You can pony up your tuition in many ways, including a student loan, a 529 plan, even cash. Credit cards may not immediately spring to mind when mulling over how to pay your tuition, but you might be surprised that, under the right conditions, using credit cards can be a savvy move.

In this article, we’ll review the best credit cards for paying tuition, one of which may be the perfect choice to have in your pocket for your appointment with the bursar.

0% Interest | Signup Bonus | Student Offers

FAQs & Methodology

Best Cards with 0% Interest for Paying Tuition

These cards offer new cardmembers a 0% APR for an introductory period following account opening. Using one makes good sense if you can pay most or all of the balance before the period ends.

Any balance remaining after the introductory period expires will incur interest at the card’s regular APR, which is why it’s critical to compare interest rates before applying.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® offers new cardmembers a promotional APR (0% Intro APR on Purchases 15 months) after opening the account. In addition, you can earn an introductory bonus when you meet the very attainable time frame and purchase requirements.

The card also lets you earn cash back on every purchase. The Chase Freedom Unlimited® card has no annual fee, no redemption minimums, and no reward expiration while the account remains open.

2. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The Chase Freedom Flex℠ card gives new cardmembers a promotional APR () after opening the account. In addition, you can receive a cash back bonus when you exceed a set spending limit during the first three months. This card has no annual fee.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

After opening your account, the Capital One Quicksilver Cash Rewards Credit Card offers an introductory purchase APR of 0% for 15 months.

The card pays you cash back on all purchases. The card charges no foreign transaction fees, no annual fee, and your cash back rewards don’t expire while the account remains open.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card gives new cardmembers a promotional APR — 0% for 15 months — to pay off your tuition over time.

This no-annual-fee card offers benefits such as virtual card numbers, no foreign transaction fees, and special access to events.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card offers new cardmembers a promotional APR on purchases. The cash back you earn with the card never expires while the account is open, and you can redeem your rewards at any time, in any amount.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card offers a promotional 0% APR on purchases after opening the account. Your cash back is worth 25% to 75% more when redeemed through Preferred Rewards.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card offers an introductory APR — 0% for 15 months — to new cardmembers. The Capital One VentureOne Rewards Credit Card charges no annual or foreign transaction fees. You can transfer your miles to 15+ travel partners or use them for travel without any blackout dates.

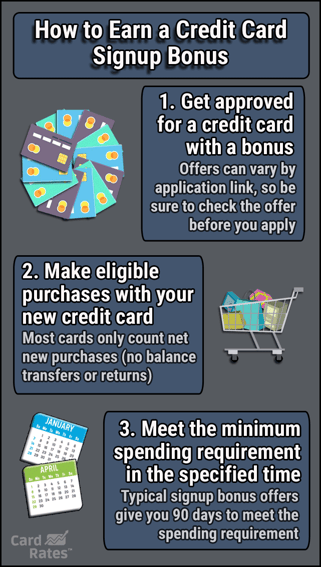

Best Cards for Paying Tuition to Earn a Signup Bonus

Signup bonuses incentivize you to obtain a card and then use it right away. You earn the bonus by spending a set amount on purchases during the first three months.

If you’re going to pay some or all of your tuition with a credit card, you may as well use one with a generous signup bonus. These cards all offer large bonuses that can make a substantial dent in your tuition and help ease some of the financial pain.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card card rewards you a hefty sum of introductory bonus points when you spend $4,000 on purchases (including tuition) during the first three months after opening the account. Those points are worth a large chunk of change, especially toward travel when redeemed at Chase Travel, where points are worth 25% more for certain redemptions.

You can transfer your points one for one to Chase’s airline travel and hotel partners. This is a premium card and it charges an annual fee.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card gives you a one-time signup bonus when you meet a purchase threshold in a set time frame from when you first receive your card. These bonus miles add up to serious travel rewards.

