I recently spoke to a friend’s son about credit cards that don’t do a hard pull. The young lad was a little depressed after experiencing several credit card rejections, but he cheered up when he learned about credit cards that don’t require a credit check.

He was happy to plunk down a $200 deposit and now has a secured credit card. His father was grateful — I think.

If you have bad or limited credit, a card that doesn’t require a credit check can get you into the game. Use it responsibly, and you’ll be stepping up to more rewarding cards before you know it.

-

Navigate This Article:

One Credit Card Doesn’t Check Your Credit History

The OpenSky® Secured Visa® Credit Card requires only a small deposit to overcome most obstacles (including bad, no, or limited credit) preventing you from owning a credit card. It is almost as easy to get as a prepaid card (although a prepaid card doesn’t offer credit).

This card emphasizes its commitment to helping cardowners quickly build credit (or rebuild credit from past mistakes). The refundable deposit is the small price of admission to help you attain a good credit score when you use the card responsibly.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

The OpenSky® Secured Visa® Credit Card will let you earn a higher credit limit or graduate to an unsecured card in as few as six months. This no-credit-check Visa credit card offers low interest rates and fees, fraud protection, and email alerts.

It only takes four short steps to apply for this soft pull credit card, and you can set your credit limit anywhere between $200 and $3,000, subject to the approval of the issuing bank, Capital Bank N.A.

Alternative Cards For Bad Credit That Allow You to Prequalify

If you’d prefer to own an unsecured credit card, these cards offer easy prequalification to folks with subprime or thin credit. Although prequalifying for a credit card offer doesn’t guarantee final approval, it won’t hurt your credit score to try.

Because these cards are unsecured, they carry higher costs than similar secured cards for bad credit. None is a cash rewards credit card — you won’t find a good travel or business credit card in the lot, nor any student credit cards.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 – $125

|

See website for Details*

|

The Surge® Platinum Mastercard® from Continental Finance protects you from bogus charges with Mastercard’s Zero Liability Protection. The card comes with free Experian VantageScore tracking. You can access its mobile app to check due dates, view statements, pay bills, and verify direct deposits.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% APR (Variable)

|

$75 – $125

|

Bad, Fair, or No Credit

|

The Reflex® Platinum Mastercard®, also from Continental Finance, is virtually identical to the Surge® Platinum Mastercard®. It offers strong fraud protection and waives its monthly maintenance fee for the first year. The card may give you a credit limit increase if you consistently pay your bill on time.

Mission Lane Visa® Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Mission Lane Visa® Credit Card lets you prequalify before applying without hurting your credit score. If you’re preapproved, chances are good you’ll be approved for the card, and a security deposit isn’t required. But pay attention to the fees, and try to pay your balance off each month to avoid interest charges.

What Is a Hard Pull?

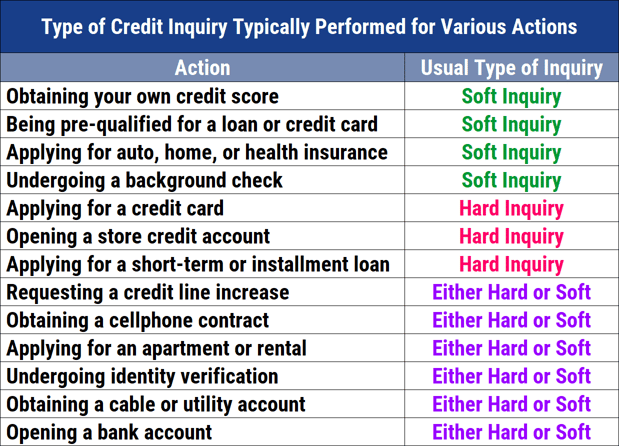

A credit inquiry (or pull) occurs when someone requests a copy of your credit report from a major credit bureau (i.e., Equifax, Experian, or TransUnion). The bureaus keep track of these requests and classify them as hard or soft pulls.

A hard pull is a credit inquiry you authorize creditors and lenders to make when you apply for a new account. All other pulls, including those you make for your personal report, are soft.

Hard pulls remain on your credit reports for two years and slightly decrease your credit score for up to one year. Soft pulls do not affect your score, and only you can see them on your credit reports.

So, why do hard pulls hurt your credit while soft pulls do not? The answer lies in how your credit score is calculated.

