Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Real estate has many advantages as an investment class, but high barriers to entry obscure them. SparkRental replaces expensive down payments and syndications with a Co-Investing Club that gathers groups of investors, including nonaccredited individuals, for monthly deals. Diversification is a goal extending from the types of properties selected to the general partners sponsoring the deals, but all require only a $5,000 minimum outlay. The concept of infinite returns spurs many in the SparkRental community to leverage their earnings to seek financial independence and the ideal life.

There’s a lot to be said for investing in real estate over other asset classes, or at least making real estate a prominent part of a diversified portfolio.

For example, real estate values tend to rise with inflation and are much more stable and resilient than stock prices. Copious deductions, including paper losses from depreciation, reduce taxable income. And while home prices can drop precipitously during recessions, rents tend to flatline, protecting cash flow consistency for landlords.

Evidence is that rents stayed steady even during the Great Recession of 2007-8, the worst real estate-related downturn in the last century, while home prices tumbled 25%.

The problem with traditional real estate is its exclusiveness. Those who seek to own outright must find properties and work with lenders, contractors, property managers, and tenants. Syndication partners obviate those responsibilities, but they typically still need something in the neighborhood of $50-100,000 to enter.

SparkRental, active in the real estate investment industry since 2016, fixes the access problem through its Co-Investing Club, a first-of-its-kind solution for democratizing real estate investing. With SparkRental, nonaccredited investors can reap the benefits of real estate for as little as a $5,000 minimum.

Investor, author, and certified real estate geek Brian Davis co-founded SparkRental with Deni Supplee, landlord, investor, and licensed real estate agent. Together they have more than 60 years of real estate investing experience. They put their personal money into every deal as equal members of the club, which meets monthly to consider new opportunities.

“The minimum investment is not chump change, but it’s also not the 50 or 100 grand you’d need as a down payment or to invest by yourself in a syndication,” Davis said.

Democratizing Real Estate Through Joint Ventures

The $50-100,000 figure isn’t just large. It’s a significant sum tied up in a single long-term investment that may or may not play out as anticipated. Investing at that level is feasible for accredited investors and high-net-worth individuals but poses a high barrier for everyone else.

SparkRental allows investors to spread that sum and more into multiple properties. Individual assets require less capital, and diversification shields investors if the unexpected happens with a particular property.

“Instead of lying awake at night worrying about this one investment you put 100 grand into, it just becomes an average of a bunch of different deals and investments,” Davis said.

Joining the Co-Investing Club requires a small monthly or annual fee for access to once-a-month virtual club meetings, where Davis and Supplee introduce a new property for mutual consideration.

“We bring in the sponsor so we can vet the deal directly,” Davis said.

The minimum investment is $5,000, and participation is always optional. After careful consideration, those who choose to go in on the deal form a joint LLC and bank account and become partial owners with full voting rights and privileges. They receive K-1 tax forms usually showing paper losses from depreciation even as they collect cash flow.

Davis and Supplee draw on their extensive network of general partners and sponsors in choosing deals to bring to the club. They strive for as much diversification as possible, spreading properties across the country and including different asset types, including multifamily properties, self-storage units, mobile home parks, and beyond.

They aim for an average internal rate of return of 15-25% or more annually.

“We just try to keep an eye out for moderate-risk deals with high return potential,” Davis said. “It’s been a priority for us from the beginning to serve nonaccredited investors.”

Monthly Access to an Inflation-Proof Asset Class

These investments are entirely passive, with the general partners handling fundraising, working with lenders, overseeing maintenance and renovations, and hiring property managers. As limited partners in the deals, club members are financial investors with no legal or loan liability.

Davis and Supplee and their co-investors seek to build multiple passive income streams and use that passive income to replace their full-time jobs and have more flexibility and freedom.

Housed on the SparkRental site, the frequently updated Landlord Blog chronicles Davis and Supplee’s tips and tricks for achieving financial independence through real estate. Davis and Supplee also host a free and interactive podcast and videocast, Live Off Rents, via the SparkRental Facebook page.

Their inclusive approach covers basics from finding deals and calculating rental cash flow to more advanced topics for achieving financial independence.

Resources and tools for investors interested in taking a more active role in their investments include rental property cash flow and loan amortization calculators and a house hacking calculator, which helps people devise ways to have others pay their housing costs.

