The most basic function of a credit card is that it allows you to purchase things using the issuer’s funds. Each time you charge, you borrow the amount of that purchase.

At the end of the month, you’ll get the bill for everything you bought and are given the option to pay in any increment above the minimum amount due.

Your credit card can do plenty of other things for you, too. Depending on the card, yours may entitle you to all or some of the following perks.

1. Pay You For Your Spending

A large number of credit cards come with a rewards program that allows you to earn cash back, points, or miles every time you use the card to purchase something. As long as you pay the balance in full so no interest is added to your debt, you will earn money each time you use the card for transactions.

For example, If you charged a total of $1,800 in a year and earned 2% cash back, your profit would be $360.

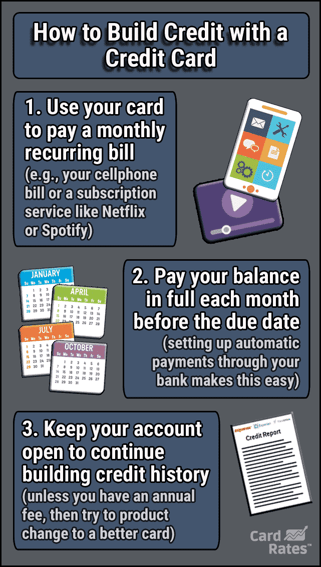

2. Help You Build Credit

Every major credit card issuer will send information about your card account to the three major credit bureaus — TransUnion, Experian, and Equifax. Just pay your bill on time and in full every month, and you will be on your way to building a positive credit history.

How do you get credit when you have never used it before? You can start with an account made specifically for credit development, such as the Discover it® Secured Credit Card.

3. Give You a Free Credit Score

As a consumer, you are entitled to three free credit reports once every year, but credit scores are a product that you typically have to purchase. Some credit card issuers will provide you with a free credit score, though, and you may not even have to be a cardholder.

For example, Chase Bank offers Chase Credit Journey that will give you a free credit score – the VantageScore 3.0 model based on your Experian credit report — with no Chase account needed.

4. Provide a Bonus Just to Get the Card

You may also get a bulk of rewards, known as a signup bonus, when you open the account. To get the signup bonus, you must charge a certain amount to your card within a specified period. Typically, the higher the minimum spending requirement, the larger the bonus.

For example, The Platinum Card® from American Express usually offers 100,000 points (worth roughly $2,000) or more if you spend $6,000 in the first six months of opening the card. The Capital One SavorOne Cash Rewards Credit Card, on the other hand, may give you $200 after spending $500 in the first three months.

5. Award Cash for Referring Friends

Yet another way to earn a book of rewards is to refer friends to a credit card offered by your issuer. When you send a promotional link to them they can apply for the card, and if they are accepted, you will earn rewards.

For example, with the Chase Freedom Flex℠, you may be able to earn $100 cash back for each successful referral. The reward is capped at $500 per year.

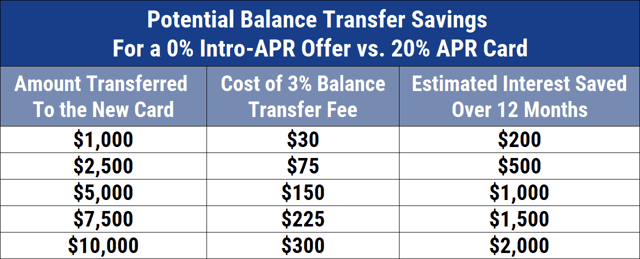

6. Charge No Financing Fees on Purchases and/or Balance Transfers

Under normal circumstances, card issuers apply finance fees to any balance you roll over from one month to the next. But if your card offers a 0% APR promotion, you won’t be charged any interest on the debt for a specific period. The 0% rate may be for purchases, balance transfers, or both, depending on the card.

Cards with 0% balance transfer deals can really help you save a lot of cash, as illustrated above.

7. Offer Special Concierge Services

A few cards, including the Chase Sapphire Reserve®, come with personal assistance. Depending on the program, the concierges can do everything from arrange travel, purchase gifts, book tickets to events, and get you into the most exclusive restaurants. Some can help you out of a jam, too, by rebooking canceled or delayed flights and tracking down lost luggage.

8. Free Hotel Accommodations

If your credit card is associated with a hotel chain, your card may entitle you to a free night’s stay every year or after a certain number of nights at the hotel. For example, if you have a Marriott Bonvoy Brilliant® American Express® Card, you will get a free night’s stay every year after your account anniversary.

- Earn 95,000 Marriott Bonvoy Bonus Points after you use your new Card to make $5,000 in purchases within the first 3 months of Card Membership.

- Earn 6X Points on hotels for eligible purchases at participating Marriott Bonvoy hotels, 3X Points at U.S. restaurants and flights booked directly with airlines, and 2X Points for each dollar on everything else.

- Enjoy up to $25 a month in Dining statement credits each calendar year for eligible purchases made at restaurants worldwide.

- Receive 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy® points) at hotels participating in Marriott Bonvoy®

- Book direct using a special rate for a 2-night minimum stay at The Ritz-Carlton® or St. Regis® and get up to $100 in credit for qualifying charges.

- With Card Membership, you can enroll in Priority Pass™ Select, which offers unlimited access to over 1,200 lounges in over 130 countries, regardless of which carrier or class you are flying.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 29.24% (Variable)

|

$650

|

Excellent

|

This perk will either extend your vacation or reduce the price of it!