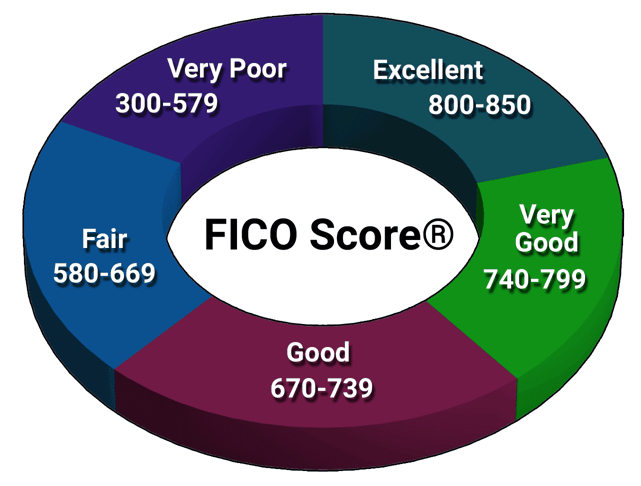

FICO, the dominant scoring system for consumer credit, recognizes five factors that affect scores. The FICO scoring range runs from 300 (worst credit) to 850 (perfect credit).

The “new credit” factor accounts for 10% of your credit score and is the one that responds to hard inquiries. FICO considers each hard inquiry to be a credit application you submitted.

Hard pulls may lower your score because FICO associates too many requests for new credit (i.e., more than once every six months, more or less) with financial distress and higher default risk.

Can You Get Approved For a Credit Card Without a Hard Inquiry?

Most credit card issuers perform a hard pull of your credit when you apply for one of their cards. But they don’t submit a hard inquiry when you attempt to prequalify for a card.

The reason is simple: The credit card companies want to encourage you to get their cards and therefore provide you a consequence-free way to determine whether you qualify. They hope that you’ll take the next step and apply for their card once you prequalify, even though it may hurt your score a bit.

What’s remarkable about the OpenSky® Secured Visa® Credit Card is that it doesn’t perform hard inquiries on applicants.

Other secured credit cards may also avoid hard pulls, but this card is the only one that publicly commits to it and saves you the prequalification step.

FICO calculates 35% of your credit score from your payment history and 30% from the amount of credit you use. Creditors and lenders that don’t do hard credit pulls usually don’t report your payments to the credit bureaus, thereby preventing your behavior from helping (or harming) your credit score. But reset assured that this card will report your payments to all three credit bureaus even though it doesn’t require a hard inquiry for approval.

Does Preapproved Mean No Credit Check?

Preapproval and prequalification mean the same thing, and the terms are used interchangeably by credit card companies. “No credit check” usually connotes a credit card issuer that doesn’t do a hard credit pull when you apply for a card.

Almost all card issuers skip a credit check at the preapproval stage but then pull your credit when you apply. Only a couple are no-credit-check cards, the cards that don’t pull your credit when you apply.

In this review, the two secured credit cards are no-credit-check cards; the others aren’t.

Contrast this to the mortgage lending industry. Home shoppers seek preapproval for a set mortgage amount to better compete against other buyers. Banks and other mortgage lenders invariably do hard credit checks before they preapprove mortgages and impose an expiration date by which they convert it to a mortgage application.

When you subsequently apply for a mortgage on the property you want, the lender may do another credit check to see if anything has changed since you were preapproved.

Do Credit Card Preapprovals Hurt Your Credit?

The point behind the preapproval process is to shield your credit score from harm as you find out whether you prequalify for a credit card. Credit card companies can preapprove consumers because doing so does not guarantee final approval. In other words, the card issuers have nothing to lose by offering the prequalification step.

And, to the extent that successful prequalification encourages consumers to apply for the card, the issuers have a lot to gain.

Preapproval is basically a marketing technique. It’s a way to suck potential customers into a funnel that ends with them becoming new cardmembers. Preapproval builds consumer engagement, generating leads that issuers hope will turn into sales.

The strategy is similar to the one that issuers of student credit cards use to instill young adults with brand loyalty.

Lest the issuers sound too cynical, consumers also benefit from credit card preapproval:

- It can serve as a way to learn more about a credit card without committing to it. The credit card company must disclose a card’s rates and terms when attempting to prequalify, allowing you to comparison shop.

- You may not receive preapproval, at which point you’ll know it’s futile applying for the card and can prevent a slight credit score decline.

- It takes money for the card companies to check credit, money they will save if they deny preapproval to unqualified consumers. This arrangement leaves more cash for the issuers to improve their cards, which generally benefits consumers.

The bottom line is that credit card preapproval serves the interests of consumers and credit card issuers alike, which is why all the best credit card issuers offer it (including American Express, Discover, and Capital One).

Can You Get Denied After Preapproval?

