So many consumers use prepaid cards to pay bills and make purchases that they’ve become a staple financial product in some American households.

Whether you choose a Visa debit card or a debit Mastercard, you can use the prepaid cards below to pay bills, make a purchase online or in-store, get cash from an ATM, and even accept a direct deposit of your payroll or government benefits checks.

-

Navigate This Article:

Best Prepaid Cards to Pay Your Bills With

Each reloadable prepaid card listed below gives you the option to safely and securely store your money and use your card to pay bills and make purchases. You don’t have to worry about overdraft fees with these cards, as they only allow you to spend up to the amount of money you’ve deposited.

As long as your card is adorned with the Visa, Mastercard, or American Express logo, you can use it to pay bills online, in person, or over the phone.

- Brink’s knows Security! 24/7 access to a suite of security benefits to help keep your account armored.

- Get access to over 100,000 Brink’s Money ATMs.

- Get paid faster than a paper check with direct deposit.

- Add funds to your Brink’s Armored Account and use Brinks Armored debit card anywhere Debit Mastercard is accepted.

- Account opening is subject to registration and ID verification. Terms & fees Apply. Deposit Account is established by Pathward®, N.A., Member FDIC.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fees

|

Not applicable

|

Brinks is known for its long history of securely storing and transporting cash — and the Brink’s Armored™ Account puts just as much emphasis on your card account as it does for the banks and large institutions it works with.

You can access your cardholder account at any time using the Brink’s Armored™ Account mobile app. This allows you to track spending, review purchases, check your balance, and find a location to conduct a free ATM cash withdrawal.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

You can link your Playcard Prepaid Mastercard directly to your new or existing PayPal account to instantly move money to and from your prepaid card account. You can also receive a direct deposit of funds into your card account to potentially lower your monthly fee.

This reloadable prepaid card also gives members a chance to earn cash back on eligible purchases while enjoying no liability for unauthorized transactions.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

Netspend is a long-time staple in the prepaid card industry and the NetSpend® Visa® Prepaid Card is possibly its best product. Along with low prepaid card fees, this card won’t check your credit score, as it isn’t a credit card and doesn’t require a credit check.

You’ll also have no problem with cash reloads using this card, as Netspend has thousands of locations throughout the U.S. where you can add money to your prepaid account. You can also make debit card payments — including paying bills — at any location that accepts Visa.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Up-to $9.95 monthly

|

Not applicable

|

You’ll get extra value with your NetSpend® Visa® Prepaid Card when you use the Netspend Mobile App. Aside from monitoring your account for unauthorized transactions, you can add identity verification protection that ensures no one else has access to your money.

The prepaid card fees attached to your account vary based on your account balance and whether you accept direct deposit payments. These factors can affect your transaction fee, cost of ATM withdrawals, monthly fee, and possibly your reload fee.

- A reloadable prepaid debit account that can be used anywhere American Express® cards are accepted

- Get your paycheck up to 2 days faster with free direct deposit

- Shop with added confidence and Purchase Protection, which can help protect eligible purchases made with the card against accidental damage and theft for up to 120 days from the date of purchase

- Get free ATM access at over 37,000 MoneyPass® ATM locations. It’s free to add cash to your account at Family Dollar locations and free to transfer money to other Bluebird Accountholders.

- With Roadside Assistance, you can call us in case of emergency for coordination and assistance services to help you get on your way

- Pay no monthly fees or foreign transaction fees

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

The Bluebird® American Express® Prepaid Debit Account is a great tool for getting your foot in the door with one of America’s most prestigious credit card issuers. Along the way, you’ll enjoy free ATM withdrawals at thousands of locations as well as other cardholder perks that include roadside assistance and around-the-clock customer service.

American Express also offers lower prepaid card fees when compared with other prepaid issuing banks. You don’t have a monthly fee or foreign transaction fee with this account, and you may qualify for an account with a discounted transaction fee and/or reload fee discounts.

- Mango is a safe and convenient way to manage and access your money when and where you need it

- The Mango Card is a prepaid card account and there are no hidden fees or interest charges. See your Cardholder Agreement for fees and details.

- You can use your Mango Card everywhere debit Mastercard is accepted

- Manage your account anywhere you are. Securely check your balance, transaction history, and send money to friends and family.

