If you’re looking to save money on travel, check out some of the best credit cards for buying airline tickets. Credit cards can be a great way to earn free or cheap travel. Signing up for a new card can get you a large number of airline bonus miles or credit card points, and you can use those miles and points to help get you to your destination a little cheaper.

Here are some of the best credit cards for buying airline tickets.

Best Overall | More Top-Rated Cards | Tips | FAQs

Best Overall Card for Buying Airline Tickets

The Capital One Venture Rewards Credit Card is an outstanding card for buying airline tickets. One of the main reasons is that the Venture miles you earn are very flexible.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

You can use your Venture miles in two ways: You can use them to offset past purchases, or you can transfer your Venture miles to Capital One’s list of hotel and airline transfer partners.

Each Venture mile has a value of 1 cent. So, if you had 100,000 Venture miles, you can use those to offset a travel purchase of up to $1,000. This is the easiest and most straightforward use of your Venture miles.

For most of Capital One’s travel partners, you can transfer at a rate of 2 Venture miles to 1.5 airline miles, with a minimum of 1,000 miles transferred. Using your Venture miles in this way does take a bit more understanding of airline rewards programs, but we’ll show you later in this article how this can supercharge the value of your miles.

You’ll earn unlimited double miles on all purchases and will be eligible to receive up to a $100 credit for Global Entry or TSA PreCheck®.

More Great Cards for Buying Airline Tickets

The Capital One Venture Rewards Credit Card is our best overall card for buying airline tickets. But several other cards are good options if you’re looking to buy an airline ticket, starting with one of our favorite Chase cards.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card is another great card for buying airline tickets because it can be used to purchase travel in two ways.

First, you can transfer your Ultimate Rewards points to one of Chase’s airline transfer partners. Or you can buy airline tickets by redeeming your points at a value of 1.25 cents per point through the Chase travel portal.

The welcome offer on the Chase Sapphire Preferred® Card varies but can provide a big bonus. If the signup bonus were 60,000 Ultimate Rewards points, you could immediately redeem them for up to $750 in airfare on any other airline.

This is the simplest way to use a Sapphire Preferred card to buy airline tickets. It is possible to get even more value through Chase’s transfer partners, which we’ll discuss below.

The Chase Sapphire Preferred® Card also comes with a variety of useful benefits for travelers, including trip cancellation/interruption insurance, baggage delay insurance, and trip delay reimbursement. You’ll also pay no foreign transaction fees when you use your card to pay for purchases in other countries.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card also earns Venture miles, like its sister card, the Capital One Venture Rewards Credit Card, does. With the VentureOne card, you can use your miles either to erase travel purchases or transfer them to Capital One’s airline and hotel partners

But unlike the Capital One Venture Rewards Credit Card, the Capital One VentureOne Rewards Credit Card has no annual fee and usually has a lower welcome offer. You will not pay a foreign transaction fee with the Capital One VentureOne Rewards Credit Card.

The Capital One VentureOne Rewards Credit Card is a more basic card and doesn’t come with the Global Entry / TSA PreCheck® perk that the Capital One Venture Rewards Credit Card has, but you can still use your miles on any airline or at any hotel with no blackout dates.

If you’re looking for a no-fee travel credit card, the VentureOne is a great option.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Travel Rewards credit card comes with no annual fee and no foreign transaction fees. Points can be redeemed for any travel purchases at a value of 1 cent per point. The welcome bonus offer can be used as a statement credit for a travel reward at a rate of 1 cent per point.

Another nice perk of the Bank of America® Travel Rewards credit card is that it comes with an introductory 0% APR offer. This can be a great option if you have a large purchase or a balance on another card that you want to transfer over. The points you earn do not expire as long as your account remains open.

You can also get an extra 25% to 75% bonus on your earning rate, depending on your relationship with Bank of America and the amount of money you have deposited with Bank of America. This means you can earn up to 2.625 points for every dollar spent.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred® Credit Card comes with one of the best signup bonus offers of any travel credit card out there. Not only are the points quite high, but the bonus points you earn with this signup bonus are among the most valuable credit card points out there.

