In a Nutshell: TripInsuranceStore was one of the first one-stop-shop internet sites for travel insurance. Today, the website and its founder, Steve Dasseos, helps countless travelers protect their financial investments when booking a trip for business or pleasure. During a global pandemic, those insurance plans become more important — and sometimes harder to understand.

Most people don’t plan a big vacation in the days leading up to their departure. In fact, many people start booking and paying for a trip as much as a year in advance. As we’ve all learned recently, a lot can happen in a few days — let alone a year.

Trip insurance is typically written for people who get sick or injured before their trip or have to cancel for other various reasons. But a global pandemic — who’d expect that?

Millions of people around the world have had their travel plans thwarted since travel restrictions and stay-at-home orders were put into place due to Covid-19. Some travelers managed to get refunds or new departure dates. But others haven’t been so lucky.

Steve Dasseos, the founder of TripInsuranceStore.com, has helped countless travelers protect their financial and health interests when it comes time to book a trip. But travel hasn’t always been his passion. In fact, Dasseos spent 15 years as a financial planner before pivoting to a different industry.

Steve Dasseos, Founder of TripInsuranceStore.

“As my clients were nearing retirement, they started to travel,” he said. “Most asked me about travel insurance, which I had never heard of at the time. After researching the topic, I found that the few travel insurance websites that existed weren’t very detail-oriented. In my opinion, most of them are still like that.”

Dasseos took it upon himself to build a repository of travel insurance knowledge with comprehensive search functionality that finds the best travel insurance plans available for any traveler.

Dasseos said he wants someone to visit his website at any time of day or night and quickly find the same insurance options that he’d find when searching for them. The cost of those plans will depend on the coverage needed, among other factors.

“You should expect to pay between 8% and 13% of your prepaid trip cost if you’re getting a trip cancellation plan,” Dasseos said. “The total cost will depend on your age and the state that you live in.”

But will those plans cover the traveler in the unforeseen circumstance of a global pandemic?

“About half of the plans on the market currently exclude coverage related to anything with this virus,” Dasseos said.

That’s because most travel insurance plans cover circumstances that people experience regularly, such as illness. But plans weren’t written to cover a global pandemic and mandatory stay-at-home orders.

“You have to have a valid reason for canceling your trip under any plan,” Dasseos said. “Fear, worry, or concern isn’t considered a valid reason. Most governmental actions aren’t covered either. So if the government says that TSA is going to take 10 minutes to screen each person at the airport and flights get backed up for days, you aren’t covered.”

Most Plans Aren’t Written to Cover a Global Health Crisis

Many of the generic plans sold through travel providers or touring websites have no language in place for global health scares. They’re traditionally cookie-cutter plans that cover the basics. That’s why it’s important to research a travel insurance plan through an expert, such as Dasseos, who has no ties to the travel company and has the traveler’s best interests in mind.

“A lot of travel insurance websites sell policies that seem easy, but make it very difficult to make a claim should you need it,” he said. “In more than 20 years, I’ve never had an honest claim turned down.”

In the world of travel insurance, there isn’t a one-size-fits-all plan. Travelers can literally choose from hundreds of options that vary based on their needs and other factors.

The most common is trip cancellation and trip interruption insurance. These plans can cover paid expenses if someone cancels a trip for a valid reason. Interruption insurance helps cover expenses should something prematurely end a trip.

Dasseos noted that most people think they can only make a claim for trip interruption if they experience a traumatic injury that requires emergency medical services, but that isn’t true.

“The medical treatment doesn’t have to be anything that’s life-threatening,” he said. “It can be anything that causes a normal person to go to the doctor — anything from a twisted ankle or something very serious.”

Travelers can purchase these plans together or separately. Dasseos said that trip interruption plans often cost less if purchased alone because they don’t include trip cancellation, which typically triggers more claims.

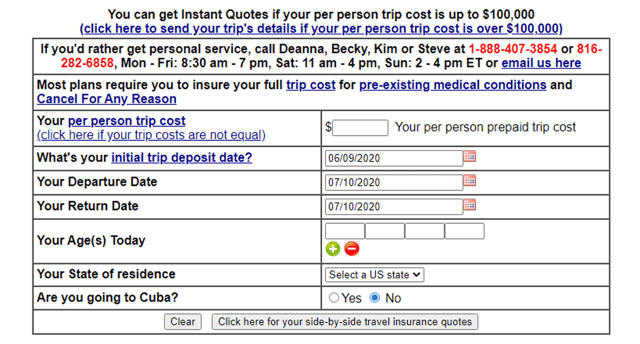

Travelers can easily compare travel insurance quotes on TripInsuranceStore.com.