- Once you activate and load your Mango Card, you can open a Savings Account with as little as $25 and get up to 6.00% Annual Percentage Yield with up to 6 transfers out each month

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

The Mango Prepaid Mastercard® can turn your prepaid debit card into a full-fledged savings account with a tremendous interest rate on your deposited money. That means you can use your card account to make money — not just spend it.

And when it comes time to use the money you’ve earned, you can access cash through an ATM withdrawal or by swiping or inserting your card with any merchant or service provider that accepts Mastercard payments.

- Get rewarded with unlimited 1% Cash Back when you spend money in stores or online. The funds are available to add to your account as soon as the transaction settles with us, so you don’t have to wait to enjoy the rewards.

- Get your tax refund and direct deposits up to 2 days faster than standard electronic deposits.

- You can withdraw your money without a fee at over 37,000 MoneyPass® ATM locations nationwide.

- Can’t find your Serve card? No need to worry – you can quickly freeze it while you look for it and unfreeze it when you find it. And for extra reassurance, know you won’t be held responsible for fraudulent charges.

- With Emergency Assistance, you can get select access to select emergency coordination and assistance services when you’re traveling more than 100 miles from home.

- Amex Offers provides a range of offers – shopping, dining, and more – from places you love. It’s easy and free.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

This version of the Serve® American Express® Prepaid Debit Account has an online Bill Pay feature that makes this card ideal for paying recurring bills. Simply log in to your account, go to Money Out, and select Bill Pay to add your payee. Payments take two to five business days to complete.

You can also use your card account to make purchases at any location that accepts American Express cards.

- Waive your monthly fee when you direct deposit $500+ in previous monthly period. Otherwise, $5.94 a month.*

- Earn 3% cash back at Walmart.com, 2% cash back at Walmart fuel stations, & 1% cash back at Walmart stores, up to $75 each year.*

- Earn 2% interest rate on up to $1,000 balance in your savings account. Plus, get chances to win cash prizes each month!*

- Get peace of mind with three coverage levels, up to $200, for purchase transactions with opt-in & eligible direct deposit.*

*Please see site for full terms and conditions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Walmart MoneyCard® is a debit card offer.

The Walmart MoneyCard® features online bill pay that allows you to make one-time digital payments or set up recurring payments for regular monthly bills, such as rent, phone, insurance, or utility payments.

This feature is accessible through the MoneyCard app. You’ll also receive the added perk of cash back on Walmart purchases.

- Enjoy FREE withdrawals at over 37,000 MoneyPass® ATM locations nationwide.

- Get access to your money up to 2 days faster with early Direct Deposit

- No monthly fee when you direct deposit $500 or more within a statement period

- Use Online Bill Pay to help you save time and help you avoid late fees. Terms apply.

- Check your balance and recent transactions, pay bills on the go, get SMS text alerts, and send money to family or friends who have a Serve Account

- No credit check, no hidden fees

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

Unlike its sibling card listed above, this iteration of the Serve® American Express® Prepaid Debit Account allows every cardholder to earn cash back on all eligible purchases. Cardholders also receive purchase protection, fraud protection, emergency assistance, and exclusive Amex Offers.

Can I Pay Bills Using a Prepaid Card?

You can use your prepaid card to pay bills or make purchases at any location that accepts your card’s payment network (Visa, Mastercard, American Express).

You can find your card network by looking for the logo on the front or back of the card. For example, a Visa debit card will work with any merchant that accepts Visa credit cards. The same goes for Mastercard or American Express.

Some specialty cards, such as the Walmart MoneyCard® or cards issued by Apple Inc. or other non-banking institutions, still use the major payment networks to process transactions. You can also use those cards to pay bills or make online, over-the-phone, or in-store purchases — just like a debit card attached to a bank account.

The Netspend cards above all allow you to use your Netspend account number and routing number — found in your online account center — to pay bills online, while the Amex cards all have an online Bill Pay feature that allows you to add payees to send money to. Payments usually take a few days to process, so it’s best to schedule payments at least a week before they’re due.

What Is a Prepaid Card?

