In a Nutshell: CardMatch is a proprietary, online tool created by the experts at CreditCards.com to help its users make informed decisions when choosing a new credit card. By entering your name, address, email, and the last four digits of your social, CardMatch is able to show you card offers from its participating partners that you’re more likely to be approved for based on your current credit profile. CardMatch does not affect your credit score and is free to use as often as you’d like to find your best matches. Furthermore, CreditCards.com is able to present offers for CardMatch users that are exclusive to its site and the CardMatch tool. //

Choosing a new credit card usually begins with what you think will be a simple task that quickly spirals into an overwhelmingly complicated chore. Issuers are vying for your business in a competitive market (hence those mailers and emails you receive unless you opt out of them). Between the endless options of rewards programs, signing bonuses, APRs, and fees, you can easily find yourself in analysis paralysis — or worse. You can settle for a sub-par card not knowing any better — gasp!

In an effort to help card shoppers avoid this potential downward spiral and make informed decisions when comparing credit cards, CreditCards.com created its propriety web-based tool, CardMatch.

In an effort to help card shoppers avoid this potential downward spiral and make informed decisions when comparing credit cards, CreditCards.com created its propriety web-based tool, CardMatch.

For anyone looking to get a new card, CardMatch is a great resource for a few reasons. For one, users can see which offers they’re most likely to qualify for based on just a few data points. Secondly, CardMatch uses a soft credit inquiry, meaning your credit score isn’t affected in any way. Last but certainly not least, CardMatch can offer shoppers special sign-up bonuses you won’t find on other sites (we’ll dive deeper into this later).

We sat down with Matt Schulz, Senior Industry Analyst for CreditCards.com, to learn more about the tool, such as how to use it, what to expect, and why it was created.

How to Use CardMatch

“We’re all about helping people make the best decisions they can about credit,” Matt says of the development of the site’s popular tool. “We thought that CardMatch was a good way to get them to sort of jump-start their search, while not being too intrusive.”

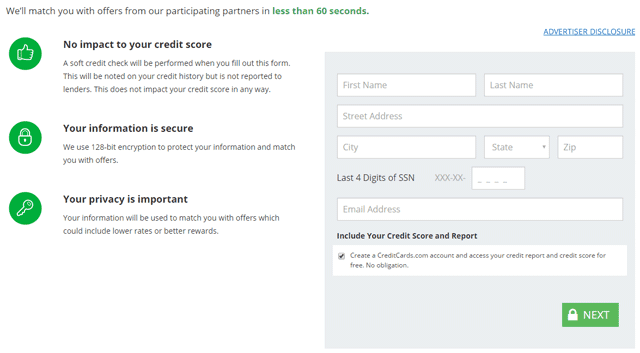

By entering four simple personal-identifying pieces of information – your name, address, last four digits of your Social Security number, and your email address – CardMatch will show you offers you’re best qualified for from CreditCards.com’s participating partners, all in less than 60 seconds. This seems to be an under-promise, over-deliver estimate because when I tried CardMatch, my matches appeared in about 10 seconds.

Enter your name, address, last four digits of your social, and email to see your matches in less than 60 seconds.

Once you enter your information, you’ll be directed to the “Terms & Conditions” page, where you must check a box acknowledging that it is not a credit application, and your credit report will not be pulled. You’ll then be sent to a full list of its partners’ credit cards that you’re most likely to qualify for, based on the criteria you entered.

“It helps the average consumer have a better feel for what type of cards on our site they might qualify for,” says Matt. “Basically, CardMatch talks with one of the credit bureaus (TransUnion) and also with a few participating credit card issuers, and it takes the information you provided and applies that information to whatever criteria the issuers have for various cards.”

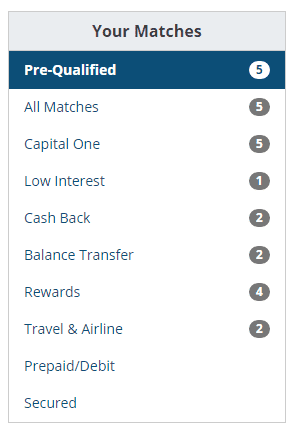

CardMatch finds the best offers you’re likely to qualify for in multiple categories.

