In a Nutshell: Zap provides a truly decentralized way for businesses, service providers, and information curators to exchange their goods on token specific exchanges with the use of proprietary cryptocurrency tokens. Through the use of bonding curves, users can leverage the many tools provided by Zap to run their own tokenized ecosystem that ushers their business into the next generation of finance.

In today’s digital age, information is becoming a currency in and of itself. Instead of mining for small shiny bits of elements and minerals, speculators now hunt for information on anything from orange juice futures to the predicted future price of a newly released comic book.

But while someone would have no problem selling scrap gold from their collection at a local pawn shop or jewelry store, there aren’t any specific businesses that help them profit from their expertise and other knowledge.

Zap sees data as a business unto itself. The startup helps anyone who has access to valuable information profit off that data by creating a data feed or API that’s listed on the Zap Marketplace. The data provider can then earn Zap’s cryptocurrency token every time a user calls upon that information.

“If you are a publisher of a newsletter, you can create a token that people have to first purchase so that they can trade that token for access to the newsletter. In addition, people can speculate on how much popular demand there is of that newsletter,” said Nick Spanos, Zap Co-Founder.

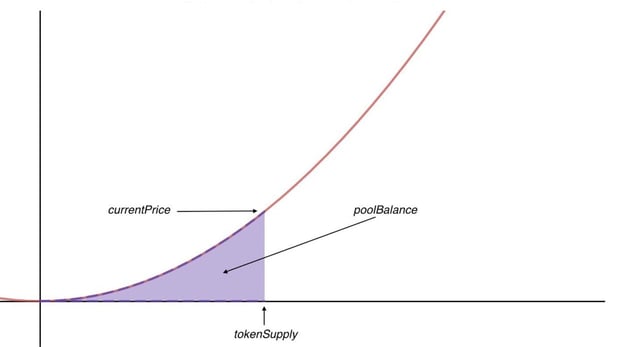

Zap is traded for a vendor-specific token, which is used to redeem the service provided. Data and other service providers set an immutable pricing algorithm when creating the token which is used to determine the market value of what is being provided at any given time.

“All the cryptocurrency stays in the contract until someone calls the data,” Spanos said. “That’s difficult to do in the physical world, but you can do it much easier in the digital world.”

And, when there’s cryptocurrency involved, you’ll also typically find speculators who want to partner with providers. Investors can also earn profits by staking dots on users’ data through Zap, which can potentially be sold back to the bonding curve smart contract later at a higher price.

In addition to redeeming a service (which is the only time a provider will receive the pooled Zap in the smart contract), a dot can be converted back to Zap by trading it to the bonding curve smart contract based spot price of a dot/zap at any given time. Because the price of trading and redeeming a service is predetermined, as demand rises the currency’s value will increase. As more Zap is staked or bonded to the Oracle, the data and services — i.e. the dots used to purchase them — become more expensive.

Speculators can stake Zap to an Oracle and hold the dots until the value of the dots increases. Once satisfied with the market value, the investor can sell the dots back to the Oracle at the new price.

“The more people want it, the higher the price of your token goes,” Spanos said. “It’s basic supply and demand — and this is a much better model in this day and age when businesses create fake reviews and other things to drum up false demand.” Spanos elaborated by describing that this system is better due to ZAP’s bonding curves which requires actual capital, not manipulation, to make the price move.

As demand rises, so does the price of the token.

The process of bonding and redeeming incentivizes the creation and maintenance of third-party data feeds. As users stake more Zap to the data feed, the provider has added incentive to remain honest with the information he or she provides as each time the dots are redeemed for services the provider receives payment.

But Zap isn’t just for data providers.

Businesses Get Unique Exchange and Other Crypto Tools

Zap’s Oracles and Exchange platform can meet the needs of just about any type of business. Spanos said that Zap is reinventing traditional business models and has the potential to create new revenue streams by monetizing opportunities that were previously unmonetizable.

“We call upon all businesses and individuals to create their own crypto token and get their own free decentralized exchange for their business,” he said. There are so many opportunities the average business owner will be able to capitalize on through integrating the Zap Protocol into their traditional business model. Zap, upon its release, had opened the gateway to the Decentralize Finance ecosystem.”

Spanos noted that many of the largest exchanges can charge up to $5 million for a token creator to list their currency on the exchange. When a company creates its own token with Zap, the new token enhances the business and creates a unique identifier or “symbol” that sets it aside from all of the other tokens in the space.

Businesses can then use their token to sell any goods or services it wants. Whether it’s mowing lawns or offering experienced API assistance, businesses can offer their tokens on a wide range of platforms.

“You can put the exchange directly on your website, which allows people to buy and sell your token immediately,” Spanos said. “Plus, we offer an automated market maker which is inherent to the bonding curve.”

Automated market makers provide liquidity in electronic financial markets through sophisticated algorithms governed by game theory. For example, Zap uses modern economic principles coupled with an algorithmic market maker to replace the antiquated bid/ask spread based in traditional exchanges. Participants in trades involving our bonding curves are guaranteed liquidity as they are always able to buy and sell.

“The bid and the ask happen within the smart contract,” Spanos said. “It’s completely decentralized finance. You can create gift cards, sell your data sources, market your services, or anything else.”

Reimagining the Gift Card Marketplace

Spanos envisions a next-generation gift card protocol on the Zap platform as one of the many use cases. Through the platform, a business can create a set number of cards for their business and sell them through the marketplace or on their own website.

That means that the value of the gift card tokens will increase as demand expands unless the business chooses to preset the price at a flat rate, meaning that there is no speculative side.

Nick Spanos is the cofounder of Zap and founder of the Bitcoin Center in New York City.

Since public demand essentially sets the price — and value — of the gift card token, the business has little control over how much it can charge and profit from the product, unless it issues the token at a flat rate.

“We want people and companies to use decentralized finance,” Spanos said. “When that happens, the companies with the best practices will win. That’s how it should be.”

Spanos noted that creating gift cards through Zap is substantially more cost-effective than having them printed and sold on the physical market. That aspect alone makes it attractive to businesses on a budget.

“With this platform, you can create a million gift cards for your business for around $18 in Ethereum,” he said. “With that, you’ll also get the trading platform, the market maker, the pricing index, and you’ll get the HTML to place everything on your website.”

A Truly Decentralized Experience

Zap has grown rapidly since its 2019 inception. Several partnerships have since increased the scope and utility of the Oracles and other crypto tools.

This includes platforms such as BitUnits that decentralize real estate holdings and allows non-U.S. investors to buy portions of real-world property from a corporation that holds the property’s deed.

“BitUnits uses tokenized real estate,” Spanos said. “We tokenize a corporation that holds real estate and people can buy and sell these asset-backed tokens.”

For example, a multi-unit residential building can allow multiple investors to purchase tokens that essentially make the investors partial owners of the property. When rent payments arrive each month, the proceeds are distributed to each token holder.

“We can build for anybody,” Spanos said. “We built the platform, and just about any type of business can build on top of the platform.”

To that end, Spanos and his team have tied themselves to the original Bitcoin plan of a truly decentralized marketplace. That mission continues as Zap negotiates further partnerships to build out the platform.

“A lot of other people have kill switches and other things that allow them to back out of projects,” Spanos said. “We can’t do any of that. We’re decentralized all the way.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Business Credit Cards for New Businesses ([updated_month_year]) 7 Best Business Credit Cards for New Businesses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/newbus2--1.png?width=158&height=120&fit=crop)