In a Nutshell: From advertising to everyday expenses, business owners know that credit cards can be a real asset, especially in industries that require frequent travel. The United MileagePlus Explorer Business Card rewards SMB owners with two miles for every dollar spent on United Airlines flights, as well as categories, like restaurants, gas stations, and office supplies. All other purchases are worth one mile per dollar spent, and cardholders receive 50,000 bonus miles after spending $3,000 in the first three months. Thanks to its rewards and perks, like free checked bags, travel insurance, and airport lounge passes, the United MileagePlus Explorer Business Card offers one of the best frequent flyer bonus programs for small business owners. //

It’s no surprise that we spend a lot of time here at CardRates examining the benefits and drawbacks of different credit cards. We get far more excited than a person should when examining the fine print on any given card.

Through this process, we’ve studied hundreds of cards aimed at small business owners. Some have great benefits and others have perks that are only attainable if you’re charging six figures every year on the card. After extensive research, we’ve found that the United MileagePlus Explorer Business Card can best fit the needs of small business owners who tend to travel often.

While the card, issued by JPMorgan Chase, can compete with most any offering on the market in terms of rates and fees, the beauty of the United MileagePlus Explorer Business Card is how cardholders are able to rack up double miles on the world’s third-largest airline, United Airlines, and the ease with which they can redeem those flights without blackout dates.

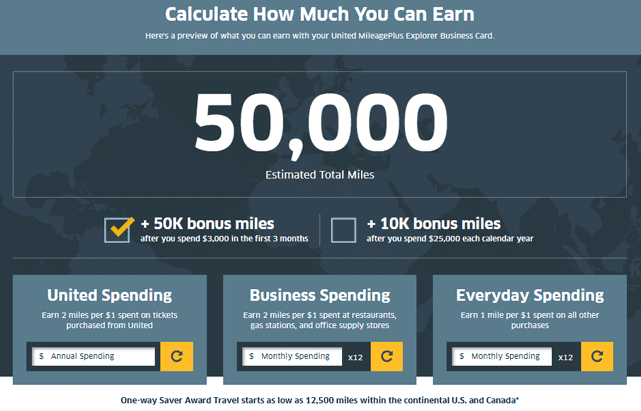

The United MileagePlus Explorer Business card is a version of United’s popular credit card, but tailored specifically for business owners. The card offers 50,000 bonus miles when you charge $3,000 within the first three months of owning the card. Another 10,000 miles are added after you’ve charged a total of $25,000 to the card in a year, which is one of the lowest thresholds on the market.

The United MileagePlus Explorer Business card is a version of United’s popular credit card, but tailored specifically for business owners. The card offers 50,000 bonus miles when you charge $3,000 within the first three months of owning the card. Another 10,000 miles are added after you’ve charged a total of $25,000 to the card in a year, which is one of the lowest thresholds on the market.

You also earn two miles for every dollar spent on purchases from United, as well as for charges in select categories often used by business owners, including restaurants, gas stations, and office supply stores. All other purchases earn one mile for every dollar charged, which we all know can add up fast.

This means every expense you charge for your business takes you one step closer to that vacation or business trip you’ve been planning. Every SMB wants to cut costs and earn perks, and this card is built for just that. United offers an interactive map on its website to show just what the mileage you’ve earned can get you, and that’s just with the bonus miles. This card offers much more than that.

Travel Benefits that Go Beyond Bonus Miles

Many credit cards promise travel benefits, but earned miles expire or there’s something in the fine print about blackout dates during peak times that render your accumulated rewards useless when you want to use them most. The United MileagePlus Explorer Business Card has neither of these drawbacks.

In addition to the mileage accruals, the card offers priority boarding as well as one free checked bag for all of your United flights. Each year, the card nets its owner two free United Club passes for complimentary drinks, snacks, wifi, and a work area to relax in before your flight. If your plans change, there’s a complimentary trip cancellation service if you’ve booked the flight through United using your card.

Card benefits also include hotel room upgrades, travel insurance, and auto damage waivers on rental cars. Travel rewards cards tend to be popular with international travelers, and with this in mind, the United MileagePlus Explorer Business Card has zero foreign transaction fees, meaning no additional charges if you use the card outside of the United States.