Plans that cover pre-existing conditions are also available. These plans become valuable if you or a loved one has a medical condition that has required treatment within the last 60 to 180 days.

“Say your Grandmother has congestive heart failure and isn’t in good health,” Dasseos said. “You’re worried, though, that something could happen when it comes time to take your cruise. You can purchase a policy that protects you, should something happen to her and you can’t go because you want to stay with her.”

Separate or combined plans can also cover flight insurance, rental car insurance, luggage insurance, and more. With so many options available, it makes sense to consult with an expert when purchasing a plan to protect large financial interests during a trip.

“Don’t assume that all companies will work the same,” Dasseos said. “There are hundreds of companies out there with hundreds of plans. We only offer a handful of them. We simply don’t trust some companies. Others have great plans, but terrible customer service.”

But what if someone doesn’t purchase a travel insurance plan — or a plan turns out to be a bad one?

Credit Card Policies May Provide Backup Coverage

Travelers do their research, pick the perfect place to stay, and map out their itineraries minute by minute. But what happens when a global pandemic prohibits travel and keeps them at home?

Some accommodation providers aren’t giving refunds to travelers who aren’t taking their pre-paid trips due to Covid-19. Others are only offering to reschedule trips, but many people are still generally wary of traveling and just want a refund.

Dasseos said that even if someone has no travel insurance — or they’re under-insured — they may still have options to receive a refund.

Many credit card companies provide basic travel insurance benefits if the customer pays for their trip using the card and may provide refunds when a trip becomes impossible to take.

“This isn’t guaranteed,” Dasseos said. “I’ve seen some people successfully challenge the charge and others who aren’t successful. The higher-end cards tend to offer more comprehensive benefits than the basic cards. It’s sometimes governed by the state the person lives in or the terms and conditions of the card they use.”

If a traveler decides to reschedule a trip that was booked with insurance, Dasseos said that nearly all travel insurance plans will carry over to the new date. It’s important, though, to inform the insurance provider of the change or the plan may forfeit its coverage.

Travelers Shouldn’t Assume a Policy Fully Covers Them

Most of us learned from an early age that we shouldn’t sign anything without reading it first. That also goes for trip insurance plans. While one may think that all plans cover the same things, Dasseos said most people don’t realize how different travel insurance plans are, despite similar verbiage.

“You might have five travel insurance providers that use the same wording in their contracts, but all five might define the words differently,” he said. “One company might provide 23 different reasons why you could cancel your trip, and another company might have nine. People think that companies all cover the same things. Never assume with a contract.”

Dasseos said he’s seen just about every monkey wrench an insurance provider can throw at a traveler. His business has learned from those experiences to help new customers avoid repeating the same mistakes.

“Even though we sell travel insurance, we aren’t in the business of selling,” he said. “We’re more about educating. I don’t want to sell anything to someone if they don’t need it. I can’t ethically feel right if I sell something to someone that doesn’t meet their needs.”

That dedication to the customer keeps previous clients coming back to purchase insurance plans for their upcoming trips. And word of mouth — as well as an easy-to-use website — keeps new travelers coming to the site.

And as the Covid-19 global pandemic continues, the need for good insurance plans only grows. That also means that travel providers will continue to alter the wording in their plan’s contracts.

“It’s always important to get to know the terms and conditions of any travel document you sign,” Dasseos said. “A lot of people become surprised and say ‘I didn’t know the touring company, airline, or travel provider could do that,’ but they signed it anyway — which means they can do it.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Vacation Credit Cards ([updated_month_year]) 7 Best Vacation Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/vacation.png?width=158&height=120&fit=crop)

![7 Best Vacation Credit Cards ([updated_month_year]) 7 Best Vacation Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/04/Best-Vacation-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Best Vacation Rental Credit Cards ([updated_month_year]) 7 Best Vacation Rental Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Best-Vacation-Rental-Credit-Cards.jpg?width=158&height=120&fit=crop)