When most of us choose a credit card, design is rarely at the top of our minds. Honestly, there are so many other features to consider. Perks, interest rate, intro APR, and card protections are considered more often when selecting an aesthetically cool credit card.

But what if all things were created equal? Could a card’s look persuade you to apply?

Card companies know that looks aren’t everything — but flash any one of these 13 cards the next time you go out, and get noticed! There are cool options available for all credit types. In this article, we’ll take a look at these cool cards that include options for consumers with good credit, fair credit, cards for students, cards with appealing cash back offers, cards for air miles, and more.

You no longer have to qualify for that titanium card to show some precious metal. This slick-looking card has a brushed metal look and all the perks that people love about Discover cards. If you don’t like the metal look, you can actually choose from more than 40 card designs!

A beautiful blue color and striking “gem” design make this card an attractive addition to any wallet. It even has a solid piece of metal inside. The popular card is more than just a pretty face, however. Its perks and sign-up bonus offers are among the most buzzed about.

This card designed for younger credit holders with shorter credit history is much like the Chrome mentioned before. Both cards have the option to choose from a selection of unique and fun card designs. Or pick from a range of vibrant textured solids in blue, green, purple, and more!

Along with its sleek and simplistic modern design, this card carries a hefty bonus for new cardholders. Earn bonus points after you spend a predefined amount on purchases in the first 3 months from account opening. If you’re a frequent traveler and have good to excellent credit, this card would be a great fit in your wallet.

5. NFL Extra Points Visa Signature Card

NFL fans who plan on spending some cheddar on football-related expenses may want to check out this card, issued by Barclays. It features excellent NFL perks, and cardholders can select their favorite NFL team for a design. Not particularly loyal to any one team? They offer a generic “NFL” design, as well.

- Good to excellent credit required

- Apply for the NFL Extra Points Visa Signature card here.

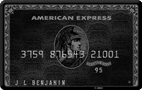

6. American Express Centurion® Card (The Black Card)

This card has no need for photos, designs, or distractions. This completely black anodized card is the crème-de-la-crème and is what most people refer to when speaking of “the black card.” Did you know that it is actually made with genuine titanium?

This card has no need for photos, designs, or distractions. This completely black anodized card is the crème-de-la-crème and is what most people refer to when speaking of “the black card.” Did you know that it is actually made with genuine titanium?

- This card is by invitation only, and you can read more about it here.

7. J.P. Morgan Reserve Card

This rich-looking metal card just begs for attention. That’s because most applicants have $10 million or more in assets before they get the invite. With a JP Morgan signature scrawled across the top, it’s a shiny addition to any well-kept wallet.

- This card is by invitation only.

(Non-Monetized. The information related to J.P. Morgan Reserve® was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

If you believe the coolest card design is one you create, then you’ll love this! Capital One has joined the ranks of card issuers letting you upload your own photo. While they do have final say on the photo before they create it, most people have been able to place pets, kids, and their favorite memories on their VISA with no issues.

9. Japan’s ANA EPOS Card

Here’s a card that deserves to be on the list, though it’s for Japanese cardholders only. The card company ANA actually has a card design competition to find the best artwork for their cards. Collectible designs have included mixtapes and unwrapped bars of chocolate. The cards are so popular that expired ones have been in collector’s auctions!

- This card is only available in Japan.

10. BankAmericard Cash Rewards™ Card

Bank of America is changing its affiliations all the time, but they usually offer a handful of attractive cards linked to special perks and bonus offers. Current partnerships include MLB, World Wildlife Fund, and Susan G. Komen. The card design for each is unique to Bank of America.

Bank of America is changing its affiliations all the time, but they usually offer a handful of attractive cards linked to special perks and bonus offers. Current partnerships include MLB, World Wildlife Fund, and Susan G. Komen. The card design for each is unique to Bank of America.

- Good to excellent credit required

- Apply for the Bank of America® Customized Cash Rewards credit card here.

This card is not only a good choice for those with average, fair, or limited credit, but it has the look of high-end cards. With a smooth metallic finish and bold font, it definitely represents the Quicksilver brand. It answers the question “What’s in your wallet?” with something pretty cool!

12. Chase Disney Visa® Premier Card

Are you a big Disney fan? If you spend a good amount each year on Disney merchandise and property visits, this card offers unique rewards and 10 Disney-themed designs to choose from. Options change regularly, but they include Frozen and Star Wars!

- Good to excellent credit required

- Apply for the Disney Visa® Premier Card here.

A great card for travelers, this platinum-color metal card will certainly catch some eyes when you take it out of your wallet. Though it comes with a hefty annual fee, you can definitely make it worth your while if you take full advantage of all the perks.

(Non-Monetized. The information related to Chase Disney Visa® Premier Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

How this List was Selected

Cards were chosen for this list based on aesthetic appeal and what we’ve heard card users say are their favorites. While we think all of the cards on this list are stunning to look it, we also understand that beauty is in the eye of the beholder. What you might find to be a cool card, others might eschew in favor of something more low-key. In the end, we hope that you choose a card that helps you meet your financial goals and build credit that you can use for a lifetime.

Many of the cards on the list also come with the option to change your look after a time. If you’ve grown tired of that picture of a puppy, most cards will let you update the design. Simply inquire at the phone number on the back of your card, or log in to your accounts and access card design options from the services menu.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Cutest Credit Cards & Designs ([updated_month_year]) 8 Cutest Credit Cards & Designs ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/cute-cards.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year]) 3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/carbuy--1.jpg?width=158&height=120&fit=crop)

![How to Use a Credit Card: 5 Ways to Do So Wisely ([updated_month_year]) How to Use a Credit Card: 5 Ways to Do So Wisely ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/how-to-use-a-credit-card-1.jpg?width=158&height=120&fit=crop)

![What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year]) What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/good-apr2.png?width=158&height=120&fit=crop)

![6 Pros & Cons of Owning a Credit Card ([updated_month_year]) 6 Pros & Cons of Owning a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/procon.png?width=158&height=120&fit=crop)