In a Nutshell: Small businesses make up more than 99% of US employer firms. These 28.8 million companies employ a majority of the American workforce and help support the economy in good times and bad. Still, many of these businesses have difficulty obtaining loans for the working capital they need to remain operational. OnDeck, the largest online small business lender in the US, offers term loans and lines of credit with application requirements that are easier than those at traditional banks. Since 2007, OnDeck has issued $8 billion in capital to over 80,000 small businesses in the US, Canada, and Australia. Loan disbursement through ACH can happen in as little as 24 hours, but a recent agreement with Ingo Money and Visa will soon provide real-time funding of loans through a customer’s existing small business debit card. //

Entrepreneurship isn’t easy. Deciding to leave the traditional workforce to create your own business takes vision and determination — as well as the ability to stretch a dollar and function on very little sleep.

To these people, their small business is anything but small. A 2016 survey determined there are 28.8 million operational small businesses in the US — which accounts for 99.7% of all American businesses.

The US depends on the success of these companies to keep people employed and maintain the current upward trajectory of the economy. So why is working capital — the lifeblood of these firms — often impossible to obtain?

Banks are typically reluctant to approve small business loans because some small businesses lack the stability of time-tested large firms. In fact, banks only approve approximately 24.1% of SMB loan applications. The difficulty of getting a traditional bank loan and non-flexible terms from banks create a gap that frustrates many small businesses and creates a demand for affordable capital online.

But OnDeck aims to fill in the gaps where other lenders fall short. The largest online small business lender in the US offers its clients term loans up to $500,000 with rates as low as 9.99% AIR (annualized interest rate excluding fees) and lines of credit of up to $100,000 with rates as low as 13.99% APR.

Since 2007, OnDeck has issued $8 billion in capital to over 80,000 small businesses in the US, Canada, and Australia, and delivers financing in as little as 24 hours. The company’s latest partnership with Ingo Money and Visa will provide real-time funding of loans through a customer’s existing small business debit card.

$8 Billion in Loans to Over 80,000 Small Businesses

OnDeck strives to make its loan qualifications less intensive than those of banks. As such, the company’s main requirements are that an applicant have a 500+ personal credit score, be in business for at least one year in business, and show annual revenue of more than $100,000 in the past 12 months. OnDeck’s loans are available to businesses in over 700 industries, with only a few business types unable to acquire funding.

Adoption of the small business loans was so popular that OnDeck eventually expanded its coverage area to incorporate the millions of SMBs in both Canada and Australia. More than three years later, OnDeck sees usage rates steadily improving — so much so that OnDeck CEO Noah Breslow recently said that fintech adoption in Australia is outpacing initial adoption in the US.

Simple Onboarding for Loans and Revolving Credit Lines

OnDeck offers business owners one-time term loans or revolving lines of credit to keep them operational and growing.

“We tailor our term loan and line-of-credit products to fit small business owners’ needs,” said Jim Larkin, VP of Marketing/Communications at OnDeck. “Whether it’s a one-time disbursement or a revolving line of credit, we offer a variety of term lengths, loan amounts, and payback schedules.”

The OnDeck application consists of three online pages that take minutes to complete. Applicants answer questions about their financing needs and business information that includes time in business and annual revenue.

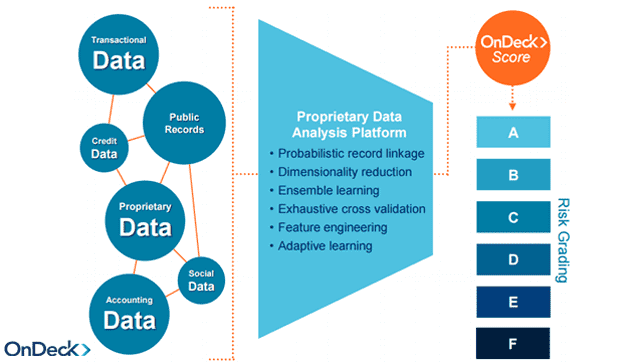

That leads to OnDeck’s proprietary credit scoring system — the OnDeck Score® — which allows the company to give applicants an immediate response. The score looks at more than 2,000 data points to create an accurate business credit profile. These data range from cash flow and transactional data to public records to historical performance data.

A dedicated loan advisor is available by phone or email to answer questions and ensure that applicants remain informed during every step in the process. Funds are available through ACH disbursal as soon as 24 hours after a loan closes.

Real-Time Funding Opportunities are in the Works

Although many OnDeck loans receive ACH funding within 24 hours, the company wants to push the envelope of innovation even further by becoming the first online lender to offer real-time access to capital via a customer’s existing small business debit card.

OnDeck plans to use Visa Direct’s funding capabilities through Ingo Money’s technology platform to securely disburse loan proceeds in real time to its line-of-credit customers via their existing small business debit cards.

“Over the last decade, OnDeck has grown to be the largest online lender to small businesses by relentlessly innovating and unleashing new technologies that benefit small business owners,” said Noah Breslow, CEO of OnDeck. “By partnering with Ingo Money and Visa to deliver real-time capital to our customers, we will empower small businesses in the next decade to achieve their goals with the fastest and most flexible credit solutions in the market.”

OnDeck expects the program, which it announced in October 2017, to begin real-time distributions sometime in 2018.

Studies show that roughly 20% of new businesses survive past their first year of operation. By year five, nearly half of all businesses no longer exist. Approximately 1 in 3 businesses celebrate their 10th anniversary.

Many of the closures are avoidable with better access to working capital to promote growth and improve business operations. While many traditional banks are slow to come to the aid of these businesses, online lenders like OnDeck are doing their part to make sure future surveys show a brighter future for entrepreneurs.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How Much Will a Secured Card Raise My Score? ([updated_month_year]) How Much Will a Secured Card Raise My Score? ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/08/How-Much-Will-a-Secured-Credit-Card-Raise-My-Score.png?width=158&height=120&fit=crop)

![Capital One Quicksilver Card: Review & Options ([updated_month_year]) Capital One Quicksilver Card: Review & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Capital-One-Quicksilver-Card-Review.jpg?width=158&height=120&fit=crop)

![Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year]) Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/recon.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards with Free Reload Options ([updated_month_year]) 8 Prepaid Debit Cards with Free Reload Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Prepaid-Debit-Cards-With-Free-Reload.jpg?width=158&height=120&fit=crop)

![Citi Credit Card Preapproval Options ([updated_month_year]) Citi Credit Card Preapproval Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Credit-Card-Preapproval.jpg?width=158&height=120&fit=crop)