In a Nutshell: Financial Plus Credit Union is a rapidly expanding credit union in Michigan. The credit union is based in Flint. Just two years ago, Financial Plus Credit Union opened to all residents in Michigan. The credit union partners with different financial companies to bring more credit products and services that benefit members. Financial Plus’s services focus on smart spending, saving and rebuilding credit. For its dedication to creating the next generation of helpful financial institutions, CardRates is recognizing Financial Plus Credit Union with our Editor’s Choice™ Award.

Expansion is the sign of a healthy institution looking to reach the most people it can. Financial Plus Credit Union has been serving members for 70 years. Financial Plus was founded in 1952 as Chevy-Flint Federal Credit Union by auto workers to serve the employees of Chevrolet Motor Company in Flint. It has since grown to proudly serve the entire state of Michigan.

It’s been a busy couple of years for the credit union. Financial Plus Credit Union is answering the call with new services, products, and partnerships that focus on financial wellness.

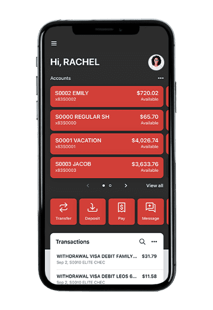

The credit union has seven branches in the Central Michigan area, with access to digital services throughout the state. The credit union told us all of its products are accessible through the website so all members have equal access.

Access to credit, accounts, and loans is an important asset for Financial Plus Credit Union. The credit union takes pride in offering customized support that big banks can’t provide. Credit unions are owned by its members. There are no shareholders to please and no emphasis on creating a profit.

When the credit union makes money, that revenue goes right back into offering better and more affordable services to its members.

“The reason why I love and made this credit union my career is because I can play the long game,” President and CEO of Financial Plus Credit Union Brad Bergmooser said. “I get to do what’s right for the members in the long run. We can be committed to brick-and-mortar and digital channels, where my counterparts in banking couldn’t because the focus is always turning a profit.”

Offering Unique Credit and Loan Services

Financial Plus Credit Union is taking advantage of the advancements in the banking industry that allow for the creation of new products. The credit union told us that this is an exciting time for the credit card industry, with a lot of innovations on the way.

The credit union specifically pointed to the rise in mobile wallets and how smartphones are impacting Financial Plus’s credit card strategy. Right now, the credit union highlights its rewards card that features low interest rates, no annual fee, and 1% cash back.

Financial Plus is taking the steps to stay ahead of the curve by recently hiring an expert for an entirely new role: the financial wellness counselor. The financial wellness counselor focuses solely on the financial well-being of the credit union’s members, as well as that of the general population of Michigan.

“We view financial wellness as a mix between product and education,” Bergmooser said. “We put a whole lot of resources into partnering with fintechs and building out some of our internal services, and that all goes back to financial counseling.”

The emphasis on financial wellness led to a brand-new product that helps members get out of the dangerous cycle of payday loans. The credit union partnered with a fintech company to create a new loan called the Greenlight Loan.

“Our goal is to get members out of the payday loan cycle,” Bergmooser said. “Payday loan lenders are structured to keep people in that situation with hundreds of percent APR, and you never break that cycle.”

The loan’s specific structure keeps interest rates and fees as low as possible. There’s no credit check for applying, and the application features automatic approval so members get access to funds when they need it.

Financial Plus Credit Union’s financial counselor receives an alert when a new loan is written. The financial counselor calls the borrower and explains the steps necessary to keep from defaulting on the loan, and shows how to transition into more traditional lending.

Adopting a Digital-First Approach with Branch Support

The pandemic served as a wake-up call for all of us. Everyone needed to get their finances in order and find ways to pay the bills. Financial Plus Credit Union answers the call to provide members the service they need whenever it’s needed.

The credit union has a strong digital banking presence for all of its members who are not near a branch. But many of the online systems are supported by its physical branches. The credit union told us the branches provide a critical service to its members.

“We are the experts,” Bergmooser said. “Our members rely on us, and that’s where I really think they see the benefit of the brick-and-mortar delivery channel. And even if that stretches resources thin, it shows that we’re committed to being a little bit of everything to everybody.”

Members can scan through the website to find current loan rates, apply for loans, and use the site’s many calculators that help members assess their financial strategy. The calculator can help users create a payment plan to pay off debt or figure out how much to save for retirement.

Anyone who lives in Michigan or has an immediate family member with an account at the credit union can apply to join Financial Plus Credit Union. The application process is done completely online, and only takes a few minutes.

Providing Financial Wellness at Every Life Stage

Financial Plus Credit Union sets financial wellness as one of the pillars to personal success. Members can prepare for any situation with proper financial health.

The credit union assists members reach their financial goals through its plentiful resources. The credit union said all of its branch managers, and most of the employees in the contact center are CUNA certified. The branch managers and employees are specifically trained to find solutions to financial problems.

“It doesn’t matter where the financial institution is, the amount of people that are either underbanked or unbanked is not where we want to be,” Bergmooser said. “It’s like the saying says, rising tide will raise all ships. The more educated and better the financial lives of the entire community, we’ll all do better.”

Financial Plus Credit Union does its part to teach the next generation. The credit union said the main hurdle is getting younger people to rethink the stigma of the banking industry. It plans to do that through transparency every step of the way. The credit union partners with local colleges, universities, and trade schools to build awareness on the financial services it has available.

Helping people close to retirement create a better focus for their plans is also important to the credit union. Financial Plus’s goal with people entering retirement is to determine a path toward savings so the member can live their life peacefully and without worry.

The credit union plans to continue working with new partners who can help have those kinds of conversations with college students and people entering retirement. Financial Plus wants to develop solutions for those groups.

“I think fintech companies can be great allies,” Bergmooser said. “The fintechs who understand the business model know the benefit of working with traditional financial institutions. We have brand loyalty and customers who know us and love us. And as a credit union, we want to help our members.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What Is Netspend? The Company & Its Products ([updated_month_year]) What Is Netspend? The Company & Its Products ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/10/What-Is-Netspend.jpg?width=158&height=120&fit=crop)