This Luxury Card review is a must-read if you like credit cards that pamper. Not only will you find out how this trio of stunningly beautiful metal cards cushions all the tiresome traveling and shopping your lifestyle demands, but you’ll also learn about the premium credit cards competing for your affection.

We’ll show you the best since, for some, only the best will do.

-

Navigate This Article:

Luxury Card With the Best Redemption Rates

The gold-plated Mastercard® Gold Card™ weighs an extraordinary 22 grams. Acquiring it will cost you and your significant other triple digits, but you’ll receive good value for airfare and cash back redemptions.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 2% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $200 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Gold Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Made with 24K Gold: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $995 ($295 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$995 ($295 for each Authorized User added to the account)

|

Excellent

|

You receive VIP travel benefits, including complimentary lounge access and a subscription to Luxury Magazine, that enhance your experiences and save you money. Luxury Card Concierge stands ever-ready to help with your personal requests, travel bookings through Luxury Card Travel, resort reservations, and access to exclusive events.

Luxury Card With the Best Cost/Benefit Tradeoff

You may prefer the Mastercard® Black Card™ for its more reasonable annual fee. It still offers the top rate on airfare redemptions, although it scales back its cash back rewards and annual airline credit.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1.5% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $100 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Black Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Black PVD-Coated Metal Card: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $495 ($195 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$495 ($195 for each Authorized User added to the account)

|

Excellent

|

As with all Luxury Cards, this one may offer a 0% intro APR to new cardmembers from time to time, and it never charges a foreign transaction fee. Luxury Card Concierge can procure entry to the best spa services and five-star restaurants anywhere you travel. No review of this card would be complete without mentioning the substantial fee for adding an authorized user.

Luxury Card With the Lowest Annual Fee

The Mastercard® Titanium Card™ is the trio’s bargain option but still provides the same high airfare redemption rate: 50,000 points will get you a $1,000 ticket on any airline with no seat restrictions or blackout dates.

- Ideal for those seeking an introductory premium travel card that provides exceptional airfare redemption, access to hotel privileges and elevated service beyond the ordinary. Find peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Members-only LUXURY MAGAZINE®.

- Brushed Metal Card Design: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual fee: $195 ($95 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$195 ($95 for each Authorized User added to the account)

|

Excellent

|

You won’t sacrifice any of your fabulous Luxury Card Concierge privileges with this card, from booking tee times to arranging flower deliveries. You also receive a subscription to Luxury Magazine and free insurance against trip cancellations and interruptions, travel accidents, and rental car collisions.

What Is Luxury Card?

Luxury Card LLC, a global leader in the premium credit card market, owns the three Luxury Cards and licenses Barclays Bank to issue them. More than 8 million retailers in 210 countries accept these Mastercards.

Barclays has offices in the United States, China, Japan, and the Netherlands. These heavyweight cards have garnered 70 patents worldwide for their unique design and construction.

The Luxury Cards reward travelers with a high travel redemption rate and first-class concierge services, available online, over the phone, through the Luxury Credit Card app, or via email. The in-house travel program provides an average value of $500 per stay in benefits and services at more than 3,000 properties worldwide.

The Luxury Cards may offer a 0% intro APR on balance transfer transactions. Note that each balance transfer incurs a transaction fee.

How Do I Get a Luxury Card?

You can visit the Luxury Credit Card website to apply for any of its cards. You must be at least 18 years old and live in the United States or its territories to be eligible.

You can’t get a new card if you currently or previously had an account with Luxury Card. While never explicitly stated, you need good or excellent credit and a healthy income to qualify for a Luxury Card.

Barclays Bank performs a hard credit inquiry when you apply for any of these cards, triggering a small point drop and a two-year annotation on your credit report. You must provide your name, street address, date of birth, Social Security number, and other personal information. You may also have to supply proof of citizenship and copies of identifying documents,

How Do I Redeem Luxury Card Rewards?