As previously stated, preapproval does not guarantee final approval. When you attempt to prequalify for a credit card offer, the issuer will review your basic information, including your age and residence, without a hard credit inquiry.

If you then apply for the card, the issuer will pull your credit (the two reviewed secured cards excepted) and receive additional information about your finances, employment, and credit history. It’s always possible that the issuer will uncover facts that cause it to deny your application.

If the issuer turns you down, it must send you an adverse action notice telling you why it denied your application and the source of the information on which it based its decision. Be smart and use the information in the notice to clean up your credit. The effort may require you to check your credit reports for errors, a task you can do yourself or farm out to a credit repair agency.

If you have no luck obtaining an unsecured credit card, consider a secured card instead. These cards have easier acceptance standards since you must deposit collateral to secure your credit line.

What Credit Score Is Required For Approval?

There is a credit card out there for just about any credit score. The two reviewed secured cards don’t check credit at all, and many secured cards have lenient approval criteria.

The alternative unsecured cards in this review welcome applicants with bad credit (i.e., FICO scores below 580) and approve a fair share.

Certain issuers are willing to accept low scores because they have taken steps to mitigate financial losses from cardmember defaults. There are two basic methods at work:

- Secured cards: Issuers can access your security deposit if you fail to pay your bill. This collateral protects them from loss if they must cancel your account.

- Unsecured cards for poor credit: Issuers protect themselves by collecting high fees, including a setup and annual fee (the annual fee can run as high as $99). They couple these charges with a low credit limit (as low as $200) and a high interest rate (up to 36% APR). By collecting upfront money and limiting capital at risk, these issuers can afford to take chances that larger credit card companies cannot.

The point is not to be discouraged if an issuer denies your card application. We review dozens of subprime cards each year, and one may be a perfect fit. In addition, you can take steps to improve your credit, as we describe next.

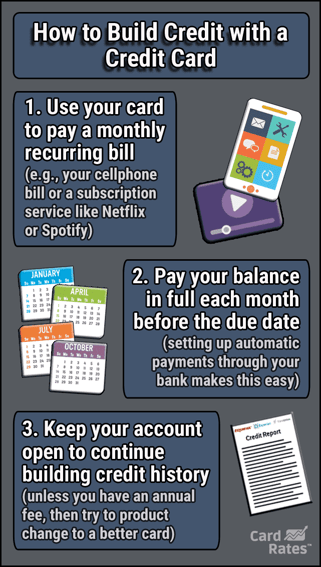

How Do I Use My Card to Rebuild Credit?

The key to building credit is responsible behavior, starting with paying your bill on time, every time. Nothing destroys credit faster than failing to pay your bills, which is often a gateway to more severe events, including default, collection, property repossession, and bankruptcy.

You can also use a credit card that offers balance transfers to consolidate credit card debt instead of relying on a personal loan. Consolidation alone won’t improve your credit, but it does make it easier to pay down your debt.

A card that offers a 0% introductory interest rate for balance transfers can cost less than a consolidation personal loan. Your credit score should improve as your credit utilization ratio (i.e., the total credit you are currently using divided by the total credit available to you) falls below 30%.

There are two other ways to use credit cards to build credit. The first is to keep old card accounts open, as FICO looks favorably on long-lived accounts. Second, refrain from opening new accounts too frequently, no more than once every six months. These two tactics are only minor contributors to your credit score but are nonetheless helpful.

Credit Cards That Don’t Do a Hard Pull Are Easy To Get

The reviewed credit card that doesn’t do a hard pull is easy to obtain. It is a secured card that requires a relatively small deposit and welcomes credit profiles of every stripe, from poor credit to fair credit to good credit.

You can also apply to an issuer of subprime unsecured credit cards, including those described in this article. Although these issuers will likely pull your credit, they will also look for ways to accommodate your application.

One way or another, most consumers can acquire a credit card, even if it is not particularly attractive. Use it to build credit, and over time, you’ll have access to better cards (from the best credit card issuers, including Citi, Chase, and Capital One) with handsome rewards and benefits.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Soft-Pull Credit Cards ([updated_month_year]) 12 Best Soft-Pull Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/softpull.png?width=158&height=120&fit=crop)

![7 Best First Credit Cards, No Credit Needed ([updated_month_year]) 7 Best First Credit Cards, No Credit Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/firstcard.png?width=158&height=120&fit=crop)

![9 Best Credit Cards For Rebuilding Credit ([updated_month_year]) 9 Best Credit Cards For Rebuilding Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/rebuildcredit.png?width=158&height=120&fit=crop)

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for No Credit ([updated_month_year]) 9 Best Credit Cards for No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/nocredit.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)