As a Chase Freedom Flex℠ owner, I can vouch for how great its rotating bonus cash back categories can be for savings. Each quarter of the year becomes a great time to save on things you already spend money on, like gas, groceries, dining out, and holiday shopping.

If you’re reading this article, the odds are high that you’ve already received a GetChaseFreedom.com invitation in your inbox or mailbox. Congratulations, because this means your credit score is in good shape. The Chase Freedom Flex℠ is considered to be a card for those in the “good” to “excellent” credit range, and you wouldn’t get an offer like this if Chase didn’t consider you a strong candidate for the Chase Freedom Flex℠.

You’re minutes away from applying for one of the most sought-after cards on the market. But first, we’ll walk you through signing up at GetChaseFreedom.com and tell you about some other Chase cards that can really help you maximize the rewards available when used together. Keep reading as we explore the Chase Freedom Flex℠ and some of the other top cards in the Chase credit card family. Even if the Chase Freedom Flex℠ card isn’t the best fit for you, perhaps you’ll find some of their other offerings appealing.

1. Visit GetChaseFreedom.com with Your Invitation Number

If you’ve received the GetChaseFreedom.com invitation in the mail, you’re just a few steps away from submitting an application for one of our favorite cards.

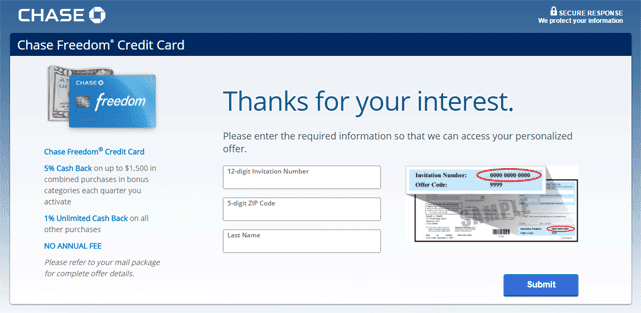

First, go to GetChaseFreedom.com and you’ll be greeted by this secure welcome page.

When you visit GetChaseFreedom.com, the site asks for your invitation number, ZIP code, and last name to get started.

The site will ask you to enter your 12-digit Invitation Number, ZIP Code, and last name to confirm you’ve actually been invited to apply. Once you submit this form, Chase will ask you for some extra personal and employment information to help confirm your identity.

Your odds of approval are high since Chase reviewed your credit score and reached out to you about getting the Chase Freedom Flex℠. Below you can see specific details of the Chase Freedom Flex℠ and easily apply through the issuer’s website by clicking the “Apply Now” button.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.Chase Freedom Flex℠

If you’re approved, read below because we have more information on what you should know about your new card.

2. Maximize Freedom Flex Rewards with Other Chase Offers

If you already have a Chase Freedom Flex℠ or there’s one coming in the mail, you should know about some of the other Chase cards that you can use in conjunction with your Chase Freedom Flex℠ that can really help you rack up the rewards.

The Chase Sapphire Preferred® Card is an exceptional companion to the Chase Freedom Flex℠, especially if you enjoy traveling and dining out because you’ll earn twice the points on these types of purchases.

As previously mentioned, the Chase Freedom Flex℠ is known for having no annual fee and offering extra cash back in rotating quarterly categories. Chase allows you to transfer points earned on your Chase Freedom Flex℠ to your Chase Sapphire Preferred® Card, and when you book travel through the Chase Ultimate Rewards program, your points are worth 1.25 cents per point.

In this arrangement, you can look at the Chase Sapphire Preferred® Card card, which has no foreign transaction fees, as your vacation card because you’ll have a lot of extra cash back you can devote to getting out and seeing the world. Check out more information on how to apply for the Chase Sapphire Preferred® Card card:

The Chase Freedom Unlimited® is another excellent pairing with the Chase Freedom Flex℠, providing a higher, fixed cash-back percentage on every purchase. In this arrangement, you’ll get your bonus cash back on whatever category is in session with your Chase Freedom Flex℠ and cash back rewards on every other purchase with your Chase Freedom Unlimited®.

So no matter what you buy, you can count on earning rewards every time you swipe your Chase cards. Below are extra details for obtaining the Chase Freedom Flex℠:

3. Be Mindful of the 5/24 Rule Before Applying

Before applying for a second Chase offer, you should be aware that Chase adheres to what’s been dubbed the “5/24” rule. Essentially, Chase is likely to reject applications from people who have applied for five or more credit cards in the past 24 months. Even if your credit is in good standing, you could be rejected on a Chase application for a card you would otherwise be qualified for.

Most people won’t fall into this category, but if you’ve already applied for multiple credit cards in the past two years, you should prioritize your Chase applications. If the Chase Freedom Flex℠ is at the top of your list, be sure to apply for it before trying for one of Chase’s other offers.

Chase Freedom Flex℠ is a Great Option Among Rewards Cards

With a GetChaseFreedom.com invitation in hand, you’re well on your way to acquiring an excellent credit card. Once you have your Chase Freedom Flex℠, be sure to activate the quarterly awards on your account page. The rotating cash back rewards are not something you want to miss out on.

I typically try to be aware of which category is active and use my Chase Freedom Flex℠ exclusively on these types of purchases. That’s why it’s such an effective strategy to couple the Chase Freedom Flex℠ with another card like the Chase Sapphire Preferred® Card — using two or more cards in conjunction can really rack up the rewards, and Chase has several options that can help your rewards points add up quickly.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Tips: How to Increase Chase Credit Limit ([updated_month_year]) 6 Tips: How to Increase Chase Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Chase-Credit-Limit-2.jpg?width=158&height=120&fit=crop)

![Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year]) Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/recon.jpg?width=158&height=120&fit=crop)

![How Quickly Can I Get a Credit Card? 2 Tips for Fast Turnaround ([updated_month_year]) How Quickly Can I Get a Credit Card? 2 Tips for Fast Turnaround ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/quick.png?width=158&height=120&fit=crop)

![6 Tips: Increase Your Capital One Credit Limit ([updated_month_year]) 6 Tips: Increase Your Capital One Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Capital-One-Credit-Limit-2--1.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Discover Credit Limit ([updated_month_year]) 6 Tips: How to Increase Discover Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/09/DiscoverCreditLimit--1.jpg?width=158&height=120&fit=crop)

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![7 Tips: Paying Rent or Mortgage with Credit Cards ([updated_month_year]) 7 Tips: Paying Rent or Mortgage with Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/rent--1.png?width=158&height=120&fit=crop)

![3 Tips: Credit Card Limit Increases Without Asking ([updated_month_year]) 3 Tips: Credit Card Limit Increases Without Asking ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Limit-Increase-without-Asking-Feat--1.jpg?width=158&height=120&fit=crop)