Luxury Cards provide points rewards that you can redeem in several ways:

- Airfare rewards: You can redeem your points for a scheduled, nonrefundable ticket on a participating major airline carrier. You must book your air travel through Luxury Card Travel. Redemptions start at 50 points ($1.00) and continue in 50-point increments after that.

- Cash back: You can get a statement credit in increments of 66 points ($1.00). You can’t combine cash back with other rewards. It will take five to seven business days to receive your credit, which you can apply against your account balance but not your minimum payment.

- Gift cards: You can redeem points for gift cards at a 1% rate, subject to change at any time. For example, you need 5,000 points for a $50 gift card. You’ll receive your gift card via standard mail, but you can pay an extra fee for expedited delivery. You cannot exchange or transfer gift cards.

- Hotel/car rental certificates: These are subject to the same rules as those for gift cards. You can use them at participating locations through the printed expiration date.

- Merchandise shopping: You can redeem your points for merchandise delivered by standard mail with a four- to six-week lead time. Items are subject to availability and substitution.

You can redeem points online anytime at myluxurycard.com. You can also call the Rewards Service Center at 844-724-2500, option 1, between 7:00 AM and 9:00 PM Monday through Friday and between 9:00 AM and 9:00 PM Saturday and Sunday, Eastern Time to redeem points.

Your points won’t expire while your account remains open and in good standing. You cannot earn or redeem points in billing cycles when your payment is late or your account is delinquent. You may forfeit your points if you:

- Allow your account to become seriously delinquent or go into default

- You or the bank close the account

- You engage in fraudulent activity

The credit card issuer cannot reinstate forfeited points.

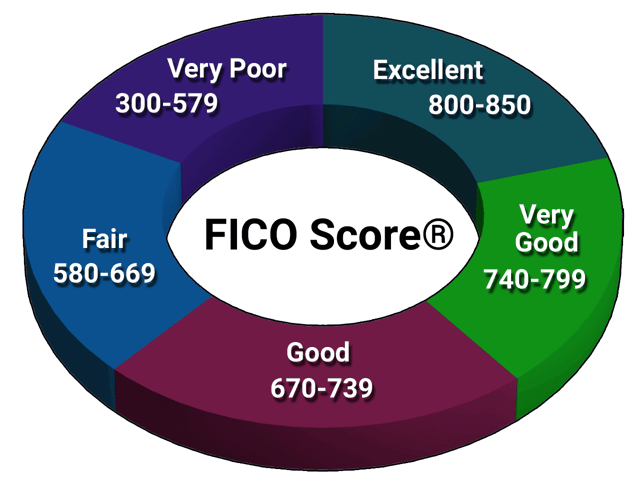

What Credit Score Do You Need For a Luxury Card?

You need good to excellent credit to get a Luxury Mastercard. Although the translation to a FICO score is imprecise, you should have a credit score of at least 720 to apply.

But you may still qualify with a lower score since part of the decision by the credit card issuer depends on your income, spending levels, employment history, and debts. A record of on-time bill payments is essential.

We have no proof, but it can’t hurt your approval chances if you have a pre-existing account in good standing with Barclays Bank.

What Credit Limit Can I Get From a Luxury Card?

Of the three, the Luxury Card™ Mastercard Gold Card no doubt has the highest credit limit (to accompany its annual fee, which is also the highest). The card belongs to the World Elite Mastercard collection, giving it a minimum credit limit of $5,000.

We expect that you can get a $10,000 limit without too much fuss, and much higher limits are probably available if you have the income. We’ve seen other World Elite Mastercards with credit limits of up to $100,000.

Which Credit Cards Directly Compete With Luxury Card?

Luxury Card faces stiff competition in the premium travel card space. Most of these rivals offer better perks for less cost.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® has a steep price tag, though well below that of the Mastercard® Gold Card™. But it more than pays for itself through its generous rewards, travel rebates, annual airline credit, and extensive protections and conveniences.