You can transfer your miles to more than a dozen travel partners or redeem your miles for travel with no blackout dates. Capital One Venture Rewards Credit Card gives you a credit to reimburse up to $100 for TSA Preè or Global Entry fees.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® points you earn are worth 50% more when redeemed at Chase for travel and hotel expenses.

Additionally, the card gives you a $300 credit each year to reimburse travel expenses. This premium travel rewards card charges a hefty annual fee.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred® Credit Card points you earn are worth 25% more if you redeem them through Chase Travel℠ for travel-related purchases.

The card provides 3X points on combined purchases, up to $150,000 per year, on selected expenses, including social media advertising, internet, cable, phone, travel, and shipping. All other purchases earn unlimited 1X points. This card has an annual fee.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card gives you a cash back bonus when you meet a set purchase threshold in the first three months of your account opening. This no-annual-fee card gives you 5% cash back on the first $25,000 spent each year on purchases at office supply stores and for phone, cable, and internet services.

Best Student Cards for Paying Tuition

It’s not unusual for students to have poor or limited credit. Fortunately, these three cards are optimized for students, which comes in handy if your parents aren’t paying all your tuition costs.

These cards offer one or more features that can at least partially offset your tuition and/or interest costs.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Cash Back card provides a promotional APR on new accounts. Not only is there no annual fee, but there are also no late fee on your first late payment and no APR change for paying late.

Students will earn cash back rewards with this card that never expire.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Chrome offers tiered cash back rewards on gas and restaurant purchases each calendar quarter (up to the quarterly limit).

New cardmembers receive a promotional APR, and like the previously mentioned Discover student card, statement credit is awarded when students refer their friends who get approved for the card.

Can You Use a Credit Card to Pay Tuition?

There is a mixed picture regarding tuition payment via credit card. Most public colleges and community colleges accept credit cards for tuition purposes, but many private colleges do not.

However, some top private schools accept credit cards for tuition, including Johns Hopkins, Carnegie Mellon, Northwestern, Rice, and Wellesley. You can use your credit card at virtually all post-secondary schools to pay for other expenses, such as books, supplies, meal plans, fees, and more.

It’s important to carefully consider whether using your credit card for tuition is your best option.

Pros:

- You can earn a signup bonus potentially worth hundreds of dollars.

- Many cards provide a year or more of 0% APR to new cardmembers, which saves you the cost of interest.

- You can earn rewards in the form of cash back, points, or miles.

- Some cards offer cash back matches or enhanced redemption values.

Cons:

- Credit card APRs are higher than student loan APRs. According to U.S. News, the average minimum and maximum credit card APRs for consumers with fair credit are 24.96% and 25.81%, respectively. The averages for student credit cards are a minimum of 16.54% and a maximum of 24.25%. Compare that to the APR of 4.53% for undergraduate federal student loans.

- Most colleges will charge a fee, usually 2.5% to 3%, when you use a credit card to pay tuition. You’ll want to compare the fee against the card’s regular and bonus rewards.

- Your credit card spending limit may be too low to cover the cost of tuition.

This last point deserves discussion. If your tuition cost exceeds your card’s spending limit, you may want to consider using multiple cards — if you can qualify for them. If you do use multiple cards, you may want to consolidate the balances afterward.

Several of the cards in this review offer new cardmembers a 0% APR for balance transfers (fees apply, usually around 3%). Balance transfers make monthly payments more convenient and may reduce your minimum payment amount.

Do You Earn Rewards for Paying Tuition?

Tuition can cost thousands of dollars, so it would be nice to reap some rewards when paying it. The cards in this review offer a variety of rewards for paying tuition.

Our top choice for cards offering an introductory 0% APR on purchases is the Chase Freedom Unlimited®. The current introductory period is 0% Intro APR on Purchases 15 months after opening the account. This gives you some time to pay as much of the card balance as possible without the drag caused by interest.

