If you’ve ever needed cash when your bank account was low, you’ll be interested in credit cards you can use at an ATM. These cards let you use an ATM to borrow money without ever touching the balance in your checking account.

The credit cards that have this superpower use one of the big four payment networks (Visa, Mastercard, Discover, and Amex). Store credit cards that use secondary payment networks don’t offer ATM-based cash advances.

You’ll need a PIN to unleash an ATM’s awesome ability to dispense cash from your credit card account. Typically, you set up your PIN online, but you can also do it over the phone.

Good Credit | Students | Bad Credit | Prepaid | FAQs

Cards For Good Credit You Can Use at an ATM

When you have good credit, you’re able to get a credit card with low fees and APRs. That’s what distinguishes these three cards, all of which unlock cash from an ATM with nary a problem.

The smallest credit card cash advance fee is about $10 or 3% of the advance amount, whichever is greater. Many cards charge 5% rather than 3%. APRs for cash advances average around 25%.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

You’ll need a PIN to withdraw from your Discover it® Cash Back credit limit, which you can create online. You can use the card at over 415,000 ATMs, with access to more than 60,000 surcharge-free ATMs. The amount you can withdraw from an ATM using this card is limited to your available cash advance credit limit.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

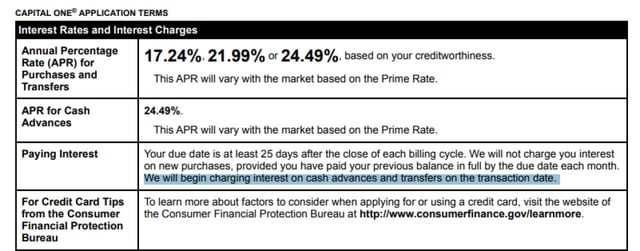

The Capital One Venture Rewards Credit Card charges a low cash advance fee, but you may have to pay an additional ATM fee for machines that aren’t in the 39,000-location Capital One or AllPoint networks. You can get the required PIN online or by calling 1-800-227-4825.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

You’ll need a four-digit PIN (available by calling 800-432-3117) for ATM withdrawals with the Chase Freedom Unlimited®. Withdraws are free at any of the 16,000 Chase ATMs nationwide. There are limits as to how much cash you can access so be sure to check your card’s terms and conditions first.

Cards For Students You Can Use at an ATM

Students need cash for myriad reasons, and a credit card that works with ATMs allows cash advances at all hours of the day and night. These student credit cards are available to undergraduates who don’t necessarily have any previous credit history.

Students may need the ability to get a cash advance when their bank account balances are vanishingly small, a phenomenon that millions face each academic year. We like these student credit cards because they offer cash back on purchases and do not charge an annual fee.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

You can use the Discover it® Student Cash Back to take cash advances at more than 415,000 ATMs, of which 60,000 are surcharge-free through the AllPoint and MoneyPass ATM networks. You can use the online ATM Locator to find nearby machines so you can plan your surcharge-free withdrawals.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card for Students can provide cash advances at thousands of Bank of America ATMs without an extra ATM fee. The APR for ATM cash advances is unusually high, but the transaction fee is about average. You can get the required ATM PIN online or order it over the phone (800-732-9194) for mail delivery, and you can reset your PIN at any Bank of America ATM.

Cards For Bad Credit You Can Use at an ATM

Bad credit shouldn’t prevent you from getting an ATM cash advance, and these three cards do the job well. The two bank-issued cards charge higher-than-average APRs, but the credit union card is a bargain, boasting a very low APR and transaction fee.

Generally, the size of cash advances permitted by these cards is low, although a secured credit card may accept larger deposits that boost the maximum cash advance.

6. Merrick Bank Double Your Line® Mastercard®

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Merrick Bank Double Your Line® Mastercard® is an unsecured card available to folks with bad credit. Unfortunately, it charges high fees and APRs, including those for cash advances, as well as low initial credit lines. You can use the card at any ATM that accepts a Mastercard debit card, (extra fees may apply), but you’ll need a PIN, available by calling 800-204-5936.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

The Capital One Platinum Secured Credit Card charges an above-average APR for cash advances, but its transaction fee is low. There is no extra charge when you take a cash advance at one of the 39,000 Capital One or AllPoint ATMs, but other ATMs may require a surcharge. You can order the ATM PIN for this secured credit card over the phone or online.

