Many consumers struggle over whether to purchase a store’s extended warranty plan when buying a new electronic gadget. But, if you carry one of the best credit cards for electronics, you can confidently decline the offer and still feel safe.

That’s because you can automatically extend your warranty without having to pay an extra fee when you use any of the cards listed below to make your purchase. Some cards will even offer price protections that refund part of your purchase price if you find the same item cheaper in a different store shortly after your purchase.

And did we mention the cash back rewards and potential interest-free financing? If you’re a techie and an early adopter of all the latest gizmos, consider these cards as insurance policies on all your new items.

Overall

Extended Warranty | 0% Financing | Business | Bad Credit | FAQs

Best Overall Card for Buying Electronics

The Chase Freedom Unlimited® card offers everything a techie could ask for. This includes cash back on every purchase — which makes those tech buys a little cheaper — and adds a welcome bonus that can pay for part of your purchase. New cardholders receive a signup bonus after they meet a minimum amount using the card within three months of opening the account.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

But that’s not all. The card also offers an extended intro 0% financing period for new cardholders. And you can have your original manufacturer’s warranty extended for up to one year when you use the card to purchase the item. You get all of this with no annual fee.

Best Cards for Electronics with Extended Warranties

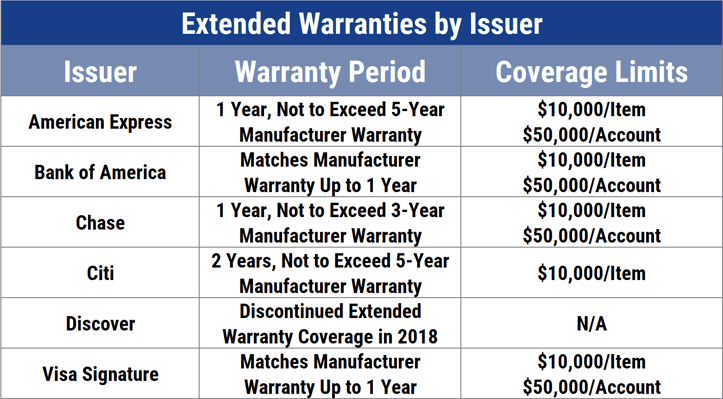

Over the last five years, many credit card issuers have added extended warranty protection to their cards — but not many actively publicize the benefit. This is one of the least-used credit card perks, yet it’s one that can save you the most money if your new tech item goes on the fritz.

2. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

Chase offers one of the best extended warranty programs in the credit card space, and the Chase Freedom Flex℠ card helps you reap the extra protection by adding up to one year on your manufacturer’s original warranty. Just note that this does not cover boats, automobiles, aircraft, or any other motorized vehicles.

There’s also no protection on items purchased for resale, professional, or commercial use, or pre-owned items and computer software.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

With the Capital One Venture Rewards Credit Card, you can double the manufacturer’s warranty for up to one year on warranties of three years or less. Capital One limits all claims to $10,000 per item or $50,000 per cardholder.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

Chase Sapphire Preferred® cardholders receive an additional year of warranty protection on items purchased using the card. This card also provides some of the best travel rewards in the industry — so you can use those electronics purchases to save up for your next trip to E3 or another tech conference.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card can extend an original warranty for up to 12 months on qualifying purchases. And Preferred Rewards members can earn even more bang for their buck, with increased rewards values depending on their membership tier.

Best Cards for Electronics with 0% Financing

While all the cards above offer extended warranties on your electronics purchases, only three also provide interest-free financing for a promotional period. This is particularly helpful if the item you have your eye on is costly.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® card offers new cardholders more than a year of interest-free financing. After that period, the card reverts to its standard interest rate, based on your creditworthiness.

7. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

With the Chase Freedom Flex℠ card, you’ll receive more than a year of interest-free financing after opening your account. Once the introductory period is over, the variable APR will apply. You’ll also earn cash back rewards for all your purchases, all with no annual fee.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card provides a 0% Intro APR for 15 billing cycles for purchases, after which the regular APR kicks in. This is a solid offer for financing more expensive electronics purchases.

Best Business Cards for Buying Electronics

Part of succeeding in business is having the latest technology that makes the customer experience both simple and memorable. If you’re looking to stay ahead of the tech curve, the cards below can offer you price protection and other perks that make your new purchase easier on your bottom line.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

- Earn a $750 bonus when you spend $6,000 in the first 3 months of account opening

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won't expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.49% - 24.49% (Variable)

|

$0

|

Excellent

|

With the Capital One Spark Cash Select for Excellent Credit, you have price protection benefits that refund you the difference if you find an item you purchased with the card advertised at a cheaper price within 60 days of the date of purchase.

Capital One limits claims to $500 each with a maximum benefit of $2,500 each year. Thanks to the card’s partnership with Visa, the issuer will double the length of the manufacturer’s warranty and replace, repair, or reimburse eligible defective items within 90 days of purchase.

With the Capital One Spark Miles for Business, you can earn the same price protection and extended warranties as you would with the card above, but you also rack up travel miles that can pay for your next business trip.

This card charges an annual fee (which is waived for your first year) but pays out an impressive 2X miles for every $1 spent and a generous signup bonus when you meet specific spending thresholds during your first three months with the card.

