In a Nutshell: When financial institutions halted in-person services early on during the COVID-19 pandemic, Freedom Federal Credit Union increased its staff to ensure members knew their digital options. Freedom FCU also took that commitment a step further by rolling out a new online platform that seamlessly merged mobile and desktop experiences. The platform also powers a suite of credit cards that provide members and businesses with better deals. It’s all part of a service standard that the credit union calls the Freedom Advantage.

There’s a point in the growth process of large financial firms when people begin to wonder if they’re too big to fail. However, well before an institution reaches that stage, consumers may start to think it is too big to care about their needs.

Freedom FCU offers the best of both worlds as a powerful financial institution that cares about individual members. The credit union serves members in Maryland’s Harford and Baltimore counties with five branches. Freedom FCU prides itself on providing the same high-quality products and services as big banks, but with a local touch.

It offers a complete line of personal and business credit cards, and a high-yield checking account that pays better than a conventional savings account or CD. Freedom FCU also has a special credit product aimed directly at dedicated school system employees. Those products and services exist to serve members, not the other way around.

“We’re big enough where you can pretty much get any financial services you’re looking for — anything you would get out of a big bank you can get from Freedom FCU,” said Carmen David Mirabile, Freedom FCU SVP of Marketing. “Being small enough to care means we don’t lose sight of the humanity behind what we’re trying to do. And that all comes from having conversations and asking questions.”

When an associate at Freedom FCU fields a call asking about an account balance, the goal isn’t to complete the exchange in the shortest amount of time. Instead, Freedom FCU member services professionals view all their interactions with members as relationship-building opportunities.

“We just do things differently,” Mirabile said. “When we provide products and services our members need, that benefits not only them but also the organization as a whole.”

Card Products for All Stages of the Financial Journey

The philosophy behind the credit union’s commitment is known as the Freedom Advantage. Mirabile said that its credit offerings best represent that mission.

Freedom FCU offers a suite of Freedom Visa® Platinum personal credit cards to cover all the bases for members and their families. Its Freedom Business Visa® Platinum card also helps member businesses contribute to healthy community growth.

Members who are just starting out with a personal credit account, or those who need to rebuild after a setback, can sign up for the Platinum Share-Secured card that extends credit based on collateral.

“We have a lot of members who take advantage of it,” Mirabile said. “They’re certainly appreciative when they know a lot of the bigger credit issuers will just turn them down completely.”

Freedom FCU offers a variety of credit card options to its members.

Judicious use of the Platinum Share-Secured card over a 12- to 18-month period puts the holder in a position to move to an unsecured Platinum card. The unsecured card also carries a low variable APR, with an introductory rate for 15 months on purchases and balance transfers made in the first 90 days.

“It’s great for people who don’t need the credit-building aspect of a secured card and who are interested in a lower APR,” Mirabile said.

Members interested in incorporating personal credit as part of an asset-building strategy can use the Platinum Rewards card. The card helps consumers earn rewards with 4X points on video streaming services, 3X points on restaurants, takeout, and food delivery, 2X points on gas and groceries, and regular points on all other items.

“We love our rewards card because you can use the points for cash back, merchandise, gift cards, and travel discounts — it is one card for all,” Mirabile said.

Integrated Online Tools Offer a Seamless Experience

The Freedom FCU Business Visa® card offers the same financial benefits as its personal cards, which complements additional tools for automatic bill pay and simplified billing and reporting that businesses need.

“We feel like we’re the perfect financial institution for that small business owner who owns their own dental practice, accounting practice, or retail shop on Main Street,” Mirabile said.

Making it all work together seamlessly at a time when people were transitioning to a new normal brought on by the COVID-19 pandemic and social distancing restrictions was challenging.

The Freedom FCU team used the past year to put more energy into revamping its online presence and bringing convenience to members who may still be uncomfortable with digital tools.

