In a Nutshell: Few things can make someone feel worse than making a purchase or signing up for a service without knowing if you got the best possible deal. Internet consumer reviews can help shoppers make informed decisions, but these reviews typically highlight singular experiences and rarely compare one company to another. Mozo fills in the gaps by providing Australians with in-depth and real-time comparisons of banking, energy, insurance, and other service providers throughout the country. Mozo customers can search several products and services and receive instant price quotes and quality comparisons that reflect the pricing rates at that exact moment — not ballpark estimates of what they may be. //

When was the last time you heard a bank proclaiming that it has the second-best service in Australia? Or what about an energy company claiming it has less downtime than ‘most’ of the other providers in the country?

Chances are, you’ve never heard that and you never will. Businesses like to promote what they’re best at and skim over any flaws in their organization. That practice has led to an explosion in product and service comparison websites over the years.

But while many of those sites couldn’t outlive the companies they reviewed, Mozo still stands as one of the most reliable resources for Australians to compare banking, energy, insurance, and other service providers in real time.

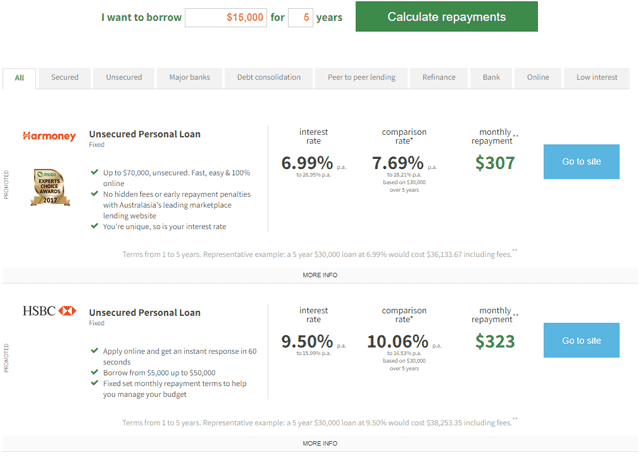

Mozo compares everything from the savings and loan rates to credit card and international money transfer fees of more than 200 of the leading Australian banks. Mozo’s Director, Kirsty Lamont, said that comparing banks often leads to the most savings for Mozo users.

Mozo compares everything from the savings and loan rates to credit card and international money transfer fees of more than 200 of the leading Australian banks. Mozo’s Director, Kirsty Lamont, said that comparing banks often leads to the most savings for Mozo users.

“Taking out a mortgage is one of the biggest financial commitments in customers’ lives and switching to a better value home loan can literally save them tens of thousands of dollars in interest charges over the life of their home loan,” she said.

Mozo helps consumers choose a financing provider when it’s time to make a big purchase, but Lamont said the site is also useful for making sure you’re getting the best possible deal on your current commitments.

“While the savings aren’t as huge, it’s crucial our customers constantly review their energy provider and insurer, as the deal they’re getting may not be as competitive as it once was,” she said. “You could save upwards of hundreds of dollars.”

Live Data Updates Provide Real-Time Quotes

Consumers can be sure that the quotes they see on Mozo reflect current market conditions because the company pulls rates, quotes, and other vital information in real time.

“We employ a multi-layered strategy that includes data provided directly by providers, web tracking software, and manual checks by our dedicated, in-house data team,” Lamont said. “Having several layers means we are equipped to cover products, whether they change hourly or yearly and whether they come from a large or a smaller provider.”

Mozo’s failsafe and quality controls ensure its customers have an accurate data snapshot on which to base their decisions. That data empowers consumers to take swift and decisive action and save money over the long-run.

Covering a Majority of the Australian Market

Consumers often judge comparison sites by the accuracy of their data, but it’s just as important that a site compare plenty of options so customers can make the most of their decision.

Mozo compares more than 200 banks, with an in-depth analysis of multiple services and products they each offer.

“Mozo aims to cover the bulk of the market so that consumers have as much information as they need to make an informed choice,” Lamont said. “In banking, this means including every retail bank and those in the non-bank segment who have a broad market presence, and we take a similar approach in energy and insurance.”

Even if you’re not yet in the rate-research stage, you can still benefit from Mozo’s quality reviews and other helpful articles, tips, and tools in its Life & Money section.

“Mozo’s content section is stacked with quirky savings tips, checklists to get you financially prepared for the start of each month, and topical articles like how to take advantage of the end of financial year sales (EOFYS) or budget for the Christmas period,” Lamont said. “As well as the blog, Mozo has comprehensive guides for each product category to help our customers compare easier and choose the right deal for them.”

Experts Choice Awards Focus on Quality Over Quantity

Mozo often hands out its Experts Choice Award to companies that provide stellar service at an affordable price. While Mozo initially intended for the awards to highlight the lowest-cost product in each category, the company has expanded the award’s focus to include affordable quality over rock-bottom pricing.

“We use our database and industry knowledge to judge the best products in the market, including home loans, credit cards, energy plans, deposit accounts, and car and home insurance,” Lamont said.

That change in approach helped customers save money and receive a quality service that they return to whenever needed.

That change in approach helped customers save money and receive a quality service that they return to whenever needed.

“We are proud of the approach we take to the awards,” Lamont said. “We design our awards criteria to recognize genuine consumer benefit, and we aim to cover the broadest cross-section of the market. We don’t limit it to providers we have relationships with and we don’t require providers to apply — or pay — to enter.”

Mozo’s unbiased and comprehensive rate comparisons are the main reason Australians of all financial means turn to the company every day for the information they need to make informed decisions that often lead to substantial savings.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year]) Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Is-It-Bad-to-Apply-For-Multiple-Credit-Cards-At-The-Same-Time.jpg?width=158&height=120&fit=crop)

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![9 Best Credit Cards With Car Rental Insurance ([updated_month_year]) 9 Best Credit Cards With Car Rental Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-With-Car-Rental-Insurance.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For Paying Car Insurance ([updated_month_year]) 5 Best Credit Cards For Paying Car Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Credit-Cards-for-Paying-Car-Insurance.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards With Travel Insurance ([updated_month_year]) 7 Best Credit Cards With Travel Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Best-Credit-Cards-With-Travel-Insurance.jpg?width=158&height=120&fit=crop)

![12 Ways Credit Cards Help Save on Vacations ([updated_month_year]) 12 Ways Credit Cards Help Save on Vacations ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Ways-Credit-Cards-Help-You-Save-on-Summer-Vacations.jpg?width=158&height=120&fit=crop)