You’ll learn how to get a Costco Citi Card the first time you walk into the giant warehouse store. A pleasant person will direct you to the customer service desk when you try to enter without a Costco membership card.

Another nice person will sell you a membership, take your photo, and hand you your ID card. You may also receive an offer to apply for a Costco Anywhere Visa® Card by Citi.

As it turns out, there are three ways to apply for a Costco credit card:

- In-person at any Costco warehouse store in the US and Puerto Rico

- Online

- Over the phone at 1-800-259-3052

It takes only a few minutes to apply. You’ll need to supply your Costco member number (it’s a no-go without one), personal identity information, total annual income, and monthly mortgage/rent payment. You also have the option to add authorized users.

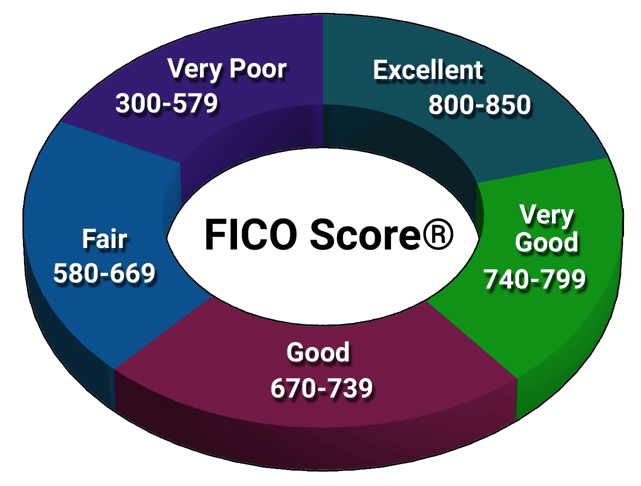

You’ll need excellent credit for good approval odds. Most approval decisions are instantaneous, but you may have to wait up to 10 business days if your application requires additional consideration.

Citi Offers 2 Costco Cards You Can Apply For Online

It’s easy to apply online for either Costco Citi Visa Card. Just click SEE DETAILS in the offer boxes below to learn more and access Citi’s application. But first, decide which of the two cards is right for you by reading the terms and conditions, especially the bit about redeeming your cash back rewards, which we describe below.

For Everyone: The Costco Anywhere Visa® Card by Citi

Most consumers will opt for the Costco Anywhere Visa® Card by Citi.

- Discover one of Citi’s best cash back rewards cards designed exclusively for Costco members

- 4% cash back on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter

- 3% cash back on restaurants and eligible travel purchases

- 2% cash back on all other purchases from Costco and Costco.com

- 1% cash back on all other purchases

- No annual fee with your paid Costco membership and enjoy no foreign transaction fees on purchases

- Receive an annual credit card reward certificate, which is redeemable for cash or merchandise at U.S. Costco warehouses, including Puerto Rico

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% (Variable)

|

$0

|

Excellent

|

Additional Disclosure: Citi is a CardRates advertiser.

The card offers a handsome cash back rewards rate (especially on gas purchases), but the redemption procedure is unusual. You can redeem your Costco cash rewards only once per year.

Citi will send you an award certificate after your February billing cycle closes. You then present the certificate to a Costco checkout cashier, who will apply the cash back to your Costco purchase. The cashier will hand you money for any leftover amount.

Remember to cash in your certificate before it expires at the end of the year.

For Business Owners: The Costco Anywhere Visa® Business Card by Citi

The Costco Anywhere Visa® Business Card by Citi should appeal to any business owner who shops for bulk supplies.

2. Costco Anywhere Visa® Business Card by Citi

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Citi is a CardRates advertiser.

The business credit card version is almost identical to its consumer twin, except that it doesn’t allow balance transfers. This Citi rewards card allows you to add employees as authorized card users, as long as the employee is a Costco member. Primary cardholders can set spending limits for each authorized user.

The Costco business credit card provides Citi Concierge and Citi Quick Lock, which instantly blocks new transactions without affecting recurring payments set to the account.

Citi makes a hard credit inquiry when you apply for either Citi Costco card. A hard pull may lower your credit score by a few points and remain on your credit reports for two years.

But a new account can also increase your credit score by expanding your available credit. How opening a new account will affect your credit score depends on your personal credit history.

Alternative Credit Cards For Costco Shoppers

Costco only accepts Visa credit cards and most debit cards. The following Visa credit cards may be better suited to your wallet, and these seven rank highest in our ratings.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® card charges no annual fee (although it does impose a foreign transaction fee) while offering attractive introductory promotions and top-notch security features. You earn versatile Chase Ultimate Rewards points on all your eligible purchases.