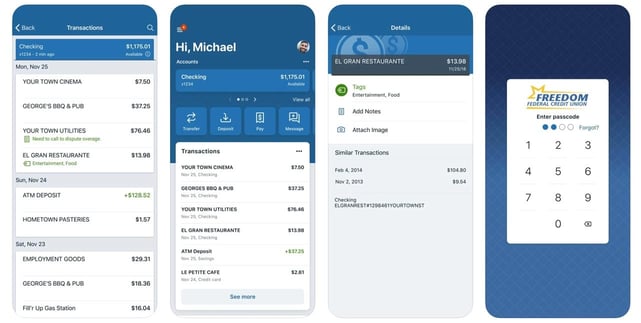

Freedom’s new online banking experience brings the visual simplicity of its mobile app interface to the desktop. It is called a screen agnostic approach, but all Freedom FCU members need to know is that they can navigate the same way no matter what type of screen they use.

Freedom FCU upgraded its online banking tools to make them easier for members to use.

“While our old online banking platform was a completely different interface and there was definitely a separation for our members when they did something on their device versus on their desktop, now it’s all seamless and integrated,” Mirabile said.

The experience is also more than just visually appealing. Security upgrades and enhanced password recovery features bring additional peace of mind to those who count on Freedom FCU to protect their assets — physically and digitally.

“We’ve enhanced our digital connection to our members,” Mirabile said. “Now it all looks the same and functions better.”

Freedom FCU: Meeting Member and Community Needs

Freedom FCU responded with flexibility, waiving overdraft charges and increasing skip-a-payment benefits for members who have been struck hard by the COVID-19 pandemic. The credit union also lowered rates on personal loans that might be used for debt consolidation.

Other members interested in leveraging a favorable financial environment turned to Freedom FCU to refinance home and auto loans and obtain additional liquidity.

“It was a bit of both worlds for us — we’ve been there to help members who have needed help, and we’ve been there to help members seize their opportunities,” Mirabile said.

In transitioning service away from the branches, however, Freedom FCU needed to be there for everyone.

“We’ve kept our drive-throughs open, and we’ve upped the staffing in our call centers to ensure we can give our members the right amount of time and engagement,” Mirabile said.

Lobbies reopened as soon as possible on an appointment basis. Meanwhile, Freedom FCU has continued to address member and community needs by providing robust alternatives through people-centric product innovation.

Empower Checking, which debuted in 2019, pays 3% rewards on balances of up to $10,000 when the accompanying debit card is used at least 15 times a month. That’s better than current savings and CD rates.

Freedom FCU’s Golden Apple Educator Rewards program recently introduced a card called the Educator Visa that carries an APR pegged to the U.S. prime rate.

“You’re not going to find that anywhere else,” Mirabile said. “It gives teachers and other school employees an opportunity to contribute to classrooms and not incur a lot of interest.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Key Differences: Chase Slate vs. Freedom Flex vs. Freedom Unlimited ([updated_month_year]) 3 Key Differences: Chase Slate vs. Freedom Flex vs. Freedom Unlimited ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/12/chase-slave-vs-freedom.jpg?width=158&height=120&fit=crop)

![Chase Freedom: Credit Limit & Benefits ([updated_month_year]) Chase Freedom: Credit Limit & Benefits ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/chasefreedom.png?width=158&height=120&fit=crop)

![Chase Freedom vs. Discover it® Cards ([updated_month_year]) Chase Freedom vs. Discover it® Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Chase-Freedom-vs.-Discover-it.jpg?width=158&height=120&fit=crop)

![Is the Chase Freedom a Visa or Mastercard? ([updated_month_year]) Is the Chase Freedom a Visa or Mastercard? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/chasevisa.png?width=158&height=120&fit=crop)

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![7 Personal Loans For Fair Credit ([updated_month_year]) 7 Personal Loans For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/08/Personal-Loans-for-Fair-Credit.png?width=158&height=120&fit=crop)