With the Ink Business Preferred® Credit Card, your points receive a 25% bonus when redeeming them for travel through Chase Travel℠. That means 100,000 rewards points would be worth $1,250 in travel toward any airline, hotel, cruise, car rental, or other travel purchase.

You can transfer your rewards points to Chase’s airline and hotel transfer partners. This can be an even more lucrative way to maximize the value of your rewards. You can also combine your points with the rewards you earn from other Chase credit cards.

The Ink Business Preferred® Credit Card is a small business credit card, which means you are required to have a business to apply. It’s important to note that there are no specific requirements regarding the business — you’re not required to have an EIN, or reach a certain sales amount, or have a certain number of employees. You are often able to qualify with a small sole proprietorship.

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Use Membership Rewards® Pay with Points for all or part of an eligible fare and get 35% of those points back, up to 1,000,000 points back per calendar year

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.74% - 26.74% Pay Over Time

|

$695

|

Excellent

|

Business Platinum Card® from American Expressfrom American Express is an ultra-premium credit card that charges a very high annual fee in exchange for significant travel and luxury benefits.

One of the biggest benefits of the card is access to the American Express Global Lounge Collection, which gives you lounge access to over 1,200 airport lounges around the world.

In addition to the hefty signup bonus, you earn Membership Rewards points for all eligible purchases you make with Business Platinum Card® from American Express. You can also earn additional bonus points for purchases of over $5,000 and on airline purchases and hotel bookings made directly or on amextravel.com.

You also get up to $200 in statement credits each year for incidental charges on one specific airline. You can use this credit toward things such as baggage fees, seat assignment fees, and onboard food and drink purchases. You also get up to $100 in credit toward application fees for Global Entry or TSA Pre✓ ®.

The American Express Membership Rewards points you earn with Business Platinum Card® from American Express are quite valuable. You can use them for travel or transfer them to one of American Express’s airline and hotel transfer partners. Business Platinum cardholders can get a 35% rebate on the points used to pay for flights, up to 500,000 points back each calendar year.

Like the Ink Business Preferred® Credit Card, this is a small business card, which means you will need to enter information about your business when you apply for the card. Business Platinum Card® from American Express is also a metal credit card for those extra style points (and weight) in your wallet.

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% - 27.49% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® from American Express is the individual consumer version of Business Platinum Card® from American Express and comes with many of the same luxury benefits. One major difference is that it is a personal credit card, so unlike Business Platinum Card® from American Express, you won’t need to enter any business information on your credit card application.

As with Business Platinum Card® from American Express, you get a $200 airline incidental fee credit that can be used each year on a specific airline for seat assignments charges, onboard food and drink purchases, or checked bag fees. You also have the same airport lounge access, including Priority Pass Select membership, access to Amex Centurion lounges, and other airport lounges.

Another benefit is the increased category bonus earning on flights and hotels that are booked directly or through amextravel.com. However, The Platinum Card® does not earn any bonus miles for large purchases as its business counterpart does. It also does not get the 35% points rebate when using Pay with Points on eligible flights.

But you do get up to $100 in credits annually toward hotel dining and spa services, monthly credits toward Uber rides or Uber Eats, and up to $100 in credits toward application fees for Global Entry or TSA Pre✓ ®.

The Platinum Card® helps you qualify for elite status when staying in hotels. You will get Hilton Honors Gold elite status and Marriott Bonvoy Gold elite status just for being a cardmember.

8. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The Chase Freedom Flex℠ is a relatively new entry as a travel card. The Chase Freedom Flex℠ has no annual fee and a compelling 0% introductory APR offer. Taking advantage of the 0% introductory APR offer can be useful if you have large purchases you are planning to make after opening the new card.

If the Chase Freedom Flex℠ is the only Chase-branded credit card you have, the points you earn are effectively cash back and are worth 1 cent per point. But if you have premium Chase cards, such as the Ink Business Preferred® Credit Card or the Chase Sapphire Reserve®, you can turn the cash back you earn with the Chase Freedom Flex℠ into valuable points.

