In a Nutshell: Traditional student loan providers in the United States offer funding at a fixed rate by default. But that’s not how student loans work in some other nations, and Edly brings that approach to Americans. Edly allows students to repay loans based on their income, making it easier to boost savings and pursue other life goals. Instead of focusing the underwriting strictly on the borrower, Edly leverages their tech platform along with their state-chartered bank partnership to primarily underwrite the degree and the school program based on value and earning potential. Investors can diversify their portfolios by adding private student loans, simultaneously bolstering their financial futures and those of students.

In the United States, student loan repayment is pretty straightforward, with borrowers paying every month until they pay off the balance — unless they can’t. Only then do other options, including income-based repayment, come into play.

That structure leaves many graduates struggling to make ends meet and pay their monthly loan payments. As a result, they can have trouble saving for retirement and defer life goals — including buying a home or starting a family.

But that isn’t the case in some other countries around the world.

“In a lot of other countries, including the UK and Australia, they don’t do it the way we do, where you have a fixed interest rate, accrued interest, and all the rest,” said Chris Ricciardi, CEO and Co-Founder of Edly. “They make it a percentage of your income.”

Edly brings that model to students in the United States to help them achieve academic goals and ease the financial pressure after graduation.

It’s a sharp contrast from the standard model, which only gives students a break when they find themselves unable to make payments. That also may place their credit scores and financial futures in jeopardy.

“If you get in trouble with your fixed-rate student loan in the US, the Department of Education may look to refinance and change that into an income-based repayment plan,” Chris said. “There’s a lot of evidence to suggest that having tuition financed via an income-based repayment option is the way to go, and yet, we don’t do that as a primary tuition payment method. In this country, you finance your tuition with a fixed rate loan, and you have to wait until you get in trouble to change it.”

Edly helps students to avoid that situation. In addition to financing student loans, the platform enables private investors to support those goals and diversify their portfolios, ensuring a brighter financial future for both parties.

Private Lending Helps Students Cover the College Funding Gap

Students attending universities may have multiple funding options available. Some earn scholarships that help cover the cost of tuition and even living expenses. They may also qualify for grants that can help fund their education.

But in many cases, those funding sources don’t cover the full cost, leaving students with a gap. Depending on academic goals, the size of that gap can vary wildly.

“It’s hard to cover it sometimes. So it could be a private student lender that covers it, or it could be covered by cash if you happen to have it,” Chris said. “It could be that you have to work your way through school for a longer period to come up with the money, or, sadly, sometimes people drop out because they can’t afford it. Edly provides that type of gap funding.”

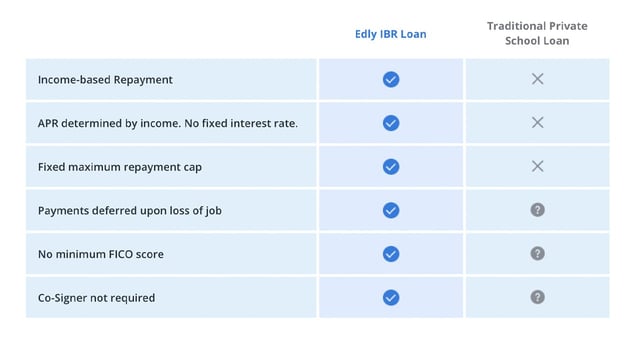

Loans through Edly are comparable to traditional private student loans, according to Chris. The key differentiator is that it bases student repayments on their income after graduation.

Under the traditional student lending model, borrowers pay a fixed rate regardless of their income. That can strain budgets for people starting their careers and adult lives, leading to reliance on credit to meet everyday expenses. Edly’s loans, on the other hand, are sensitive to the borrower’s financial circumstances.

“If your income happens to drop, then you pay a smaller amount,” Chris said. “If your income happens to increase, you can pay it off faster. It can automatically adjusts to what you’re doing. In addition, it is, basically, unemployment insurance a type of payment protection. If you lose your job, you don’t have to pay.”

A New Approach to Lending Underwrites Colleges

When a student applies for a government or private loan that operates according to the traditional model, the lender assesses borrower, or cosigner, creditworthiness. But Edly takes a different approach.