9. Assistance at the Airport

If you are a frequent traveler, it pays to look for a credit card that offers cardholders free or discounted membership into programs that will help you move through the airport with ease. Some cards give a discount on CLEAR®, which bumps you to the front of the security line.

Other cards reimburse the cost of TSA PreCheck®, which offers fast security screening benefits for domestic flights, or Global Entry, which can help you through US customs when reentering the United States from international destinations.

10. Provide Free Food and Beverages

Whether at the airport or in a hotel, your credit card may also provide you with a credit for food and beverages. Look for a card that comes with a Priority Pass membership, such as the Chase Sapphire Reserve® card.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

This card provides dining credits at over 50 airport restaurants.

11. Pay Rewards & Credits For Streaming Subscriptions

Chances are you’re paying for movies, shows, or music via any of the popular streaming services. So why not get extra rewards for it? Several cards pay cash back when you use your card to pay your monthly streaming service subscription, and a few others even pay credits to reimburse part or all of the cost.

For example, The Platinum Card pays $20 each month toward select digital entertainment providers, including Disney+, Hulu, and SiriusXM, among others.

12. Pay Rewards & Credits For Ride-Hailing Services

If you regularly use ride-hailing companies to get around, but it’s blowing your budget, your credit card can help ease the pain.

For example, the Chase Sapphire Reserve® card will give you 10x the points on Lyft purchases through 2025 plus annual travel credits that can offset your Uber or Lyft costs.

13. Provide Cellphone Protection For Loss and Damage

Chances are you carry around a particularly expensive and important item: your cellphone. If your credit card offers cellphone protection, you may be able to make a claim if it’s lost, stolen, or damaged. This insurance can save you a lot of money even if there is a deductible — usually starting at $50 — before the insurance pays for the replacement expense.

14. Pay For Your Checked Bags

You can either bring your bags on the plane to stash in the overhead compartment or check them. If you get the lowest price airfare, you may have to pay for either of these choices. But if you use a credit card that covers the cost of checked bags, you can save the $35 or so the airline will charge for each bag.

But if you pay for your United Airlines flight with your United MilagePlus Card, for example, you’ll get free checked bags even when you purchase the most basic fare (where you would still have to pay for carry-on bags).

15. Extend Your Purchase Protection Window

Retailers typically give you a certain amount of time to return a purchase and not lose any money. It could be 60 days or fewer. Your credit card, however, can extend that time frame.

For example, many Chase credit cards give you purchase protection that replaces, repairs, or reimburses eligible items that are damaged, lost, or stolen during the 120 days following the date of purchase.

16. Reimburse You For Trip Delays

One of the facts of modern travel is that flying isn’t as glamorous as it once was. Nor is it as seamless. If your flight is canceled or delayed, you could be stuck at the airport or have to pay for accommodations with your own money.

Your credit card can come to the rescue if it comes with travel insurance. Depending on the insurance, you may be reimbursed for any costs associated with the delay, from meals at the airport to hotel accommodations.

17. Allow You to Board Flights Early

Don’t want to wait to board your flight because you’re worried there won’t be enough space in the overhead compartment for your bags? Or maybe you just want to settle in before most of the other passengers do. Several cards associated or co-branded with airlines offer preboarding privileges.

18. Provide Access to Airport Lounges

If you are stuck at the airport for any length of time, you will appreciate the comfort available at airport lounges. Some credit cards give you access to these lounges. The Citi® / AAdvantage® Executive World Elite Mastercard®, for example, grants you and two of your travel companions (and immediate family members) entry into the Admirals Club.

And The Platinum Card® provides unlimited access to The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% – 27.49% Pay Over Time

|

$695

|

Excellent

|

19. Give You Free Flight, Room & Car Rental Upgrades

Many travel cards, especially those co-branded with an airline or hotel chain, provide valuable upgrades, such as preferred seating on your flight or a better room at check-in. If your credit card has a relationship with a car rental company, you may be entitled to a vehicle a step or two above the economy option without paying extra for luxury.

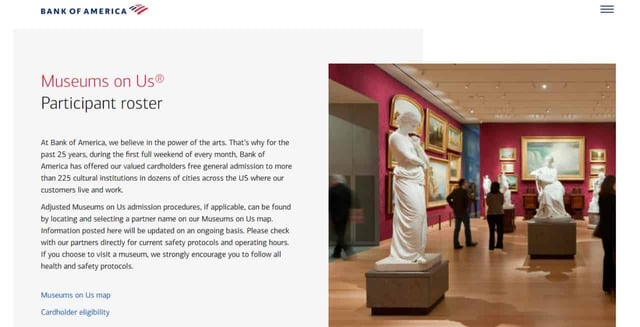

20. Visit Museums For Free

Always check out the different promotions available from your credit card issuer, as some are especially valuable. For example, Bank of America cardholders can enjoy the company’s Museums on Us program.

During the first full weekend of every month, Bank of America offers cardholders one free general admission ticket to more than 225 cultural institutions across the US, and the savings can be substantial. After all, an adult ticket to the Metropolitan Museum of Art in New York City will set you back $30.

The Bottom Line on Credit Card Perks

Credit cards can do much more than help you make safe and convenient transactions. You may benefit from numerous perks depending on the card and the issuer. The more you know about what your account offers, the better you can take advantage of its features and programs.

Issuers are always updating their offerings, so it’s a good idea to regularly visit the credit card company’s website or use the app to see what you are entitled to!

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![How to Calculate APR on a Credit Card ([updated_month_year]) How to Calculate APR on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/CalculateAPR-1--1.png?width=158&height=120&fit=crop)