Your Chase Ultimate Rewards points gain extra value when you redeem them through Chase Travel, and you receive a travel credit each anniversary year. The card offers the best travel insurance coverages available, including a primary collision damage waiver on rental cars.

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% – 27.49% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® from American Express is an excellent choice for travel rewards. Its high annual fee helps pay for hotel stays, airline and baggage fees, digital entertainment, and discounts at select merchants.

The card offers exclusive deals from American Express Travel and does not charge a foreign transaction fee. It also insures you against trip delays, cancellations, and lost baggage.

- Earn 60,000 Membership Rewards® points after you spend $4,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the Gold Card at Grubhub, Seamless, Boxed and other participating partners. This can be an annual savings of up to $120. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. A minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% – 28.49% Pay Over Time

|

$250

|

Excellent

|

The American Express® Gold Card competes head-on with the Luxury Card Mastercard Titanium Card. It charges a moderate annual fee and offers bonus points for the flights you book directly with airlines or Amex Travel.

Perks include car rental loss and damage insurance, baggage insurance, personalized travel services, and no foreign transaction fees. You earn top rewards when you use the card to pay for restaurant dining and supermarket shopping.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

Priced well below the Mastercard® Black Card™, the Capital One Venture X Rewards Credit Card provides a signup bonus and better rewards. Both cards offer the same anniversary credit, but Venture X also gives you an annual reimbursement for bookings through Capital One Travel.

Although either card gives you access to Priority Pass lounges, only Venture X can get you into a Capital One Lounge. You can transfer the points from this Visa Infinite card to more than a dozen travel partner programs.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. - Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% (Variable)

|

$95

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Premier® Card has replaced the Citi Prestige Card as the bank’s leading travel card. The card charges a remarkably low annual fee yet offers a generous signup bonus.

You can redeem your reward points directly or transfer them to select airline frequent flyer programs such as JetBlue TrueBlue®, Virgin Atlantic Flying Club, and Singapore Airlines Kris Flyer. Benefits include free addition of authorized users, access to Citi Entertainment, digital wallet compatibility, and contactless pay.

- Earn 150,000 Hilton Honors Bonus Points after you spend $4,000 in purchases on the card within your first 3 months of Card Membership

- Earn 14X points on hotels and resorts in the Hilton portfolio

- Earn 7X points on select travel, including flights booked directly with airlines or AmexTravel.com and car rentals booked directly with select car rental companies, and at US restaurants, including takeout and delivery. Earn 3X points on other eligible purchases.

- Enjoy complimentary Hilton Honors Diamond status with your Hilton Honors Aspire Card

- Enjoy one weekend night reward with your new Hilton Honors American Express Aspire Card and every year after renewal. Plus, earn an additional night after you spend $60,000 on purchases on your card in a calendar year.

- $450 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 29.24% (variable)

|

$450

|

Good/Excellent

|

The Hilton Honors American Express Aspire Card offers Hilton Honor points and resort credits, annual airline purchase credits, and Diamond Elite status. You earn Hilton Honor points at any Hilton property, including Waldorf Astoria, Conrad, and DoubleTree.

This card offers excellent perks for flights, hotels, and US restaurants.

What Is the Most Elite Credit Card in the World?

The American Express Centurion Card was the original Black Card and is still the hardest to acquire. It is a millionaire’s card, a favorite of executives and celebrities, and available by invitation only. Excellent credit alone isn’t enough to qualify for the American Express Centurion Card.

Amex designed the card for wealthy shoppers who charge hundreds of thousands of dollars on yearly purchases. The eye-watering initiation and annual fees discourage all but the wealthiest consumers.

Interestingly, the card’s benefits (other than its astronomical spending limit) fall well below those of Chase Sapphire Reserve, one of the best credit cards for travelers.

Does Luxury Card Offer a Business Credit Card?