For the SMB owner who travels a lot, either for pleasure or business, this card has many benefits that will keep you moving at a greater savings to your bottom line.

Cover Your Entire Business (and Staff) with a Single Account

Whether you’re a company of one or 100, the United MileagePlus Explorer Business Card has a way of helping you get more out of your typical expenses. Employee cards can be added at no additional expense, and you have the ability to set individual spending limits. If you have employees who travel often for business, you can now earn mileage for their expenses without having to hand over your personal card while they’re gone.

Charging business expenses on this card can earn you free flights or points to put toward rental cars or hotels.

Since the card is part of the Visa payment network, cardholders qualify for the Visa Signature program, which, if approved, adds several more perks that make the card even more attractive to the avid traveler. These include travel accident insurance, lost luggage reimbursement, roadside dispatch, and travel and emergency assistance service.

While the card’s frequent flyer rewards make it attractive to most any business owner who travels regularly, it’s what’s under the hood of this card that really makes it stand out for business owners.

The Card Pays for Itself and Helps Your Bottom Line

Any discussion of credit cards starts with the APR. The United MileagePlus Explorer for Business Card has an APR between 16.99% and 23.99%, depending on creditworthiness. That rate is on the low end of standard rates for cards in its class. The APR will vary depending on the prime rate, and, as always, interest can be entirely avoided if the balance is paid in full every month.

The $95 annual membership fee is waived for the first year. Many travel cards these days require a membership fee ranging from $95 to $175. Other cards on the market do not have these fees, but they often have fewer cardholder benefits.

To put it in perspective, if you’re the type of traveler who wants to use the United Club before flights, a one-time pass will cost you $50. An annual pass runs $550, which you can buy with your rewards once you earn enough miles. The two complimentary United Club passes alone pay for the annual fee. Since the first year’s fee is waived, you can take the card for a trial run to see if it fits into your goals as a SMB owner and if the benefits outweigh the cost for your bottom line.

Chase Your Dream Trip with the MileagePlus® Explorer Business Card

Americans travel a lot. In fact, US citizens are among the most traveled in the world, second only to citizens of Finland. Chances are, you’ve got a dream trip that you’ve thought about for a while, but haven’t planned because of the rising costs of doing business.

The United MileagePlus Explorer Business Card helps you get closer to that dream with its ability to rack up miles for expenses that you’re already incurring even without the card. If you aren’t quite ready for that dream trip, then the card offers the ability for you to travel to conferences, trade shows, meetings, or other business opportunities without draining your marketing budget along the way.

The card bills itself as a concierge for your business, and in many ways it is. It offers peace of mind with the insurance and liability coverage, while allowing business owners to relax and get to their destinations so they can focus on the things that matter to them.

With competitive rates and an annual membership fee after the first year that pays for itself with perks, CardRates has chosen the United MileagePlus Explorer Business Card as the Best Frequent Flyer Bonus Program for Small Business Owners.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Secrets: Get Frequent Flyer Miles Without Flying – ([updated_month_year]) 3 Secrets: Get Frequent Flyer Miles Without Flying – ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/frequent.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for Pet Owners & Expenses ([updated_month_year]) 9 Best Credit Cards for Pet Owners & Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Best-Credit-Cards-for-Pet-Owners.jpg?width=158&height=120&fit=crop)

![12 Best Credit Card Signup Bonus Offers ([updated_month_year]) 12 Best Credit Card Signup Bonus Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/credit-card-signup-bonus-offers.jpg?width=158&height=120&fit=crop)

![Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year]) Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/refer.png?width=158&height=120&fit=crop)

![5 Secured Credit Cards With Cash Back Bonus ([updated_month_year]) 5 Secured Credit Cards With Cash Back Bonus ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Secured-Credit-Cards-With-Cash-Back-Bonus.jpg?width=158&height=120&fit=crop)

![9 Best 0% APR Signup Bonus Credit Cards ([updated_month_year]) 9 Best 0% APR Signup Bonus Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-0-APR-Signup-Bonus-Credit-Cards-3.jpg?width=158&height=120&fit=crop)