Socially responsible credit cards not only provide consumers with the convenience that comes with plastic — swipe and go or make online purchases — but they also offer a simple way to support worthy causes in the process.

While many of us are happy to do our parts to help protect nature, wildlife, and each other, it’s often difficult to know how to really execute those goals. Even something that seems like a no-brainer, like reducing carbon output by driving an electric car, can have levels of effectiveness.

In the end, most of us are simply not experts on the causes we support, no matter how much we may find them worthwhile. That’s where charities and nonprofit organizations come into the mix. These organizations do real good every day, operated by people who have the knowledge and experience to make the most difference.

And you can make a difference for them, simply by using the right credit card for purchases you make already. All you need is a rewards card that lets you donate cash back or points or a credit union card that gives back to your community.

Direct-Donation Cards | Rewards Cards | Credit Union Cards

Automatically Give Back with Direct-Donation Cards

A direct-donation or affinity credit card is the set-it-and-forget-it method of donating with a credit card, as they automatically donate a portion of your purchases to your designated organization, with no work needed on your part. Affinity credit cards are co-branded with a specific nonprofit organization, donating a portion of every card purchase directly to that organization. Some affinity cards also provide additional funds for card signups and renewals.

1. Charity Charge World Mastercard® Credit Card

One of the only cards like it in the world, the Charity Charge World Mastercard® Credit Card is an easy way to automatically donate to your favorite charity with every purchase. Unlike typical affinity cards, the Charity Charge World Mastercard® Credit Card allows you to choose the organizations you’d like to receive your donations.

- Earn unlimited 1% cash back on every purchase, which is automatically donated to the charity of your choice

- 100% of your donations go to your charity with no extra fees

- Pay no annual fee

You can change your charity of choice at any time, with the ability to choose to fund up to three different nonprofits at the same time. All of your donations are tax deductible and, even better, Charity Charge World Mastercard® Credit Card does the paperwork for you.

2. Bank of America World Wildlife Fund Visa

The Bank of America World Wildlife Fund Visa allows you to donate a portion of every purchase to the World Wildlife Fund, an organization working to conserve threatened and endangered species, as well as reduce the human impact on the environment.

- Earn 3% cash back on gas and 2% at grocery stores and wholesale clubs for the first $2,500 in combined purchases

- Earn 1% cash back on all other purchases

- Pay no annual fee

The World Wildlife Federation receives 0.08% of all net purchases made with your World Wildlife Fund Credit Card, at least $3 per new card account, and at least $3 for each annual card renewal.

3. Bank of America Susan G. Komen® Cash Rewards Visa®

The Susan G. Komen® Cash Rewards Visa® provides a way to donate to Susan G. Komen®, an organization for the fight against breast cancer.

- Earn 3% cash back on gas and 2% at grocery stores and wholesale clubs for the first $2,500 in combined purchases

- Earn 1% cash back on all other purchases

- Pay no annual fee

For each new Susan G. Komen Cash Rewards credit card used to make a transaction within — and remains open for at least — the first 90 days of account opening, Komen receives $3 and 0.08% of all retail purchases.

Turn Your Credit Card Rewards Into Charitable Donations

For the majority of cardholders, credit card rewards are the best feature offered by their cards. At the same time, however, nearly a third of cardholders fail to redeem those rewards — leaving millions of dollars in the pockets of card issuers.

Instead of letting those rewards lie fallow, you can use them to make a difference for your favorite cause. Several of the top credit card issuers allow you to redeem your cash back or points as a charitable donation, often right from your rewards redemption screen. Keep in mind that rewards donations are not typically tax deductible.

Discover | Chase | American Express

Discover Rewards Donations

With the Discover it® card, members can earn 5% cash back in quarterly rotating bonus categories that include a variety of everyday purchase categories, such as gas or restaurant purchases. Members can earn bonus cash back on up to $1,500 in purchases each quarter they activate the bonus. Cardholders also earn unlimited 1% cash back on all other purchases.

You can then take all that cash back and donate it directly to a worthwhile organization, including popular nonprofits like the American Cancer Society, ASPCA, and Make a Wish Foundation. As an added incentive, Discover will donate an extra $25,000 to the organization that receives the most cardmember donations each year.

+See More Discover Credit Cards

Chase Rewards Donations

Any talk about rewards credit cards tends to mention the Chase Freedom cards and Chase Sapphire Preferred card at some point, and not solely because of the solid earnings rates both provide. The real star of the Chase rewards show for many cardholders is the Chase Ultimate Rewards points program.

While the Ultimate Rewards program is well-lauded for its flexible rewards points and bevy of travel partners, you can use your Ultimate Rewards for more than just a free getaway. You can also donate them to a great cause through the cash back tab of the Ultimate Rewards portal, helping organizations like the ASPCA or World Wildlife Fund.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.7. Chase Freedom Flex℠

American Express Rewards Donations

Whether you want bonus points on gas and groceries or airfare and hotel stays, American Express has a Membership Rewards® points card for you. The American Express Membership Rewards® points program is popular thanks to its wide range of redemption options — including the ability to donate to a great nonprofit through the Members Give℠ portal.

