In a Nutshell: Indonesia is an economically diverse nation, but a gap exists between the funding needs of small businesses and credit support from traditional lenders. Akseleran is a P2P platform that connects SMBs to a pool of retail and institutional lenders that stepped in to fill that gap in 2017. The lenders on Akseleran’s platform typically offer favorable terms that traditional institutions can’t match. And as the Akseleran lending community continues to expand, more Indonesian businesses gain access to needed credit products.

In a developing economy, a healthy business cash flow can be the difference between capitalizing on growth opportunities and just watching from the sidelines. Many businesses in Indonesia could benefit from loans to build out their operations, but they often lack access because of the legacy lending processes of traditional financial institutions.

That’s why Akseleran, a fintech lending platform based in Jakarta, Indonesia, set out to democratize that access. The platform’s peer-to-peer model connects small businesses with short-term credit while expanding the country’s lending pool beyond what the conventional market can supply.

Since 2017, nearly 150,000 Indonesians from all walks of life have invested loan funds on the insured Akseleran platform and used their profits to realize more returns.

Indonesian SMBs in a range of sectors leverage Akseleran as an invoice-financing platform. They use invoice payments already due to them instead of fixed assets as collateral. That means quicker and broader access to credit in an economy that may leave too much economic potential unrealized.

“We started Akseleran because we saw a huge funding gap in Indonesia, particularly for SMBs. Researchers and authorities estimate the gap at about $70 billion a year,” said Christopher Gultom, Akseleran Co-Founder Chief Credit Officer.

About 90% of Akseleran’s portfolio originates from the invoice financing and prepayment invoice financing model. Now, SMBs that have finished jobs and submitted invoices to customers — but are still waiting for payment on terms typically ranging between one and four months — can leverage that capital to get ahead.

“We saw the opportunity,” Gultom said. “And we discount the invoices so SMBs can use the money for other purposes, such as acquiring new jobs or even for operational activities.”

Flexible SMB Credit Access at Affordable Rates

With more than 270 million people, Indonesia is the most populous nation in Southeast Asia and the fourth most populous in the world. Its development and global economic integration are relatively recent phenomena, and traditional financial institutions can’t supply enough credit to keep up.

Although Akseleran is sector agnostic, about 25% to 30% of its loan portfolio originates from the contracting industry. Others, including retail, argon gas mining, construction supply, food processing, and auto rental, are also prominent.

Simplicity, flexibility, and affordability are key drivers in borrowers’ adoption of the platform. Akseleran charges businesses about 18% to 21% per year plus a fee that averages 0.25% to 0.375% per month.

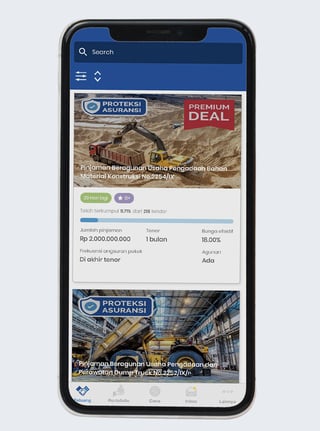

The Akseleran app makes lending more intuitive for lenders and borrowers.

“That’s favorable for them because the loan term is usually only about three or four months,” Gultom said, “In that scenario, costs amount to about 5%, but because their margins are 20% to 30%, they’re OK with that.”

Borrowers may also stipulate the loan term, type of collateral, and repayment frequency. Akseleran is fundamentally a fintech platform, so getting up and running is comparatively simple.

After a business registers and submits a proposal, the platform connects with it through an online meeting app and begins document collection. Verification of financial and bank statements happens quickly. Credit history verification is also seamless through a collaboration with the Indonesian credit bureau PEFINDO.

Invoice-based loans also involve an analysis of a company’s previous invoice payments. Loan collateralized based on a recurring transaction record is less likely to default, and ongoing payment relationships foster a higher level of confidence at Akseleran. It’s a win for businesses.

