Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Many small businesses, especially female-owned operations, have difficulty with funding. Fundid is a platform that caters to unserved businesses that need help with finding grants and capital funding. The platform offers a centralized hub where entrepreneurs can explore a range of grant opportunities and match up with the right partners. Fundid also offers its Business Building Card, which provides flexible financing solutions and is available to all types of businesses, including sole proprietorships and new businesses.

Starting and growing a business can be a challenging journey, and having access to capital is a critical factor that can determine the success or failure of a venture.

Women entrepreneurs, in particular, often face unique hurdles in securing funding and support for their businesses. That includes gender-related bias and cultural barriers that limit their chances of success.

Even though women-owned businesses account for roughly 42% of all US businesses, studies show they receive significantly less funding than male business owners, making it difficult for female entrepreneurs to scale their operations and achieve desired growth.

Fortunately, some companies are working to address these challenges. Fundid is on a mission to redefine how small businesses understand and access capital. The company provides a range of financing solutions, including access to grants and funding that cater to underserved small businesses.

The company’s Founder and CEO, Stefanie Sample, started out as a small business owner herself and knows firsthand the challenges women face when attempting to get funding.

Her husband was also an entrepreneur, and Sample said she could see the parallels between how banks would treat her husband as compared with how they would treat her.

Fundid also started at an interesting time. The company began operations right at the peak of the pandemic in November 2021, when many small business owners, particularly women, were grappling with the increasingly difficult task of getting grants and funding in an uncertain time.

Businesses could apply for PPP loans at the time, but small business owners were notably unsuccessful in gaining approval.

Riley Horigan, Fundid’s Marketing Manager, said PPP loans were really hard to get from a small business owner’s perspective. That reality ignited Fundid’s spark to help these business owners get more funding and enable them to understand what their options are.

A Service Focused On Small Business Growth

In terms of its operation, Fundid functions as a resource to help entrepreneurs find either grants or partner funding. The company itself does not provide direct lending services.

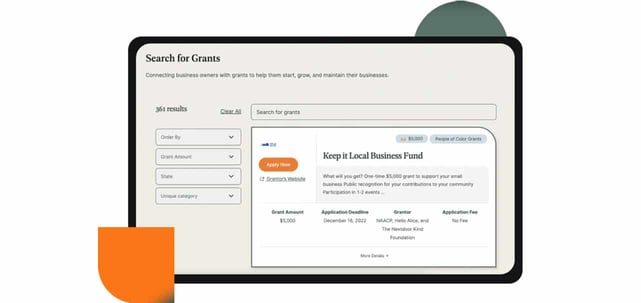

Fundid first started its content creation with grants, which have become the company’s number one driver to supporting business owners through their platform. “Our team will scrape the internet for these grants, we add them into the database, and we update it weekly, just to help these business owners save on time,” said Horigan.

She added that it can get really hard to find grants independently if you’re not signed up with multiple newsletters or organizations. There are many one-off grants that are available, but knowing where to look can be a problem. By populating the grant marketplace, Fundid can help business owners find options they wouldn’t have known otherwise.

It’s also worth noting that Fundid is not gender exclusive, and all small business owners can create their free account. But the company does put special emphasis on entrepreneurs who would normally find it difficult to get funding.

“Our platform is open to any and all business owners,” said Horigan.

But since most of the business grants available on the database are intended for women, it’s understandable that Fundid’s user base tends to be female as well.

“Typically these grant foundations tend to be for women because they have a harder time getting that access to capital,” said Horigan.

That need is also significant when considering how the livelihood of many women is tied to their business. One report by SCORE indicates that around 62% of female entrepreneurs depend on their business as their primary source of income.

Business Building Card Offers Access To Funding

To further help budding entrepreneurs, Fundid offers its Business Building Card as a key financial product. Launched in January of 2023, the business charge card features a 0% APR balance as long as cardholders pay their balances in full each month.

This card offering provides flexible financing to entrepreneurs, especially those who face unique challenges in securing funding for their businesses. The Business Building Card is available to all types of businesses, including sole proprietorships and startups.

“New businesses typically have a hard time getting a commercial lending product, and so they’re using personal credit cards or their debit cards. But our card is a true business product,” said Horigan.

It has an annual fee of $100, which is waived for the first year for new card holders.

The card is for business purposes only, as stipulated in the cardholder agreement. So, for new businesses and sole proprietorships that traditionally have a harder time getting started, Fundid’s business card can provide them a nice boost.

Horigan said that Fundid has further plans for its product roadmap, and the business card is just the start. “We have some ideas on both ends to help the businesses who we still can’t serve, because they’re either getting declined from our card, or how can we help these businesses that have our card get into other lending products,” she said.

Overall, the Business Building Card offers a creative solution to help address the variety of financial challenges that entrepreneurs face. As Fundid seeks to increase access to capital and provide resources to women and minority business owners, the business card is one of several features the company is developing for its customers.

Linking Customers With Growth Partners

Small businesses accounted for 44% of U.S. economic activity, according to a 2019 SBA report, and the team at Fundid believes that the continued growth of that market share is vital to the economy.

Fundid’s capital marketplace is where small businesses can browse and find suitable lenders who are ready to finance their growth goals. The marketplace includes a list of lenders offering various funding options that are tailored to the specific needs of small businesses.

“These small business owners are typically generating under a million dollars in annual revenue. And so we need lenders who will serve these smaller segments with smaller annual revenue, or monthly recurring revenue, as well,” said Horigan.

The marketplace platform also uses filters to provide more accurate results and better promote lenders to Fundid’s audience. Some options are state specific, so the platform tries to filter those out.

Quality control is also a high priority to ensure the best results and to avoid any predatory lending practices.

“We’re pretty transparent with our capital marketplace partners,” said Horigan. “We ask them to provide us with their interest rate ranges if possible, and we actually break down the type of loans.”

All of this plays into Fundid’s dedication to helping small businesses thrive and succeed.

With its mission to promote equality in business and support economic growth in diverse communities, Fundid is serving as an invaluable resource for underserved business owners looking to build and grow their ventures.

![7 Best Business Credit Cards for New Businesses ([updated_month_year]) 7 Best Business Credit Cards for New Businesses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/newbus2--1.png?width=158&height=120&fit=crop)

![6 Tips: Increase Your Capital One Credit Limit ([updated_month_year]) 6 Tips: Increase Your Capital One Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Capital-One-Credit-Limit-2--1.jpg?width=158&height=120&fit=crop)

![Capital One Secured Credit Card Reviews of [current_year] Capital One Secured Credit Card Reviews of [current_year]](https://www.cardrates.com/images/uploads/2021/11/Capital-One-Secured-Credit-Card-Reviews.jpg?width=158&height=120&fit=crop)

![Capital One Venture vs. Venture X: Which Wins? ([updated_month_year]) Capital One Venture vs. Venture X: Which Wins? ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Capital-One-Venture-vs-Venture-X-1.jpg?width=158&height=120&fit=crop)