As of yet, Luxury Card has not introduced any business credit cards. While you wait, consider these three excellent business cards.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more – your points don’t expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred® Credit Card has a generous signup bonus and its travel reward rate exceeds that of the Luxury Cards for the first $150,000 of spending on select categories. We think it’s the best business card value in this credit card review.

As with the Chase Sapphire Preferred® Card, this card’s rewards points gain 25% more value when you redeem them through Chase Travel℠. You can authorize cards for your employees at no additional cost. The card charges no foreign transaction fee, and you can transfer your points 1:1 to a participating frequent travel program.

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Use Membership Rewards® Pay with Points for all or part of an eligible fare and get 35% of those points back, up to 1,000,000 points back per calendar year

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.74% – 26.74% Pay Over Time

|

$695

|

Excellent

|

The annual fee for the Business Platinum Card® from American Express is about the same as the Mastercard Black Card’s, but its rewards are superior. The card offers a substantial signup bonus, and you get maximum points when you book flights and prepaid hotels through American Express Travel.

This business card’s Pay Over Time feature provides new cardowners with a 0% intro APR on purchases for a set period. You also receive a credit for Global Entry or TSA Pre-Check fees and another credit for incidental airline charges, such as checked bags and in-flight refreshments.

- Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of card membership

- Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle, including airfare purchased directly from airlines, U.S. purchases for advertising in select media (online, TV, radio), U.S. purchases made directly from select technology providers of computer hardware, software, and cloud solutions, and U.S. purchases at gas stations, restaurants, or for shipping. Applies to the first $150,000 in combined purchases from these 2 categories each calendar year.

- Earn 1X Membership Rewards® points on other purchases

- Book your flight with American Express Travel using Membership Rewards® Pay with Points and get 25% of those points back, up to 250,000 points back per calendar year

- $295 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.74% – 26.74% Pay Over Time

|

$295

|

Excellent

|

The American Express® Business Gold Card costs more than the Luxury Card Titanium Mastercard. Still, it delivers more, including a welcome bonus and a higher rewards rate on your two favorite merchant categories. Moreover, your points gain value when you use them to book a flight through American Express Travel.

This business version of the American Express® Gold Card doesn’t charge a foreign transaction fee and offers a credit for qualifying activities. You also receive complimentary insurance for baggage, trip delay, and rental cars.

A Luxury Card to Match Your Budget

The Luxury Card collection offers a credit card for almost every budget. Undeniably, Luxury Cards are beautiful to behold, and will likely boost your prestige among your impressionable friends. But no Luxury Card review would fail to mention the rather ordinary perks these cards deliver.

We suggest you consider the alternatives before deciding on the best credit card for your needs, especially if you’re seeking the most value for your money.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[card_field card_choice='29774' field_choice='title' link_type='none'] vs. The Luxury Card ([updated_month_year]) [card_field card_choice='29774' field_choice='title' link_type='none'] vs. The Luxury Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Chase-Sapphire-Reserve-vs.-Luxury-Card.jpg?width=158&height=120&fit=crop)

![7 Best Luxury Credit Cards ([updated_month_year]) 7 Best Luxury Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Luxury-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![Capital One Quicksilver Card: Review & Options ([updated_month_year]) Capital One Quicksilver Card: Review & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Capital-One-Quicksilver-Card-Review.jpg?width=158&height=120&fit=crop)

![Mercury Credit Card: Review & 5 Alternatives ([updated_month_year]) Mercury Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Mercury-Credit-Card-Review.jpg?width=158&height=120&fit=crop)

![Instacart Credit Card: Review & 5 Alternatives ([updated_month_year]) Instacart Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Instacart-Credit-Card.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5856' field_choice='title'] Review, Credit Score & Rewards ([updated_month_year]) [card_field card_choice='5856' field_choice='title'] Review, Credit Score & Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/shutterstock_119978758.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year]) [card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/09/caponesavor2.png?width=158&height=120&fit=crop)

![[card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year]) [card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/shutterstock_1023516253-1.jpg?width=158&height=120&fit=crop)