Another popular reward for new cardmembers is a signup bonus. Our choice in this category is the Chase Sapphire Preferred® Card card. It currently provides bonus points if you spend the required amount on purchases during the first three months that are redeemable for cash. If you redeem these points for travel booked through Chase, the monetary value is even higher.

Naturally, you need to time your application for a bonus reward card so you receive the card just prior to your tuition due date. If you happen to have good to excellent credit, you may consider getting multiple new cards with generous introductory bonuses. This will maximize your total bonus, and you can then choose to consolidate your balances through a 0% APR transfer.

If your credit is thin or poor, your only option may be a student credit card. Our winner in this category is the Discover it® Student Cash Back card.

The Discover it® Student Cash Back provides new cardmembers an introductory APR and bonus cash back on quarterly rotating merchant categories that you activate, up to the quarterly limit.

How Does the Tuition Tax Credit Work?

A tax credit reduces your tax bill dollar for dollar. Compare this to a less-valuable tax deduction, which reduces your taxable income. You must multiply a tax deduction by your marginal tax rate to compute the tax savings. Clearly, a credit is worth more than an equal-sized deduction.

The federal government offers two tuition tax credit programs. The first is the American Opportunity Tax Credit (AOTC). The credit reimburses eligible students for qualified education expenses, up to $2,500 a year.

The credit pays 100% of the first $2,000 in qualified education expenses and 25% of the second $2,000. To qualify, students must:

- Be working toward a degree or other education credential.

- Be enrolled at least half time.

- Not have claimed previous AOTC credits for more than four tax years.

- Have qualified expenses that include tuition, enrollment fees, and required course materials.

- Not have finished four years of higher education.

- Have no convictions for felony drug crimes.

- Not have a modified adjusted gross income (MAGI) above $90,000 for single filers or $180,000 for joint filers.

Alternatively, eligible students can apply for a Lifetime Learning Credit (LLC) to cover tuition and other qualified expenses. The credit is worth up to $2,000 per year.

You can use it if you are an undergraduate, graduate, or professional student, or you pay qualified education expenses for a dependent or third party. There is no restriction on the number of years you can apply for this credit.

To receive the LLC, you must:

- Be taking courses at an eligible institution.

- Be taking post-secondary-school courses or courses to gain a job.

- Be enrolled for at least one course per year.

- Have qualified expenses that include tuition and fees.

- Not have a MAGI in 2020 exceeding $68,000 for single filers or $136,000 for joint filers.

- Not have claimed the AOTC for the same year.

To claim either credit, you must file Schedule 3 of Form 1040 and Form 8863, Education Credits.

Ranking Methodology

Our list of the best cards for paying tuition considers various factors that are important when making a large purchase on a credit card, such as a promotional 0% interest rate, signup bonus offered, rewards earning rates, and the ongoing APR of each card. CardRates’ reviews undergo a thorough editorial integrity process to ensure that content is not compromised by advertiser influence.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Credit Cards for Paying Bills & Utilities ([updated_month_year]) 9 Best Credit Cards for Paying Bills & Utilities ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/utilities.png?width=158&height=120&fit=crop)

![7 Tips: Paying Rent or Mortgage with Credit Cards ([updated_month_year]) 7 Tips: Paying Rent or Mortgage with Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/rent--1.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for Paying Down Debt ([updated_month_year]) 9 Best Credit Cards for Paying Down Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/downdebt.png?width=158&height=120&fit=crop)

![5 Best Credit Cards for Paying Cell Phone Bills ([updated_month_year]) 5 Best Credit Cards for Paying Cell Phone Bills ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_224070166.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For Paying Car Insurance ([updated_month_year]) 5 Best Credit Cards For Paying Car Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Credit-Cards-for-Paying-Car-Insurance.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for Students with No Credit ([updated_month_year]) 8 Best Credit Cards for Students with No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-4.jpg?width=158&height=120&fit=crop)

![9 Best Student Credit Cards For Bad Credit ([updated_month_year]) 9 Best Student Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Student-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)