Matches will appear in several categories, including by issuer, low interest, cash back, balance transfer, rewards, travel & airline, prepaid/debit, and secured. There’s even a pre-qualified category, however, neither prequalification nor having a match guarantees approval.

Prequalification indicates you meet certain criteria the issuer applies to that particular card, though several other factors determine approval, such as your income and existing debts.

“We’re not making promises that you will qualify for these offers, necessarily, but what these are are potential offers that you could qualify for based on the information you provide,” Matt explained.

Additionally, CardMatch users have the option of receiving a free credit report, credit score, and credit monitoring by creating a CreditCards.com account.

CardMatch Will Not Hurt Your Credit Score

CardMatch uses a soft credit pull, meaning your credit score is not affected when the tool finds cards for you. You can use the tool as often as you’d like, without ever having to worry about your score taking a hit.

A hard credit inquiry is not done until an actual application for a card is submitted. A hard inquiry is when a prospective lender checks your credit report to make a lending decision, which, as a result, can affect your score.

However, even a hard inquiry only slightly affects your score, and if you’re approved for the card your score may improve overall because your credit utilization ratio and mix of accounts could also improve, depending on your current credit standing. Therefore, the effect of the hard inquiry could be short-lived once the issuer reports your new line of credit to the bureaus.

See Great Offers Not Available on Other Sites

CreditCards.com partners with some of the world’s largest issuers, including American Express, Chase Bank, Citibank, Discover, Capital One, and others. Through these partnerships, the site is able to present offers for CardMatch users that are exclusive to CreditCards.com and the CardMatch tool.

For example, ThePointsGuy said he was able to find a 100,000-point sign-up bonus on the American Express Platinum Card using the tool, as opposed to the commonly offered 40,000-point sign-up offer.

Something to be cognizant of is the fact that sign-up bonuses quickly change, so it’s recommended to apply for an offer that you want when it’s available. This is also another good reason to use the CardMatch tool regularly to find the best offer.

Frequently Updated to Always Show Your Best Matches

Matt explained that the tool is regularly maintained by the CreditCards.com team to provide CardMatch users with the most up-to-date offers and information.

Gone are the days when choosing a new credit card felt like a daunting chore, thanks to the CardMatch tool. Not only are you being presented with cards where your chances of approval are greater, you can feel confident in knowing you’re receiving the best offer CreditCards.com and its partnering issuers can provide you — and you’ll never settle for a sub-par card again.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Pre-Qualified Credit Cards For Bad Credit ([updated_month_year]) 5 Pre-Qualified Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Pre-Qualified-Credit-Cards-for-Bad-Credit.jpg?width=158&height=120&fit=crop)

![4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year]) 4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/charts.png?width=158&height=120&fit=crop)

![Global Entry vs. TSA PreCheck vs. CLEAR: Credit Card Benefit Comparison ([updated_month_year]) Global Entry vs. TSA PreCheck vs. CLEAR: Credit Card Benefit Comparison ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Global-Entry-vs.-TSA-PreCheck-vs.-Clear.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison) [card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison)](https://www.cardrates.com/images/uploads/2018/02/chase2.png?width=158&height=120&fit=crop)

![13 Category Winners: Best Credit Card Offers ([updated_month_year]) 13 Category Winners: Best Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-4.jpg?width=158&height=120&fit=crop)

![7 Best Credit Card Offers Right Now ([updated_month_year]) 7 Best Credit Card Offers Right Now ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Best-Credit-Card-Offers-Right-Now.jpg?width=158&height=120&fit=crop)

![12 Best Credit Card Offers Now, Per Experts ([updated_month_year]) 12 Best Credit Card Offers Now, Per Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/12-Best-Credit-Card-Offers.png?width=158&height=120&fit=crop)