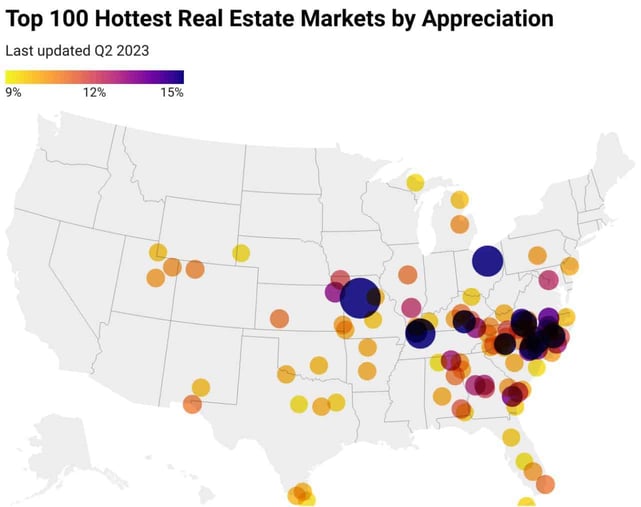

Real estate heat maps display home price appreciations and depreciations at a granular level. Reviews of real estate crowdfunding platforms help investors expand their options. And free property management software enables landlords to handle everything from marketing to maintenance.

In contrast to the relatively volatile stock market, real estate offers a stable source of passive income where valuations tend to rise and fall with inflation. Real estate investments also provide more balance between yields and value, and prices tend to rebound quickly after downturns because housing is in constant demand.

“You get some recession resilience from real estate that you don’t get from other asset groups,” Davis said. “Even when values drop, rents don’t.”

Achieve a Passive Income Stream to Realize Life Goals

Achieving FIRE — an acronym for Financial Independence, Retire Early — is Davis and Supplee’s rationale for SparkRental. They also offer free classes on the site, including FIRE from Real Estate, which provides a year of membership in the Co-Investing Club, a course schedule arranged in sections, monthly check-ins, and accountability sessions.

Although the FIRE movement tends to wane during periods of instability in the stock market because early retirement seems an unrealistic goal, Davis sees FIRE primarily as a strategy for using one’s time to the fullest advantage.

That’s because most people who retire early don’t stay retired for long. They end up doing something closer to what they love.

“People come to the idea for the retire early portion of it, but they stay for the financial independence portion,” Davis said.

Therefore, Davis and Supplee counsel club members not to seek early retirement but to have enough income to allow them to do what they want with their time.

“People ask what’s the point of saving a big chunk of their paycheck to retire early if they’re not actually going to retire,” Davis said. “The answer is that they can go back to work doing something they love and start living their ideal lifestyle, even if that ideal work pays less.”

That’s Davis’s strategy — he and his family have spent much of their time traveling and living in Brazil and are moving to Peru. SparkRental and the Co-Investing Club provide the tools and insights for diligent club members to live similar lifestyles.

“You don’t actually need enough money to cover all your expenses if you’re going back to work anyway,” Davis said. “What you need is enough passive income to cover that shortfall between your ideal work and what you feel like spending in a given year.”

![5 Best Credit Cards to Use at Sam’s Club ([updated_month_year]) 5 Best Credit Cards to Use at Sam’s Club ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/Best-Credit-Cards-to-Use-at-Sams-Club.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Students With No Income ([updated_month_year]) 9 Best Credit Cards for Students With No Income ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/noincome.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Low-Income Earners ([updated_month_year]) 12 Best Credit Cards for Low-Income Earners ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/low-income2.jpg?width=158&height=120&fit=crop)

![15 FAQs: Annual Income on Credit Card Applications ([updated_month_year]) 15 FAQs: Annual Income on Credit Card Applications ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_394244284.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year]) 7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_232260670.jpg?width=158&height=120&fit=crop)

![Credit Card Ownership By Age, Income, Gender & Race in [current_year] Credit Card Ownership By Age, Income, Gender & Race in [current_year]](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1524276980.jpg?width=158&height=120&fit=crop)

![8 Credit Cards With Lounge Access ([updated_month_year]) 8 Credit Cards With Lounge Access ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Credit-Cards-With-Lounge-Access.jpg?width=158&height=120&fit=crop)