You can’t transfer your rewards points earned with the Freedom Flex to Chase’s transfer partners unless you also have a premium Chase card.

You can earn cash back or Ultimate Rewards points with the Chase Freedom Flex℠ in a variety of ways. To start, you’ll receive a signup bonus and then you have standard category bonuses and access to rotating bonus bonus categories each quarter.

If you take the time to maximize your spending with the Chase Freedom Flex℠, you can really score a lot of rewards.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® is Chase’s premium travel rewards credit card and comes with a significant annual fee. Helping to offset the annual fee is an annual travel credit that is automatically applied to your statement when you spend on any travel purchases. Using your travel statement credits toward baggage fees can be a workaround to get a free checked bag while flying.

You will also receive a Priority Pass Select membership that gives you airport lounge access around the world. You’ll also receive up to $100 in statement credits every four years toward either TSA PreCheck® or Global Entry application fees. The Chase Sapphire Reserve® has no foreign transaction fees, which makes it one of the best cards to use in Europe.

One of the best perks of the Chase Sapphire Reserve® is that Ultimate Rewards points are worth 50% more when you redeem them for travel through Chase. That makes each Ultimate Rewards point worth 1.5 cents.

If you have a large balance of Ultimate Rewards points that you’ve earned from other Chase cards, it may be worth getting the Chase Sapphire Reserve® to combine your points and make your existing points worth more.

- Earn 10,000 bonus miles after spending $1,000 in purchases on your new card in your first 6 months of card membership

- Earn 2X miles at restaurants (including takeout and delivery) and 2X miles for every dollar spent on eligible purchases made directly with Delta. Earn 1X miles on all other purchases.

- Receive a 20% savings in the form of a statement credit after you use your card on eligible Delta in-flight purchases of food, beverages, and audio headsets

- Take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com

- No foreign transaction fees

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% - 29.24% Variable

|

$0

|

Good

|

Unlike many of the other cards on this list of the best credit cards for buying airline tickets, the Delta SkyMiles® Blue American Express Card is an airline rewards credit card that earns Delta Skymiles. Skymiles can only be used while flying Delta or partner airlines.

The Delta SkyMiles® Blue American Express Card comes with no annual fee and no foreign transaction fees. You can earn bonus miles as a welcome offer, and you will earn additional SkyMiles airline bonus miles with each purchase. You’ll earn bonus purchases at restaurants and when making a Delta purchase, and you’ll also get 20% back on in-flight Delta eligible purchases of food, beverages, and audio headsets.

Typically, you will want to use your Delta SkyMiles to purchase award flights on Delta’s website. But as a Delta SkyMiles® Blue American Express Card cardholder, you are also eligible to use Delta’s Pay with Miles program.

With Delta’s Pay with Miles, you can use 5,000 Delta SkyMiles to take $50 off the cost of a Delta flight. It’s another way to get free or cheap Delta flights.

- Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don't expire as long as your account remains open.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% - 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

As with the Bank of America® Travel Rewards credit card, the Bank of America® Premium Rewards® credit card has no foreign transaction fees. You’ll also get travel insurance to assist with trip delays, cancellations and interruptions, baggage delay inconvenience, lost luggage, and emergency evacuation and transportation.

The card charges an annual fee, but you can get annual statement credits to help make up the cost, including airline statement credits each year for things like seat upgrades, baggage fees, in-flight services, and airline lounge fees. You can also get a credit every four years toward TSA PreCheck® or Global Entry application fees.

Depending on your relationship with Bank of America, you can get an extra 25% to 75% bonus on your earning rate.

Tips and Tricks for Maximizing Rewards

One good trick to get extra miles and points is to always use a shopping portal when making any sort of online purchase. Most domestic airlines have their own shopping portal.

For example, the American Airlines shopping portal is at aadvantageeshopping.com, and many other airlines have similar sites. Each shopping portal has a list of retailers with different bonus mile amounts.

Take advantage of issuer shopping portals to earn extra rewards for your purchases.

Let’s say you wanted to make a purchase at Old Navy. Before going to Old Navy’s website, go to the American Airlines shopping portal where you’ll see that American is currently offering 4 bonus miles per $1 spent at Old Navy.

