein, certain banks, online sites, and credit unions offer credit-builder programs. These are loan programs that work as follows:

- You take out a modest loan (typically around $1,500) and deposit the proceeds into a special account maintained by the lender.

- Every month, you send a payment to the lender until you’ve repaid the loan.

- Every month, the lender sends your payment information to each credit bureau (Experian, Equifax, and TransUnion).

- After repaying the loan, the proceeds are returned to you.

By paying your monthly installments on time, you establish a record for reliability that will help your score rise over time — it may take six to 12 months to become fully effective.

Another route for non-students to build credit is through a secured credit card. With these, you deposit an amount (usually equal to your credit line) that collateralizes the card. You don’t need a credit history or good score to get a secured card, and your timely payments will help you build your credit as they do for an unsecured card.

You may want to consider asking to become an authorized user on someone else’s credit card. This extends the card’s credit to you, and the credit bureaus will track payments for you and the account owner.

Alternatively, you can recruit a cosigner to get an unsecured card even when you otherwise wouldn’t qualify. Both you and the cosigner are responsible for making timely payments, and both of you will have your payment activity tracked by the credit bureaus.

Compare Cash Back Credit Cards For Students Online

In general, cash back credit cards for students are a good deal. You don’t need a credit history or credit score to get one, and they offer cash rewards that will no doubt be helpful to students on a tight budget.

Our review of the best student cash back cards is a great place to compare the various offerings available, and by clicking on the APPLY NOW buttons, you can head to the issuer’s website and further research the cards before applying.

If you happen to travel often, you may want to consider a card that offers travel reward points, like the Bank of America® Travel Rewards credit card for Students, instead of a cash back card. You can always cash in your travel reward points if you aren’t planning a trip anytime soon.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best Credit Cards for Students with No Credit ([updated_month_year]) 8 Best Credit Cards for Students with No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-4.jpg?width=158&height=120&fit=crop)

![6 Credit Cards for Students with Fair Credit ([updated_month_year]) 6 Credit Cards for Students with Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Credit-Cards-for-Students-with-Fair-Credit.jpg?width=158&height=120&fit=crop)

![8 Credit Cards for Students with Bad Credit & No Deposit ([updated_month_year]) 8 Credit Cards for Students with Bad Credit & No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/12/Credit-Cards-For-Students-With-Bad-Credit-No-Deposit-4.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Students ([updated_month_year]) 7 Best Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2013/07/crfeatured1.jpg?width=158&height=120&fit=crop)

![8 Best Travel Credit Cards for Students ([updated_month_year]) 8 Best Travel Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Best-Travel-Credit-Cards-for-Students-1.jpg?width=158&height=120&fit=crop)

![9 Best Study Abroad Credit Cards for Students ([updated_month_year]) 9 Best Study Abroad Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/Best-Study-Abroad-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Grad Students ([updated_month_year]) 5 Best Credit Cards for Grad Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/gradstudent.png?width=158&height=120&fit=crop)

![7 Best Credit Cards for College Students ([updated_month_year]) 7 Best Credit Cards for College Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/02/college.jpg?width=158&height=120&fit=crop)