As with any credit card issuer, Chase considers your income, debt, and recent credit inquiries when reviewing your application. This card requires good credit for approval.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card lets you earn unlimited miles on every purchase. You can redeem your miles for cash, gift cards, account credits, travel expenses, hotel stays, and car rentals, among other things.

Reports indicate you’ll need a FICO score of 700+ to qualify for this rewards card. But LendingTree reports that Capital One has issued the card to consumers with lower scores.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Ultimate Rewards points you earn from the Chase Sapphire Preferred® Card gain 25% more value when you redeem them on the Chase Travel website for flights, hotel stays, car rentals, and other travel-related expenses. It is the best credit card for travel among these rankings.

You’ll have a better chance of getting the card if your credit score is 700+. Unofficial reports indicate an income requirement of at least $30,000 a year. The card offers many benefits, including purchase protection and trip interruption insurance.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card requires fair to excellent credit for approval, and they may just receive a five-digit credit limit. The card should appeal to folks who want a high, flat rewards rate on all eligible purchases.

There is no annual fee, and the card may offer new cardmembers a 0% intro APR for balance transfer transactions. After which, a regular APR will apply.

- Earn a $750 bonus when you spend $6,000 in the first 3 months of account opening

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won’t expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.49% – 24.49% (Variable)

|

$0

|

Excellent

|

Capital One Spark Cash Select for Excellent Credit is a business credit card that features cash back rewards, a low purchase APR, and a generous signup bonus. It also doesn’t impose an annual fee or foreign transaction fee for overseas purchases.

Business owners should consider this card if they have a credit score of at least 700. It provides free employee cards, extended warranties, roadside assistance, and year-end summaries.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more – your points don’t expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred® Credit Card offers a generous signup bonus but imposes a moderate annual fee. Your points go further when you redeem them for travel through Chase’s website.

Different sources place the card’s minimum score requirement between 670 and 700. Few other cards offer as many travel and purchase protection benefits.

What Are the Benefits of the Costco Citi Card?

The Costco Anywhere Visa cards offer several benefits, including Citi Entertainment. This perk lets you purchase presale tickets for thousands of sporting events, concerts, and dining experiences.

The card’s other benefits center on account protection and security:

- Citi Quick Lock, a service that stops new purchases and cash advances while permitting recurring transactions

- Fraud alerts

- Account alerts

- Citi Concierge provides around-the-clock help with your shopping, travel, dining, entertainment, and everyday needs

- Authorized users (they must have a paid Costco membership)

Only the consumer version of the card supports balance transfers. Otherwise, the cards are identical.

What Score Do You Need to Get a Costco Citi Card?

The minimum credit score for the Costco Anywhere Visa® Card by Citi is reportedly a surprisingly high 740. We’re not sure why the card demands such a high score considering cards with better benefits require less.

If you want a Costco credit card but have only average credit, you’ll want to make an effort to boost your credit score. The most direct method is to pay your bills on time. FICO apportions 35% of your score to your payment history.

Timely payments demonstrate responsibility that the major credit bureaus will reward over time. But when you miss your credit card payment by 30 days, your creditor can report you to a major credit bureau, harming your score significantly. Do what you must to avoid missing a payment, even if it’s just paying the minimum amount due.

Another 30% of your FICO score is based on your credit card balances. The scoring algorithm uses credit utilization ratio (CUR) to measure your credit card debt.

CUR equals credit used (your balance) divided by how much credit you have available (credit limit). You can improve your score by keeping your CUR below 30%.

It’s also helpful when rebuilding credit to limit how often you apply for new credit cards and loans. Each application generates a hard pull of your credit report. FICO associates too many hard inquiries with financial distress, so try to wait six months between applications.

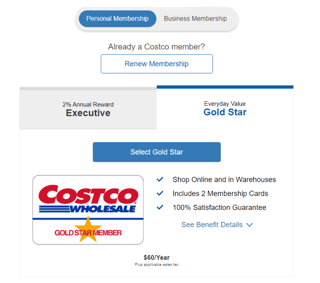

Does the Costco Anywhere Visa® Card by Citi Give You Membership?

No, but a paid Costco membership allows you to get the no-annual-fee credit card. Memberships begin at $60 a year as of May 2022. Any authorized users you add to the card must also be members.

You’ll lose any unredeemed Costco cash rewards if you cancel your membership because you can only redeem your rewards inside a Costco store. It would be best to wait until after you receive and redeem your annual reward certificate.

