The best military credit cards implement the protections of the 2003 Servicemembers Civil Relief Act (SCRA) and the 2006 Military Lending Act (MLA) in significant ways. The Acts protect members of the armed forces during periods of military service. If you serve in the U.S. military, these credit cards will help ease your financial burden when you enter active duty.

Best Military Cards For Active Service Members

The cards that follow go beyond the absolute minimum requirements specified by the SCRA and/or MLA for benefits available to active service members. Look for APRs below the SCRA 6% cap and for waived fees longer than the minimum mandatory period.

In all other respects, these are all good cards that support cash advances and balance transfer transactions if needed.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

Under the SCRA, the Capital One Venture Rewards Credit Card caps its interest rate at 4% for active duty military service members, up to one year after discharge on eligible balances. In addition, eligible service members will have all their card fees (such as the annual fee, late fee, balance transfer fee, and foreign transaction fee) waived on accounts opened prior to active duty.

You can apply for these benefits online and read more details on the issuer’s SCRA website. The card offers many other benefits, including a generous welcome bonus.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® rewards point card offers active duty service members a 4% APR on eligible balances and waives fees. Both SCRA benefits extend for one year after your tour as an active duty military member ends and can be claimed by sending a secure message from the Chase website. As with all Chase cards, you can redeem rewards at the Chase Ultimate Reward website, including points earned from the welcome bonus.

For information about MLA benefits, you can speak to a military specialist by calling 877-469-0110.

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% - 27.49% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® is an American Express card that helps service members by capping interest at 6% for credit acquired prior to active duty and 36% for credit obtained while part of the active duty military. The issuer also waives fees, including the annual fee, foreign transaction fee, late fee, and balance transfer fee, for service members.

You can apply for SCRA benefits from this American Express card by calling the customer service number on the back of the card and delve deeper into the details at the related online Amex website.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

We like the Citi Double Cash® Card — and all Citi cards for service members — because Citi charges no interest for active military members. Zero percent interest on all purchases made during the course of active duty is hard to beat, but there’s a catch — you must open your account before enrolling in the military to qualify.

For more information, you can call Citi’s military specialists at 877-804-1082 or at 605-335-2222 for service members who are overseas.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

Chase Sapphire Preferred® Card is the issuer’s premium rewards point card, purposed for well-heeled travelers who don’t mind the high annual fee. Under its SCRA program, the card caps APR at 4% and waives fees for eligible accounts. The benefits apply during active service and for a year thereafter.

Of course, you earn the usual Chase Ultimate Reward points with the card that you can use in many ways, including for the purchase of gift cards or as a statement credit.

- Get our Navy Federal More Rewards American Express® Card, and you can earn 20,000 bonus points (a $200 value) when you spend $2,000 within 90 days of account opening.

- Earn 3X points at restaurants, food delivery, supermarkets, gas and transit, and 1X points on everything else

- No annual fee, no balance transfer fee, no foreign transaction fees, and no cash advance fees

- Points can be redeemed for cash, travel, gift cards, and merchandise

- Cardholders get roadside assistance plus up to 25% off car rentals with car rental loss & damage insurance included

- Must be a member of Navy Federal Credit Union to qualify - if you're already a member, you can see if you prequalify before you submit an application

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

13.90% - 18.00% (Variable)

|

$0

|

Average to Good

|

Navy Federal Credit Union offers its members the More Rewards American Express® Credit Card, which offers unlimited rewards on purchases of groceries and gas. This unsecured credit card offers SCRA protections that include a 6% APR and waived fees.

You can claim benefits online or by speaking to a specialist at 888-842-6328.

- Get a 0% intro APR for 15 months on balance transfers and convenience checks that post to your account within 90 days of account opening. After this time, the variable regular APR will apply to these introductory balances.

- 5% cash back on your first $3,000 in combined gas station and military base purchases yearly

- 2% cash back on your first $3,000 in grocery purchases yearly plus unlimited 1% cash back on all other qualifying purchases

- Cardholders receive auto rental coverage, travel accident insurance, baggage delay and reimbursement, and more

- $0 Annual Fee

- This card is only open to current and former military and their spouses

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% for 15 months

|

16.40% - 30.40% (Variable)

|

$0

|

Good to Excellent

|

The USAA Cashback Rewards Plus American Express® Credit Card demonstrates its friendliness to the armed services by offering 5% cash back for purchases made on military bases. If you qualify for its SCRA benefits, your APR will be capped at 4%.

You can claim benefits within 180 days of completing qualifying military service.

- Earn 1X points per dollar spent with no limit on the amount of rewards you can earn; rewards expire after 4 years.

- Deposit at least $200 into your membership savings account (before submitting your application) to back your spending. If approved, we’ll hold your deposit in your account as your card’s credit limit. As you use your card, you’ll earn rewards just like any other credit card, while also earning dividends on your deposit—just like any other savings account.

