In a Nutshell: In an Autonomous NEXT Report on Augmented Finance and Machine Intelligence, analysts examine how AI is disrupting all levels of the financial service structure. Innovations include customer-facing conversational platforms, anti-fraud systems, underwriting, and AI-augmented insurance adjustment. Autonomous NEXT provides an in-depth analysis of AI’s cost impact and marketplace outlook and highlights trends and topics surrounding machine intelligence. The report gives financial industry leaders actionable insights on how to leverage AI in a rapidly changing digital environment.

Artificial intelligence (AI) has been a focus for researchers since the 1950s, yet only recently have we started to see AI-based applications touch our everyday lives.

Consider the field of machine image recognition. As late as 2010, the machine vision error rate — the rate at which a computer makes a mistake in recognizing differences in images — was nearly 30%. By 2015, that error rate had dropped to 3% — which is better than the average human error rate of 5%.

Lex Sokolin spoke with us about the impact AI will have on the financial services industry.

Lex Sokolin, Global Director of Fintech Strategy and Partner at Autonomous Research, said this rapid advance in machine vision characterizes the current position of AI technology.

“Today, it can tell apart hundreds of breeds of dogs with incredible precision. The algorithmic approach, which in the recent past could make such big mistakes, is now becoming more precise and, certainly, more scalable than a human being,” Lex said.

And rapid technological advances over the last decade have made today’s AI possible.

“Between 2012 and 2014 we started using neural networks on general processing units (GPUs). The chips and the hardware were finally there to use this mathematical approach, which has been developed over the past 50 years,” said Lex, who also leads the London-based fintech practice within the firm called Autonomous NEXT, that focuses on future technologies and implementations.

On top of technological advances, the massive amounts of data humans generate on the web has positioned machine learning — the mathematical approach to AI — to save time and money in both consumer and business sectors — including financial services.

In a report titled #Augmented Finance & Machine Intelligence, Autonomous NEXT analysts take a deep dive into the implications of AI to the financial sector. By examining all levels of the financial service structure, the report provides actionable insights on why, how, and where AI will shape global finance in the future.

Analyzing Fintech and Exploring Machine Intelligence in the Financial Frontier

Autonomous Research is an independent research partnership founded in London in 2009 that covers the financial industry. With a team of 35 analysts and offices on three continents, Autonomous Research covers everything from global banks, brokers, asset managers, and insurance to information services, payments, mortgage, and consumer finance.

Lex, who has a background in digital wealth management technology, joined the firm in 2017 and launched Autonomous NEXT, a practice within the firm dedicated to exploring the intersection of digital technology and finance.

“Two years ago, we realized that the subjects of software and technology are unavoidable in finance. The specific focus of Autonomous NEXT is on frontier technologies. What is the edge? How does the edge matter? What is the early-stage community doing? How do you backsolve that to impact financial service incumbents with barriers and reasons to resist change?” Lex said.

Over the past two years, Lex and his team have attempted to answer these questions by researching and reporting on various parts of the financial ecosystem. “We try to combine the innovations and challenges and paint a robust and believable picture of the journey, whether to institutional investors or company management,” Lex said.

Recognizing this digital disruption across the entire economy and its impact on other industries led Autonomous NEXT to research how AI and machine intelligence are specifically impacting the financial sector. “In media, 50% of revenues are from digital channels. In retail, Amazon holds 50% of the market capital share, so the question is: When is it going to happen in finance? And what are the means by which it will since the industry is much more complex?”

Process automation has been one of the first steps, but it isn’t the right answer for the financial industry, Lex said. “Taking straightforward human process and turning it into a machine process is not enough to affect the industry. You can almost think of an assembly line and turning that into a piece of software as being the last decade. That didn’t do enough to change the culture or how products are built,” he said.

But Lex said that machine intelligence — or transitioning from human judgment to machine judgment — comes closer to the fundamental role of making underwriting or investment decisions, which are at the core of the financial industry.

Breaking Down AI Adoption at Every Level of the Industry

The Autonomous NEXT report shows that implementing AI has the potential to cut operating costs in the financial services industry by 22% — which represents $1 trillion in total savings — by 2030.

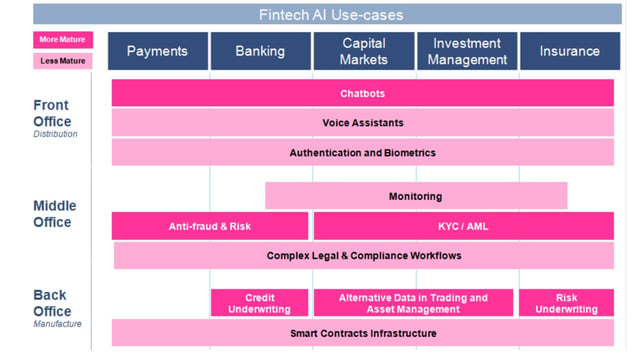

The report spreads its analysis across the front, middle and back offices to make data easier to quantify and visualize. “It gave us a meaty way to sink into the topic and also a way to attach numbers to these ideas,” Lex said.

To explain the identity and function of these levels, Lex used the analogy of a restaurant. The wait staff and dining area are comparable to the teams at financial institutions — including branch tellers, financial advisors, and insurance salespeople — who interact with customers. And, just as the chefs prepare food in the back of the restaurant, the back of the financial industry is where professionals design financial products such as loans, insurance plans, and investments. Everything between these two processes is categorized as the middle.