Then click through from the American shopping portal to Old Navy and make your purchase as you would normally. If you make a $60 purchase, you will get 240 bonus AAdvantage miles within a few weeks. These miles are in addition to any credit card rewards or cash back that you get from making the purchase, and if you consistently use a shopping portal, those bonus miles will start to really add up.

But earning airline miles and credit card rewards points from signup bonuses and spending is only one half of the equation. You’ll also want to know how to best redeem your miles and points to truly maximize their value. If you earn a lot of miles but don’t research the best way to redeem them, you could be wasting a big chunk of their value.

To truly maximize your rewards, you should understand the difference between the different types of miles and points. Cards that are tied to one specific airline (such as the Delta SkyMiles® Blue American Express Card) typically earn airline miles that are specific to that airline. Your airline miles can only be used in conjunction with the prices set out on that airline’s award chart or website.

If you know the various sweet spots of the airline’s award chart, it is possible to get extremely high value for your airline miles. This is especially true if you are looking to fly in premium cabins and/or if you are flexible in your dates and routes.

But if you have a specific date and location in mind, it may be hard to use your airline miles. Since you’re tied to flying on one specific airline, you may find the price to be outrageously high or there may not even be any award availability.

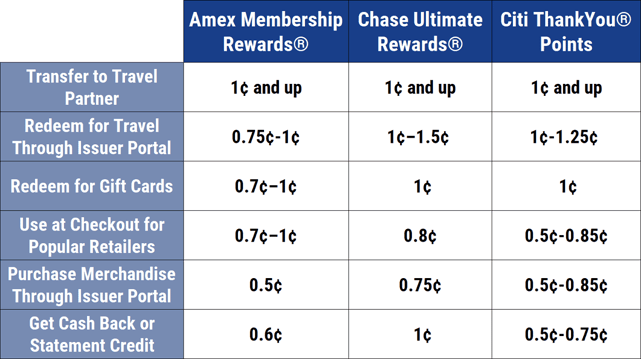

On the other hand, flexible rewards points provide more alternatives for your travel planning. Because they can be used across many different airlines, you have more options. Flexible rewards points like Chase Ultimate Rewards or Capital One Venture miles are typically worth a set amount that doesn’t change.

For example, redeeming Capital One Venture miles are always valued at 1 cent per mile. That means that while you can’t get any outsized value from your points, there is also no such thing as a bad redemption. No matter where or how you redeem them, you’ll get 1 cent per Venture mile.

Which Credit Card is Best for Buying Airline Tickets?

The Capital One Venture Rewards Credit Card is our pick for the best credit card for buying airline tickets. The Venture miles that you’ll earn from the Capital One Venture Rewards card can be used in two different ways.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

You can transfer your Venture miles to one of Capital One’s airline transfer partners. Capital One has many different airline transfer partners (as well as a few hotel transfer partners). You can transfer your Venture miles into airline miles, and then use those airline miles to get a free airline ticket with that airline.

Most people will probably use their Venture miles as a fixed-value currency, with a rate of 1 cent per mile. Your Venture miles can be used in this way on any airline with no blackout dates. If you have a $400 airline ticket that you want to purchase, you can use 40,000 Venture miles to purchase that ticket.

If you don’t have enough airline miles or credit card points to get a free flight, you may be wondering which credit card you should use when buying airline tickets to get the most miles or points back. The following credit cards can offer a category bonus when buying airline tickets:

- Ink Business Preferred® Credit Card

- The Platinum Card® from American Express

- Chase Sapphire Reserve®

- Bank of America® Premium Rewards® credit card

How Do You Get Free Airline Tickets with a Credit Card?

You can earn free airline tickets with a credit card in a few ways. One way is to get a credit card that is tied to one specific airline. The airline rewards earned by using that card come in the form of airline miles.

You can get additional airline miles by spending more money on your airline credit card, purchasing flights and flying with that airline, or several other ways to get airline miles without flying. Then you can redeem your accumulated airline miles to get free flights with that airline.