- All credit lines start at $250

- Earn Flexpoints Rewards - 1 point for every $1 spent

- Competitive low rate

- Use the card responsibly and you can be automatically graduated to a Platinum Rewards Credit Card

- Visa card benefits like Roadside Dispatch, a pay-per-use roadside assistance program

- 25-day grace period on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

16.49%

|

$0

|

N/A

|

The Savings Secured Platinum Rewards Credit Card issued by the SDFCU Credit Union offers a terrific 16.49% APR that applies to purchases, balance transfers, and cash advances, and the ATM cash advance transaction fee is a low, flat amount. You can access almost 30,000 surcharge-free ATMs on the CO-OP Network using the issued PIN. ATM cash advances are limited to a daily maximum of $810, and there is a limit of four transactions per day.

Prepaid Cards You Can Use at an ATM

Prepaid cards are not credit cards or charge cards, but rather are akin to prepaid debit cards, ATM cards, or reusable gift cards, and they are funded by your card’s balance. When you use them at an ATM for a cash advance, the money is taken from your card’s account balance, not from a credit, checking, or savings account.

Your credit score doesn’t impact your ability to get a prepaid card, but, likewise, the cards don’t impact your credit score, even when you consistently pay your bill on time. Because there is no credit involved, it is misleading to call a prepaid debit card a prepaid credit card.

In fact, we think the term “prepaid credit card” should be banned from polite company altogether. Also, it is not really a gift card since it is a reloadable prepaid card. An ATM card is also different because it is limited to ATM use. And don’t get us started on “prepaid charge cards.”

Prepaid debit cards generally charge either a monthly fee or a per-use fee for every debit card transaction. A monthly fee structure is probably more popular across the industry.

These cards charge a flat fee for each ATM cash withdrawal. If you’d like to get cash from these cards without the fee, ask for cash back when you use them to make a point-of-sale purchase at a grocery store and other retailers.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The PayPal Prepaid Mastercard® charges $2.50 for an ATM withdrawal in the United States, 4% for international ATMs. However, surcharges almost certainly apply, except for withdrawals made on the MoneyPass ATM Network. A PIN is required for ATM machine usage — you must set your PIN when you register/activate your card online.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

It will cost you $2.95 to make a domestic ATM withdrawal using the NetSpend® Visa® Prepaid Card, while foreign ATMs will trigger a 4% transaction charge plus surcharges. You can obtain cash with your card and PIN from any ATM bearing the Visa, Plus, or PULSE acceptance mark. ATM owners may set surcharges and daily withdrawal limits for this prepaid Visa debit card.

- Brink’s knows Security! 24/7 access to a suite of security benefits to help keep your account armored.

- Get access to over 100,000 Brink’s Money ATMs.

- Get paid faster than a paper check with direct deposit.

- Add funds to your Brink’s Armored Account and use Brinks Armored debit card anywhere Debit Mastercard is accepted.

- Account opening is subject to registration and ID verification. Terms & fees Apply. Deposit Account is established by Pathward®, N.A., Member FDIC.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fees

|

Not applicable

|

The Brink’s Armored™ Account charges a $2.50 domestic ATM withdrawal fee, and the surcharge for a foreign ATM withdrawal is 4% plus any local charges. Armed with your PIN, you can withdraw cash from any ATM bearing the Mastercard, Cirrus, or PULSE logos. Be prepared to pay any surcharge collected by the ATM owner.

How Do I Use a Credit Card at an ATM?

It’s child’s play, really. You insert the card, type in your PIN, select the amount you want to withdraw and collect your money and receipt. You will get an error if you use the wrong PIN or if you have insufficient credit (or funds deposited in a prepaid card account) for the amount you want to withdraw.

To minimize the fees for an ATM-based credit card cash advance, use an in-network ATM owned by or subscribed to by the credit card company. Most issuers provide some form of ATM finder service, usually online, that shows you where the nearest in-network ATMs are located. These machines can be used without an additional fee beyond what the card charges for a cash advance.