“There’s a lot of middle in the financial industry — regulation, compliance workflows, surveillance,” Lex said.

While AI is impacting all of these sectors, the front has been the first to benefit. The report predicts that $490 billion of the $1 trillion overall impact will happen in the front-office sector through technologies, including authentication and biometrics, voice assistants, and conversational interfaces.

Artificial intelligence can boost efficiency across many sectors of a financial organization.

“Most fintech innovation started with the retail customer interaction. Whether that’s putting payments into an app, a bank into your phone, a robo-advisor into a skill for a conversational assistant, or your bank into the chat channel inside of Facebook messenger. All of that is thinking about how to replace the customer interaction,” Lex said.

The middle area, which includes compliance and anti-fraud, has also seen plenty of adoption, and the projected cost impact is $350 billion. Many companies are already using AI technology to replace tedious, batched compliance checks with ongoing security protocols. In eCommerce and payments, AI is helping companies make real-time credit decisions on millions of transactions.

The back of the industry, where financial products are designed, is still the most challenging area in which to replace people with AI solutions or enhance what a human does. Here, AI adoption varies based on the nature of the financial product.

“If you look at digital lenders that have manufactured fintech products for at least a decade, they’re doing quite a bit with AI. The idea of underwriting someone’s credit sits very well with an AI approach. There may be ethical issues to wade through, but using structured data to make a ‘yes’ or ‘no’ decision is easy for AI,” Lex said.

Within the insurance sector, AI applications are also starting to stick. “It’s harder to use machine vision on unstructured data and then use machine learning algorithms on top of that to make ‘yes’ or ‘no’ decisions, but it’s also more useful. That gets into the role of claim adjusters and the human process of figuring out how much something is worth,” Lex said.

Lex identified investment management as the back-office sector where it’s hardest to implement AI since it requires the most complex human decisions. He said it would likely be the last area impacted by AI, but adds that many large investment managers are exploring AI and using alternative data to understand how they could use it.

Failure to Address Legacy Systems Will Widen Market Gaps

In addition to the challenges of replacing human judgment with machine intelligence, the financial industry has been one of the slowest to transition from legacy systems to digital technologies.

Lex said that most banks carry massive “technical debt” in the form of old systems that they’ve failed to address for decades — or generations.

“Historically, the industry didn’t have pressure from software competitors. Today, whether that’s technology firms, the fintech startup sector, or leading financial institutions, there’s a concept of R&D in financial services. That’s the opposite of how many institutions thought. They would only focus on stability, risk management, and capital preservation,” he said.

“If you upload all your information nightly in one giant batch, you can’t have APIs, real-time compliance, or transaction-level KYC (know your customer) and AML (anti-money laundering). You don’t get to take advantage of any of the regulation technology that’s coming out.” — Lex Sokolin, Global Director of Fintech Strategy and Partner at Autonomous Research

Some financial institutions have systems that are difficult to maintain or expensive to change, while others have failed to find ways to modernize or create desegregated data architectures.

“Those that update will be flexible enough to participate in new types of distribution channels, allow real-time payments, or give users the ability to check the value of investment accounts in real time. But, if you upload all your information nightly in one giant batch, you can’t have APIs, real-time compliance, or transaction-level KYC (know your customer) and AML (anti-money laundering). You don’t get to take advantage of any of the regulation technology that’s coming out,” Lex said.

Trends to Watch: Ethical Concerns and the Adoption of Conversational Interfaces

The Autonomous NEXT report takes both a broad and a detailed look at how AI is impacting all levels of the financial industry. It also delves into current trends and topics surrounding AI technology and machine intelligence.

One area Autonomous continues to watch with interest is the unfolding ethics conversation, Lex said. Many are concerned about AI systems’ known potential to make decisions influenced by data-driven biases and socio-economic inequalities. And the “Control Problem” raises questions around safety: Could powerful AI become indifferent to human needs and act contrary to our interests — whether intentionally or unintentionally?

On the consumer-facing side, the adoption of conversational interfaces is another trend to watch. Data show a generational divide when it comes to service preference: 90% of the Silent Generation (born between 1925 and 1945) prefer human contact over the phone while a significant percentage of millennials are embracing internet-based chatbot services. Still, adoption has been slower than anticipated.

Autonomous NEXT continues to research trends in machine learning and beyond.

“There seems to be a lull in it, and we don’t yet know how people use conversational interfaces,” Lex said. “I feel strongly that conversational interfaces will be ever-present, but I don’t think it will be in the form of the smart speaker that it is today.”

Building on a 50-year mathematical foundation, today’s technological capability has brought AI to the forefront of the global race for efficiency. AI is once again exciting the interest of researchers, consumers, and industry leaders, and the rapid improvements seen in fields, such as machine vision, are just the beginning.

“I don’t know where the limit of machine learning is, and it opens up a lot of other ethical questions, but, at the very least, the direction of travel for it is pretty straightforward,” Lex said.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Credit Cards For Streaming Services ([updated_month_year]) 9 Best Credit Cards For Streaming Services ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Best-Credit-Cards-For-Streaming-Services.jpg?width=158&height=120&fit=crop)