The number of airline miles required for a free flight depends on the airline’s award chart, and may not be related at all to the cash cost of the exact same flight.

Another way to get free airline tickets with a credit card is to use credit card points to pay for your airline ticket. Many rewards credit cards have their own proprietary points currencies. Among those cards are:

- Chase Ultimate Rewards points

- American Express Membership Rewards

- Citi ThankYou points

- Capital One Venture miles

- Bank of America Preferred Rewards

These credit card points can often be used for most types of travel, including airline tickets. The value of each point depends on the type of points and credit card issuer, but, usually, you’ll get around 1 cent per point.

Because you can use these types of credit card points on almost any airline, this can be a great way to get free airline tickets with a credit card.

What Credit Score Do You Need for an Airline Credit Card?

Most airline credit cards require either good or excellent credit. This means you’ll typically need a credit score of 670 or above to get an airline credit card.

If your credit score is below that number, you may need to first focus on improving your credit score before applying for a new card.

While most airline credit cards require good or excellent credit, some cards offer bonuses, even for people with bad credit. So, as an alternative, you may be able to get rewards or signup bonuses even with less-than-perfect credit. Then you can use the cash back or statement credits that you get toward airline purchases or other travel expenses.

Can I Get an Airline Credit Card with Bad Credit?

As we mentioned in the previous section, an airline credit card will likely not be available to people with bad credit. Most airline credit cards are geared toward people with good or excellent credit — which usually means a credit score of 670 or higher.

If your credit is less than ideal, you may want to focus on improving your credit first before applying for an airline credit card.

To improve your credit, begin by checking your credit report to see if there are any inconsistencies or inaccuracies. Clearing up mistakes on your credit report can help get you closer to applying for a new airline credit card.

Can I Get a Refund on My Ticket Purchase if I Paid by Credit Card?

Whether you are eligible for a refund or not depends on what type of ticket purchase you made. Most airline tickets are non-refundable unless you have airline elite status. One possible exception is that some award tickets are refundable, or at least changeable.

Typically, trying to do a chargeback with your credit card will not work, and may even put your airline loyalty account in jeopardy. Many airlines relaxed their restrictions for changing and canceling flights in response to the COVID-19 pandemic.

So, if you’re looking to get a refund on your ticket purchase, make sure to check the fine print of your ticket as well as the policy of the airline itself.

Which Credit Cards Offer Priority Boarding?

Priority boarding is something many travelers covet. There is something satisfying about being able to quickly get out of the gate area and to your seat. This is especially true for people traveling with families or groups.

Several credit cards offer priority boarding just for being a cardholder. These are almost exclusively airline credit cards, and they give you priority boarding only on one specific airline. Typically, you will board after most or all of their elite members, but before other passengers.

Here are some credit cards that offer priority boarding:

- Citi® / AAdvantage® Executive World Elite Mastercard®

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

- CitiBusiness® / AAdvantage® Platinum Select® World Elite Mastercard®

- AAdvantage® Aviator® Silver World Elite Mastercard®

- AAdvantage® Aviator® Red World Elite Mastercard®

- AAdvantage® Aviator® World Elite Business Mastercard®

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Gold American Express Card

- FRONTIER Airlines World Mastercard®

- Southwest® Rapid Rewards® Priority Credit Card

- Free Spirit® Travel More World Elite Mastercard®

- United℠ Explorer Card

- United Club Card

Many airline co-branded credit cards can help you get elite status with the airline. This is usually by either giving you elite status outright or giving you extra elite-qualifying miles to help you get to that next highest elite status level. Most airlines give members with elite status priority boarding.

Which Credit Cards Offer Free Checked Bags?

Just like priority boarding, getting a free checked bag is something that comes with airline elite status. However, some credit cards offer free checked bags.

