In a Nutshell: Credit unions deliver unique value to members and communities, and LSC works behind the scenes to ensure they can continue their missions. LSC, a subsidiary of the Illinois Credit Union League, offers low-cost card processing services and a free card onboarding program to more than 2,500 credit unions across the U.S. Along with its consulting and fraud protection tools, LSC programs support resource-strapped small credit unions as they compete in a changing marketplace.

Credit unions are essential not-for-profit financial institutions that reward members with better rates and products. They also promote financial literacy and encourage well-being in the communities they serve.

But many credit unions would struggle to succeed without assistance and support from LSC. LSC provides crucial infrastructure and expertise to help more than 2,500 credit unions, members, and their communities thrive. That is especially important amid strengthening competition from traditional banks and a growing list of fintech platforms.

“Our mission is to help credit unions compete, and we do that by providing them with a favorable operating environment and quality information, products, and services,” said Libby Calderone, President and COO of LSC.

LSC provides its credit union clients with credit and debit card processing services, reloadable and non-reloadable prepaid card issuing capabilities, and fraud protection tools. Partnerships with ATM network providers give its members wide-ranging access, and a portfolio development team offers free analytics and marketing consultation.

Without LSC, many credit unions could not play the same vital role in their communities as they do today. That’s because it offers services at scale, and credit unions benefit from efficiencies the organization passes on to members.

It’s a classic win-win scenario, with the ultimate winners being society and the economy as a whole.

“We think of our team almost like employees of our credit union clients,” Calderone said. “In many cases, we can provide the equivalent of a full-time employee to a credit union and help save them that money as well.”

Card Processing and Onboarding Can Help Lower Costs

LSC is a for-profit subsidiary of the not-for-profit Illinois Credit Union League (ICUL), the primary trade association for credit unions in Illinois. ICUL Service Corporation is LSC’s formal name. Although it started in Illinois and still claims many clients in its home state, its reach has expanded nationwide.

That’s because credit unions everywhere need the services LSC provides. Its credit card and debit card programs seamlessly integrate with overall product portfolios to increase earnings and enhance the member experiences.

“Because we bring all these 2,500-plus credit unions together, we can then go to the processors and get better pricing,” Calderone said.

Libby Calderone, LSC President and COO

One of the many beneficiaries of the LSC card programs is the Chicago Post Office Employees Credit Union (CPOECU), led by CEO Deborah Fears. CPOECU has a more than 90-year history of providing superior products and services to its postal service members in the Chicago area.

“LSC has been an integral part of our success for a number of years,” Fears said. “About five years ago, we worked with them to put together a strategy for our credit card program, and over the next few years, our card balances more than doubled.”

As a small credit union, CPOECU would not have had the resources to accomplish that on its own.

“We also provide the servicing, so the credit unions work with us to resolve any issues,” Calderone said. “When one credit union has an issue, 10 others probably do as well, so we can extrapolate our expertise across all our customers.”

Business Development and Fraud Protection Services

LSC also helps streamline training with its card program onboarding service. More than 250 institutions use EZ Launch to get up and running quickly and provide great rates, exceptional benefits, and the personal service members everywhere expect.

“We issue the cards, underwrite them, and do all the processing, and then we do a revenue share back to the credit unions,” Calderone said. “And we aggregate to do that at a bigger scale.”

As fraud escalates in the wake of the COVID-19 pandemic, LSC also protects all its card clients against fraud, which provides an additional blanket of security.

The EZ Launch program helps credit unions quickly implement card programs.

“The beauty of our program is that we see hundreds of credit unions, so we see hundreds of fraud situations,” Calderone said. “When something’s happening over here, maybe there’s a problem over there as well, and we can apply those broad principles across all our credit unions.”

LSC is on the front lines helping credit unions drive customer acquisition and retention and business development with turnkey marketing and portfolio development services.

“They’ve helped us drive usage, promote retention, increase our revenue, and stay competitive in our market,” Fears said. “It’s almost like their employees are part of our staff — it works out fantastically for us from a resource perspective.”

Many small credit unions understand the value of email and social media marketing, but often lack the resources to use them to their benefit. That’s where LSC steps in with tools and the necessary follow-up conversations.

“We work with them on best practices — on how to get more cards out there and increase usage and activation, Calderone said. “We can do email campaigns and provide metrics for ROI.”

LSC: Partnerships for Managing Credit Union Success

LSC delivers turnkey services at scale, but it’s not a one-size-fits-all operation. It provides custom insights and expertise designed to work best for each credit union market.

“We count on LSC to help us serve our members,” Fears said. “The fact that they can manage our programs from top to bottom is just so helpful. We can have as much or as little involvement as we want, and that’s important for us.”

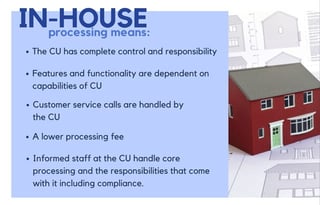

LSC card processing services allow credit unions to maintain control with lower processing fees and more customized features.

That was especially true as the COVID-19 pandemic took hold in 2020, and CPOECU began rolling out new programs and services to meet the emerging needs of its members.

“Like most credit unions, during the pandemic, we really tried to be financial first responders for our members,” Fears said.

CPOECU introduced online bill pay, remote deposit capture, a new mobile app, and started e-signatures so it could continue issuing loans. LSC was integral in the process of rolling out all of those features.

“I’ve been in the industry 30 years, and it’s a pretty awesome industry,” Calderone said. “Having that personal connection with a credit union can be helpful for you when you need them. Because a credit union is going to care about you when times are tough.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Loans & Credit Cards: 450 to 500 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 450 to 500 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/450500.png?width=158&height=120&fit=crop)

![8 Best Credit Cards for $200 to $500+ Bonuses ([updated_month_year]) 8 Best Credit Cards for $200 to $500+ Bonuses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/500.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 500-550 Score ([updated_month_year]) 9 Best Loans & Credit Cards: 500-550 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/loans-and-credit-cards-for-500-to-550-credit-scores.jpg?width=158&height=120&fit=crop)

![11 Best Credit Card Sign-Up Bonuses ($200, $300, & $500) – [updated_month_year] 11 Best Credit Card Sign-Up Bonuses ($200, $300, & $500) – [updated_month_year]](https://www.cardrates.com/images/uploads/2021/03/Best-Credit-Card-Sign-Up-Bonuses-2.jpg?width=158&height=120&fit=crop)

![8 Best $500-$1000 Limit Credit Cards ([updated_month_year]) 8 Best $500-$1000 Limit Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Best-500-1000-Limit-Credit-Cards.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Streaming Services ([updated_month_year]) 9 Best Credit Cards For Streaming Services ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Best-Credit-Cards-For-Streaming-Services.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)