- No annual fees, no balance transfer fees, no foreign transaction fees, and no cash advance fees.

- After just 3 months, you could be eligible for an upgrade. If you qualify, we’ll provide you with additional credit to allow for spending beyond your deposit. Then, at 6 months, we’ll review your account monthly to see if you’re eligible to have your hold removed and be upgraded to a cashRewards unsecured card.

- Rental car coverage

- Must be a member of Navy Federal Credit Union to qualify

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.00%

|

$0

|

None/Poor

|

If you belong to the Navy Federal Credit Union and have bad credit, the nRewards® Secured Credit Card is a good choice to rebuild your credit score. Like Navy Federal’s unsecured cards, you can apply for a 6% cap and other benefits if you qualify under the SCRA.

Similar to the Navy Federal card above, you can sign up for benefits online or by calling 888-842-6328.

What is a Military Credit Card?

In a casual sense, a military credit card is one that offers special benefits to service members. Some of these benefits apply to anyone connected with the armed forces and related services, while other benefits stem from the SCRA and MLA federal regulations.

A few credit card issuers strongly associate themselves with the military. For example, USAA was founded by 25 Army officers in 1922 to provide financial services to “U.S. military and veterans who have honorably served and their families.”

In addition, certain credit unions require some connection to the military or Department of Defense for membership, including:

- The Navy Federal Credit Union

- Penfed Credit Union

- Service Credit Union

- Security Service Federal Credit Union

Some local and regional banks also boast of military affiliations, including the Armed Forces Bank. You may be surprised to learn that Chase, Bank of America, and U.S. Bank offer Military Banking Programs with on-base branches and across-the-board benefits for many types of accounts, including SCRA benefits on credit cards.

The Military Star Card is a private label credit card offered by the Army and Air Force Exchange Service. You can use the Military Star Card to receive exclusive discounts on certain services offered at military bases.

Which Credit Cards Waive Annual Fees For Military?

All credit cards must offer some type of SCRA and MLA benefits. Issuers known to waive annual fees for military members include:

- American Express

- Bank of America

- Barclaycard

- Capital One

- Chase

- Citi

- Navy Federal Credit Union

- U.S. Bank

As benefits change over time, there may be more institutions that waive fees. Some reduced-APR benefits you’ll encounter under the SCRA include:

- 0% APR: Available from Citi and Barclaycard.

- 4% APR: Available from Chase, Capital One, and USAA.

The maximum APR under the SCRA is 6%, and all accounts must be opened prior to the start of active duty for eligible service members. Cards you obtain while already on active duty must conform to the MLA, which caps APRs at a rather high 36%.

SCRA and MLA benefits extend to many types of financial accounts, not just credit cards. If you’re connected to the military, you’ll want to learn how these benefits apply to mortgages (including VA loans), auto loans, home equity loans or lines of credit, and other account types.

Do Spouses and Dependents Qualify For Military Card Benefits?

The military card benefits available to service members and their family members depend on when the credit card was obtained relative to the start of military service.

Qualifications for SCRA

The SCRA applies to eligible service members who obtained their credit card before the start of active duty. The following persons are eligible for SCRA benefits:

- Active duty military member in the Army, Air Force, Coast Guard, Marine Corps, and Navy.

- National Guard members called to active duty for more than 30 consecutive days. The service must be paid for with federal funds.

- Commissioned officers called to active service in the Public Health Service or the National Oceanic and Atmospheric Administration.

- Service members who are absent from active duty due to sickness, wounds, or other qualifying reasons.

- Spouse of an active duty service member sharing a joint account.

- Service member attending a service school.

This is the minimum set of persons eligible for SCRA coverage. However, issuers are free to include more individuals. For example, a credit card company may include National Guard members on active duty funded with state money rather than federal.

Other extensions of SCRA eligibility may extend to deployed service members who are moving to a new permanent station or are participating in qualified military combat. Some issuers cover spouses of active duty service members, even without sharing a joint account.

Banks set their own rules as to who qualifies for military benefits, but spouses and children under 18 generally qualify.

Dependent children of eligible service members are covered by SCRA if they are unmarried and younger than age 18. Students are covered up to age 23. You’re also covered if you became incapable of supporting yourself before age 18. Dependent children include adoptees and stepchildren.

It is important to verify active duty status to claim SCRA benefits. You can accomplish this at the Defense Manpower Data Center’s Military Verification Service. If you are involved in a court process, you may also require a military affidavit.

Qualifications for MLA

The MLA protects qualified service members and their families for accounts opened after the start of active service. The following persons are eligible for MLA benefits:

- Military personnel on active duty.

- Active reserve.

- National Guard members under Title 10 orders (federal active duty).

- Spouses

- Children under 21

- Full-time students under age 23 who are enrolled in approved schools. The student must be dependent on an MLA-protected military member for at least 50% of their support.