Here are a few of the credit cards you can get if you are looking for a free checked bag:

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®: cardholder and up to four companions traveling on the same flight

- Citi® / AAdvantage® Executive World Elite Mastercard®: cardholder and up to eight companions traveling on the same flight

- Barclays AAdvantage® Aviator® Red World Elite Mastercard®: cardholder and up to four companions traveling on the same flight

- Delta SkyMiles® Gold American Express Card or Delta SkyMiles® Gold Business American Express Card: cardholder and up to eight companions traveling on the same flight

- Delta SkyMiles® Platinum American Express Card or Delta SkyMiles® Platinum Business American Express Card: cardholder and up to eight companions traveling on the same flight

- Delta SkyMiles® Reserve American Express Card: cardholder and up to eight companions traveling on the same flight

- United℠ Explorer Card: cardholder and one companion traveling together

- Alaska Airlines Visa® Credit Card: cardholder and up to six people traveling on the same flight

- Hawaiian Airlines® Bank of Hawaii World Elite Mastercard®: cardholder only

- JetBlue Card: cardholder and up to three companions traveling on the same reservation

Again, you may want to consider an airline card that helps you earn elite status with an airline. Having elite status typically comes with free checked bags.

Another option if you are looking for free checked bags across multiple airlines is to get a credit card that comes with an airline incidental fee credit. You can use your airline credit to pay for your checked bags — netting out with “free” checked bags.

Which Credit Cards Offer Lounge Access?

Most of the cards that offer airport lounge access are the luxury and premium credit cards that charge annual fees in the hundreds of dollars. Many of these luxury credit cards offer their airport lounge access through a complimentary third-party membership in lounge company Priority Pass.

Here are some of the luxury credit cards that offer unlimited complimentary visits to airport lounges via a Priority Pass Select membership:

- Chase Sapphire Reserve®

- The Platinum Card® from American Express

- Marriott Bonvoy Brilliant® American Express® Card

- U.S. Bank Altitude® Reserve Visa Infinite® Card

Note that both versions of the American Express Platinum card also offer access to the American Express Global Lounge collection. In addition to a Priority Pass membership, having these cards will gain you access to Escape lounges, Airspace lounges, American Express Centurion lounges, and Delta Sky Clubs (when flying Delta).

In addition, a few credit cards come with smaller annual fees that offer a limited number of lounge visits per year. If you’re not a frequent traveler, this may be sufficient for what you’re looking for, at a fraction of the cost:

- Hilton Honors American Express Surpass® Card: 10 free lounge visits per year

- Hilton Honors American Express Business Card: 10 free lounge visits per year

Another way you can get lounge access is by having one of the airline-specific club access cards. These cards also have large annual fees in the hundreds of dollars. Having one of these cards will grant you access to any of the airline-specific airport lounges, though, generally, you will need to be also flying on the airline in question.

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business Card

- United Club℠ Infinite Card

- Citi® / AAdvantage® Executive World Elite Mastercard®

Are Credit Card Points or Miles Better for Earning Free Flights?

Whether credit card points or miles are better for earning free flights depends on what type of flights you are looking to get. With airline miles, your miles are tied to one specific airline (and its partners).

So if you are looking to fly on Southwest Airlines, having American Airlines AAdvantage miles will not help you at all.

While it is possible to get outsized value using airline miles, credit card points are typically redeemed for free flights at a specific redemption rate. This varies depending on the type of credit card points but is usually around 1 cent per point.

Because you can use them for free flights across different airlines, credit card points are generally considered more flexible than the miles you get from an airline card.

Is an Air Miles Card Worth It?

Having an airline card that earns airline miles can be worth it for a variety of reasons. In addition to the airline miles you get from your signup bonus and ongoing spending, many airline rewards credit cards offer airline rewards such as a free checked bag or priority boarding.

If you travel often or with a family, the benefits of these airline rewards credit cards can really add up.

Deciding which airline credit card is best for you will depend on your specific travel and spending patterns. If you’re getting an airline rewards card, you’ll want one that earns airline miles for an airline that you frequently fly. If you’re looking for a new airline card, you may also consider our list of the best cards for airline miles.

Can You Combine Miles and Points from Different Credit Cards?

Combining miles and points from different programs is typically not possible (at least not at a reasonable rate). For example, you can’t combine your Delta SkyMiles with your American Airlines AAdvantage miles. You can’t combine your Hilton Honors points with your World of Hyatt points.