“We’re primarily focusing the underwriting on the schools the students go to and the programs they take, meaning the majors and degrees,” Chris said. “And that’s critical to our whole approach.”

The government and other lenders provide funding regardless of schools and majors, and they base rates and conditions on the borrower. Instead of looking solely at credit history, Edly looks ahead to predict the earning potential of a graduate. It also considers the student’s specific degree and what school or program they attended.

Edly offers loans through banking and investment partners, and borrowers go through the traditional lending process. They’ll still go through a credit check and perform the usual steps they would with another lender. But they can log on to the Edly site and quickly find out their eligibility. If they are eligible, they can begin the formal application and start working through the rest of the process.

“Universities don’t get directly involved in private fundings of their students, but the school matters,” Chris said. “Underwriting is about the school and the programs, so it’s very important.”

Investors Can Also Diversify and Hedge Against Inflation

Most Edly funding comes from large institutional investors. But anyone can invest in student loans as long as they can provide proof that they are Accredited Investors. Edly conducts a know your customer (KYC) check during onboarding.

“We have investors who want to participate in funding these students, and they do that because they believe in it, and it also provides the rate of return to them,” Chris said. “It’s considered a social impact investment, or ESG investment, where you can have the social impact of supporting affordable access to education — but also get a rate of return. It represents the rare ‘S’ in ESG investing.”

Chris said investors could expect returns comparable to private credit funds and other ESG investments. In addition to the rate of return, student loans also allow investors to diversify their portfolios. That way, they can help students pursue strong financial futures while contributing to their own.

Various government agencies, including the Departments of Education and Bureau of Labor Statistics, provide historical data investors can use to educate themselves on this investment. That information includes whether a graduate from a particular program typically passes professional certification exams, their unemployment rates, and other relevant data.

“One thing that some investors enjoy about that investment is that it’s a natural inflation hedge in the sense that if there’s inflation, particularly wage inflation, they have a direct percentage of salaries,” Chris said. “So they tend to go up if there’s inflation.”

Edly Policies and Practices Mitigate Student Debt

According to an Education Data Initiative report updated in November 2021, the national student loan debt burden was more than $1.75 trillion. Some 43.2 million student borrowers owe, on average, $39,351. The same report noted that student loan debt is growing six times faster than the nation’s economy.

The net result is more people are struggling to pay loans that don’t automatically adjust to their financial situations. Credit scores, savings, and life plans may suffer simply because that is how student debt has traditionally worked in the United States.

A college degree is an essential asset in finding gainful employment. Many positions that offer benefits and competitive wages expect job candidates to have completed a four-year degree. That leaves workers in a bind of either earning less or going into debt with the hope of earning more.

Edly’s lending approach can remedy that situation and help ease the more significant student debt crisis. Its loans help students achieve their educational goals and start their careers on stable financial footing. Edly also aims to ensure students earn degrees that will allow them to repay their debt.

“By the nature of the product, we’re trying to create affordable tuition,” Chris said. “We are trying to rationalize the cost of education by providing this screening where we say, ‘These programs make sense, and these others don’t.’ Over time, if that takes off, that’s going to help with the student debt crisis.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Unsecured Loans for Bad Credit Borrowers ([updated_month_year]) 5 Unsecured Loans for Bad Credit Borrowers ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Unsecured-Loans-for-Bad-Credit.jpg?width=158&height=120&fit=crop)

![6 Ways to Pay Student Loans With a Credit Card ([updated_month_year]) 6 Ways to Pay Student Loans With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Pay-Student-Loans-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Students With No Income ([updated_month_year]) 9 Best Credit Cards for Students With No Income ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/noincome.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Low-Income Earners ([updated_month_year]) 12 Best Credit Cards for Low-Income Earners ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/low-income2.jpg?width=158&height=120&fit=crop)

![15 FAQs: Annual Income on Credit Card Applications ([updated_month_year]) 15 FAQs: Annual Income on Credit Card Applications ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_394244284.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year]) 7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_232260670.jpg?width=158&height=120&fit=crop)

![Credit Card Ownership By Age, Income, Gender & Race in [current_year] Credit Card Ownership By Age, Income, Gender & Race in [current_year]](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1524276980.jpg?width=158&height=120&fit=crop)