“Although conventional lenders may charge slightly less interest, they require fixed assets — that’s the difference,” Gultom said.

A Platform that Facilitates Favorable Annual Returns

Once everything is settled, a loan proposal goes up on the platform. Lenders can pick and choose from competing offers that mesh with their goals.

A theoretical annual return of 18% to 21% is possible, but the introduction of credit insurance on Akseleran limits many returns to a current average of 14% to 15%.

“When we ask lenders what the most important factor leading them to choose Akseleran is, and they say peace of mind,” Gultom said. “The insurance covers about 90% of the principal.”

Christopher Gultom, Akseleran Co-Founder and Chief Credit Officer

Lenders can quickly register by taking a selfie with their personal identity card and uploading it to the site. Character-recognition functionality on Akseleran takes care of the rest.

“We connect with a government-owned identity verification institution,” Gultom said. “After that is complete, they can just input their banking preferences and invest.”

The detailed verification that every borrower goes through results in a plethora of information on each proposal. A loan summary indicates the amount requested, the term, the effective interest rate, and what form of collateral is involved.

“When you click, you get all the details about the campaign,” Gultom said.

Deep dives into collateral and repayment details are available, as is detailed information about the prospective borrower, including explanations of the borrower’s location, industry status, and more.

“We show revenue, EBITA, and net income as well as equity and short- and long-term debt,” Gultom said. “We are very open and prudent about putting this kind of data out to our lenders. It’s one of our main advantages — not many platforms do the same level of work we do. We’re very, very proud of it.”

Promoting Financial Inclusion in the Modern Economy

Borrowers and lenders can streamline their portfolios on Akseleran, which results in a more democratized loan marketplace than traditional institutions provide. People at all income levels can participate as lenders on the platform, and they need as little as $7 to begin investing and earning profits.

Akseleran also supports an auto-lending feature that streamlines entry into loan offers that follow pre-set parameters.

“Lenders can choose the criteria they prefer — such as length of the loan term or minimum borrower rating or interest rate — and then leave,” Gultom said. “When a suitable campaign opens, Akseleran automatically invests their funds.”

Those low barriers to entry attract many more participants. For example, motorcycles are commonly used for transportation in Indonesia, and Uber-like companies deploy drivers to ferry people around. Many of those gig-worker motorcyclists, who may earn $200 a month, use Akseleran to make a bit of extra money.

They exemplify a growing clientele of typically younger people who see Akseleran as an effective tech investment platform. That also means it has transformational potential in modernizing Indonesia.

“The age range of our target market is around 30 to 40,” Gultom said. “That’s the sweet spot for us because they have the knowledge, they have money, and they are tech-savvy.”

They’re taking advantage of Akseleran’s mission of financial inclusion to help themselves while assisting friends and neighbors who own and operate many of the small businesses charged with growing Indonesia’s economy.

“We want to open opportunities for all people in Indonesia,” Gultom said.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year]) How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-build-business-credit1.png?width=158&height=120&fit=crop)

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![Compare Credit Cards: 18 Best Offers Today ([updated_month_year]) Compare Credit Cards: 18 Best Offers Today ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/comparison2.jpg?width=158&height=120&fit=crop)

![Credit One Bank: Reviews & 5 Best Offers ([updated_month_year]) Credit One Bank: Reviews & 5 Best Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/creditone.png?width=158&height=120&fit=crop)

![13 Category Winners: Best Credit Card Offers ([updated_month_year]) 13 Category Winners: Best Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-4.jpg?width=158&height=120&fit=crop)

![7 Longest 0% APR Credit Card Offers ([updated_month_year]) 7 Longest 0% APR Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Longest-0-APR-Credit-Card-Offers-Feat.png?width=158&height=120&fit=crop)

![7 Best Credit Card Offers Right Now ([updated_month_year]) 7 Best Credit Card Offers Right Now ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Best-Credit-Card-Offers-Right-Now.jpg?width=158&height=120&fit=crop)