One exception to this rule is with transferable points, as we mentioned earlier in the article. This can often be a very lucrative thing to do to maximize the value of your points.

You can transfer transferable points like Chase Ultimate Rewards, American Express Membership Rewards, Citi ThankYou points, and Capital One Venture miles to a variety of transfer partners. These transfers are one-way and irreversible.

Another points currency you may not realize is transferable are Marriott Bonvoy points. You can transfer Marriott Bonvoy points at a rate of 3:1 to over 40 airlines. And for every 60,000 Marriott Bonvoy points you transfer, you get 5,000 airline bonus miles, so your 60,000 Bonvoy points become 25,000 airline miles.

It often is possible to combine miles and points within the same family of cards or sometimes even between members of the same household who have the same cards, with certain exceptions.

For example, if you have an American Express® Gold Card, you can take the Membership Reward points that you have earned with your Gold card and combine them with the Membership Rewards points that you earned with Ink Business Preferred® Credit Card. Then you can use your combined points to make an airline purchase and get the 35% rebate with Ink Business Preferred® Credit Card.

It’s an even better idea to combine your points if you have Chase Ultimate Rewards points. The value you get from your Ultimate Rewards points depends on the credit card. It pays off to combine your Ultimate Rewards points to the Chase credit card that has the highest value.

If you have only the Chase Freedom Unlimited® or Chase Freedom Flex℠, your points would be worth only 1 cent per point in the Ultimate Rewards travel portal. Points associated with the Chase Sapphire Reserve® are worth 1.5 cents per point in the Chase travel portal.

So if you take the Ultimate Rewards points you’ve earned with your Chase Freedom Unlimited® and transfer them to your Chase Sapphire Reserve® account, you’ve instantly increased the value of your points by 50%.

What is a Co-Branded Airline Credit Card?

You will often hear an airline rewards credit card referred to as a co-branded credit card. A co-branded credit card is simply the term for a credit card that is marketed under two different brands.

Usually, the two brands on a co-branded credit card are the card issuer and a hotel or airline. One example of this is the Delta SkyMiles® Blue American Express Card. This card is co-branded between American Express and Delta. Co-branded credit cards are different from cards that have just one brand.

Examples of credit cards with just one brand are the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card.

Review the Best Credit Cards for Buying Airline Tickets

There are many different options for using credit cards to purchase an airline ticket. Our choice for the best credit card for buying airline tickets is the Capital One Venture Rewards Credit Card. Its combination of a hefty signup bonus and flexible rewards make it our preferred option.

Other cards may make sense depending on the airline you’re looking to fly and the kind of airline tickets you’re looking for. Check out our list of the best credit cards for buying airline tickets to see which one works for you.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Ways to Use Credit Card Rewards to Buy Airline Tickets ([updated_month_year]) 5 Ways to Use Credit Card Rewards to Buy Airline Tickets ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/How-to-Use-Credit-Card-Rewards-to-Buy-Airline-Tickets.jpg?width=158&height=120&fit=crop)

![9 Best Airline Credit Cards ([updated_month_year]) 9 Best Airline Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Airline-Credit-Cards-Feat.png?width=158&height=120&fit=crop)

![What’s the Best Credit Card for Airline Miles? ([updated_month_year]) What’s the Best Credit Card for Airline Miles? ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Best-Airline-Miles-Card.jpg?width=158&height=120&fit=crop)

![9 Best Airline Rewards Programs: Expert Guide ([updated_month_year]) 9 Best Airline Rewards Programs: Expert Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/airline.png?width=158&height=120&fit=crop)

![5 Travel Credit Cards For Bad Credit ([updated_month_year]) 5 Travel Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Travel-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Hotel Rewards Credit Cards ([updated_month_year]) 7 Best Hotel Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/01/hotels.png?width=158&height=120&fit=crop)

![8 Best Travel Credit Cards for Students ([updated_month_year]) 8 Best Travel Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Best-Travel-Credit-Cards-for-Students-1.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards to Use in Europe ([updated_month_year]) 8 Best Credit Cards to Use in Europe ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/europe.png?width=158&height=120&fit=crop)