How Long Does It Take to Get a Costco Card?

You may receive approval in seconds after applying for a Costco credit card. You’ll first need a Costco membership, but that usually doesn’t take more than a few minutes to sign up for.

Once approved, the card should arrive in seven to 14 business days. If it doesn’t arrive, contact Citi customer service and verify that they have your correct address. Citi can issue you a new card with a different account number if necessary.

You can immediately request a temporary card at the service desk if you apply for your credit card at a Costco store. This card lacks an expiration date and CVV number, but you can use it at the Costco checkout line until you receive your new card.

Can I Use an American Express Card at Costco?

If you want to use a credit card at Costco, it will have to be a Visa. The retailer has an exclusive contract with Visa and does not accept Mastercard, American Express, or Discover credit cards.

Costco gives you other credit card payment options:

- Most PIN-based debit/ATM cards

- Costco Shop Cards

- Cash

- Personal checks from current Costco members

- Business checks from current Costco business members

- Traveler’s checks

- EBT cards

- Mobile payments (Apple Pay, Google Pay, Samsung Pay)

Don’t get too excited about that last list item. While Costco accepts mobile payments, the underlying credit card must be a Visa.

You can use an American Express debit card at Costco. If you have Amex Rewards Checking, you can order a debit card that pays cash rewards. Alternatively, you can use an Amex prepaid debit card, such as the Bluebird® American Express® Prepaid Debit Account and Serve® Prepaid Debit Accounts.

Is the Costco Citi Card a Good Travel Card?

Travel cards are supposed to deliver more than rewards on each eligible travel purchase. They should provide travel-related benefits, such as flight insurance, free baggage check, trip interruption insurance, etc.

On this basis, the Costco Anywhere Visa® Card by Citi is not a travel card at all.

If you’d like an actual travel card, check out some of the Costco Anywhere Visa alternatives reviewed above. We think travelers will prefer the Chase Sapphire Preferred® Card, Capital One Venture Rewards Credit Card, and the Ink Business Preferred® Credit Card.

These cards offer various perks that can save you money when you travel. One may be the best credit card for your needs.

In a way, it’s unfair to judge the Costco cards on their travel benefits. The two cards are primarily store cards that you can use anywhere. Costco travel rewards don’t measure up to the competitors’.

Applying For the Costco Citi Cards Is Easy, But Approval May Not Be

Now that you know how to get a Costco Citi Card, are you ready to pull the trigger? On the plus side, the card charges no annual fee and lets you earn pretty good rewards on restaurant, travel, and gas purchases. It’s a genuine Visa card with valuable benefits, including Citi Concierge and Citi Entertainment.

The biggest negative facing the prospective Costco Citi Card owner is its reward redemption policy. You can only redeem your cash back at Costco once per year. That will appeal to Costcophiles who devote significant time roving the warehouse aisles each month.

But for many others, the cards are a tough sell. They generally require excellent credit for approval. The Ascent reports that only 22% of Americans have a FICO score of 800 or higher, which is FICO’s threshold for an excellent credit rating.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Costco Credit Card Benefits & Alternatives ([updated_month_year]) 7 Costco Credit Card Benefits & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Costco-Credit-Card-Benefits.jpg?width=158&height=120&fit=crop)

![Costco Business Credit Card: 5 Things to Know ([updated_month_year]) Costco Business Credit Card: 5 Things to Know ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Costco-Business-Credit-Card.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards Accepted at Costco ([updated_month_year]) 7 Best Credit Cards Accepted at Costco ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/costco--1.png?width=158&height=120&fit=crop)

![8 Best Credit Cards to Use at Costco ([updated_month_year]) 8 Best Credit Cards to Use at Costco ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Cards-to-Use-at-Costco-Feat.png?width=158&height=120&fit=crop)

![Citi Credit Card Preapproval Options ([updated_month_year]) Citi Credit Card Preapproval Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Credit-Card-Preapproval.jpg?width=158&height=120&fit=crop)

![Citi Double Cash Credit Score Requirements ([updated_month_year]) Citi Double Cash Credit Score Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Double-Cash-Credit-Score.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Citi Credit Limit ([updated_month_year]) 6 Tips: How to Increase Citi Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/02/Citi-Credit-Limit-2.jpg?width=158&height=120&fit=crop)

![4 Citi Cash Back Cards Compared ([updated_month_year]) 4 Citi Cash Back Cards Compared ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Citi-Cash-Back.jpg?width=158&height=120&fit=crop)