- Dependents of deceased MLA-protected service members who were providing at least 50% support.

- Supported children of any age who are physically or mentally incapacitated.

Under the MLA, active duty must span more than 30 days. Once you are no longer on active duty, your MLA benefits end, and the credit card company can reapply the regular terms and conditions of the card.

Other laws, federal and state, may augment the benefits available under the MLA.

Is Chase Sapphire Free For Military Members?

The Chase Sapphire cards offer some nice benefits for eligible active military members under the SCRA. Indeed, fees are waived during active duty and for one year afterward. This can save you close to $600 a year on the Chase Sapphire Reserve® by eliminating the annual fee during the eligibility period.

In addition, Chase cards charge only 4% APR when the SCRA applies. That’s 2 percentage points less than the legal cap that all credit cards must observe under the SCRA. While not quite as good as 0%, the reduced interest rate can provide meaningful savings when you finance purchases over multiple months.

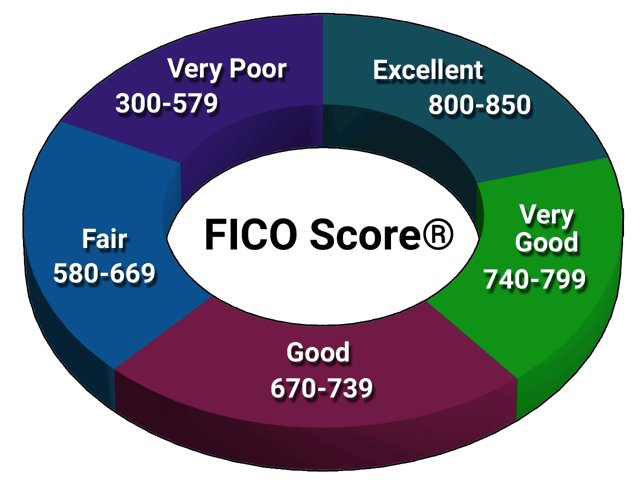

What Credit Score Is Needed For a USAA Credit Card?

The unsecured credit cards offered by USAA require good to excellent credit. Judging from comments in various forums, we’d put the minimum FICO score in the 640 to 670 range. Be aware that the score requirements can be a little twitchy, with lower scores receiving approval while higher scores are rejected.

There is some confusion as to whether you must first be a USAA member before you can get one of its credit cards. Our information indicates that only members can qualify for any USAA insurance and banking products, including credit cards, a fact confirmed by The Points Guy.

To join USAA, you or a military family member must demonstrate some connection to the military, either as a current military member or an honorably discharged veteran. You can also join if you are in training to become an officer. Children of an existing service member need not be dependents to qualify for membership on their own.

Cardholder reviews around the web suggest you need a score of 640 or better to get a USAA card.

There can be various reasons why you are turned down for a USAA credit card even if you are a member and your credit score is good enough. To start with, you must be a U.S. citizen or permanent resident and at least 18 years old. The issuer may ask for additional identifying documents and other information to confirm you are who you say.

According to one contributor, USAA does not limit the number of its cards you can own at the same time. Rather, it caps your combined credit limit at $30,000 ($50,000 for joint accounts).

If your credit score isn’t good enough for an unsecured USAA credit card, you may at one time have considered the USAA Secured Visa® Platinum instead. However, as of 2018, USAA stopped offering secured credit cards, so we refer you to our review of the best of the breed available right now.

What is the Max APR For Military Members?

Under the MLA, military members can be charged no more than a 36% APR for credit card debt. This is the cap for credit accounts obtained by a service member after the start of active duty, and it includes interest, fees, and if applicable, credit insurance.

Cards obtained before active duty are capped at 6% by the SCRA. That’s why it’s a good idea to apply for a credit card now if you are planning to enter the military soon.

All Credit Cards Provide Military Benefits

While it’s true that all credit cards must adhere to SCRA and MLA provisions, the best military credit cards offer superior benefits and are good even if you have nothing to do with the military.

However, some cards reviewed here are issued by organizations that require military affiliation for card membership. If you’d like to apply for any of these cards, simply click on the APPLY NOW link and you’re off to war.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards for Military Personnel ([updated_month_year]) 7 Best Credit Cards for Military Personnel ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Best-Credit-Cards-For-Military-1.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Rebuilding Credit ([updated_month_year]) 9 Best Credit Cards For Rebuilding Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/rebuildcredit.png?width=158&height=120&fit=crop)

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for No Credit ([updated_month_year]) 9 Best Credit Cards for No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/nocredit.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)

![7 Same-Day Credit Cards for Poor Credit ([updated_month_year]) 7 Same-Day Credit Cards for Poor Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Same-Day-Credit-Cards-for-Poor-Credit.jpg?width=158&height=120&fit=crop)