At a time when grocery prices are still increasing, consumers looking to save money will head to warehouse chains like Sam’s Club to find lower prices than they would at a traditional grocery store.

If you already shop at Sam’s Club, you know all about these savings — but did you know that using the right credit card can save you even more money? Read below to learn about the best credit cards to use at Sam’s Club, how to sign up, and which one to choose.

Best Cards to Use at Sam’s Club

Several credit card issuers offer rewards such as cash back or points for eligible purchases made at warehouse clubs. Here are the best rewards cards to use at Sam’s Club.

Best for Sam’s Club Plus Members:

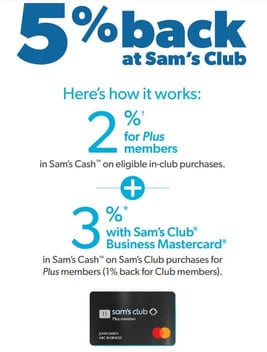

- Earn 5% back in Sam’s Cash on gas anywhere Mastercard is accepted (on first $6,000 per year, then 1%) plus 3% back on dining and takeout; all other purchases in 1% back in Sam’s Cash

- Earn 3% back in Sam’s Cash on Sam’s Club purchases for Plus members. Club members earn 1% cash back.

- Accepted at Sam’s Club and Walmart® nationwide

- Doubles as your membership card

- No annual fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.40% or 28.40%

|

$0

|

Good to Excellent

|

If you’re a Sam’s Plus member, the Sam’s Club® Mastercard®, issued by Synchrony Bank, offers extra cash back on Sam’s Club purchases. You will also get generous cash back at EV charging stations, Sam’s Club gas stations, and eligible gas stations worldwide.

Best for Preferred Rewards Members:

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card includes warehouse clubs like Sam’s in one of its top-earning categories. There is no annual fee and no expiration date for rewards. Bank of America Preferred Rewards members could earn up to 75% more cash back on their Sam’s Club purchases.

Best for First-Year Rewards:

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® ranks highly for its welcome rates in your first year of card ownership. But the card offers such great rewards thereafter without charging an annual fee that you may just decide it’s a long-term keeper. We regularly rate this Chase offering as one of the top cash back cards.

Best for Curbside Pickup:

- Earn $200 back in the form of a statement credit after you spend $2,000 in purchases on your new Card within the first 6 months of Card Membership

- 3% cash back on groceries from U.S. supermarkets (on up to $6,000 per year in purchases, then 1%)

- 3% cash back on U.S. online retail purchases (on up to $6,000 per year in purchases, then 1%)

- 3% cash back at U.S. gas stations, 1% back on other purchases

- Introductory 0% APR for 15 months on purchases and balance transfers, then a variable rate applies

- Find out if you Pre-Qualify for the Blue Cash Everyday® Card or other offers in as little as 30 seconds

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

18.49% – 29.49% Variable

|

$0

|

Good

|

The Blue Cash Everyday® Card from American Express provides 3% cash back on online retail purchases, including those made at Sam’s Club. This makes this card a top option if you prefer to shop online and use Sam’s curbside pickup. But note that you won’t receive additional rewards for purchases ordered online that are paid for in-store.

Best For In-Store Purchases:

- Automatically earn 3% cash back on your eligible top spend category, 2% on the next, and 1% on all other eligible purchases.

- Eligible spend categories include travel, dining, groceries, entertainment, and bills and utilities, among others.

- Rewards are automatically transferred to your Venmo account balance at the end of each billing cycle

- Apply for the Venmo Credit Card with no impact on your credit score if you’re not approved. An approved Venmo Credit Card application will result in a hard credit inquiry.

- No annual fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99%, 25.99%, or 28.99%

|

$0

|

Good to Excellent

|

The Venmo Credit Card lets you select your top cash back categories, which include grocery stores and warehouse clubs. This card is the only card that offers 3% back in-store (Sam’s requires you to be a Plus member to get the 3% back), but its ties to a Venmo account may be a deterrent for some, rating it lower in our evaluation.

Which Credit Cards Does Sam’s Club Accept?

While other warehouse clubs have limits on acceptable credit card issuers, Sam’s Club accepts most major domestic credit cards for both in-person and online purchases. You can use your American Express, Mastercard, Visa, or Discover card at Sam’s Club.

Prepaid credit cards can only be used at physical Sam’s Club locations, but not when shopping online. Curbside pick-up orders are treated as online orders so the same restrictions will apply.

Is it a Good Idea to Use a Credit Card at Sam’s Club?

Using a credit card at Sam’s Club can help you earn more cash back on your purchases. If you have a card that offers extra rewards when shopping at warehouse clubs like Sam’s Club, you can earn hundreds of dollars each year in potential cash back.

