In a Nutshell: When small businesses struggle to gain access to capital, profits and growth often suffer. Companies that trade internationally may face additional hurdles from financial institutions and intermediaries. Drip Capital offers credit solutions that draw on global supply chain data to give both buyers and sellers the financial tools they need to thrive. Invoice discounting and payables financing solutions from Drip Capital promote healthier cash flow for importers and exporters and also help developing economies grow.

When it comes to credit access, startups and small businesses often get the short end of the stick. But the burden is especially heavy in emerging economies where established financial institutions favor businesses with proven track records.

Developing economies also tend to be export-oriented with a focus on reaching consumer-driven markets. Smaller export businesses in these regions may find themselves boxed out of profit and growth opportunities and facing an expensive path to liquidity.

That can result in dampened economic growth in developing regions.

Drip Capital provides credit solutions to help SMBs in the export industry acquire funding. It also allows buyers to improve their cash flow and reach new customers. Drip Capital accomplishes both of those tasks by giving investors everywhere a healthy outlet for their excess capital.

The beneficial solution grew out of Co-Founder and CEO Pushkar Mukewar’s desire to address capital problems in his home country of India.

“One reason it’s difficult for small businesses to access credit is that financial institutions struggle to assess their creditworthiness,” Mukewar said. “SMBs tend not to have organized financials, and most banks will only do collateral-backed financing for them. When the SMB does not have adequate collateral, bank financing is often not enough to take care of their working capital needs.”

There are often alternatives in more informal parts of the economy, but going through money lenders and less secure channels may be extremely expensive.

“For many of our customers, we fill a gap for which the alternatives are not ideal,” Mukewar said.

Low-Cost Working Capital Promotes Global Exchange

Mukewar was trained in computer engineering and worked in financial services and consulting before receiving a business degree at Wharton. He and his Drip Capital co-founder decided to focus on international trade because it was a segment where fintech could facilitate a more productive credit model.

“You can evaluate transactions more holistically because cargo is moving across borders,” he said. “You’re often taking the credit risk on a U.S. or European buyer, which is a far better play than perhaps giving out an unsecured loan to a small business in a market like India.”

Drip Capital launched in India in 2017 before expanding into Mexico and the U.S. in 2019. It recently entered more export-oriented markets, including Bangladesh, Ecuador, and United Arab Emirates. And the team is building a global solution to a worldwide problem.

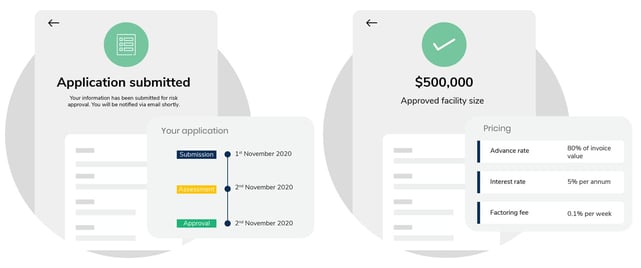

“On the seller front, the challenge is getting working capital,” Mukewar said. “What we offer is an invoice discounting solution, where the seller can get paid for 80% of the value of goods as soon as they ship.”

The company has financed more than 20,000 such transactions totaling more than $1 billion and directed at buyers in more than 65 countries. Drip Capital provides a payables financing solution for buyers in the markets it serves.

“Think about the SMB procuring goods from overseas — many of those suppliers will not give those firms adequate credit,” Mukewar said. “We pay the supplier on behalf of the buyer and provide the buyer an extended credit term of 60 to 90 days, which allows the buyer to procure more and grow their business.”

Creditworthiness Data Broadens Capital Access

The payables financing solution yields a credit line of up to $2.5 million with monthly rates as low as 0.5%. The efficiencies are possible because the platform leverages data generated by the third parties and intermediaries involved in cross-border transactions.

It sources data from credit bureaus with global agencies and insurance underwriters providing risk ratings for buyers on the platform.

“Because we have integrations with these insurance and data partners, we receive a third-party view in real time,” Mukewar said. “When credit ratings change, that information feeds into our systems, and we can act on it dynamically.”

Another robust source is trade data, which is increasingly essential for Drip Capital due to the digitization occurring in the sector. All cross-border transactions move through customs, of course, but shipping lines, inspection agencies, and tax authorities are also involved.

Drip Capital uses data, not credit scores, to provide businesses with fast access to capital.

“We can generate real-time tracking of customer shipment records,” Mukewar said. “So when we see changes — if a customer suddenly drops its volume, for example — that’s a very valuable signal for us.”

Those adjustments feed into Drip Capital’s own performance data metrics, and customers can earn higher credit limits based on superior past performance.

“Performance data across customer types or industries allows us to tweak our models when we see some sectors generally doing better than others,” Mukewar said.

Formal partnerships with participants in the cross-border trade ecosystem also generate efficiencies.

“Relationships with shipping lines, banks, payment processors, and others produce lead generation and revenue sharing opportunities,” Mukewar said. “We’re also able to capitalize on data received from those partners, which feeds into our assessments.”

Drip Capital Democratizes Global Trade Finance

Investors in markets, including the U.S., also have prominent roles in the emerging Drip Capital ecosystem. They can use the platform to channel excess capital into markets where there is a lack of funding.

Institutions, retail investors, and family offices not only receive a higher return on their investment than what is available from current short-term alternatives, but they also gain a valuable diversification opportunity.

“We’re able to help investors realize yields on capital that otherwise would just be sitting today without generating any return,” Mukewar said. “To date, we’ve raised more than $200 million in three-month, six-month, and 12-month notes with zero principal loss — a solid performance on our note program.”

Wherever inefficiencies arise in the import-export economy, Drip Capital is in a position to fix that dynamic. Its ultimate goal is to help more emerging economic regions transition to consumer-based prosperity.

“Emerging economies that have progressed to being more developed — places like China and Vietnam — have grown on the back of exports,” Mukewar said. “And the SMB segments of those markets have been massive contributors to their export growth.”

Growth in the economic middle segment is what those places need to thrive. Drip Capital is providing fuel for that growth.

“If you’re at the upper end of the spectrum, there’s enough credit access, and you continue to grow. But micro-enterprises don’t get the capital required to migrate to becoming small- and mid-sized,” Mukewar said. “They’re going to be able to get there and contribute toward exports if credit access is made available to them.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)

![Capital One Platinum Card: Credit Score Needed for Approval ([updated_month_year]) Capital One Platinum Card: Credit Score Needed for Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Capital-One-Platinum-Credit-Score-Needed.jpg?width=158&height=120&fit=crop)

![11 Highest Capital One Credit Limits ([updated_month_year]) 11 Highest Capital One Credit Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Highest-Capital-One-Credit-Limits.jpg?width=158&height=120&fit=crop)