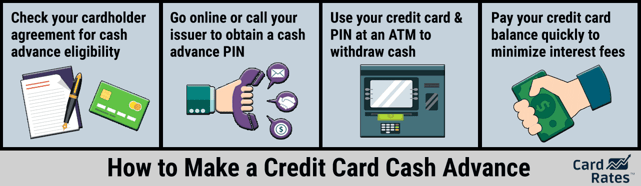

Here is a quick summary chart showing the overall procedure for making a cash advance from a credit card:

You will need a PIN before using the ATM. You can get one online or via mail when initiated by a phone request. Some machines allow you to reset your PIN directly.

Remember to repay your cash advance as soon as possible because credit cards charge high APRs for this type of transaction, and the charges kick in right away — there is no grace period for cash advances.

Is There a Limit to How Much I Can Withdraw?

Limits occur in two ways:

- You cannot withdraw more than your card’s cash advance limit, minus any existing balance on the card. If you are using a prepaid card, the limit is the current card balance.

- The card issuer and/or ATM owner may impose limits on the daily number of transactions or withdrawal amounts.

Your credit card statement will disclose your cash advance limit, which is usually some percentage of your overall credit limit. The limit kicks in when you attempt to exceed it, either in a single withdrawal or over the course of several.

How Can I Get Cash Off My Credit Card Without a PIN?

You have a few options to get cash from your credit card without a PIN:

- Human tellers: You can walk into a bank branch or other financial institution that can access your account and ask the teller for a cash advance. You will have to fill out a request form and show an acceptable form of identification.

- Checks: You can order checks from your card issuer that work just like those from your checking account, except the money comes from your credit line rather than your checking account balance.

- Cash back (prepaid cards only): You can ask the cashier at any point of sale (POS) location, such as the grocery store checkout line, for cash back when you pay for a purchase with a prepaid or debit card. The procedure is for you to pay for the purchase plus the amount of the cash back, and the cashier hands you the cash along with your receipt. There is usually no fee for cash back — it’s a customer courtesy.

Unfortunately, credit cards can’t be used for cash back transactions at POS locations.

Can I Transfer Money From My Credit Card to My Bank Account?

Yes, you can usually transfer money in either direction between a credit card and your bank account. Many ATMs support a direct deposit of cash, and you can also perform a transfer online if the two accounts are linked.

There are apps like Venmo that allow you to transfer money, and you can even use a money transfer service like MoneyGram or Western Union. You also can write a check from your credit card issuer and deposit it into your bank account.

In some cases, you can call the bank or credit union issuer of the card and ask a customer service rep to perform the transfer for you.

Is it Bad to Withdraw Money From a Credit Card?

Credit card cash advances aren’t the cheapest way to borrow money, but they can be among the fastest. The APR on a typical credit card cash advance is about 25%, and there is a fee for each transaction, usually around 5% or $10, whichever is greater.

There is no grace period on a cash advance. Interest begins accruing right away, so you’ll want to repay the advance as soon as you can.

The APR for cash advances is generally higher than it is for purchases, and there is no interest-free grace period.

On the plus side, you can get a cash advance up to your card’s limit without prior authorization. That means you can get your hands on cash in the time it takes to walk over to an ATM, and there are no papers to fill out or loan officers to negotiate with.

If you need a loan for 30 days or longer, you may want to pursue a different arrangement, such as a personal loan.

Research Credit Cards You Can Use at an ATM

Our review of the best credit cards you can use at an ATM reveals the many choices available to you. Always understand ahead of time 1) what the fees will be for getting a cash advance and 2) what extra fees the ATM network will charge.

Our summary boxes are a good start, but you can visit the credit card company’s website by clicking on the APPLY HERE buttons. Look at each card’s Schumer box and the other fine print to find out what’s lurking in the shadows. And speaking of shadows, choose an ATM in a safe, well-lit location — you want the cash to go into your pocket, not someone else’s.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Prepaid Cards With ATM Access ([updated_month_year]) 7 Prepaid Cards With ATM Access ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Prepaid-Cards-With-ATM-Access.jpg?width=158&height=120&fit=crop)

![9 Best Debit Cards With No ATM Fees ([updated_month_year]) 9 Best Debit Cards With No ATM Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Debit-Cards-With-No-ATM-Fees.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)

![10 Credit Repair Credit Cards ([updated_month_year]) 10 Credit Repair Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Credit-Repair-Credit-Cards.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)