Best Card for Buying Electronics with Bad Credit

The Fingerhut Credit Account isn’t technically a credit card, but that won’t stop you from using it to make your electronics purchases. You can only use this credit account online at Fingerhut and its retail partners. But with the line of credit, you can purchase name-brand merchandise — including electronics — at discounted prices.

- Easy application! Get a credit decision in seconds.

- Build your credit history – Fingerhut reports to all 3 major credit bureaus

- Use your line of credit to shop thousands of items from great brands like Samsung, KitchenAid, and DeWalt

- Not an access card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See Issuers Website

|

$0

|

Poor Credit

|

And since this is a revolving line of credit, you can reuse the credit as soon as you pay off your previous purchases. Fingerhut also reports your payment history to the credit bureaus, which can help you rebuild your credit score with responsible use.

Which Credit Card is Best for Big Purchases?

A good credit card will give you more than just a line of credit. The best cards will give you a lot more.

The Chase Freedom Unlimited® card goes above and beyond when it comes to protecting your electronics and other purchases from premature damage. The card extends your original manufacturer’s warranty for up to one year while also providing 0% financing.

Keep in mind that the extended warranty does not cover boats, automobiles, aircraft, or any other motorized vehicles. It also doesn’t cover items purchased for resale, professional or commercial use, and pre-owned items or computer software.

That said, you’ll receive unlimited cash back for your big purchase and every other purchase you make using the card. New cardholders can quickly make this card pay off with the welcome bonus.

Chase will give you a cash back bonus award once you meet the relatively low minimum spending requirement within your first three months after activation. You can easily earn that with one large purchase, and you won’t pay an annual fee for the card.

If you have a big purchase in your future, you’d be hard-pressed to find a card that can offer the combination of benefits Chase packs into the Freedom Unlimited® card. Evidence of this can be found in the card’s glowing feedback through the years.

Which Credit Card has the Best Extended Warranty?

Extended warranties aren’t uncommon in the credit card space. Most will add a year to your manufacturer’s original warranty that protects against defects and malfunctions. In other words, if the item you purchased using your credit card goes bad, the card issuer will pay to fix or replace it — whichever is cheaper.

If you regularly purchase electronics, this is a big deal. We all know how unpredictable some items can be.

What sets the various extended warranties apart is exactly how much they’ll cover per claim and for how long after you buy the item. After all, a warranty is only as good as its coverage.

Chase provides one of the best extended warranties in the industry. The same protection applies to purchases made using any Chase card on this list.

You’ll get the standard extra year of coverage — but you can get back up to $10,000 in damages for each claim with a maximum payout of $50,000 per account. That amount is substantially higher than most other card issuers and can help protect you when you make very large purchases.

Keep in mind that Chase will only offer the extended warranty plan if the original manufacturer’s warranty runs for three years or less. If the item comes with a warranty of four years or longer, Chase will not extend the plan or offer the extra coverage.

That’s a fairly standard caveat in the industry. Some issuers — namely Citi and American Express — will still extend your warranty if it runs for five or fewer years, but the maximum coverage and other benefits are not as robust.

Are Electronics Cheaper Online than In-Store?

This depends mainly on the retailer you shop with. In many cases, you can find a better deal online because these stores don’t have the same overhead costs as traditional brick-and-mortar retailers.

For example, consumers know Walmart for its low prices, but Amazon.com will regularly have better deals than the nationwide chain. That’s because Walmart must factor in the cost of maintaining more than 4,600 retail locations into its prices.

That includes real estate costs, operating costs, and workforce costs, among many other expenses. The chain must also pay to transport all its items from warehouses to retail locations. Those costs add up — and the company passes them down to the customer.

Amazon can generally offer lower prices because it doesn’t have to pay overhead costs for so many physical locations. The speed and relatively low cost of shipping services today make shopping online cheaper and more convenient than ever.

You can often find better deals online, and you have more options.

Depending on the state you live in, you may also pay fewer taxes on purchases you make online, which adds to the savings. That said, you may prefer to make certain purchases in person. Some people like to try clothes on and see furniture in person before paying for it.

But when it comes to electronics, you’ll often find better deals online. And since you rarely have to worry about large sizes, fits, or colors with these items, it won’t matter where you purchase them.

Another key factor in purchasing electronics online is that you have a greater number of retailers available to purchase from. That means you’ll increase your chances of finding that hot item that’s out of stock in your area if you scour the internet.

Just keep in mind you may pay more if an in-demand item is harder to find. Many online retailers act independently of large chains and aren’t tied to suggested retail prices.

Don’t Waste Money on the Store’s Extended Warranty

Just about every time you buy an electronic gadget or gizmo in person, the cashier suggests you purchase the store’s extended warranty plan. At that moment, you may feel the need to add the extra protection — and added cost — to your total, even though you may never use it.

But the credit cards above offer extended warranty protection at no additional cost. That means you can pass up the extra expense at the register and still have the peace of mind that you’re covered if the unthinkable happens to your new gadget.

Many of the cards will also offer cash back or travel miles for your purchase. Others give you extra time to pay off your purchases without incurring finance charges for a promotional period.

That’s why it’s a no-brainer that every techie should consider one of the best credit cards for electronics when making their next tech purchase.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![4 Best Credit Cards for Jewelry Purchases ([updated_month_year]) 4 Best Credit Cards for Jewelry Purchases ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Jewelry-Credit-Cards.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Large Purchases ([updated_month_year]) 9 Best Credit Cards for Large Purchases ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/largepurchase.png?width=158&height=120&fit=crop)

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)