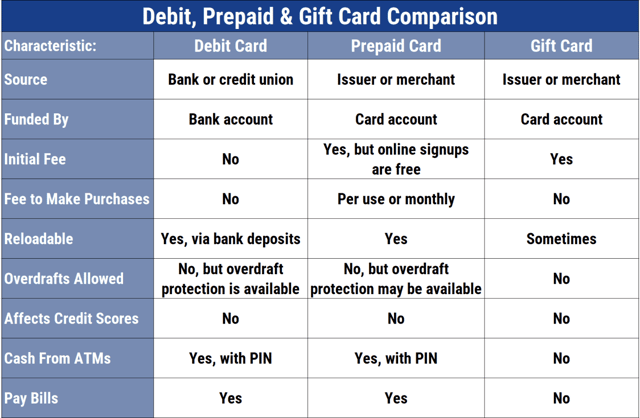

A prepaid card is a financial tool that allows you to deposit (or load) money into a secured account and later spend it using your card.

This is almost identical to a debit card issued by a traditional bank linked to a checking account. The main difference is that you don’t need a bank account to qualify for a prepaid card.

In fact, many consumers use prepaid cards in place of bank accounts. After all, these accounts safely store your money and still allow you to receive direct deposits of your payroll or government benefits checks. Some card accounts also offer an optional savings account that provides a competitive interest rate return on your deposited money.

Your prepaid card acts as a key to your account. It allows you to spend your money at the register, over the phone, or online. You can also get your money through ATM withdrawals and deposit more money at reload locations throughout the U.S. or via online bank transfers.

Netspend, for example, maintains partnerships with convenience stores and grocery stores throughout the country that allow cardholders to bring in cash and add the funds instantly to their prepaid card accounts.

How Do I Get a Prepaid Card?

You can apply for a prepaid card online by following the links to each card listed above. The online application takes less than five minutes to complete and doesn’t require a credit check or access to your credit score.

Once you provide your basic identifying information, the card’s issuing bank will print a card with your name on it and send it to you within seven to 10 business days.

You can load money onto your card account before it arrives or once you have it in hand. After you’ve added money to your card account, you can immediately use it to make purchases or pay bills.

Can You Build Credit With a Prepaid Card?

You will not build credit with a prepaid card because your account has no associated line of credit.

Your credit score changes based on information lenders report to the three major credit bureaus — TransUnion, Equifax, and Experian. This information includes your payment history and account balance.

Credit scores examine how you handle debt. A prepaid card has no line of credit and therefore creates no debt. As a result, your card issuer won’t report your account history to a credit bureau, and you won’t impact your credit score with your activity.

Suppose you need to improve or work on your credit score. In that case, you can consider a secured credit card that offers many similar benefits as a prepaid card but includes a line of credit that can help you improve your credit score with responsible behavior.

Compare the Best Prepaid Cards For Paying Bills

A prepaid card is no longer fodder for gift card racks or as impulse buys by the register. These handy financial tools can be found in the wallets of millions of Americans to help them maintain a budget, make purchases without carrying cash, and pay bills every month.

And when you use prepaid cards to pay bills, you can do away with money orders, stamps, or trips to bill-paying locations.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Pay Bills With a Credit Card ([updated_month_year]) How to Pay Bills With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/How-to-Pay-Bills-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Paying Bills & Utilities ([updated_month_year]) 9 Best Credit Cards for Paying Bills & Utilities ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/utilities.png?width=158&height=120&fit=crop)

![5 Best Credit Cards for Paying Cell Phone Bills ([updated_month_year]) 5 Best Credit Cards for Paying Cell Phone Bills ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_224070166.jpg?width=158&height=120&fit=crop)

![5 Prepaid Cards That Work With Apple Pay ([updated_month_year]) 5 Prepaid Cards That Work With Apple Pay ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Prepaid-Cards-That-Work-With-Apple-Pay.jpg?width=158&height=120&fit=crop)

![11 Best Credit Cards to Pay Off Debt ([updated_month_year]) 11 Best Credit Cards to Pay Off Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Credit-Cards-to-Pay-Off-Debt-Feat.png?width=158&height=120&fit=crop)

![9 Best Apple Pay Credit Cards ([updated_month_year]) 9 Best Apple Pay Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Apple-Pay-Credit-Cards.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards to Pay in Full Monthly ([updated_month_year]) 9 Best Credit Cards to Pay in Full Monthly ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/11/Best-Credit-Cards-to-Pay-in-Full-Monthly.jpg?width=158&height=120&fit=crop)

![How to Pay Off Credit Card Debt ([updated_month_year]) How to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/02/How-to-Pay-Off-Credit-Card-Debt.jpg?width=158&height=120&fit=crop)