For example, if you spend $700 a month at Sam’s Club and shop with a card that offers 1.5% cash back, you’ll get $10.50 in rewards each month, or $126 a year.

When using a credit card, make sure you can afford to pay off the balance at the end of the month. The amount you’ll pay in credit card interest will generally outweigh any cash back rewards, so don’t spend more just to get cash back.

What’s the Difference Between a Sam’s Club Credit Card and a Sam’s Club Mastercard?

If you’re new to Sam’s Club, you may not know that the retailer offers two store-branded credit card options for consumers: the Sam’s Club Credit Card and the Sam’s Club® Mastercard®.

To make things even more confusing, these cards have different benefits, and it can be easy to apply for the wrong one without realizing it. In short, the Mastercard version requires good to excellent credit while the Sam’s Club Credit Card is easier to get approved for with a lower credit score.

The Sam’s Club® Mastercard® is the only option that offers cash back on in-store purchases; the Sam’s Club Credit Card does not. You will also get cash back for eligible purchases made at gas stations, restaurants, and other retailers, so this rewards card offers more benefits beyond extra Sam’s Club perks.

If you have the Sam’s Club® Mastercard®, you will earn the most “Sam’s Cash” on gas purchases, up to $6,000 spent annually, after which the reward rate drops to 1%. Plus members will also receive 2% more cash back for their in-store Sam’s purchases than non-Plus members.

The Sam’s Club Credit Card can be used to pay for purchases at the warehouse club, but users will not receive any cash back. There’s no annual card fee for either card, but you still have to pay the annual price of a Sam’s Club membership.

How Do Sam’s Club Rewards Work?

Cardholders who open a Sam’s Club® Mastercard® can receive Sam’s Club rewards, also known as Sam’s Cash.

When you earn Sam’s Cash, you can use the rewards to pay for your annual membership or put it toward Sam’s Club purchases. Unfortunately, you can’t use Sam’s Cash to pay for gas purchases.

Sam’s Cash can be used for in-store, online, and Sam’s Club app purchases. You can also cash out your Sam’s Cash by visiting the Member Services department.

There is no minimum requirement necessary to redeem your Sam’s Cash, but there is a $5,000 maximum annual limit that you can earn in Sam’s Cash. Sam’s Cash will be calculated and distributed one or two billing cycles after you earn it. Returns, cash advances, and balance transfers do not earn Sam’s Cash.

Sam’s Club cash rewards may not be as versatile as other types of credit card rewards, such as the Chase Ultimate Rewards program. If you want to earn travel rewards, consider applying for a travel card and using your warehouse card for your Sam’s Club purchases.

What’s the Best Business Credit Card to Use at Sam’s Club?

Believe it or not, warehouse stores like Sam’s Club aren’t just for big families or people hosting large gatherings. They’re also a popular resource for businesses that need large quantities of cleaning supplies, kitchen tools, electronics, and other things.

Sam’s Club offers small businesses the opportunity to save money without having to go through an official wholesale provider.

And just like regular consumers, business owners can save money by using the right credit card at Sam’s Club. The Sam’s Club® Business Mastercard® provides bonus cash back for purchases made at gas stations, restaurants, and at Sam’s Club, plus 1% back on all other eligible purchases.

You may also qualify for a special welcome offer when opening the card. The card has no foreign transaction fees or annual fees, but you’ll need to pay for a Sam’s Club membership.

For business owners with bad credit, the Business Advantage Unlimited Cash Rewards Secured credit card from Bank of America is the best choice for Sam’s Club purchases. Because it’s a secured card, you must deposit a minimum of $1,000 to open the business card account. Your credit line is equal to your deposit amount.

Secured credit cards return the deposit after a period of responsible use at the credit card issuer’s discretion. Using a secured credit card is a great way to build credit with consistent on-time payments.

Score Even More Savings at Sam’s With the Right Card

When you shop at a warehouse store like Sam’s Club, you’re already guaranteed to save money on groceries and household goods, among other things. But you can maximize those savings by using the right credit card at Sam’s Club.

And since none of the cards above charge an annual fee, you won’t have to pay extra just to save a few bucks (other than the price of club membership, of course). Make sure to compare each card carefully and see how it can benefit you outside of Sam’s Club as well. The best credit card for you will reward you everywhere you shop.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)

![10 Credit Repair Credit Cards ([updated_month_year]) 10 Credit Repair Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Credit-Repair-Credit-Cards.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards to Build Credit ([updated_month_year]) 5 Best Secured Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Best-Secured-Credit-Cards-to-Build-Credit.png?width=158&height=120&fit=crop)