American Express has one of the largest selection of nonprofits to which members can choose to donate their Membership Rewards® points, with organizations in categories from arts and education to health care and disaster relief. If you don’t have points to donate, you can also use the Members Give℠ portal to contribute with a direct donation with any Amex card.

10. The Amex EveryDay® Credit Card from American Express

The Amex EveryDay® Credit Card really is an everyday card, not only rewarding you bonus points for grocery purchases, but also offering extra points for making 20 or more transactions each billing period.

- Earn 2X Membership Rewards® points per $1 on US supermarket purchases, up to $6,000 per year in purchases

- Earn unlimited 1X points per $1 on all other purchases

- Pay no annual fee

The Amex EveryDay® Credit Card also comes with a quality signup bonus with a reasonable spending requirement that can get your Membership Rewards® points collection started on the right foot.

11. The Platinum Card® from American Express

Offering a high earnings rate on hotel and airfare purchases, credits for Uber rides, and a host of travel perks, the Platinum Card® from American Express is perfect for anyone who spends most of their time on-the-go.

- Earn 5X Membership Rewards® points per $1 on flights/hotels booked directly with the airline/hotel or American Express Travel

- Receive up to $200 in Uber credits per year

- Receive a $200 airline fee credit each year

While the Platinum Card® from American Express has a hefty $550 annual fee, the bulk of that can be offset simply by using your full Uber and airline fee credits each year.

12. American Express® Gold Card

The American Express® Gold Card is a solid everyday card, offering 4X points per dollar at US restaurants and grocery stores, plus triple points on travel booked through Amex.

- Earn 4X Membership Rewards® points per $1 at US restaurants and grocery stores

- Receive 3X points on flights booked directly with the airlines

- Pay $250 annual fee

Cardholders can also earn an annual $100 airline fee credit and up to $120 a year in credit toward select restaurants.

+See More American Express Credit Cards

Choose a Card From a Socially Minded Credit Union

Although we often think of charities first when it comes to organizations working for the common good, they aren’t the only groups making a difference — especially at the local level. The not-for-profit credit unions found in towns big and small across the country often contribute to the betterment of their communities every day.

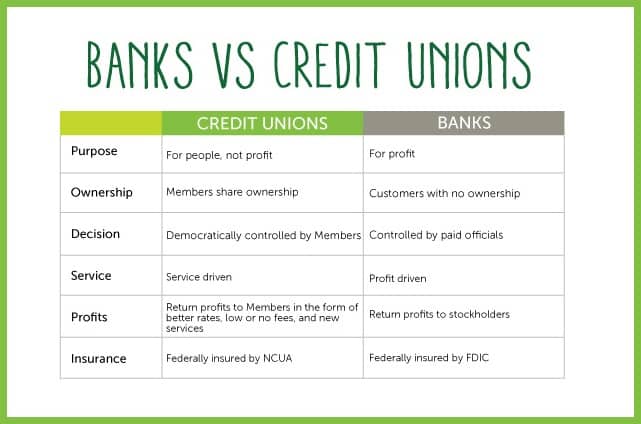

Unlike big banks, which are typically owned by boards and investors, credit unions are owned by the members they serve, which means each credit union is fully a part of its community. Furthermore, because the members essentially own the credit union, all of its profits go back to the members, generally in the form of dividends, lower rates and fees, increased services, and more flexible credit requirements.

This chart from Redwood Credit Union shows the differences between banks and credit unions.

Plus, while most big banks seem to primarily finance equally big companies, credit unions are significantly more likely to finance a local small business or community improvement project that may slip through the cracks at a larger financial institution. Credit unions are also frequent sponsors of local nonprofits and community events. So, a credit union credit card gives back to you and your community.

The National Federation of Community Development Credit Unions is a perfect example of how credit unions can have a big impact on the communities they serve. Its hundreds of member credit unions focus on providing services to low-income urban, rural, and reservation-based communities throughout the US that would otherwise struggle to find affordable banking and financial services.

Use Any Credit Card to Donate Directly to Your Favorite Cause

No matter which causes are near and dear to your heart, chances are good there is a nonprofit organization working to promote and execute goals in line with those causes. And you can help these great organizations make a difference simply by choosing the right credit card to make your everyday purchases.

But even if you don’t have a rewards credit card that allows you to donate cash back or points, an affinity card that automatically contributes, or even a credit union card that gives back to the community, you can still use your favorite credit card to make a difference. That’s because just about any credit card can be used to make a donation directly to the group of your choice.

What’s more, you can often earn rewards on your donation (provided your credit card offers rewards). Plus, enjoy the benefits of a tax-deductible donation when you donate directly to the organization (or through a qualifying third-party provider).

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)

![10 Credit Repair Credit Cards ([updated_month_year]) 10 Credit Repair Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Credit-Repair-Credit-Cards.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards to Build Credit ([updated_month_year]) 5 Best Secured Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Best-Secured-Credit-Cards-to-Build-Credit.png?width=158&height=120&fit=crop)