Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

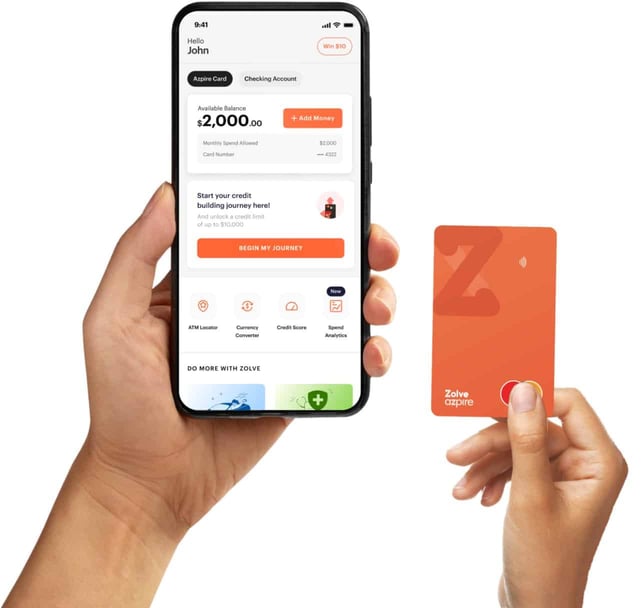

In a Nutshell: International students and professionals who move to the US to work or study must start from scratch financially, even when they have good credit scores back home. US citizens new to financial services overcoming setbacks must also build credit to access financial services. Everyone who lives and works in the US can use Zolve’s Credit Building Card to build a credit score while earning up to 10% cash back rewards.

Zolve’s Credit Building Card is a product for everyone who lives and works in the US. Consumers who aspire to financial independence can use the fee-free Credit Building Card to report their activity to the three major US credit bureaus and build a credit score while earning up to 10% cash back rewards at more than 10,000 retail outlets.

When people leave home to study or work in another country, they take a leap of faith that their decision will benefit them. They hope success in their chosen academic or career path will lead to prosperity and happiness.

US citizens also face hardship when low credit scores limit financial access. They may need additional liquidity and credit access to secure rental leases, mortgages, insurance, and loans.

Many immigrants arrive without a financial bridge to support them. Although they may have a history of responsible credit use back home, their good reputation doesn’t immediately result in a high US credit score.

Likewise, US citizens with a limited financial history often need help to build a good score. And it’s challenging to overcome financial damage when unfortunate mishaps lower credit scores.

US immigrants may turn to slow and expensive foreign exchange services to access money. And when consumers resort to high-interest loans to gain financial flexibility, the strategy may backfire and put them in an even worse position.

Working Toward a High US Credit Score

Zolve is a financial services firm created to help everyone overcome those obstacles. With Zolve’s Credit Building Card, cardholders can use a small bank balance to build a solid credit score. With that balance as collateral, they can spend up to the limit and build or rebuild their financial reputation.

Zolve’s founder, Raghunandan G, said the Credit Building Card is a differentiator because it makes attaining financial flexibility in the US more convenient and less expensive.

“It’s a card with zero fees and no security deposit,” Raghunandan said. “With each swipe, we report your activity to the three major US credit bureaus to build your credit score automatically and quickly.”

The most crucial financial challenge for US consumers, no matter where they originate, is meeting the requirements to enjoy the full benefits of US financial services.

Good credit makes everyday life easier. Insurance costs less, and deposits for access to utility services are lower. Rental contracts, auto loans, and mortgages can only proceed with proof that the person signing the agreement can pay their bills. And employers may check credit scores before offering a job.

The Credit Building Card makes starting the credit-building journey as frictionless as possible. Al US citizens and residents are eligible, including students and working professionals residing in the US with valid visas and those about to move to the US.

Applying from the Zolve website or mobile app is easy. Start by submitting personal identity proof with a US Social Security number, an Individual Taxpayer Identification Number (ITIN), or a valid passport. Zolve takes care of the rest, performing its security due diligence to ensure the application is legitimate.

Monitor Progress in the App

In addition to requiring no fees or security deposit, the Credit Building Card charges no interest or late fees. Because it’s a secured card that depends on collateral, overspending is impossible. Cardholders who use their card responsibly and pay their balances on time will build a better US credit score.

The Credit Building Card also pays up to 10% cash back rewards through partnerships with 10,000+ US retailers. So using the card responsibly pays in two ways.

To make the Zolve journey easier for users, they begin a seven-day educational journey in which the app explains how the card and cashback offer work. Push notifications and videos introduce users to features like spend analytics to help them understand where their money’s going and how they can save more. The app also has a free credit score checker so users can stay up-to-date regarding their progress.

On the Zolve website, a blog walks readers through banking basics and primers on studying and living abroad, credit education, and the benefits of using the Credit Building Card.

One customer who moved to the US after marrying reported having difficulty applying for a credit card because she didn’t have a Social Security number. Using the Credit Building Card helped her achieve financial independence alongside her husband.

Another significantly dropped his score because he struggled financially during the COVID-19 pandemic. After he learned about the Credit Building Card through an ad, he increased his score to 700 within four months. These examples illustrate that starting at the beginning and doing the right thing can pay off surprisingly quickly.

![Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year]) Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/refer.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Building Credit ([updated_month_year]) 12 Best Credit Cards for Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/BUILD.jpg?width=158&height=120&fit=crop)

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)

![How to Start Building Your Credit at 18 ([updated_month_year]) How to Start Building Your Credit at 18 ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/04/How-to-Start-Building-Credit-at-18.jpg?width=158&height=120&fit=crop)

![5 Best Travel Credit Cards With Lounge Access ([updated_month_year]) 5 Best Travel Credit Cards With Lounge Access ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Best-Travel-Credit-Cards-With-Lounge-Access.jpg?width=158&height=120&fit=crop)